by Calculated Risk on 4/22/2023 02:11:00 PM

Saturday, April 22, 2023

Real Estate Newsletter Articles this Week: "Most Multi-family Under Construction Since 1973"

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March; Median Prices Declined 0.9% YoY

• March Housing Starts: Most Multi-family Under Construction Since 1973

• Lawler on Demographics: New Population Estimates Incorporate Unprecedented Methodological Changes

• Why Measures of Existing Home Inventory appear Different

• 4th Look at Local Housing Markets: California Home Sales down 34% YoY in March; Prices Down 7.0% YoY

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of April 23, 2023

by Calculated Risk on 4/22/2023 08:11:00 AM

The key reports scheduled for this week are the advance estimate of Q1 GDP and March New Home sales.

Other key reports include February Case-Shiller house prices and Personal Income and Outlays for March.

For manufacturing, the April Dallas, Richmond and Kansas City manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for April.

9:00 AM: S&P/Case-Shiller House Price Index for February.

9:00 AM: S&P/Case-Shiller House Price Index for February.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.5% year-over-year increase in the Comp 20 index for February.

9:00 AM: FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for March from the Census Bureau.

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 630 thousand SAAR, down from 640 thousand in February.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 0.9% increase in durable goods orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 245 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2023 (Advance estimate). The consensus is that real GDP increased 2.0% annualized in Q1, down from 2.6% in Q4.

10:00 AM: Pending Home Sales Index for March. The consensus is for a 1.0% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for April. This is the last of regional manufacturing surveys for April.

8:30 AM ET: Personal Income and Outlays, March 2023. The consensus is for a 0.2% increase in personal income, and for a 0.1% decrease in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 4.1% YoY, and core PCE prices up 4.5% YoY.

9:45 AM: Chicago Purchasing Managers Index for April. The consensus is for a reading of 43.5, down from 43.8 in March.

10:00 AM: University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 63.5.

Friday, April 21, 2023

COVID Apr 21, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 4/21/2023 09:00:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 94,142 | 101,598 | ≤35,0001 | |

| Hospitalized2 | 11,097 | 12,418 | ≤3,0001 | |

| Deaths per Week2 | 1,160 | 1,333 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

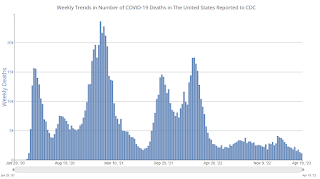

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Q1 GDP Tracking: Around 2%

by Calculated Risk on 4/21/2023 01:31:00 PM

The advance estimate of Q1 GDP will be released this coming Thursday, April 27th. The consensus is that real GDP increased 2.0% annualized in Q1, down from 2.6% in Q4.

From BofA:

On net, the data lowered our tracking estimate a tenth to 1.5% q/q saar. ... Our tracking estimate for personal consumption expenditures (PCE) increased from 3.5% q/q saar to 4.0% q/q saar owing to slightly stronger than expected retail sales and a surge in utitilities production. [Apr 21st estimate]From Goldman:

emphasis added

We have left our Q1 GDP tracking estimate unchanged at +2.2% (qoq ar). Our domestic final sales growth forecast stands at +3.9%. [Apr 20th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 2.5 percent on April 18, unchanged from April 14 after rounding. After this morning's housing starts report from the US Census Bureau, the nowcast of first-quarter real residential investment growth increased from -5.8 percent to -5.5 percent. [Apr 18th estimate]

Why Measures of Existing Home Inventory appear Different

by Calculated Risk on 4/21/2023 09:57:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Why Measures of Existing Home Inventory appear Different

A brief excerpt:

Here is a graph comparing the year-over-year change in Realtor.com’s active inventory, the NAR’s inventory, and Realtor.com inventory including pending sales. Note that the blue line (NAR) and dashed black line (Realtor including pending sales) track.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

As Lawler noted, including pending sales understated the decline in active inventory in 2020 and 2021, and is now understating the increase in active inventory.

But what about Redfin? Redfin takes a very different approach. Their active inventory number for any month includes homes that came on the market and sold quickly during the month, whereas the other measures are a snapshot at the end of the month (or week).

Black Knight: "Mortgage Delinquencies Hit Record Low in March"

by Calculated Risk on 4/21/2023 08:30:00 AM

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies Hit Record Low in March, While Prepayments Rose on Easing Rates and Seasonal Tailwinds

• The national delinquency rate dropped 53 basis points (-15%) in March, falling below 3% for the first time on record, ending the month at just 2.92%According to Black Knight's First Look report, the percent of loans delinquent decreased 15% in March compared to February and decreased 13% year-over-year.

• While delinquency rates almost always fall in March – as borrowers utilize tax refunds and other seasonal revenues to pay down past-due debt – the drop marked the second largest decline in the past 17 years

• Factoring in March’s decline, the total number of past-due mortgages (including active foreclosures) has fallen to its lowest level in nearly 23 years, dating all the way back to April 2000

• Serious delinquencies (90+ days past due) showed marked improvement, falling by 51K to their lowest level since March 2020, with volumes shrinking in every state

• Likewise, every state saw overall delinquencies fall in March, with improvements ranging from 11.9% in Washington to 21.5% in Vermont

• Both foreclosure starts (+9.0%) and sales (+4.6%) rose in the month but still remain well below pre-pandemic volumes at the national level

• Active foreclosure inventory held steady, but remains 31K (12%) below March 2020 levels

• The prepayment rate (SMM) rose to 0.50% (+44% month over month) driven, as anticipated, by seasonal tailwinds in sale-related prepayments and an increased demand for refis due to falling rates

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.92% in March, down from 3.45% the previous month.

The percent of loans in the foreclosure process was essentially unchanged in March at 0.46%, from 0.46% the previous month.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Mar 2023 | Feb 2023 | |||

| Delinquent | 2.92% | 3.45% | ||

| In Foreclosure | 0.46% | 0.46% | ||

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,539,000 | 1,811,000 | ||

| Number of properties in foreclosure pre-sale inventory: | 240,000 | 240,000 | ||

| Total Properties | 1,779,000 | 2,050,000 | ||

Thursday, April 20, 2023

Hotels: Occupancy Rate Up 3.7% Year-over-year

by Calculated Risk on 4/20/2023 03:39:00 PM

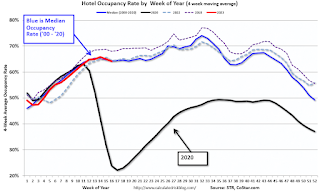

U.S. hotel performance increased from the previous week, according to STR‘s latest data through April 15.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

April 9-15, 2023 (percentage change from comparable week in 2022):

• Occupancy: 64.2% (+3.7%)

• Average daily rate (ADR): $155.33 (+4.7%)

• Revenue per available room (RevPAR): $99.67 (+8.6%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Realtor.com Reports Weekly Active Inventory Up 49% YoY; New Listings Down 5% YoY

by Calculated Risk on 4/20/2023 01:32:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Apr 15, 2023

• Active inventory growth continued to climb, with for-sale homes up 49% above one year ago. The number of homeowners shifting home listing timelines around spring holidays helped push active inventory growth up this week. Despite the big surge, the number of homes for-sale continues to trail pre-pandemic levels, keeping many cards in the hands of sellers sitting on very high levels of home equity.

...

• New listings–a measure of sellers putting homes up for sale–were down again this week, but only by 5% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 41 weeks and while this week continued that trend, the magnitude shifted in a big way. Shifts in religious holidays that fell earlier in 2023 are likely responsible for last week’s big drop and this week’s significantly smaller decline. On average across the two weeks, the decline in new listings is roughly on track with what we’ve seen so far this year.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up year-over-year - from record lows - however, the YoY increase has slowed recently, although this was a pickup from up 44% YoY last week.

NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March; Median Prices Declined 0.9% YoY

by Calculated Risk on 4/20/2023 10:42:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March; Median Prices Declined 0.9% YoY

Excerpt:

On prices, the NAR reported:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!The median existing-home price for all housing types in March was $375,700, a decline of 0.9% from March 2022 ($379,300). Price climbed slightly in three regions but dropped in the WestMedian prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

The YoY change in the median price peaked at 25.2% in May 2021 and prices are now down 0.9% YoY. Median house prices increased 3.3% from February to March and have declined 9.2% from the peak in June 2022 (NSA).

It is likely the Case-Shiller index will be down soon year-over-year.

Note that closed sales in March were mostly for contracts signed in January and February. Mortgage rates, according to the Freddie Mac PMMS, were around 6.3% in January and February, and that provided a boost to closed sales in February and March compared to closed sales in December and January.

April sales will be for contracts signed in February and March, and mortgage rates averaged 6.5% in March and that might impact closed sales in April.

NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March

by Calculated Risk on 4/20/2023 10:11:00 AM

From the NAR: Existing-Home Sales Slid 2.4% in March

Existing-home sales edged lower in March, according to the National Association of Realtors®. Month-over-month sales declined in three out of four major U.S. regions, while sales in the Northeast remained steady. All regions posted year-over-year decreases.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – fell 2.4% from February to a seasonally adjusted annual rate of 4.44 million in March. Year-over-year, sales waned 22.0% (down from 5.69 million in March 2022).

...

Total housing inventory registered at the end of March was 980,000 units, up 1.0% from February and 5.4% from one year ago (930,000). Unsold inventory sits at a 2.6-month supply at the current sales pace, unchanged from February but up from 2.0 months in March 2022.

emphasis added

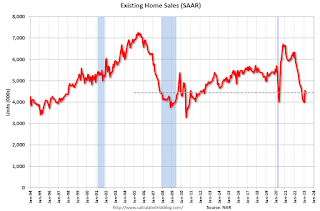

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March (4.44 million SAAR) were down 2.4% from the previous month and were 22.0% below the March 2022 sales rate.

According to the NAR, inventory increased to 0.98 million in March from 0.97 million in February.

According to the NAR, inventory increased to 0.98 million in March from 0.97 million in February.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 5.4% year-over-year (blue) in March compared to March 2022.

Inventory was up 5.4% year-over-year (blue) in March compared to March 2022. Months of supply (red) was unchanged at 2.6 months in March from 2.6 months in February.

This was below the consensus forecast. I'll have more later.