by Calculated Risk on 5/13/2023 08:11:00 AM

Saturday, May 13, 2023

Schedule for Week of May 14, 2023

The key reports this week are April Retail Sales, Housing Starts and Existing Home Sales.

For manufacturing, April Industrial Production, and the May NY and Philly Fed manufacturing surveys will be released.

Fed Chair Powell speaks on Friday.

8:30 AM: The New York Fed Empire State manufacturing survey for May. The consensus is for a reading of -2.0, down from 10.8.

11:00 AM: NY Fed: Q1 Quarterly Report on Household Debt and Credit

8:30 AM ET: Retail sales for April is scheduled to be released. The consensus is for 0.6% increase in retail sales.

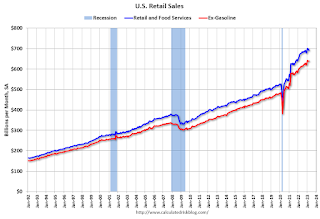

8:30 AM ET: Retail sales for April is scheduled to be released. The consensus is for 0.6% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales were down 0.6% in March (revised).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.

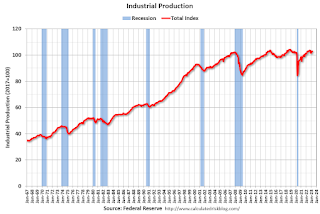

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.This graph shows industrial production since 1967.

The consensus is for a 0.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 79.7%.

10:00 AM: The May NAHB homebuilder survey. The consensus is for a reading of 45 unchanged from 45 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

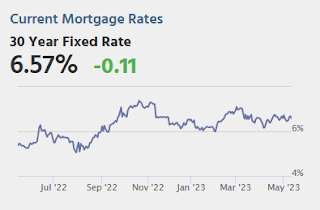

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Housing Starts for April.

8:30 AM ET: Housing Starts for April. This graph shows single and total housing starts since 2000.

The consensus is for 1.396 million SAAR, down from 1.420 million SAAR in March.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 253 thousand initial claims, down from 264 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for May. The consensus is for a reading of -21.1, up from -31.3.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 4.30 million SAAR, down from 4.44 million.

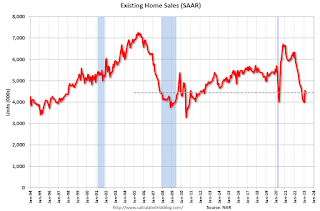

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 4.30 million SAAR, down from 4.44 million.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for April 2023

11:00 AM: Discussion, Conversation with Chair Jerome Powell and Ben Bernanke, former Chair of the Board of Governors of the Federal Reserve System At the Thomas Laubach Research Conference, Washington, D.C.

Friday, May 12, 2023

May 12th COVID Update: New Pandemic Low for Hospitalizations

by Calculated Risk on 5/12/2023 09:04:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | N/A | 77,924 | ≤35,0001 | |

| Hospitalized2 | 8,701 | 9,697 | ≤3,0001 | |

| Deaths per Week2 | 993 | 1,123 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Early Q2 GDP Tracking: Wide Range

by Calculated Risk on 5/12/2023 03:22:00 PM

From BofA:

Overall, incoming data this week pushed down our 1Q US GDP tracking estimate from 1.0% q/q saar to 0.9% q/q saar. [May 12th estimate]And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2023 is 2.7 percent on May 8, unchanged from May 4 after rounding. [May 8th estimate]

Part 2: Current State of the Housing Market; Overview for mid-April

by Calculated Risk on 5/12/2023 09:24:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-April

A brief excerpt:

Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-April I reviewed home inventory and sales, and mortgage delinquencies.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Other measures of house prices indicated year-over-year slowing or further declines in March. The NAR reported median prices were down 0.9% YoY in March. Black Knight reported prices were up 1.0% YoY in March, and Freddie Mac reported house prices were up 1.0% YoY in March. Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. The median price was down YoY in March, and based on the recent trend, the FMHPI will be negative year-over-year in April or May - and Case-Shiller will follow within a few months.

In real terms, the Case-Shiller National index is down 4.6% from the peak, seasonally adjusted. Historically it takes a number of years for real prices to return to the previous peak, see House Prices: 7 Years in Purgatory.

Hotels: Occupancy Rate Up 2.0% Year-over-year

by Calculated Risk on 5/12/2023 08:21:00 AM

U.S. hotel performance showed mixed results from the previous week but grew year over year, according to STR‘s latest data through 6 May.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

30 April through 6 May 2023 (percentage change from comparable week in 2022):

• Occupancy: 65.2% (+2.0%)

• Average daily rate (ADR): US$157.62 (+6.4%)

• Revenue per available room (RevPAR): US$102.74 (+8.4%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Thursday, May 11, 2023

Realtor.com Reports Weekly Active Inventory Up 31% YoY; New Listings Down 16% YoY

by Calculated Risk on 5/11/2023 04:15:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending May 6, 2023

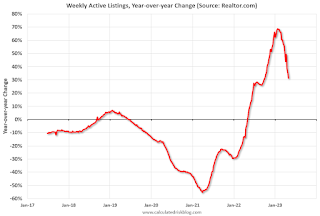

• Active inventory was up at a slower pace, with for-sale homes up just 31% above one year ago. The number of homes for sale continues to grow, but compared to one year ago, the pace is slowing.

...

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 16% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 44 weeks.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up year-over-year - from record lows - however, the YoY increase has slowed sharply recently.

Part 1: Current State of the Housing Market; Overview for mid-April

by Calculated Risk on 5/11/2023 12:35:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-April

A brief excerpt:

Interestingly, new home inventory is essentially at a record percentage of total inventory. This graph uses Not Seasonally Adjusted (NSA) existing home inventory from the National Association of Realtors® (NAR) and new home inventory from the Census Bureau (only completed and under construction inventory).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Note: Mark Fleming, Chief Economist at First American pointed this out in March.

It took a number of years following the housing bust for new home inventory to return to the pre-bubble percent of total inventory. Then, with the pandemic, existing home inventory collapsed and now the percent of new homes is over 25% of total for sale inventory. The lack of existing home inventory, and few distressed sales, has been a positive for homebuilders.

MBA: "Mortgage Delinquency Rate in First-Quarter 2023 Declines to Second-Lowest Level in MBA’s Survey"

by Calculated Risk on 5/11/2023 10:19:00 AM

From the MBA: Mortgage Delinquency Rate in First-Quarter 2023 Declines to Second-Lowest Level in MBA’s Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.56 percent of all loans outstanding at the end of the first quarter of 2023, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was down 40 basis points from the fourth quarter of 2022 and down 55 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the first quarter rose by 2 basis points to 0.16 percent.

“The mortgage delinquency rate fell to its lowest level for any first quarter since MBA’s survey began in 1979 and was the second lowest quarterly rate overall, just 11 basis points above the survey low in the third quarter of 2022,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Mortgage delinquencies and the unemployment rate continue to track each other closely, with the unemployment rate in April falling back to the 54-year low of 3.4 percent set in January.”

Added Walsh, “Consistent with the resilient job market, the performance of existing mortgages is exceeding expectations. Across all states, there was an improvement in the first quarter compared to one year ago. Year-over-year delinquencies for all product types – FHA, VA, and conventional – were also down.”.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q1.

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 15 basis points to 1.77 percent, the 60-day delinquency rate decreased 11 basis points to 0.55 percent, and the 90-day delinquency bucket decreased 14 basis points to 1.24 percent.The sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 0.57 percent, unchanged from the fourth quarter of 2022 and 4 basis points higher than one year ago.

The percent of loans in the foreclosure process increased slightly year-over-year in Q1 with the end of the foreclosure moratoriums but are still historically low.

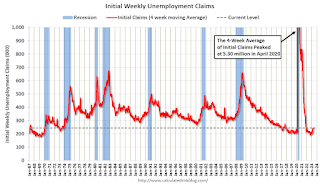

Weekly Initial Unemployment Claims increase to 264,000

by Calculated Risk on 5/11/2023 08:32:00 AM

The DOL reported:

In the week ending May 6, the advance figure for seasonally adjusted initial claims was 264,000, an increase of 22,000 from the previous week's unrevised level of 242,000. This is the highest level for initial claims since October 30, 2021 when it was 264,000. The 4-week moving average was 245,250, an increase of 6,000 from the previous week's unrevised average of 239,250. This is the highest level for this average since November 20, 2021 when it was 249,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 245,250.

The previous week was unrevised.

Weekly claims were above the consensus forecast.

Wednesday, May 10, 2023

Thursday: Unemployment Claims, PPI

by Calculated Risk on 5/10/2023 09:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 242 thousand last week.

• Also at 8:30 AM, The Producer Price Index for April from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.3% increase in core PPI.