by Calculated Risk on 3/07/2023 02:40:00 PM

Tuesday, March 07, 2023

Leading Index for Commercial Real Estate Increases in February

From Dodge Data Analytics: Dodge Momentum Index Gets a Boost in February

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, advanced 1.9% in February to 203.0 (2000=100) from the revised January reading of 199.3. In February, the commercial component of the DMI rose 1.4%, and the institutional component increased 2.9%.

“The Dodge Momentum Index returned to growth in February after falling 9% last month,” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. “The continued elevation in the DMI should provide hope that construction activity will grow in 2024. Owners and developers tend to put projects into planning until well after economic conditions weaken. During the Great Recession, for example, the DMI did not substantially decline until 2009. Therefore, the anticipated mild economic growth in 2023 could cause the DMI to moderate over the year, but it is unlikely to fall below historical norms.”

Commercial planning in February was bolstered by almost 20% growth in office planning activity, as data centers continued to steadily enter the planning queue. Institutional planning was driven higher by growth in education and healthcare projects, notably the continued investment in research laboratories. On a year-over-year basis, the DMI remains 43% higher than in February 2022. The commercial component was up 55%, and the institutional component was 22% higher.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 203.0 in February, up from 199.3 in December.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a solid pickup in commercial real estate construction in 2023.

Pandemic Economics, Housing and Monetary Policy: Part I; The Economic Fireworks have been in Housing!

by Calculated Risk on 3/07/2023 10:23:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Pandemic Economics, Housing and Monetary Policy: Part I

A brief excerpt:

Pandemic economic outcomes were frequently largely unexpected.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

For example, early in the pandemic, there was a shortage of toilet paper. Since there are two supply chains for toilet paper - one residential and the other commercial - and many more people were using the bathroom at home instead of at the office, there was a shortage of residential toilet paper. ...

More generally, in 2020, we saw a surge in spending on goods as many services were shut down. With fiscal policy supporting incomes, the increase in demand for goods eventually led to an increase in prices as inventories were depleted.

The graph above shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions. ...

In his testimony today, Fed Chair Powell clearly doesn’t see service inflation as transitory:That said, there is little sign of disinflation thus far in the category of core services excluding housing, which accounts for more than half of core consumer expenditures. To restore price stability, we will need to see lower inflation in this sector, and there will very likely be some softening in labor market conditions.Clearly Powell believes service-related price increases will not as transitory as goods and commodities and will require “some softening in labor market conditions”. The FOMC is clearly committed to further raising rates to curb inflation.

… the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes. Restoring price stability will likely require that we maintain a restrictive stance of monetary policy for some time.

emphasis added

...

In Part II, I’ll discuss what I think will happen with housing going forward and - since housing is the key transmission mechanism for monetary policy - the implications for Fed policy. I’ll suggest some out of consensus possibilities!

Wholesale Used Car Prices Increased in February, Down 7.0% Year-over-year

by Calculated Risk on 3/07/2023 09:20:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices See Large Increase in February

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) increased 4.3% in February from January. This was the largest increase for the full month of February since 2009’s 4.4% rise. The Manheim Used Vehicle Value Index (MUVVI) rose to 234.5, down 7.0% from a year ago. February’s increase was driven partially by the seasonal adjustment. The non-adjusted price change in February was an increase of 3.7% compared to January, moving the unadjusted average price down 5.6% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

CoreLogic: House Prices up 5.5% YoY in January; Declined 0.2% MoM in January NSA

by Calculated Risk on 3/07/2023 08:00:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic: US Annual Home Price Growth Continues Single-Digit Slowdown in January

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for January 2023.

U.S. home prices continued their gradual free fall in January, with the 5.5% annual gain down for the ninth straight month and the lowest recorded since June 2020. Deceleration was particularly noticeable in the Western U.S. and other states and metro areas that saw substantial appreciation over the past few years. Three Northwestern states (along with Washington, D.C.) posted at least slight annual declines as migration patterns that began during the pandemic shifted, slowing demand and driving price decreases.

"While 2023 kicked off on a more optimistic note for the U.S. housing market, recent mortgage rate volatility highlights how much uncertainty remains," said Selma Hepp, chief economist at CoreLogic. "Nevertheless, the continued shortage of for-sale homes is likely to keep price declines modest, which are projected to top out at 3% peak to trough."

"Home price depreciation and strong income growth are expected to boost affordability, which is particularly important for first-time buyers," Hepp continued. "This group has accounted for a higher share of mortgage applications since last summer, as first-time buyers don't need to surrender an extremely low mortgage rate like current homeowners."

...

U.S. home prices (including distressed sales) increased by 5.5% year over year in January 2023 compared to January 2022. On a month-over-month basis, home prices declined by 0.2% compared to December 2022.

emphasis added

Monday, March 06, 2023

Tuesday: Fed Chair Powell

by Calculated Risk on 3/06/2023 07:11:00 PM

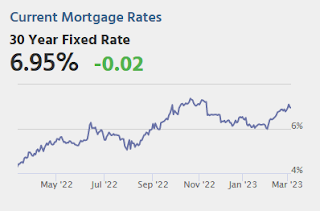

Mortgage rates have been hovering around the highest levels in months over the past 2 weeks, but had made a bit of progress by the end of last week. The improvement carried over into the early part of today. In other words, the average lender was offering just slightly lower rates this morning compared to the end of last week.Tuesday:

Unfortunately, as the day progressed, the bond market began losing ground. Bonds dictate day-to-day changes in rates. As such, the average mortgage lender was forced to recall their initial rate sheets and "reprice" to slightly higher rates.

This brings the average lender up to the 7% neighborhood for the average conventional conforming 30yr fixed scenario. [30 year fixed 6.95%]

emphasis added

• At 8:00 AM: CoreLogic House Price index for January.

• At 10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the U.S. Senate Committee on Banking, Housing, and Urban Affairs

Black Knight Mortgage Monitor: Home Prices Declined in January, "on pace to fall below 0% by March/April"

by Calculated Risk on 3/06/2023 09:55:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: Home Prices Declined in January, "on pace to fall below 0% by March/April"

A brief excerpt:

Here is a graph of the Black Knight HPI. The index is still up 3.4% year-over-year but declined for the seventh consecutive month in January and is now 5.5% off the peak in June 2022.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• Home prices fell again in January, pulling back by 0.24% from December and a more modest 0.13% on a seasonally adjusted basis

• That’s the smallest monthly decline in seven months, as falling interest rates and improving affordability in late 2022/early 2023 ran into tightening supply

• All in, home prices are now 5.5% off their June peak and a more modest 2.9% off peak when adjusting for typical seasonal trends

• The annual home price growth rate fell to 3.43% in January – more than a full percentage point below the 30-year average – and is on pace to fall below 0% by March/April

Housing March 6th Weekly Update: Inventory Decreased 2.6% Week-over-week

by Calculated Risk on 3/06/2023 08:30:00 AM

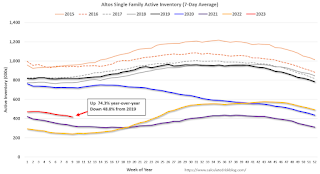

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, March 05, 2023

Sunday Night Futures

by Calculated Risk on 3/05/2023 07:38:00 PM

Weekend:

• Schedule for Week of March 5, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 4 and DOW futures are down 30 (fair value).

Oil prices were up over the last week with WTI futures at $79.68 per barrel and Brent at $85.83 per barrel. A year ago, WTI was at $116, and Brent was at $124 - so WTI oil prices are DOWN 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.36 per gallon. A year ago, prices were at $4.00 per gallon, so gasoline prices are down $0.64 per gallon year-over-year.

Update: Framing Lumber Prices Down 72% YoY, Below Pre-Pandemic Levels

by Calculated Risk on 3/05/2023 09:36:00 AM

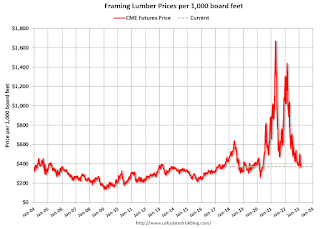

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through March 3rd.

Prices are down 8% compared to the same week in 2019, and below the pre-pandemic levels of around $400.

Click on graph for larger image.

Click on graph for larger image.It is unlikely we will see a significant runup in prices this Spring due to the housing slowdown.

Saturday, March 04, 2023

Real Estate Newsletter Articles this Week: "Price-to-rent index is 7.1% below recent peak"

by Calculated Risk on 3/04/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index "Decline Continued" to 5.8% year-over-year increase in December

• Year-over-year Rent Growth Continues to Decelerate

• Freddie Mac House Price Index Declines for 7th Consecutive Month in January

• Lawler: AMH Net Seller of Existing Single-Family Homes, “Investor” Home Purchases Plunged

• Inflation Adjusted House Prices 3.9% Below Peak Price-to-rent index is 7.1% below recent peak

• Measures of Shelter in the CPI and PCE price indexes Still Increasing

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!