by Calculated Risk on 5/09/2023 08:55:00 PM

Tuesday, May 09, 2023

Wednesday: CPI

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for April from the BLS. The consensus is for 0.4% increase in CPI (up 5.0% YoY), and a 0.3% increase in core CPI (up 5.5% YoY).

Leading Index for Commercial Real Estate Decreased in April

by Calculated Risk on 5/09/2023 04:17:00 PM

From Dodge Data Analytics: Dodge Momentum Index Declines In April After Pullback In Commercial Planning

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, fell 5.1% in April to 180.9 (2000=100) from the revised March reading of 190.6. In April, the commercial component of the DMI fell 8.0%, and the institutional component improved 0.3%.

“On par with our expectations, the Dodge Momentum Index continued to recede in April, due to declining economic conditions and ongoing banking uncertainty.” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. “Weaker commercial planning is driving the DMI’s decline, as it is more exposed to real-time economic changes than the largely publicly funded institutional segment.”

Commercial planning in April was pushed down by sluggish office, hotel and retail activity. Institutional planning remained flat, as weak education planning offset growth in healthcare and amusement projects. Year over year, the DMI remains 11% higher than in April 2022. The commercial and institutional components were up 7% and 17% respectively.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 180.9 in April, down from 190.6 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a solid pickup in commercial real estate construction in early 2023. but a slowdown towards the end of 2023 or in 2024.

House Price Battle Royale: Low Inventory vs Affordability

by Calculated Risk on 5/09/2023 10:33:00 AM

Today, in the Calculated Risk Real Estate Newsletter: House Price Battle Royale: Low Inventory vs Affordability

Brief excerpt:

I’ve been wrestling with the impact on house prices of the rapid increase in mortgage rates and monthly payments over the last year. My reaction was the current situation was somewhat similar to the 1978 to 1982 period and we would see prices decline in real terms (adjusted for inflation). See from March 2022: Housing: Don't Compare the Current Housing Boom to the Bubble and Bust.There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/.

In that article I wrote on prices:[W]e should expect something similar to the what happened in the late ‘70s - a decline in real house prices seems likely … Currently we just have to watch and wait. However, we can be fairly confident that we won’t see cascading nominal price declines like during the housing bust - since there will be few distressed sales.In the 1980 period, nominal prices only declined slightly on a month-to-month basis a few times according to the Case-Shiller National house price index. However, real prices - adjusted for inflation - declined 10.7% from the peak. The inflation adjusted peak was in October 1979, and real prices didn’t exceed that peak until May 1986 (See from October 2022: House Prices: 7 Years in Purgatory).

Note that if we use the Freddie Mac House Price Index, nominal prices declined 6.9% in the early 1980s, and real prices declined 17.5%!

As I noted in “7 Years in Purgatory”:Earlier this year, I argued the most likely path for house prices was for nominal prices to “stall”, and for real prices (inflation adjusted) to decline over several years. The arguments for a stall included historically low inventory levels, mostly solid lending over the last decade, and that house prices tend to be sticky downwards. … However, we are already seeing nominal house price declines on a national basis.And the historically low level of inventory is a key reason house prices haven’t declined more to date. As of February, the Case-Shiller National Index was off 2.8% in nominal terms (seasonally adjusted), and off 4.6% in real terms.

Here is a look at the house price battle between low inventory and affordability.

Second Home Market: South Lake Tahoe in April

by Calculated Risk on 5/09/2023 08:27:00 AM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through April 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, and only up slightly from the record low set in February 2022.

It is possible the massive snowstorms have limited listings in the Tahoe market this year.

Monday, May 08, 2023

"Mortgage Rates Jump to Highest Levels Since Last Monday"

by Calculated Risk on 5/08/2023 09:00:00 PM

Mortgage rates moved noticeably higher to start the new week--high enough that you'd have to go back to last Monday to see anything higher. That's the bad news.Tuesday:

The good news is that rates are in the midst of their flattest trend in a long time. This is true both in a broad sense going back to Q4 2022 and a more recent/narrow sense going back to mid-March. Since then, the top tier 30yr fixed rate hasn't strayed too far from 6.5% despite spending time on both sides of that level. [30 year fixed 6.65%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for April.

Update: Framing Lumber Prices Down 57% YoY, Below Pre-Pandemic Levels

by Calculated Risk on 5/08/2023 04:00:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through May 8th.

Prices are below the pre-pandemic levels of around $400.

Click on graph for larger image.

Click on graph for larger image.We didn't see a significant runup in prices this Spring due to the housing slowdown.

Fed Survey: Banks reported Tighter Standards, Weaker Demand for All Loan Types

by Calculated Risk on 5/08/2023 02:08:00 PM

From the Federal Reserve: The April 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices

The April 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the first quarter of 2023.

Regarding loans to businesses, survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to large and middle-market firms as well as small firms over the first quarter. Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans other than government-sponsored enterprise (GSE)-eligible and government residential mortgages, which remained basically unchanged. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Standards tightened for all consumer loan categories; demand weakened for auto and other consumer loans, while it remained basically unchanged for credit cards.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate demand is from the Senior Loan Officer Survey Charts.

This shows that demand has declined.

Fannie "Real Estate Owned" inventory essentially unchanged in Q1

by Calculated Risk on 5/08/2023 12:02:00 PM

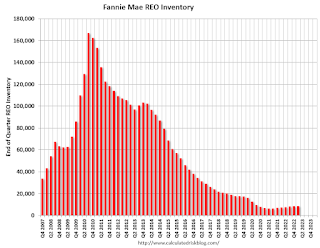

Fannie reported results for Q1 2023. Here is some information on single-family Real Estate Owned (REOs).

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie Real Estate Owned (REO).

This is well below a normal level of REOs for Fannie, and REO levels will increase further in 2023, but there will not be a huge wave of foreclosures.

Lawler: American Homes 4 Rent Net Seller of Single-Family Homes Last Quarter

by Calculated Risk on 5/08/2023 09:46:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: American Homes 4 Rent Net Seller of Single-Family Homes Last Quarter

Brief excerpt:

Housing economist Tom Lawler brings us some interesting data from American Homes 4 Rent. Last week, Lawler discussed Invitation Homes Net Seller of Single-Family Properties for Second Straight Quarter and also provided statistics from eight public builders):There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/.

American Homes 4 Rent Net Seller of Single-Family Homes Last Quarter; Rent Growth Slowed but Remained Elevated

American Homes 4 Rent (AMH), a publicly-traded company in the single-family rental business with over 58,000 SF rental properties, reported that it disposed of 354 more SF properties than it acquired last quarter, and excluding deliveries of build-to-rent homes from its own AMH Development Program its net sales of SF properties totaled 653 properties. Below is a table showing AMH’s acquisitions, dispositions, and total wholly-owned SF properties.

Housing May 8th Weekly Update: Inventory Decreased 0.6% Week-over-week

by Calculated Risk on 5/08/2023 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.