by Calculated Risk on 4/11/2023 01:28:00 PM

Tuesday, April 11, 2023

The Top Ten Job Streaks: Current Streak is in 9th Place

For fun:

| Headline Jobs, Top 10 Streaks | |

|---|---|

| Year Ended | Streak, Months |

| 2019 | 100 |

| 1990 | 48 |

| 2007 | 46 |

| 1979 | 45 |

| 1943 | 33 |

| 1986 | 33 |

| 2000 | 33 |

| 1967 | 29 |

| 20231 | 27 |

| 1995 | 25 |

| 1Currrent Streak | |

2nd Look at Local Housing Markets in March

by Calculated Risk on 4/11/2023 10:53:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in March

A brief excerpt:

This is the second look at local markets in March. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in March were mostly for contracts signed in January and February. Since 30-year fixed mortgage rates were over 6% for all of January and February - compared to 4% range the previous year - closed sales were down significantly year-over-year in March. However, the impact was probably not as severe as for closed sales in December and January (rates were the highest in October and November 2022 when contracts were signed for closing in December and January)..

Median sales prices for single family homes were down 2.2% year-over year (YoY) in northeast Florida (Jacksonville), and unchanged YoY in Georgia.

...

In March, sales in these markets were down 21.0%. In February, these same markets were down 21.9% YoY Not Seasonally Adjusted (NSA).

This is a similar YoY decline NSA as in February for these markets. The March existing home sales report will show another significant YoY decline, and the 19th consecutive month with a YoY decline in sales.

Many more local markets to come!

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Diffusion Indexes

by Calculated Risk on 4/11/2023 09:25:00 AM

A few more employment graphs ...

Click on graph for larger image.

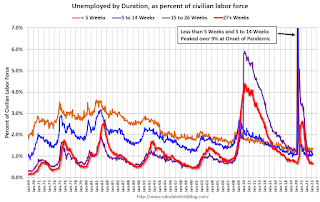

Click on graph for larger image.This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately, this data only goes back to 1992 and includes only three recessions (the stock / tech bust in 2001, and the housing bust/financial crisis, and the 2020 pandemic). Clearly education matters with regards to the unemployment rate, with the lowest rate for college graduates at 2.0% in March, and highest for those without a high school degree at 4.8% in March.

All four groups were generally trending down prior to the pandemic. And all are close to pre-pandemic levels now.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

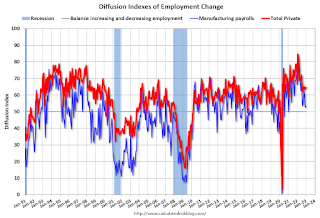

The BLS diffusion index for total private employment was at 60.2 in March, up from 57.4 in February. A solid reading.

The BLS diffusion index for total private employment was at 60.2 in March, up from 57.4 in February. A solid reading.For manufacturing, the diffusion index was at 56.3, up from 47.9 in February.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Overall private job growth was widespread in March.

Monday, April 10, 2023

"Mortgage Rates Have Quickly Erased Last Week's Drop"

by Calculated Risk on 4/10/2023 09:09:00 PM

There was no new data behind today's move. Truly, it was as simple as the mortgage market getting caught up with the bond market (bonds ultimately dictate rate momentum).Tuesday:

The next big flashpoint will be Wednesday morning's Consumer Price Index (CPI)--the most important monthly inflation report, and oftentimes more important than the jobs report ... While there's no way to know if the report will be good or bad for rates, nothing else on this week's calendar has the potential to cause as much of a reaction. [30 year fixed 6.50%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for March.

Leading Index for Commercial Real Estate Decreased in March

by Calculated Risk on 4/10/2023 03:01:00 PM

From Dodge Data Analytics: Dodge Momentum Index Drops in March

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, slipped 8.6% in March to 183.7 (2000=100) from the revised February reading of 201.0. In March, the commercial component of the DMI fell 6.6%, and the institutional component decreased 12.9%.

“We are predicting the Dodge Momentum Index to work its way back to historical norms throughout 2023, concurrent with weaker economic conditions,” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. “Lending standards for small banks in particular have substantially tightened as banking insecurity intensifies. As a result, owners and developers are more likely to pullback in the short-term, which would further contract the DMI as we continue into the year.”

Commercial planning in March was driven down by less projects in the office and warehouse sectors, decreasing 29% and 11%, respectively. Institutional planning weakened more substantially, as healthcare fell 17%, education dipped 6%, and amusement planning activity dropped 14%. On the upside, however, a steady flow of research and development laboratories entered the queue, supporting the otherwise weakening sector. Year over year, the DMI remains 24% higher than in March 2022. The commercial component was up 37%, and the institutional component was 2% higher.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 183.7 in March, down from 201.0 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a solid pickup in commercial real estate construction in 2023. but a slowdown towards the end of 2023 or in 2024.

A Few Comments on Commercial Real Estate

by Calculated Risk on 4/10/2023 10:34:00 AM

Today, in the Calculated Risk Real Estate Newsletter: A Few Comments on Commercial Real Estate

A brief excerpt:

The focus of this newsletter is residential real estate, although I follow several commercial real estate (CRE) sectors on my blog. There have been numerous warnings recently about a potential CRE lending crisis and I’d like to add a few comments.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

First, when most people think “CRE” they think office and retail space. The concern for retail is online shopping eroding in-store buying (a long-term trend), and work-from-home (WFH) reducing the need for office space (another long-term trend that increased sharply during the pandemic but has reversed recently).

However, there are many other CRE sectors in addition to office and retail: lodging (hotels), health care, warehouses (including self-storage), manufacturing facilities, food and beverage establishments, power and communication, amusement and recreation (Disneyland!), religious, transportation and more.

Most of these other CRE sectors are fine. Of the $11.1 trillion invested in CRE since the year 2000 (according to the BEA), about 12% was in offices and 4% in malls. These are important sectors, but there is much more to CRE.

...

The office sector is concerning mostly due to the shift in the need for space with WFH increasing. However, there wasn’t the extreme overbuilding and poor underwriting that we saw in the 1980’s. This graph shows investment in offices, malls and lodging as a percent of GDP through Q4 2022.

Investment in offices (blue) was increasing prior to the pandemic, but the increase was nothing like the office building boom in the ‘80s with poor underwriting. From 1981 through 1989, office investment averaged 0.7% of GDP - about double the normal level of investment. The vacancy problem this time is related to decreased demand.

Housing April 10th Weekly Update: Inventory Increased 0.2% Week-over-week

by Calculated Risk on 4/10/2023 08:30:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, April 09, 2023

Sunday Night Futures

by Calculated Risk on 4/09/2023 06:34:00 PM

Weekend:

• Schedule for Week of April 9, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 8 and DOW futures are up 50 (fair value).

Oil prices were up over the last week with WTI futures at $81.02 per barrel and Brent at $85.45 per barrel. A year ago, WTI was at $98, and Brent was at $101 - so WTI oil prices are down about 17% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.57 per gallon. A year ago, prices were at $4.09 per gallon, so gasoline prices are down $0.52 per gallon year-over-year.

Q1 GDP Tracking: Around 2%

by Calculated Risk on 4/09/2023 12:51:00 PM

From BofA:

On net, since the last weekly publication, our 1Q US GDP growth tracking estimate rose from 0.8% q/q saar to 1.6% q/q saar [Apr 7th estimate]From Goldman:

emphasis added

[W]e lowered our Q1 GDP tracking estimate by 0.3pp to +2.3% (qoq ar)). [Apr 5th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 1.5 percent on April 5, down from 1.7 percent on April 3. [Apr 5th estimate]

Second Home Market: South Lake Tahoe in March

by Calculated Risk on 4/09/2023 08:11:00 AM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

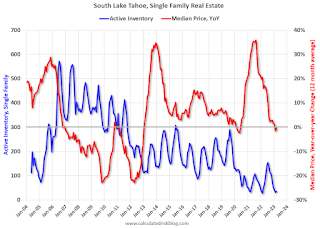

This graph is for South Lake Tahoe since 2004 through March 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, and only up slightly from the record low set in February 2022.

It is possible the massive snow storms have limited listings in the Tahoe market this year.