by Calculated Risk on 4/29/2023 02:11:00 PM

Saturday, April 29, 2023

Real Estate Newsletter Articles this Week: Case-Shiller House Prices up 2.0% YoY

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index "Declines Moderated" to 2.0% year-over-year increase in February

• New Home Sales Increase to 683,000 Annual Rate in March

• Inflation Adjusted House Prices 4.6% Below Peak

• Final Look at Local Housing Markets in March

• NMHC: "Apartment Market Continues to Loosen"

• Freddie Mac House Price Index Increased Slightly in March; Up 1.0% Year-over-year

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of April 30, 2023

by Calculated Risk on 4/29/2023 08:11:00 AM

The key report scheduled for this week is the April employment report.

Other key reports include April vehicle sales, and the March trade balance.

The FOMC meets this week, and the FOMC is expected to raise rates 25bp.

For manufacturing, the April ISM manufacturing index will be released.

10:00 AM ET: ISM Manufacturing Index for April. The consensus is for the ISM to be at 46.8, up from 46.3 in March.

10:00 AM: Construction Spending for March. The consensus is for a 0.2% increase in construction spending.

8:00 AM ET: Corelogic House Price index for March.

10:00 AM ET: Job Openings and Labor Turnover Survey for March from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for March from the BLS. This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in February to 9.9 million from 10.6 million in January.

The number of job openings (black) were down 14% year-over-year in February.

All day: Light vehicle sales for April. The expectation is for light vehicle sales to be 14.8 million SAAR in April, unchanged from 14.8 million in March (Seasonally Adjusted Annual Rate).

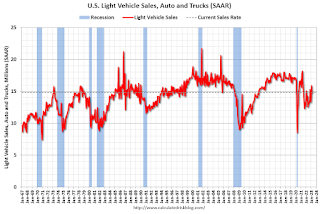

All day: Light vehicle sales for April. The expectation is for light vehicle sales to be 14.8 million SAAR in April, unchanged from 14.8 million in March (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for the previous month.

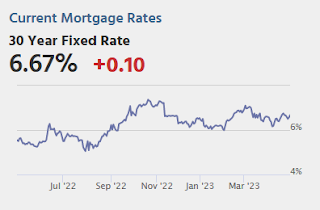

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 135,000 payroll jobs added in April, down from 145,000 added in March.

10:00 AM: the Q1 2023 Housing Vacancies and Homeownership from the Census Bureau.

10:00 AM: the ISM Services Index for April. The consensus is for a reading of 51.7, up from 51.2.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 25bp at this meeting and indicate a likely "pause" in June.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 243 thousand initial claims, up from 230 thousand last week.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $63.8 billion. The U.S. trade deficit was at $70.3 billion in February.

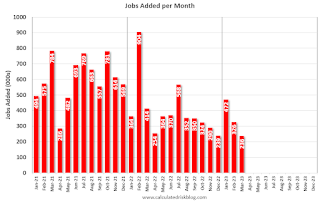

8:30 AM: Employment Report for April. The consensus is for 178,000 jobs added, and for the unemployment rate to increase to 3.6%.

8:30 AM: Employment Report for April. The consensus is for 178,000 jobs added, and for the unemployment rate to increase to 3.6%.There were 236,000 jobs added in March, and the unemployment rate was at 3.5%.

This graph shows the jobs added per month since January 2022.

Friday, April 28, 2023

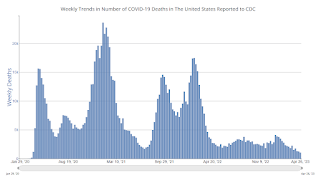

COVID Apr 28, 2023, Update: New Pandemic Low for Weekly Deaths

by Calculated Risk on 4/28/2023 09:00:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 88,330 | 97,893 | ≤35,0001 | |

| Hospitalized2 | 9,876 | 11,497 | ≤3,0001 | |

| Deaths per Week2 | 1,052 | 1,246 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Hotels: Occupancy Rate Up 2.3% Year-over-year

by Calculated Risk on 4/28/2023 03:28:00 PM

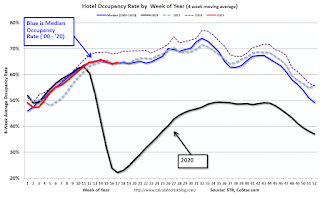

U.S. hotel performance increased from the previous week, according to STR‘s latest data through April 22.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

April 16-22, 2023 (percentage change from comparable week in 2022):

• Occupancy: 67.2% (+2.3%)

• Average daily rate (ADR): $155.76 (+4.2%)

• Revenue per available room (RevPAR): $104.64 (+6.6%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

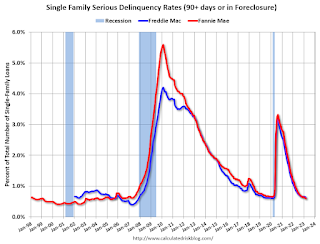

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in March

by Calculated Risk on 4/28/2023 01:41:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.59% in March from 0.62% in February. The serious delinquency rate is down from 1.01% in March 2022. This is below the pre-pandemic levels.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 1.93% are seriously delinquent (down from 2.04% in February).

Mortgages in forbearance were counted as delinquent in this monthly report, but they were not reported to the credit bureaus.

Freddie Mac reported earlier.

Freddie Mac House Price Index Increased Slightly in March; Up 1.0% Year-over-year

by Calculated Risk on 4/28/2023 11:16:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased Slightly in March; Up 1.0% Year-over-year

A brief excerpt:

Freddie Mac reported that its “National” Home Price Index (FMHPI) increased 0.3% month-over-month on a seasonally adjusted (SA) basis in March, putting the National FMHPI down 1.3% SA from its June 2022 peak, and down 2.6% Not Seasonally Adjusted (NSA) from the peak.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

On a year-over-year basis, the National FMHPI was up 1.0% in March, down from 2.1% YoY in February. The YoY increase peaked at 19.2% in July 2021. ...

In March, 24 states and D.C. were below their 2022 peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Idaho (-8.8%), Nevada (-7.9%), Arizona (-6.8%), Utah (-6.5%), Washington (-6.3%), California (-5.6%), and Colorado (-4.4%).

In March, house prices in 9 states and D.C. were down YoY, led by Idaho (-7.5% YoY), Nevada (-6.3%) and Washington (-5.1%).

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted.

PCE Measure of Shelter Still Accelerating YoY

by Calculated Risk on 4/28/2023 08:59:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through March 2023:

Since rents are soft and "Apartment Market Continues to Loosen" this means both CPI and PCE measures are currently overstating actual inflation.

Personal Income increased 0.3% in March; Spending increased Slightly

by Calculated Risk on 4/28/2023 08:40:00 AM

The BEA released the Personal Income and Outlays report for March:

Personal income increased $67.9 billion (0.3 percent) in March, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $71.7 billion (0.4 percent) and personal consumption expenditures (PCE) increased $8.2 billion (less than 0.1 percent).The March PCE price index increased 4.2 percent year-over-year (YoY), down from 5.1 percent YoY in February, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.3 percent. Real DPI increased 0.3 percent in March and Real PCE decreased less than 0.1 percent; goods decreased 0.4 percent and services increased 0.1 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through March 2023 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income and PCE were slightly above expectations.

Thursday, April 27, 2023

Friday: Personal Income & Outlays

by Calculated Risk on 4/27/2023 08:50:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, March 2023. The consensus is for a 0.2% increase in personal income, and for a 0.1% decrease in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 4.1% YoY, and core PCE prices up 4.5% YoY.

• At 9:45 AM, Chicago Purchasing Managers Index for April. The consensus is for a reading of 43.5, down from 43.8 in March.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 63.5.

Realtor.com Reports Weekly Active Inventory Up 39% YoY; New Listings Down 21% YoY

by Calculated Risk on 4/27/2023 02:52:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Apr 22, 2023

• Active inventory was up at a slower pace, with for-sale homes up just 39% above one year ago. The number of homes for sale continues to climb, but hesitant seller participation is limiting the pace of growth. As a result, a greater share of current for-sale inventory is new construction.

...

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 21% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 42 weeks.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up year-over-year - from record lows - however, the YoY increase has slowed sharply recently.