by Calculated Risk on 3/31/2023 01:23:00 PM

Friday, March 31, 2023

Freddie Mac House Price Index Declines for 8th Consecutive Month in February

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Declines for 8th Consecutive Month in February

A brief excerpt:

Freddie Mac reported that its “National” Home Price Index (FMHPI) declined for the eighth consecutive month on a seasonally adjusted basis in February, putting the National FMHPI down 2.5% from its June 2022 peak, and down 4.7% Not Seasonally Adjusted (NSA) from the peak.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

On a year-over-year basis, the National FMHPI was up 1.1% in February, down from 2.9% YoY in January. The YoY increase peaked at 19.2% in July 2021. ...

In February, 29 states and D.C. were below their 2022 peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Idaho (-10.0%), Nevada (-8.4%), Washington (-7.5%), Arizona (-7.1%), California (-6.9%), Utah (-6.8%), and D.C. (-6.7%).

...

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted.

Q1 GDP Tracking: Around 2%

by Calculated Risk on 3/31/2023 12:29:00 PM

From BofA:

Personal income rose by a larger-than-expected 0.3% m/m in February, after a 0.6% m/m print in January. Personal spending rose by 0.2% m/m in nominal terms with sizeable upward revisions to January, both in nominal and real terms. This increased our 1Q PCE tracking estimate. Overall, today's personal income and outlays print pushed up our 1Q US GDP tracking estimate from 0.8% q/q saar to 1.5% q/q saar. [Mar 31st estimate]From Goldman:

emphasis added

The February core PCE price index rose by 0.30% month-over-month, below consensus expectations, and the year-over-year rate decreased to 4.60%. ... The spending details of this morning’s data were firmer than our previous assumptions, and we boosted our Q1 GDP tracking estimate by 0.2pp to +2.4% (qoq ar). [Mar 31st estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 2.5 percent on March 31, down from 3.2 percent on March 24. After recent releases from the US Census Bureau and the US Bureau of Economic Analysis, the nowcasts of first-quarter real personal consumption expenditures growth, first-quarter real gross private domestic investment growth, and first-quarter real government spending growth decreased from 5.0 percent, -7.0 percent, and 1.8 percent, respectively, to 4.6 percent, -7.3 percent, and 1.7 percent. [Mar 31st estimate]

Personal Income increased 0.3% in February; Spending increased 0.2%

by Calculated Risk on 3/31/2023 08:36:00 AM

The BEA released the Personal Income and Outlays report for February:

Personal income increased $72.9 billion (0.3 percent) in February, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $89.9 billion (0.5 percent) and personal consumption expenditures (PCE) increased $27.9 billion (0.2 percent).The February PCE price index increased 5.0 percent year-over-year (YoY), down from 5.3 percent YoY in January, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index also increased 0.3 percent. Real DPI increased 0.2 percent in February and Real PCE decreased 0.1 percent; goods and services each decreased 0.1 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through February 2023 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was at expectations, and the increase in PCE was below expectations.

Using the two-month method to estimate Q1 real PCE growth, real PCE was increasing at a 4.0% annual rate in Q1 2023. (Using the mid-month method, real PCE was increasing at 4.7%)

Thursday, March 30, 2023

Friday: Personal Income and Outlays

by Calculated Risk on 3/30/2023 08:44:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for February. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.4%. PCE prices are expected to be up 5.1% YoY, and core PCE prices up 4.7% YoY.

• At 9:45 AM, Chicago Purchasing Managers Index for March. The consensus is for a reading of 43.6, unchanged from 43.6 in February.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 63.4.

Hotels: Occupancy Rate Down 6.3% Compared to Same Week in 2019

by Calculated Risk on 3/30/2023 02:29:00 PM

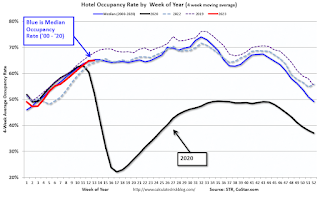

Reflecting the normal ebb and flow of spring break season, U.S. hotel performance decreased from the previous week, according to STR‘s latest data through March 25.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

March 19-25, 2023 (percentage change from comparable weeks in 2022, 2019):

• Occupancy: 64.9% (-0.6%, -6.3%)

• Average daily rate (ADR): $158.61 (+4.7%, +19.5%)

• Revenue per available room (RevPAR): $102.98 (+4.1%, +12.0%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Realtor.com Reports Weekly Active Inventory Up 57% YoY; New Listings Down 20% YoY

by Calculated Risk on 3/30/2023 12:26:00 PM

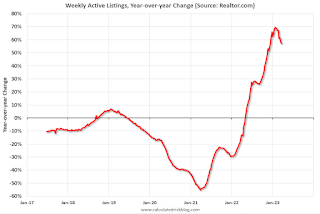

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Mar 25, 2023

• Active inventory growth continued to climb with for-sale homes up 57% above one year ago. Inventories of for-sale homes rose, but at a slightly slower pace than the previous week for a second time as the smaller number of hopeful homebuyers still outnumber new sellers on the market. Growth in the number of homes for sale is primarily being driven by longer time on market and needs to be put into context. The number of homes for-sale in March surpasses the two most recent years, but is still roughly only half of what was typical for this time of year in 2017 to 2019.

...

• New listings–a measure of sellers putting homes up for sale–were again down, this week by 20% from one year ago. For 38 weeks, the number of newly listed homes has trailed the prior year. The gap was steady this week, but at a fairly low level. In fact, March data show that the number of new listings to hit the market was nearly on par with the low in April 2020 when a large number of activities were curtailed in the early days of the pandemic.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up sharply year-over-year - from record lows - however, the YoY increase has slowed recently.

Inflation Adjusted House Prices 4.6% Below Peak

by Calculated Risk on 3/30/2023 09:45:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 4.6% Below Peak; Price-to-rent index is 7.9% below recent peak

Excerpt:

It has been 17 years since the bubble peak. In the January Case-Shiller house price index released on Tuesday, the seasonally adjusted National Index (SA), was reported as being 60% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 11% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is at the bubble peak.

These inflation adjusted indexes have been declining for eight months in real terms.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $200,000 in January 2000, the price would be almost $340,000 today adjusted for inflation (70% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index.

Q4 GDP Growth Revised Down to 2.6% Annual Rate

by Calculated Risk on 3/30/2023 08:37:00 AM

From the BEA: Gross Domestic Product, Fourth Quarter and Year 2022 (Third Estimate), GDP by Industry, and Corporate Profits

Real gross domestic product (GDP) increased at an annual rate of 2.6 percent in the fourth quarter of 2022), according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 1.4% to 1.0%. Residential investment was revised up from -25.9% to -25.1%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.7 percent. The revision primarily reflected downward revisions to exports and consumer spending (refer to "Updates to GDP"). Imports, which are a subtraction in the calculation of GDP, were revised down.

emphasis added

Weekly Initial Unemployment Claims increase to 198,000

by Calculated Risk on 3/30/2023 08:34:00 AM

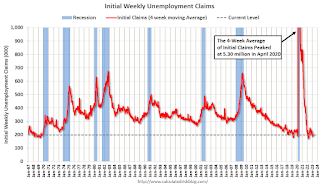

The DOL reported:

In the week ending March 25, the advance figure for seasonally adjusted initial claims was 198,000, an increase of 7,000 from the previous week's unrevised level of 191,000. The 4-week moving average was 198,250, an increase of 2,000 from the previous week's unrevised average of 196,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 198,250.

The previous week was unrevised.

Weekly claims were slightly above the consensus forecast.

Wednesday, March 29, 2023

Thursday: GDP, Unemployment Claims

by Calculated Risk on 3/29/2023 08:32:00 PM

Thursday:

• At 8:30 AM ET, Gross Domestic Product, 4th Quarter and Year 2022 (Third Estimate), GDP by Industry, and Corporate Profits. The consensus is that real GDP increased 2.7% annualized in Q4, unchanged from the second estimate.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 196 thousand initial claims, up from 191 thousand last week.