by Calculated Risk on 5/19/2023 12:03:00 PM

Friday, May 19, 2023

Similar Number of Housing Units started in Q1 as 'Built-for-Rent' as 'Built-for-Sale'

Today, in the Calculated Risk Real Estate Newsletter: Similar Number of Housing Units started in Q1 as 'Built-for-Rent' as 'Built-for-Sale'

A brief excerpt:

Along with the monthly housing starts report for January last week, the Census Bureau released Housing Units Started by Purpose and Design through Q1 2023.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and multi-family built for sale.Single family starts ‘built for sale (red) were down 33% in Q1 2023 compared to Q1 2022. And owner built starts (orange) were down 22% year-over-year. Multi-family ‘built for sale’ decreased and are still low.

The 'units built for rent' (blue) and were up 8% in Q1 2023 compared to Q1 2022. The number of ‘built-for-rent’ units in Q1 was almost the same number as ‘built-for-sale’. Last quarter, Q4 2022, was the first time since this series started in 1974, that there were more units built-for-rent started than single family units built-for-sale started.

Q2 GDP Tracking: Around 2%

by Calculated Risk on 5/19/2023 08:41:00 AM

From BofA:

Overall, this week’s data pushed up our 1Q US GDP tracking estimate up from 0.9% q/q saar to 1.1% q/q saar and kicked off our 2Q GDP tracking estimate at 1.2% q/q saar [May 19th estimate]From Goldman:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +2.0% (qoq ar) and our past-quarter GDP tracking estimate for Q1 unchanged at +1.4%. Our Q2 domestic final sales growth forecast stands at +1.9%. [May 17th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2023 is 2.9 percent on May 17, up from 2.6 percent on May 16. After this morning's housing starts report from the US Census Bureau, the nowcast of second-quarter real residential investment growth increased from -6.3 percent to 0.6 percent. [May 17th estimate]

Thursday, May 18, 2023

Friday: Discussion, Fed Chair Jerome Powell and Ben Bernanke

by Calculated Risk on 5/18/2023 08:35:00 PM

Friday:

• At 10:00 AM ET, State Employment and Unemployment (Monthly) for April 2023

• At 11:00 AM, Discussion, Conversation with Chair Jerome Powell and Ben Bernanke, former Chair of the Board of Governors of the Federal Reserve System

At the Thomas Laubach Research Conference, Washington, D.C.

Hotels: Occupancy Rate Down 2.0% Year-over-year

by Calculated Risk on 5/18/2023 04:01:00 PM

U.S. weekly hotel performance produced mixed year-over-year comparisons, according to STR‘s latest data through 13 May.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

U.S. weekly hotel performance produced mixed year-over-year comparisons, according to STR‘s latest data through 13 May.

• Occupancy: 65.1% (-2.0%)

• Average daily rate (ADR): US$154.90 (+3.4%)

• Revenue per available room (RevPAR): US$100.81 (+1.3%)

Worsened comparisons than the week prior were expected and normal given seasonal slowing and the negative side of the Mother’s Day calendar shift.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

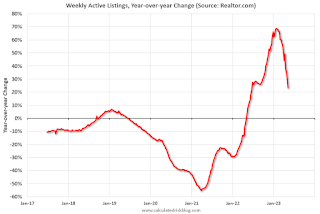

Realtor.com Reports Weekly Active Inventory Up 23% YoY; New Listings Down 25% YoY

by Calculated Risk on 5/18/2023 02:09:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending May 13, 2023

• Active inventory was up at a slower pace, with for-sale homes up just 23% above one year ago. The number of homes for sale continues to grow, but at a slower pace compared to one year ago.

...

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 25% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 45 weeks.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up year-over-year - from record lows - however, the YoY increase has slowed sharply recently.

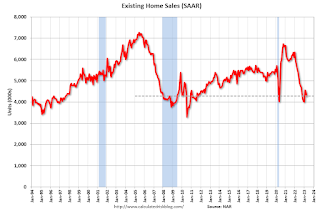

NAR: Existing-Home Sales Decreased to 4.28 million SAAR in April; Median Prices Declined 1.7% YoY

by Calculated Risk on 5/18/2023 10:47:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.28 million SAAR in April; Median Prices Declined 1.7% YoY

Excerpt:

The second graph shows existing home sales by month for 2022 and 2023.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!

Sales declined 23.2% year-over-year compared to April 2022. This was the twentieth consecutive month with sales down year-over-year.

NAR: Existing-Home Sales Decreased to 4.28 million SAAR in April

by Calculated Risk on 5/18/2023 10:13:00 AM

From the NAR: Existing-Home Sales Faded 3.4% in April

Existing-home sales decreased in April, according to the National Association of REALTORS®. All four major U.S. regions registered month-over-month and year-over-year sales declines.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – slid 3.4% from March to a seasonally adjusted annual rate of 4.28 million in April. Year-over-year, sales slumped 23.2% (down from 5.57 million in April 2022).

...

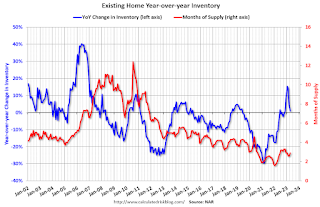

Total housing inventory registered at the end of April was 1.04 million units, up 7.2% from March and 1.0% from one year ago (1.03 million). Unsold inventory sits at a 2.9-month supply at the current sales pace, up from 2.6 months in March and 2.2 months in April 2022.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in April (4.28 million SAAR) were down 3.4% from the previous month and were 23.2% below the April 2022 sales rate.

According to the NAR, inventory increased to 1.04 million in April from 0.97 million in March.

According to the NAR, inventory increased to 1.04 million in April from 0.97 million in March.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 1.0% year-over-year (blue) in April compared to April 2022.

Inventory was up 1.0% year-over-year (blue) in April compared to April 2022. Months of supply (red) increased to 2.9 months in April from 2.6 months in March.

This was slightly below the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims decrease to 242,000

by Calculated Risk on 5/18/2023 08:33:00 AM

The DOL reported:

In the week ending May 13, the advance figure for seasonally adjusted initial claims was 242,000, a decrease of 22,000 from the previous week's unrevised level of 264,000. The 4-week moving average was 244,250, a decrease of 1,000 from the previous week's unrevised average of 245,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 244,250.

The previous week was unrevised.

Weekly claims were below the consensus forecast.

Wednesday, May 17, 2023

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 5/17/2023 08:52:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 253 thousand initial claims, down from 264 thousand last week.

• Aslo at 8:30 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of -21.1, up from -31.3.

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 4.30 million SAAR, down from 4.44 million.

4th Look at Local Housing Markets in April

by Calculated Risk on 5/17/2023 06:01:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in April

A brief excerpt:

Yesterday, housing economist Tom Lawler noted:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.33 million in April, down 2.5% from March’s preliminary pace and down 22.3% from last April’s seasonally adjusted pace.The National Association of Realtors (NAR) is scheduled to release April existing home sales on Thursday, May 18, 2023, at 10:00 AM ET. The consensus is for 4.30 million SAAR.

...

In April, sales in these markets were down 24.7%. In March, these same markets were down 19.4% YoY Not Seasonally Adjusted (NSA).

This is a larger YoY decline NSA in April than in March for these markets, however there was one less selling day in April this year. This data suggests the April existing home sales report will show another significant YoY decline, and the 20th consecutive month with a YoY decline in sales.

Several more local markets to come next week!