by Calculated Risk on 4/26/2023 10:17:00 AM

Wednesday, April 26, 2023

Inflation Adjusted House Prices 4.6% Below Peak; Price-to-rent index is 8.4% below recent peak

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 4.6% Below Peak; Price-to-rent index is 8.4% below recent peak

Excerpt:

It has been 17 years since the bubble peak. In the January Case-Shiller house price index released on Tuesday, the seasonally adjusted National Index (SA), was reported as being 61% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 11% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is at the bubble peak.

The inflation adjusted indexes have declined for nine consecutive months in real terms.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $200,000 in January 2000, the price would be almost $340,000 today adjusted for inflation (70% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index.

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 4/26/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 21, 2023.

The Market Composite Index, a measure of mortgage loan application volume, increased 3.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 5 percent compared with the previous week. The Refinance Index increased 2 percent from the previous week and was 51 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index increased 6 percent compared with the previous week and was 28 percent lower than the same week one year ago.

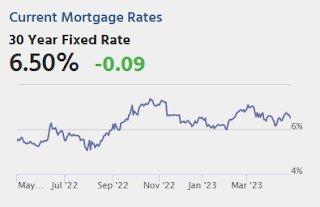

“Both conventional and government home purchase applications increased last week. However, activity was still nearly 28 percent below last year’s pace, as high mortgage rates and low supply have slowed the market this year, even as home-price growth has decelerated in many markets across the country,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Refinance applications also increased last week but remained at half of last year’s levels. Although incoming data points to a slowdown in the U.S. economy, markets continue to expect that the Fed will raise short-term rates at its next meeting, which have pushed Treasury yields somewhat higher. As a result of the higher yields, mortgage rates increased for the second straight week to their highest level in over a month, with the 30-year fixed rate now at 6.55 percent.”

..

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.55 percent from 6.43 percent, with points remaining at 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 28% year-over-year unadjusted.

Tuesday, April 25, 2023

Wednesday: Durable Goods

by Calculated Risk on 4/25/2023 09:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for March from the Census Bureau. The consensus is for a 0.9% increase in durable goods orders.

Las Vegas March 2023: Visitor Traffic Down 1.1% Compared to 2019; Convention Traffic Up 39.6%

by Calculated Risk on 4/25/2023 02:07:00 PM

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions). Vegas is Back!

From the Las Vegas Visitor Authority: March 2023 Las Vegas Visitor Statistics

Benefitting from a mix of headliners and events from NASCAR to Taylor Swift to several college basketball tournaments, paired with a robust convention month that included the triennial CONEXPO‐CON/AGG tradeshow and its 140k+ attendees, Las Vegas visitation neared 3.7M in Mar 2023, up +9.6% YoY and nearly matching Mar 2019.

Overall hotel occupancy exceeded 88% for the month, +7.7 pts YoY. Achieving impressive levels by both pre and post‐pandemic standards, Weekend occupancy reached 94.5% for the month (+2.4 pts YoY) while conventions helped propel Midweek occupancy to 85.8%, +9.2 pts YoY.

Overall ADR exceeded $213, breaking the record from just a few months ago (Oct 2022, $208) and surpassing Mar 2022 and Mar 2019 by +30.7% and +59.2%, respectively. RevPAR also broke records, reaching $188, +43.2% YoY and +53.6% over Mar 2019

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (light blue), 2021 (purple), 2022 (orange), and 2023 (red).

Visitor traffic was down 1.1% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.

New Home Sales Increase to 683,000 Annual Rate in March; Likely New Home Sales will be up YoY in Mid-2023

by Calculated Risk on 4/25/2023 10:50:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Increase to 683,000 Annual Rate in March

Brief excerpt:

The next graph shows new home sales for 2022 and 2023 by month (Seasonally Adjusted Annual Rate). Sales in March 2023 were down 3.4% from March 2022.You can subscribe at https://calculatedrisk.substack.com/.

It seems likely that new home sales will be up year-over-year sometime in the next few months.

...

As previously discussed, the Census Bureau overestimates sales, and underestimates inventory when cancellation rates are rising, see: New Home Sales and Cancellations: Net vs Gross Sales. This has reversed now since cancellation rates have started to decline. When a previously cancelled home is resold, the home builder counts it as a sale, but the Census Bureau does not (since it was already counted).

There are still a large number of homes under construction, and this suggests we might see a further increase in completed inventory over the next several months, but in general, this is a positive report for new home sales.

New Home Sales Increase to 683,000 Annual Rate in March

by Calculated Risk on 4/25/2023 10:07:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 683 thousand.

The previous three months were revised down slightly, combined.

Sales of new single‐family houses in March 2023 were at a seasonally adjusted annual rate of 683,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 9.6 percent above the revised February rate of 623,000, but is 3.4 percent below the March 2022 estimate of 707,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are close to pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply decreased in March to 7.6 months from 8.4 months in February.

The months of supply decreased in March to 7.6 months from 8.4 months in February. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of March was 432,000. This represents a supply of 7.6 months at the current sales rate."Sales were above expectations of 630 thousand SAAR, however, sales in the three previous months were revised down slightly, combined. I'll have more later today.

Comments on February Case-Shiller and FHFA House Prices

by Calculated Risk on 4/25/2023 09:46:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index "Declines Moderated" to 2.0% year-over-year increase in February

Excerpt:

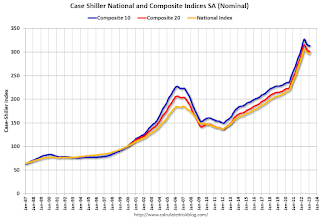

Both the Case-Shiller House Price Index (HPI) and the Federal Housing Finance Agency (FHFA) HPI for February were released today. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The Case-Shiller Home Price Indices for "February" is a 3-month average of December, January and February closing prices. December closing prices include some contracts signed in October, so there is a significant lag to this data.

The MoM increase in the seasonally adjusted Case-Shiller National Index was at 0.16%. This increase followed seven consecutive MoM decreases.

On a seasonally adjusted basis, prices declined in 11 of 20 Case-Shiller cities on a month-to-month basis. The largest monthly declines seasonally adjusted were in Seattle (-1.5%), Las Vegas (-0.9%), and Portland (-0.4%). Seasonally adjusted, San Francisco has fallen 13.5% from the peak in May 2022 and Seattle is down 12.8% from the peak. All 20 cities have seen price declines from the recent peak (SA).

Case-Shiller: National House Price Index "Declines Moderated" to 2.0% year-over-year increase in February

by Calculated Risk on 4/25/2023 09:15:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3-month average of December, January and February closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Declines Moderated in February

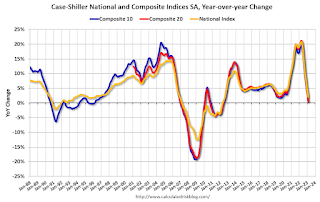

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 2.0% annual gain in February, down from 3.7% in the previous month. The 10-City Composite annual increase came in at 0.4%, down from 2.5% in the previous month. The 20-City Composite posted a 0.4% year-over-year gain, down from 2.6% in the previous month.

Miami, Tampa, and Atlanta again reported the highest year-over-year gains among the 20 cities in February. The order remained the same with Miami leading the way with a 10.8% year-over-year price increase, followed by Tampa in second with a 7.7% increase, and Atlanta in third with a 6.6% increase. All 20 cities reported lower prices in the year ending February 2023 versus the year ending January 2023.

...

Before seasonal adjustment, the U.S. National Index posted a 0.2% month-over-month increase in February, while the 10-City and 20-City Composites posted increases of 0.3% and 0.2%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.2%, while both the 10-City and 20-City Composites posted increases of 0.1%.

In January, before seasonal adjustment, 19 cities reported declines with only Miami reporting an increase at 0.1%. After seasonal adjustment, 15 cities reported declines while Miami, Boston, Charlotte, and Cleveland had slight increases.

“Home price trends moderated in February 2023,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite, which had declined for seven consecutive months, rose a modest 0.2% in February, and now stands 4.9% below its June 2022 peak. Our 10- and 20-City Composites performed similarly, with February gains of 0.3% and 0.2%; these Composites are currently 6.0% and 6.6% below their respective peaks. On a trailing 12-month basis, the National Composite is only 2.0% above its level in February 2022; the 10- and 20-City Composites are both up 0.4% on a year-over-year basis."

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.1% in February (SA) and down 4.3% from the recent peak in June 2022.

The Composite 20 index is up 0.1% (SA) in February and down 4.6% from the recent peak in June 2022.

The National index is up 0.2% (SA) in February and is down 2.8% from the peak in June 2022.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 0.4% year-over-year. The Composite 20 SA is up 0.4% year-over-year.

The National index SA is up 2.0% year-over-year.

Annual price increases were below expectations. I'll have more later.

Monday, April 24, 2023

Tuesday: New Home Sales, Case-Shiller House Prices

by Calculated Risk on 4/24/2023 09:00:00 PM

The average lender moved slightly lower in cost. The change was small enough that most borrowers will see it in the form of a modest reduction in upfront costs without any change in the quoted interest rate (relative to what the same scenario would have been quoted on Friday). [30 year fixed 6.59%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for February. The consensus is for a 2.5% year-over-year increase in the Comp 20 index for February.

• Also at 9:00 AM, FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for March from the Census Bureau. The consensus is for 630 thousand SAAR, down from 640 thousand in February.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for April.

Vehicle Sales Forecast: "April U.S. Light-Vehicle Sales to Post Strong Growth"

by Calculated Risk on 4/24/2023 04:27:00 PM

From WardsAuto: April U.S. Light-Vehicle Sales to Post Strong Growth; Inventory to Fall from March (pay content). Brief excerpt:

Even though the seasonally adjusted annual rate could decline slightly from the prior quarter’s 15.2 million units, sales volume is forecast to rise a robust 13% year-over-year in Q2. Inventory will undergo a seasonally related month-to-month decline in April but resume growth by the end of the quarter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for April (Red).

The Wards forecast of 15.5 million SAAR, would be up 4.6% from last month, and up 8.5% from a year ago.