by Calculated Risk on 4/19/2023 09:01:00 PM

Wednesday, April 19, 2023

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 239 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of -20.0, up from -24.6.

• At 10:00 AM, Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 4.50 million SAAR, down from 4.58 million.

LA Port Inbound Traffic Down Sharply YoY in March

by Calculated Risk on 4/19/2023 04:11:00 PM

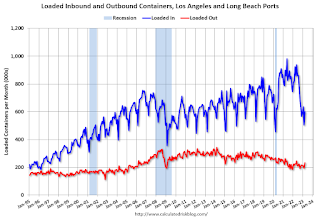

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 3.7% in March compared to the rolling 12 months ending in February. Outbound traffic increased 0.2% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.Fed's Beige Book: "The labor market becoming less tight ... increases to the labor supply"

by Calculated Risk on 4/19/2023 02:05:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Richmond based on information collected on or before April 10, 2023."

Overall economic activity was little changed in recent weeks. Nine Districts reported either no change or only a slight change in activity this period while three indicated modest growth. Expectations for future growth were mostly unchanged as well; however, two Districts saw outlooks deteriorate. Consumer spending was generally seen as flat to down slightly amid continued reports of moderate price growth. Auto sales remained steady overall, with only a couple of Districts reporting improved sales and inventory levels. Travel and tourism picked up across much of the country this period. Manufacturing activity was widely reported as flat or down even as supply chains continued to improve. Transportation and freight volumes were also flat to down, according to several Districts. On balance, residential real estate sales and new construction activity softened modestly. Nonresidential construction was little changed while sales and leasing activity was generally flat to down. Lending volumes and loan demand generally declined across consumer and business loan types. Several Districts noted that banks tightened lending standards amid increased uncertainty and concerns about liquidity. The majority of Districts reported steady to increasing demand and sales for nonfinancial services. Agriculture conditions were mostly unchanged in recent weeks while some softening was reported in energy markets.

Employment growth moderated somewhat this period as several Districts reported a slower pace of growth than in recent Beige Book reports. A small number of firms reported mass layoffs, and those were centered at a subset of the largest companies. Some other firms opted to allow for natural attrition to occur, and to hire only for critically important roles. Contacts reported the labor market becoming less tight as several Districts noted increases to the labor supply. Additionally, firms benefited from better employee retention, which allowed them to hire for open roles while not constantly trying to back-fill positions. Wages have shown some moderation but remain elevated. Several Districts reported declining needs for off-cycle wage increases compared to last year.

emphasis added

4th Look at Local Housing Markets: California Home Sales down 34% YoY in March; Prices Down 7.0% YoY

by Calculated Risk on 4/19/2023 11:53:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets: California Home Sales down 34% YoY in March; Prices Down 7.0% YoY

A brief excerpt:

This is the fourth look at local markets in March. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is the press release from the California Association of Realtors® (C.A.R.): Uptick in mortgage interest rates nudges down California home sales in March, C.A.R. reports• Existing, single-family home sales totaled 281,050 in March on a seasonally adjusted annualized rate, down 1.0 percent from February and down 34.2 percent from March 2022....

• March’s statewide median home price was $791,490, up 7.6 percent from February and down 7.0 percent from March 2022.Closed Sales in March

In March, sales in these markets were down 20.8%. In February, these same markets were down 21.8% YoY Not Seasonally Adjusted (NSA).

This is a slightly smaller YoY decline NSA than in February for these markets. The March existing home sales report will show another significant YoY decline and will be the 19th consecutive month with a YoY decline in sales.

AIA: Architecture Billings "Slightly Improved" in March

by Calculated Risk on 4/19/2023 10:28:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: After Five Straight Monthly Declines, AIA/Deltek Architecture Billings Index (ABI) Reports Slightly Improved Business Conditions

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

The billings score for March increased from 48.0 in February to 50.4 in March (any score above 50 indicates an increase in firm billings). However, firms reported that inquiries into new projects grew at a slower pace, while the value of new design contracts declined from 51.3 in February to 48.9 in March.

“In spite of the positive movement in architecture firm billings in March, core concerns remain., “said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Inflation still needs to ease further for interest rates to return to more normal levels, and the banking turmoil still threatens to hold back residential and commercial construction loans.”

...

• Regional averages: Midwest (51.4); Northeast (49.1); South (47.4); West (47.2)

• Sector index breakdown: mixed practice (firms that do not have at least half of their billings in any one other category) (53.9); institutional (48.8); commercial/industrial (49.7); multi-family residential (44.2)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.4 in March, up from 48.0 in February. Anything above 50 indicates an increase in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index had declined for five consecutive months and was slightly positive in March. This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment later in 2023.

The Fed on "Possible Macroeconomic Effects of a Temporary Federal Debt Default"

by Calculated Risk on 4/19/2023 09:19:00 AM

This is relevant today.

From Federal Reserve Staff in 2013 on the debt ceiling debate: Possible Macroeconomic Effects of a Temporary Federal Debt Default. Excerpts:

Key considerations in evaluating the consequences of a debt defaultUsually the debt ceiling (I prefer "default ceiling") is raised with a clean bill. It is up to Congress. As Senator Mitch McConnell noted in 2011, if the debt ceiling isn't raised the "Republican brand" would become toxic and synonymous with fiscal irresponsibility.

• Such an event would be unprecedented. Although other countries have defaulted on their sovereign debt, these defaults occurred in situations where the government could not feasibly continue to service its debt. Failure to raise the U.S. federal debt ceiling, in contrast, would be a voluntary decision to stop meeting the government’s obligations even though it has no problems doing so. In addition, no other nation that defaulted on its sovereign debt ever enjoyed two key features of the U.S. economy—Treasury securities are the world’s “safe” asset and the dollar is the world’s main reserve currency. For these reasons, we have essentially no historical experience to help us predict the likely consequences of a failure by the Congress and the Administration to raise the debt ceiling.

• The financial market effects of a debt default would be highly uncertain, both because of its unprecedented nature, and because (as events in recent years have illustrated) we have only a limited understanding of the dynamics of the financial system when hit with a major shock.

o Yields on Treasury securities could rise noticeably, even if the default lasted only a day or two. And if the debt limit impasse dragged on for weeks, it could conceivably lead investors to demand a premium similar to that paid on AAA corporate bonds.

o Given that Treasury yields serve as a benchmark rate for the pricing of other securities, and given that a prolonged stand-off would probably make the general economic outlook much more uncertain, private interest rates could rise sharply. Rising interest rates and risk premiums would in turn push stock prices down appreciably.

o In some extreme scenarios with a prolonged default, financial markets could be severely impaired. For example, the functioning of the repo market could be compromised and some money market mutual funds could experience liquidity pressures.

o A debt default could also have some international repercussions. For example, a prolonged default might increase the reluctance of investors to hold Treasury securities and perhaps dollar-denominated assets more generally. Although the resulting rebalancing in portfolios might be relatively gradual, it could lead to a decline in the dollar over time (although a sudden drop could not be ruled out) and a higher “country-risk” premium on all U.S. assets.

• A debt default would also adversely affect the economy through its direct effects on aggregate income flows and government operations if the impasse in raising the debt limit lasted for several weeks.

o Currently, an extremely large portion of federal government spending is funded through borrowing (in part because tax payments are concentrated in other months). From mid-October through mid-November, for example, only 65 percent of projected spending would be covered by revenues. Thus, 35 percent of government cash outlays would need to be cut if a debt limit accord was not reached until the middle of November.

o Assuming that the Treasury prioritizes its payments to cover all scheduled net interest payments, other federal spending would be temporarily reduced by the following amounts (expressed in nominal terms at an annual rate): $340 billion in nominal federal purchases; $630 billion in Social Security, Medicare, and other transfer payments; and $150 billion in grants to state and local governments.

emphasis added

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 4/19/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

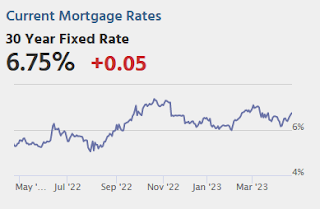

Mortgage applications decreased 8.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 14, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 8.8 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 8 percent compared with the previous week. The Refinance Index decreased 6 percent from the previous week and was 56 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 10 percent from one week earlier. The unadjusted Purchase Index decreased 9 percent compared with the previous week and was 36 percent lower than the same week one year ago.

“Last week’s increase in mortgage rates prompted a pullback in application activity. With more first-time homebuyers in the market, we continue to see increased sensitivity to rate changes. The 30-year fixed rate increased 13 basis points to 6.43 percent, which led to purchase applications declining 10 percent,” said Joel Kan, MBA’s Vice President and Chief Economist. “Affordability challenges persist and there is limited for-sale inventory in many markets across the country, so buyers remain selective on when they act. The 10-percent drop in FHA purchase applications, and the increase in the average purchase loan size to its highest level in a month, are other indications that first-time buyers have pulled back. The spread between the jumbo and conforming 30-year fixed rates widened slightly last week to 15 basis points, but this was a much tighter spread compared to the past year. As banks reduce their willingness to hold jumbo loans, we expect this narrowing trend to continue.”

Added Kan, “Refinances also declined and accounted for just over a quarter of all applications, as rates remained more than a full percentage point above the same week a year ago. This leaves very little refinance incentive for most homeowners.”

..

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.43 percent from 6.30 percent, with points increasing to 0.63 from 0.55 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 36% year-over-year unadjusted.

Tuesday, April 18, 2023

Wednesday: Architecture Billings Index, Beige Book

by Calculated Risk on 4/18/2023 08:12:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Misery Index

by Calculated Risk on 4/18/2023 12:12:00 PM

For fun, here is a graph of economist Arthur Okun's misery index (popularized by President Reagan).

Okun added inflation and the unemployment rate together as a measure of "misery".

Currently YoY inflation is at 5.0%, and the unemployment rate is at 3.5% for a "misery index" value of 8.5.

March Housing Starts: Most Multi-family Under Construction Since 1973

by Calculated Risk on 4/18/2023 09:07:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: March Housing Starts: Most Multi-family Under Construction Since 1973

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

Red is single family units. Currently there are 716 thousand single family units (red) under construction (SA). This was down in March compared to February, and 112 thousand below the recent peak in April and May 2022. Single family units under construction have peaked since single family starts are now declining. The reason there are still so many homes under construction is probably due to supply constraints.

Blue is for 2+ units. Currently there are 958 thousand multi-family units under construction. This is the highest level since November 1973! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Combined, there are 1.674 million units under construction, just 37 thousand below the all-time record of 1.711 million set in October 2022.