by Calculated Risk on 3/15/2023 08:37:00 PM

Wednesday, March 15, 2023

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

Thursday:

• At 8:30 AM ET, Housing Starts for February. The consensus is for 1.310 million SAAR, up from 1.309 million SAAR.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 205 thousand initial claims, down from 211 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for March. The consensus is for a reading of -14.8, up from -24.3.

Weather Boosted Employment by About 65,000 in February

by Calculated Risk on 3/15/2023 03:13:00 PM

The BLS also reported 493 thousand people that are usually full-time employees were working part time in January due to bad weather. The average for February over the previous 10 years was 1.57 million (median was 708 thousand). This series suggests weather positively impacted employment more than usual (boosting seasonally adjusted employment).

The San Francisco Fed estimates Weather-Adjusted Change in Total Nonfarm Employment (monthly change, seasonally adjusted). They use local area weather to estimate the impact on employment. For February, the San Francisco Fed estimated that weather boosted employment by 65 to 95 thousand jobs.

This is the second consecutive month with an employment boost from better than normal weather, and we should expect some negative payback in coming months.

Current State of the Housing Market: Overview for mid-March

by Calculated Risk on 3/15/2023 12:14:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Current State of the Housing Market; Overview for mid-March

A brief excerpt:

The following graph from MortgageNewsDaily.com shows mortgage rates since January 1, 2020. 30-year mortgage rates were at 6.75% on March 14th, up from 6.0% in early February, and down from the recent high of over 7.0% - and still up sharply year-over-year.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

A year ago, the payment on a $500,000 house, with a 20% down payment and 3.76% 30-year mortgage rates, would be around $1,855 for principal and interest. The monthly payment for the same house, with house prices up 3% YoY and mortgage rates at 6.75%, would be $2,672 - an increase of 44%! Monthly payments are still up sharply year-over-year.

There are always some people that need to sell; death, divorce, moving for employment are a few reasons. However, homeowners with a low mortgage rate will be reluctant to sell, and then buy a new home, when their monthly payment will be much higher for the new home. The sharp increase in mortgage rates is probably the key reason new listings have declined sharply year-over-year.

This is very different from the housing bust, when many homeowners were forced to sell as their teaser rates expired and they could not afford the fully amortized mortgage payment. The current situation is similar to the 1980 period, when rates increased quickly.

NAHB: Builder Confidence Increased in March

by Calculated Risk on 3/15/2023 10:13:00 AM

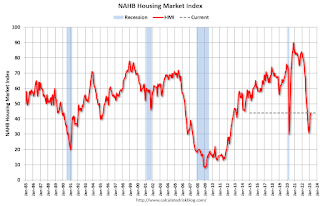

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 44, up from 42 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Edges Higher in March but Future Outlook Uncertain

Although high construction costs and elevated interest rates continue to hamper housing affordability, builders expressed cautious optimism in March as a lack of existing inventory is shifting demand to the new home market.

Builder confidence in the market for newly built single-family homes in March rose two points to 44, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This is the third straight monthly increase in builder sentiment levels..

...

The HMI index gauging current sales conditions in March rose two points to 49 and the gauge measuring traffic of prospective buyers increased three points to 31. This is the highest traffic reading since September of last year. The component charting sales expectations in the next six months fell one point to 47.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose five points to 42, the Midwest edged one-point higher to 34, the South increased five points to 45 and the West moved four points higher to 34.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was above the consensus forecast.

Retail Sales Decreased 0.4% in February

by Calculated Risk on 3/15/2023 08:42:00 AM

On a monthly basis, retail sales were down 0.4% from January to February (seasonally adjusted), and sales were up 5.4 percent from February 2022.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for February 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $697.9 billion, down 0.4 percent from the previous month, but up 5.4 percent above February 2022. ... The December 2022 to January 2023 percent change was revised from up 3.0 percent to up 3.2 percent.

emphasis added

Click on graph for larger image.

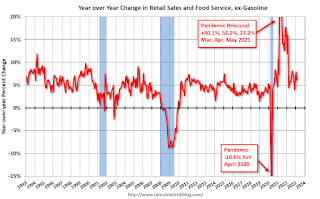

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.4% in February.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 6.1% on a YoY basis.

Sales in February were slightly below expectations, however, sales in December and January were revised up.

Sales in February were slightly below expectations, however, sales in December and January were revised up.

MBA: Mortgage Purchase Applications Increased in Weekly Survey

by Calculated Risk on 3/15/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 6.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 10, 2023.

The Market Composite Index, a measure of mortgage loan application volume, increased 6.5 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 7 percent compared with the previous week. The Refinance Index increased 5 percent from the previous week and was 74 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 7 percent from one week earlier. The unadjusted Purchase Index increased 8 percent compared with the previous week and was 38 percent lower than the same week one year ago.

“Treasury yields declined late last week, as market concerns over bank closures and the potential for broader ripple effects triggered a flight to safety in Treasury bonds. This decline pushed mortgage rates for all loan types lower, with the 30-year fixed rate decreasing to 6.71 percent,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Home-purchase applications increased for the second straight week but remained almost 40 percent below last year’s pace. While lower rates should buoy housing demand, the financial market volatility may cause buyers to pause their decisions.”

Added Kan, “Refinance activity remained more than 70 percent behind last year’s level, as rates are still more than two percentage points higher than a year ago. The dip in rates did bring some borrowers back as evidenced by the 5 percent increase in refinance applications last week.”

..

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.71 percent from 6.79 percent, with points decreasing to 0.79 from 0.80 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Tuesday, March 14, 2023

Wednesday: Retail Sales, PPI, NY Fed Mfg, Homebuilder Survey

by Calculated Risk on 3/14/2023 08:06:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for February is scheduled to be released. The consensus is for a 0.3% decrease in retail sales.

• Also at 8:30 AM, The Producer Price Index for February from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.4% increase in core PPI.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of -7.7, down from -5.8.

• At 10:00 AM, The March NAHB homebuilder survey. The consensus is for a reading of 41, down from 42. Any number below 50 indicates that more builders view sales conditions as poor than good.

Q4 Update: Delinquencies, Foreclosures and REO

by Calculated Risk on 3/14/2023 04:47:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt:

In 2021, I pointed out that with the end of the foreclosure moratoriums, combined with the expiration of a large number of forbearance plans, we would see an increase in REOs in late 2022 and into 2023. However, this would NOT lead to a surge in foreclosures and significantly impact house prices (as happened following the housing bubble) since lending has been solid and most homeowners have substantial equity in their homes.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Last week, CoreLogic reported on homeowner equity: US Annual Home Equity Gains Cool Again in Q4 2022, CoreLogic ReportsThe report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) saw equity increase by 7.3% year over year, representing a collective gain of $1 trillion, for an average of $14,300 per borrower, since the fourth quarter of 2021.With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

...

Here is some data on REOs through Q4 2022 …

...

This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) increased from $818 million in Q3 2022 to $829 million in Q4 2022. This is increasing, but still very low.

...

The bottom line is there will be an increase in foreclosures in 2023 (from record low levels), but it will not be a huge wave of foreclosures as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.

2nd Look at Local Housing Markets in February

by Calculated Risk on 3/14/2023 11:42:00 AM

Today, in the Calculated Risk Real Estate Newsletter:

2nd Look at Local Housing Markets in February

A brief excerpt:

This is the second look at local markets in February. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

In February, sales in these markets were down 23.1%. In January, these same markets were down 33.8% YoY Not Seasonally Adjusted (NSA).

This is a significantly smaller YoY decline NSA than in January for these early reporting markets.

The early data suggests NAR reported sales will rebound in February. This will still be a significant YoY decline, and the 18th consecutive month with a YoY decline.

...

Many more local markets to come!

Cleveland Fed: Median CPI increased 0.6% and Trimmed-mean CPI increased 0.5% in February

by Calculated Risk on 3/14/2023 11:23:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI:

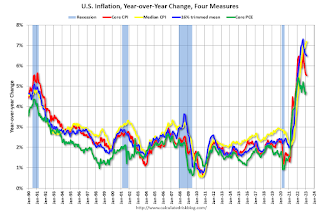

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.6% in February. The 16% trimmed-mean Consumer Price Index increased 0.5% in February. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. "Fuel oil and other fuels" decreased at a 55% annualized rate in February, and "Used Cars" decreased at a 29% annualized rate.