by Calculated Risk on 3/24/2023 09:21:00 PM

Friday, March 24, 2023

COVID Mar 24, 2023: Update on Cases, Hospitalizations and Deaths

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 133,521 | 153,183 | ≤35,0001 | |

| Hospitalized2 | 15,705 | 17,594 | ≤3,0001 | |

| Deaths per Week2🚩 | 2,060 | 1,753 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

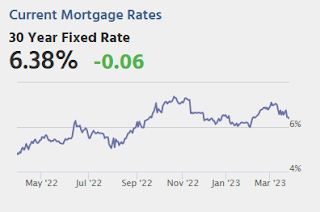

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Hotels: Occupancy Rate Down 2.5% Compared to Same Week in 2019

by Calculated Risk on 3/24/2023 03:01:00 PM

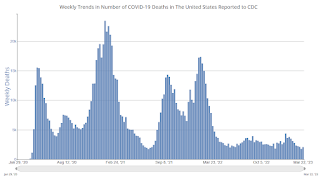

Helped by spring break travel, U.S. hotel performance increased from the previous week, according to STR‘s latest data through 18 March.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

March 12-18, 2023 (percentage change from comparable weeks in 2022, 2019):

• Occupancy: 67.6% (+1.3%, -2.5%)

• Average daily rate (ADR): $167.04 (+8.9%, +23.9%)

• Revenue per available room (RevPAR): $112.89 (+10.4%, +20.8%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Q1 GDP Tracking: Wide Range

by Calculated Risk on 3/24/2023 01:24:00 PM

Note: The FOMC is projecting Q4-over-Q4 GDP growth of 0.0% to 0.8%. Here is a table of the low, middle and high FOMC projections for Q2 through Q4 based on the GDP tracking estimates below for Q1.

| Estimated FOMC Projection Q2 - Q4 | ||||

|---|---|---|---|---|

| Q1 | Low 0.0% | Middle 0.4% | High 0.8% | |

| BofA | 0.8% | -0.3% | 0.3% | 0.8% |

| Goldman | 2.4% | -0.8% | -0.3% | 0.3% |

| GDPNow | 3.2% | -1.0% | -0.5% | 0.0% |

Based on the GDP tracking estimates, the FOMC's GDP projection for Q4-over-Q4 and the FOMC unemployment projections, many analysts pointed out that the FOMC is essentially projecting a recession in the 2nd half of 2023.

From BofA:

Core capital orders and shipments in February came in lower than expected at 0.2% m/m and 0.0% m/m, respectively. This modestly reduced our tracking estimate for equipment spending in 1Q. Inventories for nondurable goods also came in lower in February, thereby reducing our inventory tracking estimate. On net, this decreased our 1Q US GDP tracking estimate from 1.0% q/q saar to 0.8% q/q saar. [Mar 24th estimate]From Goldman:

emphasis added

Durable goods orders declined against consensus expectations for a small increase, while core capital goods orders edged higher. The report covers February activity and therefore predates the recent banking stresses. The capex shipments details of the durable goods report were weaker than our previous assumptions. We lowered our Q1 GDP tracking estimate by two tenths to +2.4% (qoq ar) and our domestic final sales growth estimate by 0.1pp to +2.9%. [Mar 24th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 3.2 percent on March 24, unchanged from March 16 after rounding. An increase in the nowcast of GDP growth from 3.2 percent to 3.5 percent following the March 21 existing-home sales release from the National Association of Realtors was reversed after this morning’s advance manufacturing report from the US Census Bureau. [Mar 24th estimate]

Final Look at Local Housing Markets in February

by Calculated Risk on 3/24/2023 10:10:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in February

A brief excerpt:

The big story for February existing home sales was the sharp year-over-year (YoY) decline in sales, and also the rebound from the low level of sales in December and January. Also, active inventory increased sharply YoY, but is still historically low - and new listings are down YoY.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the final look at local markets in February. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I update these tables throughout each month as additional data is released.

First, here is a table comparing the year-over-year Not Seasonally Adjusted (NSA) declines in sales this year from the National Association of Realtors® (NAR) with the local markets I track. So far, these measures have tracked closely. The NAR reported sales were down 23.0% NSA YoY in February.

...

Note: Even if existing home sales activity bottomed in December (4.03 million SA) and January (4.00 million SA), there are usually two bottoms for housing - the first for activity and the second for prices. See Has Housing "Bottomed"?

My early expectation is we will see a similar YoY sales decline in March as in February, since mortgage rates for contracts signed in January and February were about the same level as contracts that closed in February.

More local data coming in April for activity in March!

Realtor.com Reports Weekly Active Inventory Up 59% YoY; New Listings Down 20% YoY

by Calculated Risk on 3/24/2023 08:33:00 AM

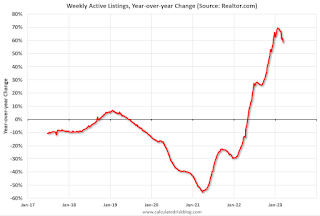

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released yesterday from Sabrina Speianu: Weekly Housing Trends View — Data Week Ending Mar 18, 2023

• Active inventory growth continued to climb with for-sale homes up 59% above one year ago. Inventories of for-sale homes rose, but at a slightly slower pace than last week’s gain, as new sellers on the market held back more. With a lack of newly listed homes compared to the same time last year, growth in the number of homes for sale is driven by longer time on market. However, it is important to note that this time last year, time on market was near all-time lows.

...

• New listings–a measure of sellers putting homes up for sale–were again down, this week by 20% from one year ago. For 37 weeks, fewer homeowners put their homes on the market for sale than at the same time a year prior. This week’s gap was larger than last week’s, and the lack of new sellers continues to be a drag on existing home sales, which declined by 22.8% compared to February of last year, according to the National Association of Realtors..

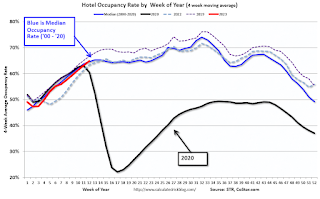

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up sharply year-over-year - from record lows - however, the YoY increase has slowed recently.

Thursday, March 23, 2023

Friday: Durable Goods

by Calculated Risk on 3/23/2023 09:04:00 PM

Friday:

• At 8:30 AM ET, Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.2% increase in durable goods orders.

• At 10:00 AM, State Employment and Unemployment (Monthly), February 2023

Vehicle Sales Forecast: Vehicle Sales to be up Year-over-year in March

by Calculated Risk on 3/23/2023 04:02:00 PM

From WardsAuto: March U.S. Light-Vehicle Sales, Inventory Pegged for Solid Gains; First-Quarter Deliveries to Rise 7% (pay content). Brief excerpt:

Though gradually improving, inventory remains the story behind why sales remain low by historical standards. There are underlying crosscurrents related to the economy, rising interest rates and geopolitics, among others, that are helping stanch demand, but lack of inventory is the main reason growth is not significantly stronger (and even largely why prices are stuck at elevated levels - though that headwind is lessening as inventory rises).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for March (Red).

The Wards forecast of 14.4 million SAAR, would be down 3% from last month, and up 6.2% from a year ago.

More Good News for Homebuilders

by Calculated Risk on 3/23/2023 01:41:00 PM

Today, in the Calculated Risk Real Estate Newsletter: More Good News for Homebuilders

A brief excerpt:

Last October I wrote: Some "Good News" for HomebuildersThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

I noted:[T]he good news for the homebuilders is activity usually picks up quickly following an interest rate induced slowdown (as opposed to following the housing bust when the recovery took many years).I included the following graph to illustrate this point. The following graph shows new home sales for three periods: 1978-1982, 2005-2020, and current (red). The prior peak in sales is set to 100 (updated through the February New Home sales release).

...

My sense is this downturn will have some similarities to the 1980 period, see: Housing: Don't Compare the Current Housing Boom to the Bubble and Bust

Black Knight: Mortgage Delinquencies Increased Slightly in February

by Calculated Risk on 3/23/2023 12:33:00 PM

From Black Knight: Black Knight’s First Look at February 2023 Mortgage Data: Prepayments Rebound from All-Time Low; Overall Mortgage Delinquencies Inch Up As 30-Days Late Payments Rise

• The national mortgage delinquency rate increased 7 basis points in February to 3.45%, but remains down 12.6% year over yearAccording to Black Knight's First Look report, the percent of loans delinquent increased 2.0% in February compared to January and decreased 13% year-over-year.

• Prepayment activity (SMM) inched up to 0.35% – breaking a four-month streak of record lows, with relief likely to extend as the spring homebuying season takes hold

• A 36K rise in overall delinquencies was driven by a nearly 65K increase in those just a single payment behind, while 60-day delinquencies fell by nearly 12K (-4.0%) and 90-day delinquencies fell by 17K (-3.0%)

...

• Foreclosure starts decreased by 9% in the month to 29K, breaking a streak of increases, with starts remaining 19% below pre-pandemic levels

...

• Active foreclosure inventory rose marginally (+2K) in the month, and is up 34K (+15%) from February 2022 despite remaining 15% below its pre-pandemic level

• February saw 7.1K foreclosure sales (completions) nationally, up 2.5% from the month prior

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.45% in February, up from 3.38% the previous month.

The percent of loans in the foreclosure process increased slightly in February to 0.46%, from 0.45% the previous month.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Feb 2023 | Jan 2023 | |||

| Delinquent | 3.45% | 3.38% | ||

| In Foreclosure | 0.46% | 0.45% | ||

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,811,000 | 1,775,000 | ||

| Number of properties in foreclosure pre-sale inventory: | 240,000 | 238,000 | ||

| Total Properties | 2,050,000 | 2,012,000 | ||

New Home Sales at 640,000 Annual Rate in February; New Home Average Prices Down 4.5% Year-over-year

by Calculated Risk on 3/23/2023 10:42:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales at 640,000 Annual Rate in February

Brief excerpt:

And on prices, from the Census Bureau:You can subscribe at https://calculatedrisk.substack.com/.The median sales price of new houses sold in February 2023 was $438,200. The average sales price was $498,700.The following graph shows the median and average new home prices. The average price in February 2023 was $498,700 down 4.5% year-over-year. The median price was $438,200 up 2.5% year-over-year. This suggests a year-over-year decrease in prices, although both the median and the average are impacted by the mix of homes sold.

...

This was for contracts signed in February when mortgage rates were lower - and builders were buying down rates. Mortgage rates increased again at the end of February, and that will likely impact sales in March.

As previously discussed, the Census Bureau overestimates sales, and underestimates inventory when cancellation rates are rising, see: New Home Sales and Cancellations: Net vs Gross Sales. This might be reversing now since cancellation rates have started to decline. When a previously cancelled home is resold, the home builder counts it as a sale, but the Census Bureau does not (since it was already counted).

There are a large number of homes under construction, and this suggests we will see a further increase in completed inventory over the next several months - and that will keep pressure on new home prices.