by Calculated Risk on 4/20/2023 03:39:00 PM

Thursday, April 20, 2023

Hotels: Occupancy Rate Up 3.7% Year-over-year

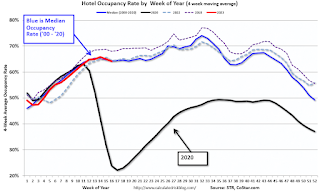

U.S. hotel performance increased from the previous week, according to STR‘s latest data through April 15.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

April 9-15, 2023 (percentage change from comparable week in 2022):

• Occupancy: 64.2% (+3.7%)

• Average daily rate (ADR): $155.33 (+4.7%)

• Revenue per available room (RevPAR): $99.67 (+8.6%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Realtor.com Reports Weekly Active Inventory Up 49% YoY; New Listings Down 5% YoY

by Calculated Risk on 4/20/2023 01:32:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Apr 15, 2023

• Active inventory growth continued to climb, with for-sale homes up 49% above one year ago. The number of homeowners shifting home listing timelines around spring holidays helped push active inventory growth up this week. Despite the big surge, the number of homes for-sale continues to trail pre-pandemic levels, keeping many cards in the hands of sellers sitting on very high levels of home equity.

...

• New listings–a measure of sellers putting homes up for sale–were down again this week, but only by 5% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 41 weeks and while this week continued that trend, the magnitude shifted in a big way. Shifts in religious holidays that fell earlier in 2023 are likely responsible for last week’s big drop and this week’s significantly smaller decline. On average across the two weeks, the decline in new listings is roughly on track with what we’ve seen so far this year.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up year-over-year - from record lows - however, the YoY increase has slowed recently, although this was a pickup from up 44% YoY last week.

NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March; Median Prices Declined 0.9% YoY

by Calculated Risk on 4/20/2023 10:42:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March; Median Prices Declined 0.9% YoY

Excerpt:

On prices, the NAR reported:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!The median existing-home price for all housing types in March was $375,700, a decline of 0.9% from March 2022 ($379,300). Price climbed slightly in three regions but dropped in the WestMedian prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

The YoY change in the median price peaked at 25.2% in May 2021 and prices are now down 0.9% YoY. Median house prices increased 3.3% from February to March and have declined 9.2% from the peak in June 2022 (NSA).

It is likely the Case-Shiller index will be down soon year-over-year.

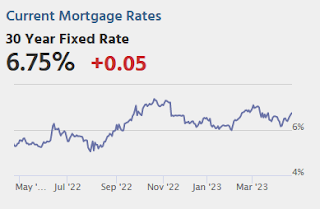

Note that closed sales in March were mostly for contracts signed in January and February. Mortgage rates, according to the Freddie Mac PMMS, were around 6.3% in January and February, and that provided a boost to closed sales in February and March compared to closed sales in December and January.

April sales will be for contracts signed in February and March, and mortgage rates averaged 6.5% in March and that might impact closed sales in April.

NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March

by Calculated Risk on 4/20/2023 10:11:00 AM

From the NAR: Existing-Home Sales Slid 2.4% in March

Existing-home sales edged lower in March, according to the National Association of Realtors®. Month-over-month sales declined in three out of four major U.S. regions, while sales in the Northeast remained steady. All regions posted year-over-year decreases.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – fell 2.4% from February to a seasonally adjusted annual rate of 4.44 million in March. Year-over-year, sales waned 22.0% (down from 5.69 million in March 2022).

...

Total housing inventory registered at the end of March was 980,000 units, up 1.0% from February and 5.4% from one year ago (930,000). Unsold inventory sits at a 2.6-month supply at the current sales pace, unchanged from February but up from 2.0 months in March 2022.

emphasis added

Click on graph for larger image.

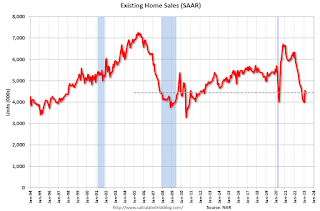

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March (4.44 million SAAR) were down 2.4% from the previous month and were 22.0% below the March 2022 sales rate.

According to the NAR, inventory increased to 0.98 million in March from 0.97 million in February.

According to the NAR, inventory increased to 0.98 million in March from 0.97 million in February.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 5.4% year-over-year (blue) in March compared to March 2022.

Inventory was up 5.4% year-over-year (blue) in March compared to March 2022. Months of supply (red) was unchanged at 2.6 months in March from 2.6 months in February.

This was below the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims increase to 245,000

by Calculated Risk on 4/20/2023 08:33:00 AM

The DOL reported:

In the week ending April 15, the advance figure for seasonally adjusted initial claims was 245,000, an increase of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 239,000 to 240,000. The 4-week moving average was 239,750, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 250 from 240,000 to 240,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 239,750.

The previous week was revised up.

Weekly claims were above the consensus forecast.

Wednesday, April 19, 2023

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 4/19/2023 09:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 239 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of -20.0, up from -24.6.

• At 10:00 AM, Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 4.50 million SAAR, down from 4.58 million.

LA Port Inbound Traffic Down Sharply YoY in March

by Calculated Risk on 4/19/2023 04:11:00 PM

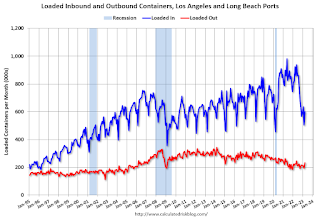

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 3.7% in March compared to the rolling 12 months ending in February. Outbound traffic increased 0.2% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.Fed's Beige Book: "The labor market becoming less tight ... increases to the labor supply"

by Calculated Risk on 4/19/2023 02:05:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Richmond based on information collected on or before April 10, 2023."

Overall economic activity was little changed in recent weeks. Nine Districts reported either no change or only a slight change in activity this period while three indicated modest growth. Expectations for future growth were mostly unchanged as well; however, two Districts saw outlooks deteriorate. Consumer spending was generally seen as flat to down slightly amid continued reports of moderate price growth. Auto sales remained steady overall, with only a couple of Districts reporting improved sales and inventory levels. Travel and tourism picked up across much of the country this period. Manufacturing activity was widely reported as flat or down even as supply chains continued to improve. Transportation and freight volumes were also flat to down, according to several Districts. On balance, residential real estate sales and new construction activity softened modestly. Nonresidential construction was little changed while sales and leasing activity was generally flat to down. Lending volumes and loan demand generally declined across consumer and business loan types. Several Districts noted that banks tightened lending standards amid increased uncertainty and concerns about liquidity. The majority of Districts reported steady to increasing demand and sales for nonfinancial services. Agriculture conditions were mostly unchanged in recent weeks while some softening was reported in energy markets.

Employment growth moderated somewhat this period as several Districts reported a slower pace of growth than in recent Beige Book reports. A small number of firms reported mass layoffs, and those were centered at a subset of the largest companies. Some other firms opted to allow for natural attrition to occur, and to hire only for critically important roles. Contacts reported the labor market becoming less tight as several Districts noted increases to the labor supply. Additionally, firms benefited from better employee retention, which allowed them to hire for open roles while not constantly trying to back-fill positions. Wages have shown some moderation but remain elevated. Several Districts reported declining needs for off-cycle wage increases compared to last year.

emphasis added

4th Look at Local Housing Markets: California Home Sales down 34% YoY in March; Prices Down 7.0% YoY

by Calculated Risk on 4/19/2023 11:53:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets: California Home Sales down 34% YoY in March; Prices Down 7.0% YoY

A brief excerpt:

This is the fourth look at local markets in March. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is the press release from the California Association of Realtors® (C.A.R.): Uptick in mortgage interest rates nudges down California home sales in March, C.A.R. reports• Existing, single-family home sales totaled 281,050 in March on a seasonally adjusted annualized rate, down 1.0 percent from February and down 34.2 percent from March 2022....

• March’s statewide median home price was $791,490, up 7.6 percent from February and down 7.0 percent from March 2022.Closed Sales in March

In March, sales in these markets were down 20.8%. In February, these same markets were down 21.8% YoY Not Seasonally Adjusted (NSA).

This is a slightly smaller YoY decline NSA than in February for these markets. The March existing home sales report will show another significant YoY decline and will be the 19th consecutive month with a YoY decline in sales.

AIA: Architecture Billings "Slightly Improved" in March

by Calculated Risk on 4/19/2023 10:28:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: After Five Straight Monthly Declines, AIA/Deltek Architecture Billings Index (ABI) Reports Slightly Improved Business Conditions

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

The billings score for March increased from 48.0 in February to 50.4 in March (any score above 50 indicates an increase in firm billings). However, firms reported that inquiries into new projects grew at a slower pace, while the value of new design contracts declined from 51.3 in February to 48.9 in March.

“In spite of the positive movement in architecture firm billings in March, core concerns remain., “said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Inflation still needs to ease further for interest rates to return to more normal levels, and the banking turmoil still threatens to hold back residential and commercial construction loans.”

...

• Regional averages: Midwest (51.4); Northeast (49.1); South (47.4); West (47.2)

• Sector index breakdown: mixed practice (firms that do not have at least half of their billings in any one other category) (53.9); institutional (48.8); commercial/industrial (49.7); multi-family residential (44.2)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.4 in March, up from 48.0 in February. Anything above 50 indicates an increase in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index had declined for five consecutive months and was slightly positive in March. This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment later in 2023.