by Calculated Risk on 4/25/2023 09:46:00 AM

Tuesday, April 25, 2023

Comments on February Case-Shiller and FHFA House Prices

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index "Declines Moderated" to 2.0% year-over-year increase in February

Excerpt:

Both the Case-Shiller House Price Index (HPI) and the Federal Housing Finance Agency (FHFA) HPI for February were released today. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The Case-Shiller Home Price Indices for "February" is a 3-month average of December, January and February closing prices. December closing prices include some contracts signed in October, so there is a significant lag to this data.

The MoM increase in the seasonally adjusted Case-Shiller National Index was at 0.16%. This increase followed seven consecutive MoM decreases.

On a seasonally adjusted basis, prices declined in 11 of 20 Case-Shiller cities on a month-to-month basis. The largest monthly declines seasonally adjusted were in Seattle (-1.5%), Las Vegas (-0.9%), and Portland (-0.4%). Seasonally adjusted, San Francisco has fallen 13.5% from the peak in May 2022 and Seattle is down 12.8% from the peak. All 20 cities have seen price declines from the recent peak (SA).

Case-Shiller: National House Price Index "Declines Moderated" to 2.0% year-over-year increase in February

by Calculated Risk on 4/25/2023 09:15:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3-month average of December, January and February closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Declines Moderated in February

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 2.0% annual gain in February, down from 3.7% in the previous month. The 10-City Composite annual increase came in at 0.4%, down from 2.5% in the previous month. The 20-City Composite posted a 0.4% year-over-year gain, down from 2.6% in the previous month.

Miami, Tampa, and Atlanta again reported the highest year-over-year gains among the 20 cities in February. The order remained the same with Miami leading the way with a 10.8% year-over-year price increase, followed by Tampa in second with a 7.7% increase, and Atlanta in third with a 6.6% increase. All 20 cities reported lower prices in the year ending February 2023 versus the year ending January 2023.

...

Before seasonal adjustment, the U.S. National Index posted a 0.2% month-over-month increase in February, while the 10-City and 20-City Composites posted increases of 0.3% and 0.2%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.2%, while both the 10-City and 20-City Composites posted increases of 0.1%.

In January, before seasonal adjustment, 19 cities reported declines with only Miami reporting an increase at 0.1%. After seasonal adjustment, 15 cities reported declines while Miami, Boston, Charlotte, and Cleveland had slight increases.

“Home price trends moderated in February 2023,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite, which had declined for seven consecutive months, rose a modest 0.2% in February, and now stands 4.9% below its June 2022 peak. Our 10- and 20-City Composites performed similarly, with February gains of 0.3% and 0.2%; these Composites are currently 6.0% and 6.6% below their respective peaks. On a trailing 12-month basis, the National Composite is only 2.0% above its level in February 2022; the 10- and 20-City Composites are both up 0.4% on a year-over-year basis."

emphasis added

Click on graph for larger image.

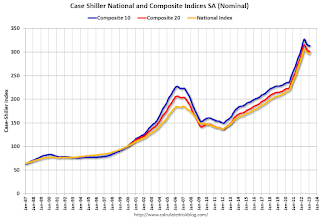

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.1% in February (SA) and down 4.3% from the recent peak in June 2022.

The Composite 20 index is up 0.1% (SA) in February and down 4.6% from the recent peak in June 2022.

The National index is up 0.2% (SA) in February and is down 2.8% from the peak in June 2022.

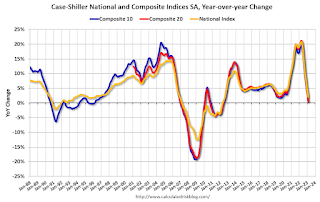

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 0.4% year-over-year. The Composite 20 SA is up 0.4% year-over-year.

The National index SA is up 2.0% year-over-year.

Annual price increases were below expectations. I'll have more later.

Monday, April 24, 2023

Tuesday: New Home Sales, Case-Shiller House Prices

by Calculated Risk on 4/24/2023 09:00:00 PM

The average lender moved slightly lower in cost. The change was small enough that most borrowers will see it in the form of a modest reduction in upfront costs without any change in the quoted interest rate (relative to what the same scenario would have been quoted on Friday). [30 year fixed 6.59%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for February. The consensus is for a 2.5% year-over-year increase in the Comp 20 index for February.

• Also at 9:00 AM, FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for March from the Census Bureau. The consensus is for 630 thousand SAAR, down from 640 thousand in February.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for April.

Vehicle Sales Forecast: "April U.S. Light-Vehicle Sales to Post Strong Growth"

by Calculated Risk on 4/24/2023 04:27:00 PM

From WardsAuto: April U.S. Light-Vehicle Sales to Post Strong Growth; Inventory to Fall from March (pay content). Brief excerpt:

Even though the seasonally adjusted annual rate could decline slightly from the prior quarter’s 15.2 million units, sales volume is forecast to rise a robust 13% year-over-year in Q2. Inventory will undergo a seasonally related month-to-month decline in April but resume growth by the end of the quarter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for April (Red).

The Wards forecast of 15.5 million SAAR, would be up 4.6% from last month, and up 8.5% from a year ago.

Final Look at Local Housing Markets in March

by Calculated Risk on 4/24/2023 09:56:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in February

A brief excerpt:

Every month I track about 40 local housing markets in the US to get an early sense of changes in the housing market. After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR (and I’m frequently adding more markets). This is the final look at local markets in March.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The big story for March existing home sales was the sharp year-over-year (YoY) decline in sales. Also, active inventory increased YoY, but is still historically low - and new listings were down YoY.

First, here is a table comparing the year-over-year Not Seasonally Adjusted (NSA) declines in sales this year from the National Association of Realtors® (NAR) with the local markets I track. So far, these measures have tracked closely. The NAR reported sales were down 23.0% NSA YoY in February.

...

Note: Even if existing home sales activity bottomed in December (4.03 million SA) and January (4.00 million SA), there are usually two bottoms for housing - the first for activity and the second for prices. See Has Housing "Bottomed"?

My early expectation is we will see a somewhat similar YoY sales decline NSA in April as in March. Even though mortgage rates were higher for contracts signed in March (closed sales in April will be mostly for contracts signed in February and March) sales were already declining in March 2022, as 30-year mortgage rates moved above 4% for the first time since early 2019 (yes, rates were below 4% prior to the pandemic).

More local data coming in May for activity in April!

Housing April 24th Weekly Update: Inventory Increased 2.1% Week-over-week

by Calculated Risk on 4/24/2023 08:30:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, April 23, 2023

Sunday Night Futures

by Calculated Risk on 4/23/2023 06:43:00 PM

Weekend:

• Schedule for Week of April 23, 2023

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for March. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for April.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 6 and DOW futures are down 44 (fair value).

Oil prices were down over the last week with WTI futures at $77.87 per barrel and Brent at $81.66 per barrel. A year ago, WTI was at $103, and Brent was at $105 - so WTI oil prices are down about 24% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.64 per gallon. A year ago, prices were at $4.09 per gallon, so gasoline prices are down $0.45 per gallon year-over-year.

The Normal Seasonal Pattern for Median House Prices

by Calculated Risk on 4/23/2023 10:37:00 AM

Last week, in the CalculatedRisk Real Estate Newsletter on March existing home sales, NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March; Median Prices Declined 0.9% YoY, I noted that median prices were down year-over-year (median prices are distorted by the mix).

Seasonally prices typically peak in June (closed sales are mostly for contracts signed in April and May).

And seasonally prices usually bottom the following January (contracts signed in November and December).

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Jan to Mar | 3.7% | 4.1% | 5.4% | 7.5% | 7.1% | 4.0% |

| Mar to Jun | 9.6% | 9.9% | 4.9% | 12.4% | 9.1% | NA |

| Total Jan to Jun | 13.7% | 14.4% | 10.6% | 20.8% | 16.8% | NA |

| Jun to Dec | -7.0% | -3.8% | 5.0% | -2.2% | -11.4% | NA |

The 2023 increase in median prices from January to March was about the same as in 2018 and 2019.

Saturday, April 22, 2023

Real Estate Newsletter Articles this Week: "Most Multi-family Under Construction Since 1973"

by Calculated Risk on 4/22/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 4.44 million SAAR in March; Median Prices Declined 0.9% YoY

• March Housing Starts: Most Multi-family Under Construction Since 1973

• Lawler on Demographics: New Population Estimates Incorporate Unprecedented Methodological Changes

• Why Measures of Existing Home Inventory appear Different

• 4th Look at Local Housing Markets: California Home Sales down 34% YoY in March; Prices Down 7.0% YoY

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of April 23, 2023

by Calculated Risk on 4/22/2023 08:11:00 AM

The key reports scheduled for this week are the advance estimate of Q1 GDP and March New Home sales.

Other key reports include February Case-Shiller house prices and Personal Income and Outlays for March.

For manufacturing, the April Dallas, Richmond and Kansas City manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for April.

9:00 AM: S&P/Case-Shiller House Price Index for February.

9:00 AM: S&P/Case-Shiller House Price Index for February.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.5% year-over-year increase in the Comp 20 index for February.

9:00 AM: FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for March from the Census Bureau.

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 630 thousand SAAR, down from 640 thousand in February.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 0.9% increase in durable goods orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 245 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2023 (Advance estimate). The consensus is that real GDP increased 2.0% annualized in Q1, down from 2.6% in Q4.

10:00 AM: Pending Home Sales Index for March. The consensus is for a 1.0% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for April. This is the last of regional manufacturing surveys for April.

8:30 AM ET: Personal Income and Outlays, March 2023. The consensus is for a 0.2% increase in personal income, and for a 0.1% decrease in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 4.1% YoY, and core PCE prices up 4.5% YoY.

9:45 AM: Chicago Purchasing Managers Index for April. The consensus is for a reading of 43.5, down from 43.8 in March.

10:00 AM: University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 63.5.