by Calculated Risk on 3/13/2023 04:43:00 PM

Monday, March 13, 2023

Bank Failure #2 in 2023: Silicon Valley Bank

Note: There were over 500 bank failures during and immediately following the GFC, and almost 300 in just 2009 and 2010. That was mostly due to default risk (poor performing MBS). I don't expect a large wave of failures now.

From the FDIC: FDIC Establishes Signature Bridge Bank, N.A., as Successor to Signature Bank, New York, NY

Signature Bank, New York, NY, was closed today by the New York State Department of Financial Services, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect depositors, the FDIC transferred all the deposits and substantially all of the assets of Signature Bank to Signature Bridge Bank, N.A., a full-service bank that will be operated by the FDIC as it markets the institution to potential bidders. ... Signature Bank had total assets of $110.4 billion and total deposits of $88.6 billion as of December 31, 2022. As receiver, the FDIC will operate Signature Bridge Bank, N.A. to maximize the value of the institution for a future sale and to maintain banking services in the communities formerly served by Signature Bank.

Pandemic Economics, Housing and Monetary Policy: Part II

by Calculated Risk on 3/13/2023 10:32:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Pandemic Economics, Housing and Monetary Policy: Part 2

A brief excerpt:

Special Note: This was mostly written prior to the failure of Silicon Valley Bank. Now it appears the Fed might pause in March. Goldman Sachs economists wrote last night: “we no longer expect the FOMC to deliver a rate hike at its next meeting on March 22 (vs. our previous expectation of a 25bp hike)”, although BofA economists wrote this morning “After the latest developments around Silicon Valley Bank and the Fed, we retain our outlook for a 25bp hike in March.”There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

In Part 1 of Pandemic Economics, Housing and Monetary Policy I noted that pandemic economic outcomes were frequently largely unexpected. And that this has been especially true for housing.

Housing is the key transmission mechanism for monetary policy. And we need to be on the lookout for pandemic distortions to normal economic patterns - especially in housing - and hope that the Federal Open Market Committee (FOMC) will adjust monetary policy accordingly.

Many analysts are puzzled about why the economy hasn’t slowed quicker given the rapid increase in the Fed Funds rate over the last year. Some analysts are even concerned about “premature reacceleration”. Some analysts are even concerned about “premature reacceleration”. Goldman Sachs economists wrote last week:“In recent months we have argued that the drag on GDP growth from last year’s fiscal and monetary policy tightening is fading, not growing, and that this means that the key risk for the economy is a premature reacceleration, not an imminent recession.”When I read some of the recent comments from FOMC members, I’m reminded of a great scene from the movie China Syndrome where a stuck indicator almost led to catastrophic failure.

emphasis added

Housing March 13th Weekly Update: Inventory Decreased 1.5% Week-over-week

by Calculated Risk on 3/13/2023 08:47:00 AM

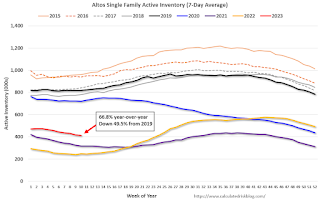

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, March 12, 2023

Sunday Night Futures

by Calculated Risk on 3/12/2023 06:12:00 PM

Weekend:

• Schedule for Week of March 12, 2023

Monday:

• At 10:00 AM ET, State Employment and Unemployment (Monthly) for January 2023

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 8 and DOW futures are up 40 (fair value).

Oil prices were up over the last week with WTI futures at $76.68 per barrel and Brent at $82.78 per barrel. A year ago, WTI was at $109, and Brent was at $118 - so WTI oil prices are DOWN 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.43 per gallon. A year ago, prices were at $4.29 per gallon, so gasoline prices are down $0.86 per gallon year-over-year.

Second Home Market: South Lake Tahoe in February

by Calculated Risk on 3/12/2023 10:05:00 AM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through February 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, and only up slightly from the record low set in February 2022.

Saturday, March 11, 2023

Real Estate Newsletter Articles this Week: "Pandemic Economics and Housing"

by Calculated Risk on 3/11/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Pandemic Economics, Housing and Monetary Policy: Part I

• Black Knight Mortgage Monitor: Home Prices Declined in January, "on pace to fall below 0% by March/April"

• 1st Look at Local Housing Markets in February

• "Home ATM" is Closing

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of March 12, 2023

by Calculated Risk on 3/11/2023 08:11:00 AM

The key reports this week are February CPI, Retail Sales, and Housing Starts.

For manufacturing, the February Industrial Production report and the March NY and Philly Fed manufacturing surveys will be released.

10:00 AM: State Employment and Unemployment (Monthly) for January 2023

6:00 AM ET: NFIB Small Business Optimism Index for February.

8:30 AM: The Consumer Price Index for February from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.4% increase in core CPI. The consensus is for CPI to be up 6.0% Year-over-year (YoY), and core CPI to be up 5.5% YoY.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

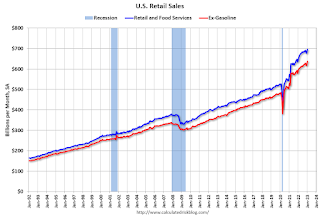

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.3% decrease in retail sales.

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.3% decrease in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales ex-gasoline were up 3.2% in January.

8:30 AM: The Producer Price Index for February from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.4% increase in core PPI.

8:30 AM: The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of -7.7, down from -5.8.

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 41, down from 42. Any number below 50 indicates that more builders view sales conditions as poor than good.

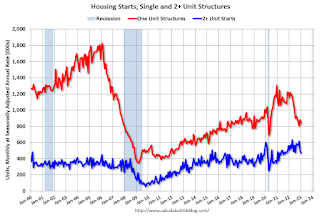

8:30 AM: Housing Starts for February.

8:30 AM: Housing Starts for February. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.310 million SAAR, up from 1.309 million SAAR.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 205 thousand initial claims, down from 211 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for March. The consensus is for a reading of -14.8, up from -24.3.

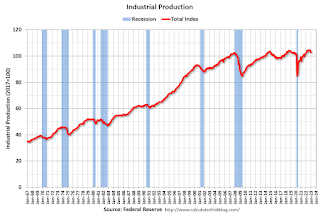

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.5%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for March).

Friday, March 10, 2023

COVID Mar 10, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 3/10/2023 09:03:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 170,576 | 226,995 | ≤35,0001 | |

| Hospitalized2 | 18,561 | 21,235 | ≤3,0001 | |

| Deaths per Week2 | 1,862 | 2,265 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Hotels: Occupancy Rate Down 5.6% Compared to Same Week in 2019

by Calculated Risk on 3/10/2023 04:11:00 PM

U.S. hotel performance fell from the previous week, according to STR‘s latest data through March 4.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Feb. 26 through March 4, 2023 (percentage change from comparable weeks in 2022, 2019):

• Occupancy: 62.8% (+3.0%, -5.6%)

• verage daily rate (ADR): $151.35 (+8.9%, +14.1%)

• Revenue per available room (RevPAR): $95.06 (+12.1%, +7.7%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019. Year-over-year comparisons will once again become standard after Q1.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Q1 GDP Tracking

by Calculated Risk on 3/10/2023 03:42:00 PM

From BofA:

The trade deficit in January widened to $68.3bn, the widest deficit in the last three months. Exports increased by 3.4% m/m while imports went up by 3.0%. This increased our tracking estimate for bothexports and imports, while reducing our estimate fornet exports in 1Q. On net, since the last weekly publication, this pushed down our 1Q US GDP tracking estimate from 0.9% q/q saar to 0.7% q/q saar. [Mar 10th estimate]From Goldman:

emphasis added

We left our Q1 GDP tracking estimate unchanged at +2.0% (qoq ar). We also left our domestic final sales forecast unchanged at +2.3%. [Mar 8th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 2.6 percent on March 8, up from 2.0 percent on March 7. [Mar 8th estimate]