by Calculated Risk on 5/04/2023 08:48:00 AM

Thursday, May 04, 2023

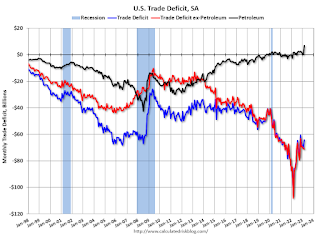

Trade Deficit decreased to $64.2 Billion in March

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $64.2 billion in March, down $6.4 billion from $70.6 billion in February, revised.

March exports were $256.2 billion, $5.3 billion more than February exports. March imports were $320.4 billion, $1.1 billion less than February imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in March.

Exports are up 5% year-over-year; imports are down 9% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - but imports have been decreasing recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have picked up.

The trade deficit with China decreased to $16.6 billion in March, from $34.0 billion a year ago.

Weekly Initial Unemployment Claims increase to 242,000

by Calculated Risk on 5/04/2023 08:30:00 AM

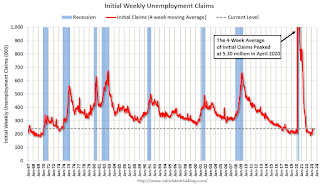

The DOL reported:

In the week ending April 29, the advance figure for seasonally adjusted initial claims was 242,000, an increase of 13,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 230,000 to 229,000. The 4-week moving average was 239,250, an increase of 3,500 from the previous week's revised average. The previous week's average was revised down by 250 from 236,000 to 235,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 239,250.

The previous week was revised down.

Weekly claims were close to the consensus forecast.

Wednesday, May 03, 2023

Thursday: Unemployment Claims, Trade Balance

by Calculated Risk on 5/03/2023 09:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 243 thousand initial claims, up from 230 thousand last week.

• At 8:30 AM, Trade Balance report for March from the Census Bureau. The consensus is the trade deficit to be $63.8 billion. The U.S. trade deficit was at $70.3 billion in February.

Heavy Truck Sales Up Sharply Year-over-year in April

by Calculated Risk on 5/03/2023 03:53:00 PM

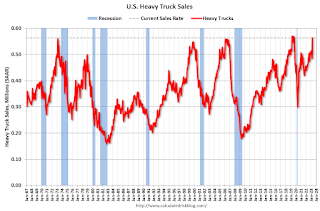

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the April 2023 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

FOMC Statement: Raise Rates 25 bp; Pause in June Likely

by Calculated Risk on 5/03/2023 02:02:00 PM

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

FOMC Statement:

Economic activity expanded at a modest pace in the first quarter. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated.

The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 5 to 5-1/4 percent. The Committee will closely monitor incoming information and assess the implications for monetary policy. In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Lorie K. Logan; and Christopher J. Waller.

emphasis added

Black Knight Mortgage Monitor: Home Prices Increased in March; Prices Up 1.0% YoY

by Calculated Risk on 5/03/2023 10:57:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: Home Prices Increased in March; Prices Up 1.0% YoY

A brief excerpt:

Here is a graph of the Black Knight HPI. The index is still up 1.0% year-over-year and will likely turn negative YoY soon.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• Nationally, home prices rose by 0.45% in March on a seasonally adjusted basis, slightly stronger than the revised 0.43% rise in the prior month

• On a non-adjusted basis, home prices were up 1.38% in March, roughly on par with the 10-year March average of 1.43% (typically the strongest monthly uptick each year)

• Despite prices strengthening this spring, annual home price growth continues to cool; prices were up just 1.0% on an annual basis, a backward-looking metric that has been falling by 1.3-1.4% each month since the start of 2023

• A continuation of recent trends would drop that annual home price growth rate to around 0% when April 2022 metrics are reported next month

emphasis added

HVS: Q1 2023 Homeownership and Vacancy Rates; Rental Vacancy Rates Increased Sharply

by Calculated Risk on 5/03/2023 10:18:00 AM

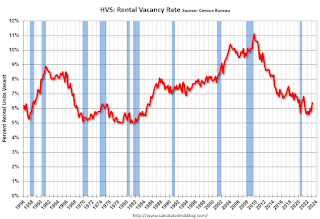

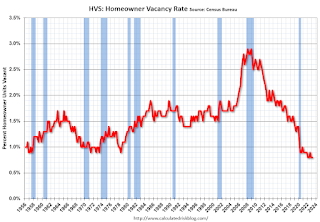

The Census Bureau released the Residential Vacancies and Homeownership report for Q1 2023.

The results of this survey were significantly distorted by the pandemic in 2020.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. Analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

National vacancy rates in the first quarter 2023 were 6.4 percent for rental housing and 0.8 percent for homeowner housing. The rental vacancy rate was higher than the rate in the first quarter 2022 (5.8 percent) and higher than the rate in the fourth quarter 2022 (5.8 percent).

The homeowner vacancy rate of 0.8 percent was virtually the same as the rate in the first quarter 2022 (0.8 percent) and virtually the same as the rate in the fourth quarter 2022 (0.8 percent).

The homeownership rate of 66.0 percent was not statistically different from the rate in the first quarter 2022 (65.4 percent) and not statistically different from the rate in the fourth quarter 2022 (65.9 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The HVS homeownership rate was unchanged at 66.0% in Q1, from 66.0% in Q4.

The results in Q2 and Q3 2020 were distorted by the pandemic and should be ignored.

The HVS homeowner vacancy was unchanged at 0.8% in Q1 from 0.8% in Q4.

The HVS homeowner vacancy was unchanged at 0.8% in Q1 from 0.8% in Q4. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

ISM® Services Index Increases to 51.9% in April

by Calculated Risk on 5/03/2023 10:05:00 AM

(Posted with permission). The ISM® Services index was at 51.9%, up from 51.2% last month. The employment index decreased to 50.8%, from 51.3%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 51.9% April 2023 Services ISM® Report On Business®

Economic activity in the services sector expanded in April for the fourth consecutive month as the Services PMI® registered 51.9 percent, say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®. The sector has grown in 34 of the last 35 months, with the lone contraction in December.The PMI was slightly above expectations.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In April, the Services PMI® registered 51.9 percent, 0.7 percentage point higher than March’s reading of 51.2 percent. The composite index indicated growth in April for the fourth consecutive month after a reading of 49.2 percent in December, the first contraction since May 2020 (45.4 percent). The Business Activity Index registered 52 percent, a 3.4-percentage point decrease compared to the reading of 55.4 percent in March. The New Orders Index expanded in April for the fourth consecutive month after contracting in December for the first time since May 2020; the figure of 56.1 percent is 3.9 percentage points higher than the March reading of 52.2 percent.

“The Supplier Deliveries registered 48.6 percent, 2.8 percentage points higher than the 45.8 percent recorded in March. Looking back beyond the past few months, this month the index has reflected the fastest supplier delivery performance since December 2015, when it registered 48.5 percent. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.)

“The Prices Index was up 0.1 percentage point in April, to 59.6 percent. The Inventories Index contracted in April after two consecutive months of growth preceded by eight straight months of contraction; the reading of 47.2 percent is down 5.6 percentage points from March’s figure of 52.8 percent. The Inventory Sentiment Index (48.9 percent, down 9 percentage points from March’s reading of 57.9 percent) contracted after four consecutive months of growth preceded by a four-month period of contraction.

“Fourteen industries reported growth in April. The Services PMI®, by being above 50 percent for a fourth month after a single month of contraction and a prior 30-month period of expansion, continues to indicate sustained growth for the sector. The composite index has indicated expansion for all but three of the previous 159 months.”

Nieves continues, “There has been a slight uptick in the rate of growth for the services sector, due mostly to the increase in new orders and ongoing improvements in both capacity and supply logistics. The majority of respondents are mostly positive about business conditions; however, some respondents are wary of potential headwinds associated with inflation and an economic slowdown.”

emphasis added

ADP: Private Employment Increased 296,000 in April

by Calculated Risk on 5/03/2023 08:21:00 AM

Private sector employment increased by 296,000 jobs in April and annual pay was up 6.7 percent year-over-year, according to the April ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”).This was way above the consensus forecast of 135,000. The BLS report will be released Friday, and the consensus is for 178 thousand non-farm payroll jobs added in April.

...

“The slowdown in pay growth gives the clearest signal of what's going on in the labor market right now,” said Nela Richardson, chief economist, ADP. “Employers are hiring aggressively while holding pay gains in check as workers come off the sidelines. Our data also shows fewer people are switching jobs.”

emphasis added

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 5/03/2023 07:00:00 AM

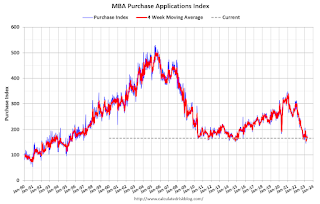

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

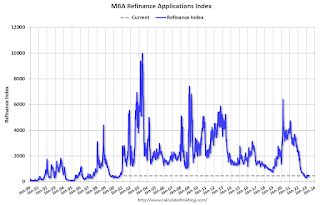

Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 28, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.2 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 0.4 percent compared with the previous week. The Refinance Index increased 1 percent from the previous week and was 51 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 32 percent lower than the same week one year ago.

“Mortgage applications decreased last week, despite rates declining slightly for the first time in three weeks. The 30-year fixed rate decreased five basis points to 6.5 percent, which is still 114 basis points higher than a year ago,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Elevated rates continue to both impact homebuyer affordability and weaken demand for refinancing. Home purchase activity has been very sensitive to rates and local market trends, including the very low supply of existing-home inventory. However, newly constructed homes account for a growing share of inventory, giving more options for prospective buyers.”

Added Kan, “The jumbo-conforming spread continues to narrow, an indication that there is reduced lender appetite for jumbo loans following the recent turmoil in the banking sector and heightened concerns about liquidity. The spread was 13 basis points last week, after being as wide as 64 basis points in November 2022.”

..

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.50 percent from 6.55 percent, with points remaining at 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 32% year-over-year unadjusted.