by Calculated Risk on 4/13/2023 02:35:00 PM

Thursday, April 13, 2023

U.S. Demographics: Largest 5-year cohorts, and Ten most Common Ages in 2022

Nine years ago, I wrote: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group.

Earlier the Census Bureau released the population estimates for July 2022 by age, and I've updated the table from the previous post.

The table below shows the top 10 cohorts by size for 2010, 2022 (released recently), and the most recent Census Bureau projections for 2030.

In 2022, the top 6 cohorts were under 45 (the Boomers are fading away), and by 2030 the top 10 cohorts will be the youngest 10 cohorts.

There will be plenty of "gray hairs" walking around in 2030, but the key for the economy is the population in the prime working age group is now increasing.

As I noted in 2014, this was positive for apartments, and more recently positive for housing.

| Population: Largest 5-Year Cohorts by Year | ||||

|---|---|---|---|---|

| Largest Cohorts | 2010 | 2022 | 2030 | |

| 1 | 45 to 49 years | 30 to 34 years | 35 to 39 years | |

| 2 | 50 to 54 years | 20 to 24 years | 40 to 44 years | |

| 3 | 15 to 19 years | 35 to 39 years | 30 to 34 years | |

| 4 | 20 to 24 years | 25 to 29 years | 25 to 29 years | |

| 5 | 25 to 29 years | 15 to 19 years | 20 to 24 years | |

| 6 | 40 to 44 years | 40 to 44 years | 45 to 49 years | |

| 7 | 10 to 14 years | 60 to 64 years | 5 to 9 years | |

| 8 | 5 to 9 years | 55 to 59 years | 10 to 14 years | |

| 9 | Under 5 years | 10 to 14 years | Under 5 years | |

| 10 | 35 to 39 years | 50 to 54 years | 15 to 19 years | |

Click on graph for larger image.

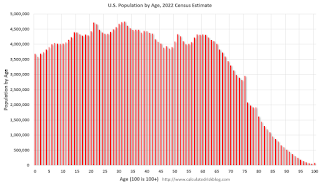

This graph, based on the 2022 population estimate, shows the U.S. population by age in July 2022 according to the Census Bureau.

Note that the largest age group is in the early-to-mid 30s. There is also a large cohort in their early 20s.

And below is a table showing the ten most common ages in 2010, 2021, and 2030 (projections are from the Census Bureau, 2017).

Note the younger baby boom generation dominated in 2010. In 2022 the millennials had taken over and the boomers are off the list.

This is why - a number of years ago - I was so positive on housing. And this is a positive for the economy.

| Population: Most Common Ages by Year | ||||

|---|---|---|---|---|

| 2010 | 2022 | 2030 | ||

| 1 | 50 | 32 | 39 | |

| 2 | 49 | 31 | 40 | |

| 3 | 19 | 21 | 38 | |

| 4 | 48 | 30 | 37 | |

| 5 | 47 | 22 | 36 | |

| 6 | 46 | 33 | 41 | |

| 7 | 20 | 29 | 35 | |

| 8 | 45 | 34 | 30 | |

| 9 | 18 | 28 | 34 | |

| 10 | 52 | 23 | 33 | |

Realtor.com Reports Weekly Active Inventory Up 44% YoY; New Listings Down 32% YoY

by Calculated Risk on 4/13/2023 01:49:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Apr 8, 2023

• Active inventory growth continued to climb, but at a notably lower rate, with for-sale homes up 44% above one year ago. One of 2023’s biggest bright spots for buyers has dimmed again, with active inventories registering just 44% above 2022’s record lows for the first part of the year. With homeowners increasingly likely to sit on the sidelines instead of selling, homebuyers still outnumber new sellers in a market with a smaller number of both buyers and sellers.

...

• New listings–a measure of sellers putting homes up for sale–were again down, this week by 32% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 40 weeks. This past week, the gap from last year increased more significantly, perhaps due in part to shifts in religious holidays that fell earlier in 2023. If this is the case, we will likely see some improvement in the next week.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up year-over-year - from record lows - however, the YoY increase has slowed recently.

Hotels: Occupancy Rate Down 7.4% Year-over-year

by Calculated Risk on 4/13/2023 01:18:00 PM

Affected by both the Easter and Passover calendar shift, U.S. hotel performance reflected lower year-over-year comparisons from the previous week, according to STR‘s latest data through April 8.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

April 2-8, 2023 (percentage change from comparable week in 2022):

• Occupancy: 61.3% (-7.4%)

• Average daily rate (ADR): $153.30 (+0.8%)

• Revenue per available room (RevPAR): $94.00 (-6.7%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Current State of the Housing Market; Overview for mid-April

by Calculated Risk on 4/13/2023 10:08:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Current State of the Housing Market; Overview for mid-April

A brief excerpt:

The following graph from MortgageNewsDaily.com shows mortgage rates since January 1, 2020. 30-year mortgage rates were at 6.42% on April 12th, up from 6.0% in early February, and down from the recent high of over 7% in early March - and still up sharply year-over-year.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

A year ago, the payment on a $500,000 house, with a 20% down payment and 4.98% 30-year mortgage rates, would be around $2,142 for principal and interest. The monthly payment for the same house, with house prices up 2% YoY and mortgage rates at 6.42%, would be $2,582 - an increase of 20%.

But if we compare to two years ago, there is huge difference in monthly payments. In April 2021, the payment on a $500,000 house, with a 20% down payment and 3.06% 30-year mortgage rates, would be around $1,699 for principal and interest. The monthly payment for the same house, with house prices up 23% over two years and mortgage rates at 6.42%, would be $3,084 - an increase of 81%.

This increase in mortgage rates is probably the key reason new listings have declined sharply year-over-year - especially since a large number of homeowners refinanced at lower rates in 2020, 2021 and early 2022.

This is very different from the housing bust, when many homeowners were forced to sell as their teaser rates expired and they could not afford the fully amortized mortgage payment. The current situation is similar to the 1980 period, when rates increased quickly.

Weekly Initial Unemployment Claims increase to 239,000

by Calculated Risk on 4/13/2023 08:34:00 AM

The DOL reported:

In the week ending April 8, the advance figure for seasonally adjusted initial claims was 239,000, an increase of 11,000 from the previous week's unrevised level of 228,000. This is the highest level for initial claims since January 15, 2022 when it was 251,000. The 4-week moving average was 240,000, an increase of 2,250 from the previous week's unrevised average of 237,750. This is the highest level for this average since November 20, 2021 when it was 249,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 240,000.

The previous week was unrevised.

Weekly claims were above the consensus forecast.

Wednesday, April 12, 2023

Thursday: Unemployment Claims, PPI

by Calculated Risk on 4/12/2023 08:43:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 233 thousand initial claims, up from 228 thousand last week.

• Also at 8:30 AM, The Producer Price Index for March from the BLS. The consensus is for a 0.0% increase in PPI, and a 0.3% increase in core PPI.

FOMC Minutes: "some additional policy firming may be appropriate"; Staff Predicts Recession

by Calculated Risk on 4/12/2023 02:08:00 PM

This meeting the FOMC "members anticipated that some additional policy firming may be appropriate", whereas at the previous meeting "all participants continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate".

For some time, the forecast for the U.S. economy prepared by the staff had featured subdued real GDP growth for this year and some softening in the labor market. Given their assessment of the potential economic effects of the recent banking-sector developments, the staff's projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.From the Fed: Minutes of the Federal Open Market Committee March 21–22, 2023. Excerpt:

In their discussion of monetary policy for this meeting, members agreed that recent indicators pointed to modest growth in spending and production. They also concurred that job gains had picked up in recent months and were running at a robust pace, that the unemployment rate had remained low, and that inflation remains elevated. Members concurred that the U.S. banking system is sound and resilient. They also agreed that recent developments were likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation, but that the extent of these effects was uncertain. Members also concurred that they remained highly attentive to inflation risks.

Members agreed that the Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, members agreed to raise the target range for the federal funds rate to 4-3/4 to 5 percent. Members agreed that they would closely monitor incoming information and assess the implications for monetary policy. Given recent developments, members anticipated that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. Members concurred that, in determining the extent of future increases in the target range, they would take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, members agreed that they would continue reducing the Federal Reserve's holdings of Treasury securities and agency debt and agency MBS, as described in its previously announced plans. All members affirmed that they remained strongly committed to returning inflation to its 2 percent objective.

emphasis added

Cleveland Fed: Median CPI increased 0.4% and Trimmed-mean CPI increased 0.2% in March

by Calculated Risk on 4/12/2023 11:23:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.4% in March. The 16% trimmed-mean Consumer Price Index increased 0.2% in March. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

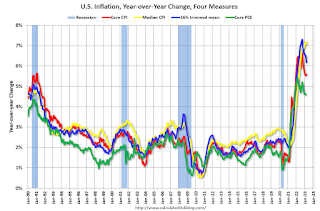

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. "Motor fuel" decreased at a 44% annualized rate in March, and "Car and truck rental" decreased at a 37% annualized rate.

Remote Work and Household Formation

by Calculated Risk on 4/12/2023 10:55:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Remote Work and Household Formation

A brief excerpt:

Back in September 2021, I wrote Household Formation Drives Housing DemandThere is more in the article. You can subscribe at https://calculatedrisk.substack.com/So what is driving demand for both homeownership and rentals? Household formation!Over time, housing economist Tom Lawler and I unraveled the household formation mystery. A key driver of household formation was work-from-home. And this analysis has some significant implications for the housing market and the Federal Reserve (see articles at the bottom of this note).

...

Today, economists Adam Ozimek and Eric Carlson published new research: Remote Work and Household Formation

Another important basic fact of housing markets during the pandemic is that there was a rapid expansion of household formation. As Figure 3 shows, household formation surged 2.5% in 2021, more than double the fastest pace post Great Recession.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 4/12/2023 09:06:00 AM

Here a few measures of inflation:

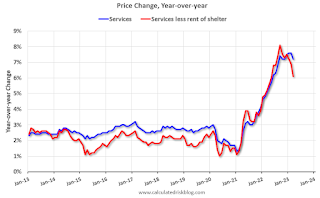

The first graph is the one Fed Chair Powell has been mentioning.

This graph shows the YoY price change for Services and Services less rent of shelter through March 2023.

Services less rent of shelter was up 6.1% YoY in March, down from 6.9% YoY in February.

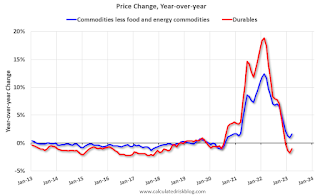

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were up 1.6% YoY in March, up from 1.0% YoY in February.

Here is a graph of the year-over-year change in shelter from the CPI report (through March) and housing from the PCE report (through February 2023)

Here is a graph of the year-over-year change in shelter from the CPI report (through March) and housing from the PCE report (through February 2023)Shelter was up 8.2% year-over-year in March, up from 8.1% in February. Housing (PCE) was up 8.2% YoY in February.

The BLS noted this morning: "The index for shelter was by far the largest contributor to the monthly all items increase."