by Calculated Risk on 4/03/2023 10:21:00 AM

Monday, April 03, 2023

Construction Spending Decreased 0.1% in February

From the Census Bureau reported that overall construction spending decreased:

Construction spending during February 2023 was estimated at a seasonally adjusted annual rate of $1,844.1 billion, 0.1 percent below the revised January estimate of $1,845.4 billion. The February figure is 5.2 percent above the February 2022 estimate of $1,753.1 billion.Private spending was "virtually unchanged" and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,453.2 billion, virtually unchanged from the revised January estimate of $1,453.6 billion. ...

In February, the estimated seasonally adjusted annual rate of public construction spending was $391.0 billion, 0.2 percent below the revised January estimate of $391.8 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 9.8% below the recent peak.

Non-residential (blue) spending is at a new peak.

Public construction spending is close to the recent peak.

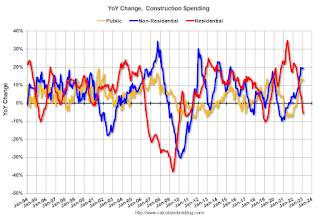

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 5.7%. Non-residential spending is up 19.4% year-over-year. Public spending is up 12.8% year-over-year.

ISM® Manufacturing index Decreased to 46.3% in March

by Calculated Risk on 4/03/2023 10:04:00 AM

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 46.3% in March, down from 47.7% in February. The employment index was at 46.9%, down from 49.1% last month, and the new orders index was at 44.3%, up from 47.0%.

From ISM: Manufacturing PMI® at 46.3%

March 2023 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in March for the fifth consecutive month following a 28-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in March. This was below the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The March Manufacturing PMI® registered 46.3 percent, 1.4 percentage points lower than the 47.7 percent recorded in February. Regarding the overall economy, this figure indicates a fourth month of contraction after a 30-month period of expansion. The Manufacturing PMI® is at its lowest level since May 2020, when it registered 43.5 percent. The New Orders Index remained in contraction territory at 44.3 percent, 2.7 percentage points lower than the figure of 47 percent recorded in February. The Production Index reading of 47.8 percent is a 0.5-percentage point increase compared to February’s figure of 47.3 percent. The Prices Index registered 49.2 percent, down 2.1 percentage points compared to the February figure of 51.3 percent. The Backlog of Orders Index registered 43.9 percent, 1.2 percentage points lower than the February reading of 45.1 percent. The Employment Index continued in contraction territory, registering 46.9 percent, down 2.2 percentage points from February’s reading of 49.1 percent. The Supplier Deliveries Index figure of 44.8 percent is 0.4 percentage point lower than the 45.2 percent recorded in February; this is the index’s lowest reading since March 2009 (43.2 percent). The Inventories Index dropped into contraction at 47.5 percent, 2.6 percentage points lower than the February reading of 50.1 percent. The New Export Orders Index reading of 47.6 percent is 2.3 percentage points lower than February’s figure of 49.9 percent. The Imports Index continued in contraction territory at 47.9 percent, 2 percentage points below the 49.9 percent reported in February.”

emphasis added

Housing April 3rd Weekly Update: Inventory Decreased 0.8% Week-over-week

by Calculated Risk on 4/03/2023 08:18:00 AM

Click on graph for larger image.

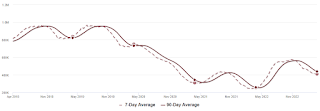

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, April 02, 2023

Monday: ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 4/02/2023 06:42:00 PM

Weekend:

• Schedule for Week of April 2, 2023

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for March. The consensus is for the ISM to be at 47.5, down from 47.7 in February.

• Also at 10:00 AM, Construction Spending for February. The consensus is for 0.1% decrease in construction spending.

• All day, Light vehicle sales for March. The consensus is for light vehicle sales to be 14.9 million SAAR in March, unchanged from 14.9 million in February (Seasonally Adjusted Annual Rate).

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $75.67 per barrel and Brent at $79.89 per barrel. A year ago, WTI was at $99, and Brent was at $106 - so WTI oil prices are DOWN 23% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.48 per gallon. A year ago, prices were at $4.20 per gallon, so gasoline prices are down $0.72 per gallon year-over-year.

Update: Framing Lumber Prices Down 63% YoY, Below Pre-Pandemic Levels

by Calculated Risk on 4/02/2023 10:23:00 AM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through March 31st.

Prices are below the pre-pandemic levels of around $400.

Click on graph for larger image.

Click on graph for larger image.It is unlikely we will see a significant runup in prices this Spring due to the housing slowdown.

Saturday, April 01, 2023

Real Estate Newsletter Articles this Week: "Price-to-rent index is 7.9% below recent peak"

by Calculated Risk on 4/01/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Inflation Adjusted House Prices 4.6% Below Peak Price-to-rent index is 7.9% below recent peak

• Year-over-year Rent Growth Continues to Decelerate

• Case-Shiller: National House Price Index "Declining Trend Continued" to 3.8% year-over-year increase in January

• Freddie Mac House Price Index Declines for 8th Consecutive Month in February

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of April 2, 2023

by Calculated Risk on 4/01/2023 08:11:00 AM

The key report scheduled for this week is the March employment report on Friday.

Other key reports include the February Trade Deficit and March Auto Sales.

For manufacturing, the March ISM Manufacturing survey will be released.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 47.5, down from 47.7 in February.

10:00 AM: Construction Spending for February. The consensus is for 0.1% decrease in construction spending.

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 14.9 million SAAR in March, unchanged from 14.9 million in February (Seasonally Adjusted Annual Rate).

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 14.9 million SAAR in March, unchanged from 14.9 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

8:00 AM: Corelogic House Price index for February.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in January to 10.8 million from 11.2 million in December.

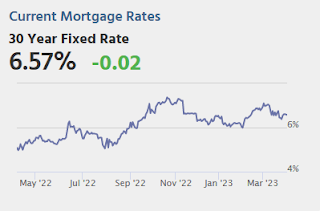

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 200,000 payroll jobs added in March, down from 242,000 added in February.

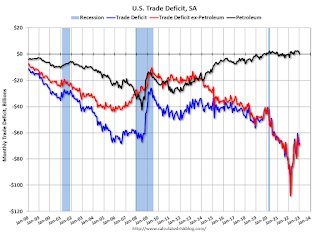

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $68.7 billion. The U.S. trade deficit was at $68.3 billion in January.

10:00 AM: the ISM Services Index for March.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 196 thousand initial claims, down from 198 thousand last week.

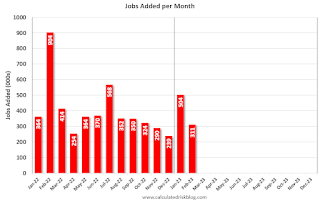

8:30 AM: Employment Report for March. The consensus is for 240,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

8:30 AM: Employment Report for March. The consensus is for 240,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.There were 311,000 jobs added in February, and the unemployment rate was at 3.6%.

This graph shows the jobs added per month since January 2022.

Friday, March 31, 2023

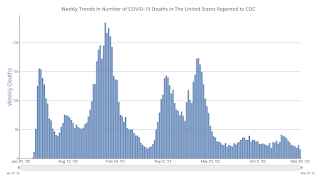

COVID Mar 31, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 3/31/2023 09:10:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 139,931 | 154,244 | ≤35,0001 | |

| Hospitalized2 | 14,650 | 15,965 | ≤3,0001 | |

| Deaths per Week2 | 1,596 | 2,260 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Freddie Mac House Price Index Declines for 8th Consecutive Month in February

by Calculated Risk on 3/31/2023 01:23:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Declines for 8th Consecutive Month in February

A brief excerpt:

Freddie Mac reported that its “National” Home Price Index (FMHPI) declined for the eighth consecutive month on a seasonally adjusted basis in February, putting the National FMHPI down 2.5% from its June 2022 peak, and down 4.7% Not Seasonally Adjusted (NSA) from the peak.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

On a year-over-year basis, the National FMHPI was up 1.1% in February, down from 2.9% YoY in January. The YoY increase peaked at 19.2% in July 2021. ...

In February, 29 states and D.C. were below their 2022 peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Idaho (-10.0%), Nevada (-8.4%), Washington (-7.5%), Arizona (-7.1%), California (-6.9%), Utah (-6.8%), and D.C. (-6.7%).

...

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted.

Q1 GDP Tracking: Around 2%

by Calculated Risk on 3/31/2023 12:29:00 PM

From BofA:

Personal income rose by a larger-than-expected 0.3% m/m in February, after a 0.6% m/m print in January. Personal spending rose by 0.2% m/m in nominal terms with sizeable upward revisions to January, both in nominal and real terms. This increased our 1Q PCE tracking estimate. Overall, today's personal income and outlays print pushed up our 1Q US GDP tracking estimate from 0.8% q/q saar to 1.5% q/q saar. [Mar 31st estimate]From Goldman:

emphasis added

The February core PCE price index rose by 0.30% month-over-month, below consensus expectations, and the year-over-year rate decreased to 4.60%. ... The spending details of this morning’s data were firmer than our previous assumptions, and we boosted our Q1 GDP tracking estimate by 0.2pp to +2.4% (qoq ar). [Mar 31st estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 2.5 percent on March 31, down from 3.2 percent on March 24. After recent releases from the US Census Bureau and the US Bureau of Economic Analysis, the nowcasts of first-quarter real personal consumption expenditures growth, first-quarter real gross private domestic investment growth, and first-quarter real government spending growth decreased from 5.0 percent, -7.0 percent, and 1.8 percent, respectively, to 4.6 percent, -7.3 percent, and 1.7 percent. [Mar 31st estimate]