by Calculated Risk on 5/01/2023 06:12:00 PM

Monday, May 01, 2023

Secretary Yellen to Speaker McCarthy: "unable to continue to satisfy all of the government’s obligations by early June"

From Treasury Secretary Janet Yellen to Speaker McCarthy:

"After reviewing recent federal tax receipts, our best estimate is that we will be unable to continue to satisfy all of the government's obligations by early June, and potentially as early as June 1, if Congress does not raise or suspend the debt limit before that time."The following is relevant today.

From Federal Reserve Staff in 2013 on the debt ceiling debate: Possible Macroeconomic Effects of a Temporary Federal Debt Default. Excerpts:

Key considerations in evaluating the consequences of a debt defaultUsually the debt ceiling (I prefer "default ceiling") is raised with a clean bill. It is up to Congress. As Senator Mitch McConnell noted in 2011, if the debt ceiling isn't raised the "Republican brand" would become toxic and synonymous with fiscal irresponsibility.

• Such an event would be unprecedented. Although other countries have defaulted on their sovereign debt, these defaults occurred in situations where the government could not feasibly continue to service its debt. Failure to raise the U.S. federal debt ceiling, in contrast, would be a voluntary decision to stop meeting the government’s obligations even though it has no problems doing so. In addition, no other nation that defaulted on its sovereign debt ever enjoyed two key features of the U.S. economy—Treasury securities are the world’s “safe” asset and the dollar is the world’s main reserve currency. For these reasons, we have essentially no historical experience to help us predict the likely consequences of a failure by the Congress and the Administration to raise the debt ceiling.

• The financial market effects of a debt default would be highly uncertain, both because of its unprecedented nature, and because (as events in recent years have illustrated) we have only a limited understanding of the dynamics of the financial system when hit with a major shock.

o Yields on Treasury securities could rise noticeably, even if the default lasted only a day or two. And if the debt limit impasse dragged on for weeks, it could conceivably lead investors to demand a premium similar to that paid on AAA corporate bonds.

o Given that Treasury yields serve as a benchmark rate for the pricing of other securities, and given that a prolonged stand-off would probably make the general economic outlook much more uncertain, private interest rates could rise sharply. Rising interest rates and risk premiums would in turn push stock prices down appreciably.

o In some extreme scenarios with a prolonged default, financial markets could be severely impaired. For example, the functioning of the repo market could be compromised and some money market mutual funds could experience liquidity pressures.

o A debt default could also have some international repercussions. For example, a prolonged default might increase the reluctance of investors to hold Treasury securities and perhaps dollar-denominated assets more generally. Although the resulting rebalancing in portfolios might be relatively gradual, it could lead to a decline in the dollar over time (although a sudden drop could not be ruled out) and a higher “country-risk” premium on all U.S. assets.

• A debt default would also adversely affect the economy through its direct effects on aggregate income flows and government operations if the impasse in raising the debt limit lasted for several weeks.

o Currently, an extremely large portion of federal government spending is funded through borrowing (in part because tax payments are concentrated in other months). From mid-October through mid-November, for example, only 65 percent of projected spending would be covered by revenues. Thus, 35 percent of government cash outlays would need to be cut if a debt limit accord was not reached until the middle of November.

o Assuming that the Treasury prioritizes its payments to cover all scheduled net interest payments, other federal spending would be temporarily reduced by the following amounts (expressed in nominal terms at an annual rate): $340 billion in nominal federal purchases; $630 billion in Social Security, Medicare, and other transfer payments; and $150 billion in grants to state and local governments.

emphasis added

Year-over-year Rent Growth Continues to Decelerate

by Calculated Risk on 5/01/2023 10:46:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Year-over-year Rent Growth Continues to Decelerate

A brief excerpt:

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand). This has been confirmed (mostly due to work-from-home), and also led to the supposition that household formation would slow sharply now (mostly confirmed) and that asking rents might decrease in 2023 on a year-over-year basis.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is important for understanding housing, but also for monetary policy. Asking rents reflect new leases, whereas most rental units see annual rent increases. These annual increases are captured by the consumer price index (CPI) and personal consumption expenditures (PCE) prices. So, shelter in CPI is significantly lagged to asking rents.

But there is more! Once we understand that asking rents will likely be flat to down year-over-year - due to the slowdown in household formation and more supply coming on the market - this suggests shelter in the CPI could be flat in the future. That means we shouldn’t just look at various measures ex-shelter, but we should assume shelter will be lower than overall inflation in the future!

...

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through March 2023, except CoreLogic is through February and Apartment List is through April 2023.

...

The CoreLogic measure is up 5.0% YoY in February, down from 5.7% in January, and down from a peak of 13.9% in April 2022.

The Zillow measure is up 6.0% YoY in March, down from 6.3% YoY in February, and down from a peak of 16.9% YoY in February 2022.

The ApartmentList measure is up 1.7% YoY as of April, down from 2.4% in March, and down from a peak of 18.3% YoY November 2021.

...

My view is it is likely that we will see a year-over-year decline in asking rents sometime in 2023.

Construction Spending Increased 0.3% in March

by Calculated Risk on 5/01/2023 10:19:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during March 2023 was estimated at a seasonally adjusted annual rate of $1,834.7 billion, 0.3 percent above the revised February estimate of $1,829.6 billion. The March figure is 3.8 percent above the March 2022 estimate of $1,768.2 billion.Both private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,435.1 billion, 0.3 percent above the revised February estimate of $1,430.8 billion. ...

In March, the estimated seasonally adjusted annual rate of public construction spending was $399.6 billion, 0.2 percent above the revised February estimate of $398.8 billion.

Click on graph for larger image.

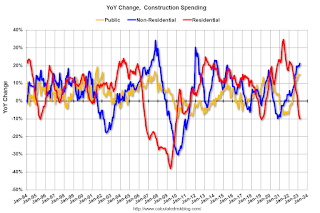

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 12.4% below the recent peak.

Non-residential (blue) spending is at a new peak.

Public construction spending is at a new peak.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 10.0%. Non-residential spending is up 21.3% year-over-year. Public spending is up 15.0% year-over-year.

ISM® Manufacturing index Increased to 47.1% in April

by Calculated Risk on 5/01/2023 10:03:00 AM

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 47.1% in March, up from 46.3% in March. The employment index was at 50.2%, up from 46.9% last month, and the new orders index was at 45.7%, up from 44.3%.

From ISM: Manufacturing PMI® at 47.1%

April 2023 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in April for the sixth consecutive month following a 28-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in April. This was slightly above the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The April Manufacturing PMI® registered 47.1 percent, 0.8 percentage point higher than the 46.3 percent recorded in March. Regarding the overall economy, this figure indicates a fifth month of contraction after a 30-month period of expansion. The New Orders Index remained in contraction territory at 45.7 percent, 1.4 percentage points higher than the figure of 44.3 percent recorded in March. The Production Index reading of 48.9 percent is a 1.1-percentage point increase compared to March’s figure of 47.8 percent. The Prices Index registered 53.2 percent, up 4 percentage points compared to the March figure of 49.2 percent. The Backlog of Orders Index registered 43.1 percent, 0.8 percentage point lower than the March reading of 43.9 percent. The Employment Index elevated into expansion territory, registering 50.2 percent, up 3.3 percentage points from March’s reading of 46.9 percent. The Supplier Deliveries Index figure of 44.6 percent is 0.2 percentage point lower than the 44.8 percent recorded in March; this is the index’s lowest reading since March 2009 (43.2 percent). The Inventories Index dropped 1.2 percentage points to 46.3 percent, lower than the March reading of 47.5 percent. The New Export Orders Index reading of 49.8 percent is 2.2 percentage points higher than March’s figure of 47.6 percent. The Imports Index remained in contraction territory, though just barely, at 49.9 percent, 2 percentage points above the 47.9 percent reported in March.

emphasis added

Housing May 1st Weekly Update: Inventory Increased 2.0% Week-over-week

by Calculated Risk on 5/01/2023 08:11:00 AM

Click on graph for larger image.

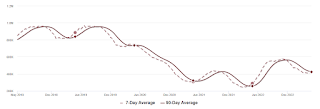

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, April 30, 2023

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 4/30/2023 06:33:00 PM

Weekend:

• Schedule for Week of April 30, 2023

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for April. The consensus is for the ISM to be at 46.8, up from 46.3 in March.

• Also at 10:00 AM, Construction Spending for March. The consensus is for a 0.2% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $76.78 per barrel and Brent at $80.33 per barrel. A year ago, WTI was at $105, and Brent was at $108 - so WTI oil prices are down about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.58 per gallon. A year ago, prices were at $4.17 per gallon, so gasoline prices are down $0.59 per gallon year-over-year.

FOMC Preview: Likely 25bp Hike

by Calculated Risk on 4/30/2023 09:01:00 AM

Most analysts expect the FOMC to raise rates 25 basis points and then hint at a pause in June, although it is possible that the FOMC will not increase rates at the meeting this week. However, there hasn't been any leaks of a possible pause at this meeting - so 25 basis points is likely.

"The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time."Then the stresses in the banking system became apparent and inflation eased somewhat quicker than expected. The FOMC statement in March suggested some additional tightening may be appropriate:

emphasis

"The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time."

"We expect the Fed to hike by 25bp at next week’s meeting. More importantly, we think the Fed will signal a pause in June, with a weak bias to hike rather than cut rates going forward. ... The challenge will be to credibly signal an extended hold and push back against market pricing of rate cuts (roughly 60bp in 2023 and 150bp in 2024 at the time of this writing), particularly given the latest bout of banking sector stress.And from Goldman Sachs economists:

Note that the Fed will have the results of the 2Q Senior Loan Officer Opinion Survey (SLOOS) in hand for the May meeting, although the survey results will only be made public in the following week. The Beige Book shows that six of the 12 regional Fed banks reported further credit tightening since the January survey. This suggests that the SLOOS data will reinforce the case for a pause in June.

emphasis added

The FOMC is likely to deliver a widely expected 25bp rate hike to 5-5.25% at its May meeting, but the focus will be on revisions to the forward guidance in its statement. We expect the Committee to signal that it anticipates pausing in June but retains a hawkish bias, stopping earlier than it initially envisioned because bank stress is likely to cause a tightening of credit.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Mar 2023 | 0.0 to 0.8 | 1.0 to 1.5 | 1.7 to 2.1 | |

The unemployment rate was at 3.5% in March. To reach the mid-point of the FOMC projections for Q4 2023, the economy would likely have to lose 1 to 2 million jobs by Q4.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Mar 2023 | 4.0 to 4.7 | 4.3 to 4.9 | 4.3 to 4.8 | |

As of March 2022, PCE inflation increased 4.2 percent year-over-year (YoY), down from 5.1 percent YoY in February.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Mar 2023 | 3.0 to 3.8 | 2.2 to 2.8 | 2.0 to 2.2 | |

PCE core inflation was up 4.6% in March year-over-year. This remains a concern for the FOMC, however this includes shelter that was up 8.3% YoY in March.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Mar 2023 | 3.5 to 3.9 | 2.3 to 2.8 | 2.0 to 2.2 | |

Saturday, April 29, 2023

Real Estate Newsletter Articles this Week: Case-Shiller House Prices up 2.0% YoY

by Calculated Risk on 4/29/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index "Declines Moderated" to 2.0% year-over-year increase in February

• New Home Sales Increase to 683,000 Annual Rate in March

• Inflation Adjusted House Prices 4.6% Below Peak

• Final Look at Local Housing Markets in March

• NMHC: "Apartment Market Continues to Loosen"

• Freddie Mac House Price Index Increased Slightly in March; Up 1.0% Year-over-year

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of April 30, 2023

by Calculated Risk on 4/29/2023 08:11:00 AM

The key report scheduled for this week is the April employment report.

Other key reports include April vehicle sales, and the March trade balance.

The FOMC meets this week, and the FOMC is expected to raise rates 25bp.

For manufacturing, the April ISM manufacturing index will be released.

10:00 AM ET: ISM Manufacturing Index for April. The consensus is for the ISM to be at 46.8, up from 46.3 in March.

10:00 AM: Construction Spending for March. The consensus is for a 0.2% increase in construction spending.

8:00 AM ET: Corelogic House Price index for March.

10:00 AM ET: Job Openings and Labor Turnover Survey for March from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for March from the BLS. This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in February to 9.9 million from 10.6 million in January.

The number of job openings (black) were down 14% year-over-year in February.

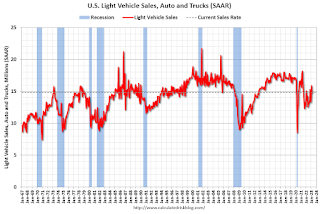

All day: Light vehicle sales for April. The expectation is for light vehicle sales to be 14.8 million SAAR in April, unchanged from 14.8 million in March (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for April. The expectation is for light vehicle sales to be 14.8 million SAAR in April, unchanged from 14.8 million in March (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for the previous month.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 135,000 payroll jobs added in April, down from 145,000 added in March.

10:00 AM: the Q1 2023 Housing Vacancies and Homeownership from the Census Bureau.

10:00 AM: the ISM Services Index for April. The consensus is for a reading of 51.7, up from 51.2.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 25bp at this meeting and indicate a likely "pause" in June.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 243 thousand initial claims, up from 230 thousand last week.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $63.8 billion. The U.S. trade deficit was at $70.3 billion in February.

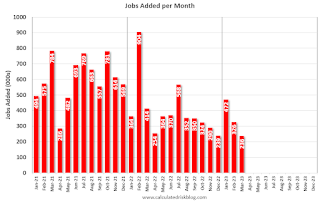

8:30 AM: Employment Report for April. The consensus is for 178,000 jobs added, and for the unemployment rate to increase to 3.6%.

8:30 AM: Employment Report for April. The consensus is for 178,000 jobs added, and for the unemployment rate to increase to 3.6%.There were 236,000 jobs added in March, and the unemployment rate was at 3.5%.

This graph shows the jobs added per month since January 2022.

Friday, April 28, 2023

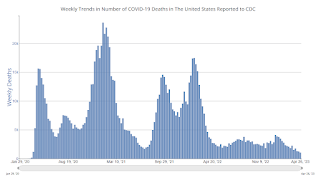

COVID Apr 28, 2023, Update: New Pandemic Low for Weekly Deaths

by Calculated Risk on 4/28/2023 09:00:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 88,330 | 97,893 | ≤35,0001 | |

| Hospitalized2 | 9,876 | 11,497 | ≤3,0001 | |

| Deaths per Week2 | 1,052 | 1,246 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.