by Calculated Risk on 4/05/2023 08:48:00 AM

Wednesday, April 05, 2023

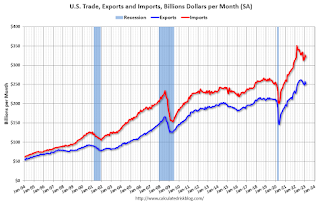

Trade Deficit increased to $70.5 Billion in February

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $70.5 billion in February, up $1.9 billion from $68.7 billion in January, revised.

February exports were $251.2 billion, $6.9 billion less than January exports. February imports were $321.7 billion, $5.0 billion less than January imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports decreased in February.

Exports are up 8% year-over-year; imports are up 1% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - but imports have been decreasing recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive.

The trade deficit with China decreased to $19.0 billion in January, from $30.7 billion a year ago.

ADP: Private Employment Increased 145,000 in March

by Calculated Risk on 4/05/2023 08:19:00 AM

Private sector employment increased by 145,000 jobs in March and annual pay was up 6.9 percent year-over-year, according to the March ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”)This was below the consensus forecast of 200,000. The BLS report will be released Friday, and the consensus is for 240 thousand non-farm payroll jobs added in March.

...

“Our March payroll data is one of several signals that the economy is slowing,” said Nela Richardson, chief economist, ADP. “Employers are pulling back from a year of strong hiring and pay growth, after a three-month plateau, is inching down.”

emphasis added

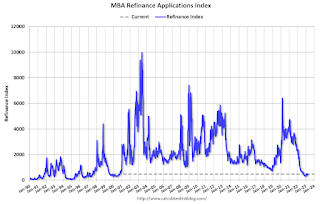

MBA: Mortgage Purchase Applications Decreased in Weekly Survey

by Calculated Risk on 4/05/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 31, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 4.1 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 4 percent compared with the previous week. The Refinance Index decreased 5 percent from the previous week and was 59 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 35 percent lower than the same week one year ago.

“Spring has arrived, but the housing market is missing the customary burst in listings and purchase activity that typically mark the season. After four weeks of increasing purchase application activity, volume declined a bit this week even with another small drop in mortgage rates,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Additionally, refinance application volume continues to be quite low. Although the mortgage rate for conforming balance loans declined by five basis points over the week to 6.40 percent, the mortgage rate for jumbo loans increased by nine basis points to 6.36 percent. While we have seen relative weakness at the high end of the housing market in recent months, the divergence in rates suggests that banks may be tightening credit in response to recent challenges, preserving balance sheet capacity as deposit balances have declined. In recent years, most jumbo loans have been kept on depository balance sheets.”

Added Fratantoni: “At the entry-level segment of the market, purchase applications for both FHA and VA loans decreased last week. We do expect strong demand from first-time homebuyers over the next several years given the large number of millennials hitting peak first-time homebuyer age, but affordability remains a real challenge in this environment.”

..

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.40 percent from 6.45 percent, with points decreasing to 0.59 from 0.62 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 35% year-over-year unadjusted.

Tuesday, April 04, 2023

Wednesday: Trade Deficit, ISM Services, ADP Employment

by Calculated Risk on 4/04/2023 09:17:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 200,000 payroll jobs added in March, down from 242,000 added in February.

• At 8:30 AM, Trade Balance report for February from the Census Bureau. The consensus is the trade deficit to be $68.7 billion. The U.S. trade deficit was at $68.3 billion in January.

• At 10:00 AM, the ISM Services Index for March.

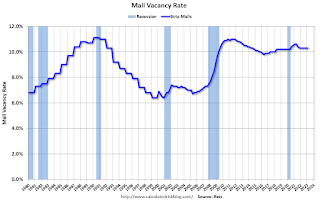

Moody's: Office Vacancy Rate Increased in Q1, Mall Vacancy Rate Unchanged

by Calculated Risk on 4/04/2023 05:04:00 PM

From Moody’s Analytics Senior Economist Lu Chen and economist Nick Luettke: Apartment temporarily oversupplied, Office approaching peak of vacancy, and Retail remained flat

Demand for office space extended its downward trend in Q1 as companies adjusted to uniquely designed hybrid models and strategically consolidated real estate space to improve operating margins. At the national level, more than 5 million square feet (sqft) was released back to the market this quarter. Meanwhile, construction slowed further with just over 3 million sqft of new space delivered in Q1. Vacancy rose to 19.0%, up 20 bps from a quarter-ago due to oversupplied stock and exceeding the pandemic peak of 18.5%. Office vacancies rose for the 5th consecutive quarter, another step closer to its historic peak of 19.3% in 1991. Asking rents increased by 0.4% in Q1 despite the rise in vacancies, likely an outcome of inflationary pressures.

The pandemic has accelerated market trends regarding how and where we work. Hybrid models have readily become adopted, though significant portions of the market remain either entirely in person or remote. With individual firms adopting competing models for specific business needs, a universal standard has yet to emerge. 2023 is poised to be a year of adaptation, or even innovation, as firms weigh their choices among location, size, and amenities given increased availability.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

And from Moody's on Retail:

Retail suffered the most when the Great Financial Crisis (GFC) hit in 2008. Oversupply and three years of negative retail net absorption increased the average vacancy from 6-7% to 10-11%. Since then, several factors weakened supply growth: developers became more cautious, demand dampened with the rise of e-commerce, and consumer preferences gradually changed. COVID-19 and the upsurge of remote work exacerbated retail woes, but this shock did not cause a freefall similar to the GFC because the sector was stumbling in the decade leading up to the pandemic. According to the latest Census Advanced Monthly Retail Trade Survey, total sales in February were up 5.4% from the same period a year ago, with food service/drinking places and general merchandise stores enjoying double-digit growth.

Supported by resilient consumer spending, neighborhood and community shopping center performance remained stable. However, with consumer confidence index starting to show subtle changes in consumers’ spending plan with less incentive towards service and stationary spending over the next six months, new retail construction and net absorption both came in light for the first quarter of the year. Vacancy flatlined at 10.3% over the past four quarters. Asking/effective rents were up slightly by 0.2%/0.3% in Q4 and remained in the $21/$18-per-sqft range, a level unchanged since 2018.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual).

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

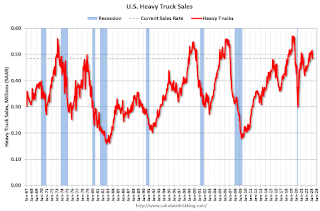

Heavy Truck Sales Up 7% Year-over-year in March

by Calculated Risk on 4/04/2023 01:00:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the March 2023 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

Moody's: Multifamily Demand "Softened notably over the past few quarters"

by Calculated Risk on 4/04/2023 11:15:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Moody's: Multifamily Demand "Softened notably over the past few quarters"

A brief excerpt:

The big story here is that demand for apartments has softened recently, rents are falling in some areas, and there are a large number of apartments currently under construction that are expected to be delivered this year.There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

From Moody’s Analytics Senior Economist Lu Chen and economist Nick Luettke: Apartment temporarily oversupplied, Office approaching peak of vacancy, and Retail remained flatThe tide has been gradually shifting for the multifamily sector. ... Multifamily demand has softened notably over the past few quarters with net absorption even teasing slightly below zero in the first quarter of 2023. ... Vacancy ticked up 13 basis-point (bps) to end Q1 at 4.71%. This was the biggest jump over the past two years, which pushed the current vacancy over the pre-pandemic level of 4.68%....

Compared to year end 2022, rent declines became more widespread in the first quarter, with 60 primary metros recording negative market rent growth ranging from -0.1% to -6.4%.Moody’s Analytics (Reis) reported that the apartment vacancy rate was at 4.7% in Q1 2023, up from 4.6% in Q4 2022, and down from a pandemic peak of 5.4% in both Q1 and Q2 2021.

This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Moody’s Analytics is just for large cities.

BLS: Job Openings Decreased to 9.9 million in February

by Calculated Risk on 4/04/2023 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings decreased to 9.9 million on the last business day of February, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations changed little at 6.2 million and 5.8 million, respectively. Within separations, quits (4.0 million) edged up, while layoffs and discharges (1.5 million) decreased.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February the employment report this Friday will be for March.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in February to 9.9 million from 10.6 million in January.

The number of job openings (black) were down 14% year-over-year.

Quits were down 7% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

CoreLogic: House Prices up 4.4% YoY in February; Increased 0.8% MoM in February NSA

by Calculated Risk on 4/04/2023 08:00:00 AM

Notes: This CoreLogic House Price Index report is for February. The recent Case-Shiller index release was for January. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: US Annual Home Price Growth Continues Single-Digit Slide in February, CoreLogic Reports

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for February 2023.

While annual U.S home price growth rose for the 133rd straight month in February, the 4.4% increase was the lowest recorded since 2019. Eight states and districts recorded annual home price losses, with much of the depreciation seen in the relatively expensive Western U.S., including California, Idaho, Oregon, Washington and Utah.

Tech company layoffs have likely affected housing demand on the West Coast, However, as noted in the latest CoreLogic S&P Case-Shiller Index, home prices gains are holding steady in some large East Coast metros, as workers return to offices and buyer demand renews in areas that saw relatively less appreciation during the pandemic. Areas in the Southern U.S. are also holding up well given current market conditions.

“The divergence in home price changes across the U.S. reflects a tale of two housing markets,” said Selma Hepp, chief economist at CoreLogic. “Declines in the West are due to the tech industry slowdown and a severe lack of affordability after decades of undersupply. The consistent gains in the Southeast and South reflect strong job markets, in-migration patterns and relative affordability due to new home construction.”

“But while housing market challenges remain, particularly in light of mortgage rate volatility and the ongoing banking turmoil,” Hepp continued, “pent-up homebuyer demand is responding favorably to lower rates in many markets. This trend holds true even in the West, leading to a solid monthly gain in home prices in February. U.S. home prices rose by 0.8% in February, double the month-over-month increase historically seen and indicating that prices in most markets have already bottomed out.”

...

U.S. home prices (including distressed sales) increased by 4.4% year over year in February 2023 compared to February 2022. On a month-over-month basis, home prices increased by 0.8% compared with January 2023.

emphasis added

Monday, April 03, 2023

Tuesday: Job Openings

by Calculated Risk on 4/03/2023 09:23:00 PM

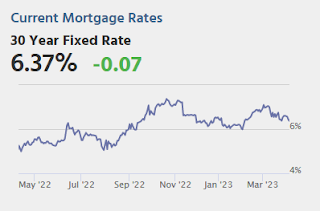

Mortgage rates moved lower today as investors reacted to economic data that showed contraction in the manufacturing sector. ... After the data was released, the bond market swung from negative to positive territory. ...Tuesday:

With that, the average mortgage lender was able to drop rates to levels just a hair higher than the lows from March 23-24. You'd have to go back to February 3rd to see anything lower. With today being April 3rd, that means we're right on the doorstep of 2 month lows. [30 year fixed 6.44%]

emphasis added

• At 8:00 AM ET, Corelogic House Price index for February.

• At 10:00 AM, Job Openings and Labor Turnover Survey for February from the BLS.