by Calculated Risk on 4/17/2023 04:00:00 PM

Monday, April 17, 2023

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.55% in March"

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.55% in March

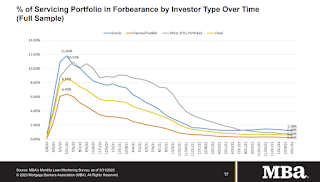

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 5 basis points from 0.60% of servicers’ portfolio volume in the prior month to 0.55% as of March 31, 2023. According to MBA’s estimate, 275,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 7.8 million borrowers since March 2020.

In March 2023, the share of Fannie Mae and Freddie Mac loans in forbearance decreased 2 basis points to 0.26%. Ginnie Mae loans in forbearance decreased 10 basis points to 1.18%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 10 basis points to 0.68%.

“As the COVID-19 national emergency draws to a close, the number of loans in forbearance continues to drop,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Mortgage performance remains strong with the percentage of borrowers who were current on their mortgage payments and post-forbearance workouts increasing in March.”

Adds Walsh, “MBA’s forecast still calls for a recession in 2023, which may change the current performance levels, but credit quality is generally good and many borrowers facing financial hardship can now access enhanced loss mitigation options that resulted from successes of pandemic-related policies.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans has been decreasing, declined to 0.55% in March from 0.60% in February.

At the end of March, there were about 275,000 homeowners in forbearance plans.

Lawler on Demographics: New Population Estimates Incorporate Unprecedented Methodological Changes

by Calculated Risk on 4/17/2023 11:30:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Lawler on Demographics: New Population Estimates Incorporate Unprecedented Methodological Changes

A brief excerpt:

Demographics are very useful in predicting long term trends for housing and the economy.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The following note from housing economist Tom Lawler discusses the most recent release from the Census Bureau.

Last week Census released its “Vintage 2022” estimates of the US resident population by single year of age, and the estimates incorporated unprecedented methodological changes that, if accurate, significantly changed estimates of the age distributions of the US population from previous “vintage” estimates.

In December Census noted that because of some “issues” with Census 2020, it would create a “blended” base (or decadal starting point) for April 1, 2020 that would incorporate age and sex data from the 2020 Demographic Analysis. Stated another way, for (I believe) the first time ever the starting point for this decade’s population estimates do NOT reflect the age distribution from the Decennial Census. Here is an excerpt from its methodology section.“At the national level, then, it is accurate to say that resident, household, and group quarters (GQ) population totals are derived from the 2020 Census, age and sex detail is drawn from 2020 DA, and race and Hispanic origin detail comes from V2020.”Incorporation of this “blended” base resulted in significant changes in the age distribution of the resident population, as shown in the table below.

As the table shows, while the total population estimates for 4/1/2020 are virtually unchanged, there were sizable changes in population estimates for various age groups.

...

CR Note: ... This estimated change in the late teens / early 20’s population in 2020 - that Lawler highlighted - is important (if accurate) for multi-family housing.

NAHB: Builder Confidence Increased Slightly in April

by Calculated Risk on 4/17/2023 10:06:00 AM

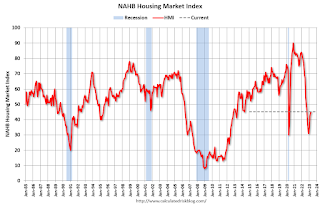

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 45, up from 44 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Lack of Existing Inventory Continues to Support Builder Sentiment

Builders remained cautiously optimistic in April as limited resale inventory helped to increase demand in the new home market even as the industry continues to grapple with building material issues.

Builder confidence in the market for newly built single-family homes in April rose one point to 45, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

Currently, one-third of housing inventory is new construction, compared to historical norms of a little more than 10%. More buyers looking at new homes, along with the use of sales incentives, have supported new home sales since the start of 2023.

...

The HMI index gauging current sales conditions in April rose two points to 51 and the component charting sales expectations in the next six months increased three points to 50. This marks the first time these components both returned to the 50+ range since June 2022. The gauge measuring traffic of prospective buyers remained unchanged at 31. This is the first time the traffic component failed to improve in 2023.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose four points to 46, the Midwest edged up two points to 37, the South increased four points to 49 and the West moved four points higher to 38.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was at the consensus forecast.

Housing April 17th Weekly Update: Inventory Decreased 1.3% Week-over-week

by Calculated Risk on 4/17/2023 08:25:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, April 16, 2023

Monday: NAHB Homebuilder Survey, NY Fed Mfg

by Calculated Risk on 4/16/2023 06:52:00 PM

Weekend:

• Schedule for Week of April 16, 2023

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of -18.0, up from -24.6.

• At 10:00 AM, The April NAHB homebuilder survey. The consensus is for a reading of 45, up from 44. Any number below 50 indicates that more builders view sales conditions as poor than good.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 8 and DOW futures are up 50 (fair value).

Oil prices were up over the last week with WTI futures at $82.52 per barrel and Brent at $86.31 per barrel. A year ago, WTI was at $107, and Brent was at $111 - so WTI oil prices are down about 23% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.65 per gallon. A year ago, prices were at $4.05 per gallon, so gasoline prices are down $0.40 per gallon year-over-year.

By Request: Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 4/16/2023 11:13:00 AM

Note: I used to post this monthly, but I stopped during the COVID-19 pandemic. I've received a number of requests lately to post this again, so here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

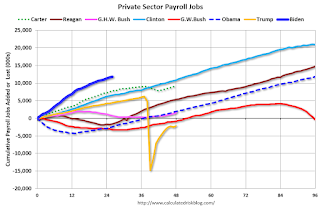

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter, George H.W. Bush and Trump only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr. Clinton (light blue) served for eight years without a recession. And there was a pandemic related recession in 2020.

First, here is a table for private sector jobs. The top two previous private sector terms were both under President Clinton.

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,039 |

| Reagan 1 | 5,363 |

| Reagan 2 | 9,351 |

| GHW Bush | 1,511 |

| Clinton 1 | 10,877 |

| Clinton 2 | 10,093 |

| GW Bush 1 | -820 |

| GW Bush 2 | 447 |

| Obama 1 | 1,906 |

| Obama 2 | 9,927 |

| Trump | -2,135 |

| Biden | 11,8241 |

| 1After 26 months. | |

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 820,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 373,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 9,039,000 under President Carter (dashed green), by 14,714,000 under President Reagan (dark red), 1,511,000 under President G.H.W. Bush (light purple), 20,970,000 under President Clinton (light blue), and 11,833,000 under President Obama (dark dashed blue). During Trump's term (Orange), the economy lost 2,135,000 private sector jobs.

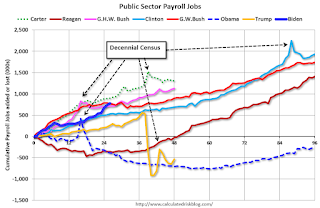

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 271,000 jobs). During Trump's term, the economy lost 535,000 public sector jobs.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -710 |

| Obama 2 | 447 |

| Trump | -535 |

| Biden | 7761 |

| 1After 26 months. | |

Saturday, April 15, 2023

Real Estate Newsletter Articles this Week: "Early Read on Existing Home Sales in March"

by Calculated Risk on 4/15/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Lawler: Early Read on Existing Home Sales in March

• Current State of the Housing Market; Overview for mid-April

• Remote Work and Household Formation

• A Few Comments on Commercial Real Estate

• 2nd Look at Local Housing Markets in March

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of April 16, 2023

by Calculated Risk on 4/15/2023 08:11:00 AM

The key reports this week are March Housing Starts and Existing Home Sales.

8:30 AM: The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of -18.0, up from -24.6.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 45, up from 44. Any number below 50 indicates that more builders view sales conditions as poor than good.

8:30 AM ET: Housing Starts for March.

8:30 AM ET: Housing Starts for March. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.400 million SAAR, down from 1.450 million SAAR in February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 239 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of -20.0, up from -24.6.

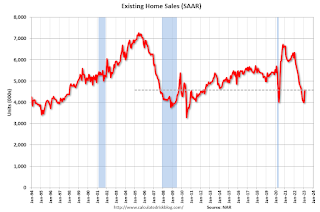

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 4.50 million SAAR, down from 4.58 million.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 4.50 million SAAR, down from 4.58 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 4.51 million SAAR for March.

10:00 AM: State Employment and Unemployment (Monthly) for March 2023

Friday, April 14, 2023

COVID Apr 14, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 4/14/2023 09:01:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 101,437 | 122,632 | ≤35,0001 | |

| Hospitalized2 | 11,933 | 13,640 | ≤3,0001 | |

| Deaths per Week2 | 1,327 | 1,779 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Lawler: Early Read on Existing Home Sales in March; 3rd Look at Local Housing Markets in March

by Calculated Risk on 4/14/2023 02:13:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in March

A brief excerpt:

This is the third look at local markets in March. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in March were mostly for contracts signed in January and February. Since 30-year fixed mortgage rates were over 6% for all of January and February - compared to 4% range the previous year - closed sales were down significantly year-over-year in March. However, the impact was probably not as severe as for closed sales in December and January (rates were the highest in October and November 2022 when contracts were signed for closing in December and January).

A few prices: Median sales prices in the Charlotte region were down 0.4% year-over year (YoY), up 1.9% YoY in Des Moines, and down 10.0% YoY in Sacramento.

...

In March, sales in these markets were down 21.2%. In February, these same markets were down 23.4% YoY Not Seasonally Adjusted (NSA).

This is a slightly smaller YoY decline NSA than in February for these markets. The March existing home sales report will show another significant YoY decline and will be the 19th consecutive month with a YoY decline in sales.

Many more local markets to come!