by Calculated Risk on 5/20/2023 02:11:00 PM

Saturday, May 20, 2023

Real Estate Newsletter Articles this Week: "Near Record Multi-Family Under Construction"

At the Calculated Risk Real Estate Newsletter this week:

• April Housing Starts: Near Record Multi-Family Under Construction

• NAR: Existing-Home Sales Decreased to 4.28 million SAAR in April; Median Prices Declined 1.7% YoY

• Similar Number of Housing Units started in Q1 as 'Built-for-Rent' as 'Built-for-Sale'

• 4th Look at Local Markets in April

• Lawler: Early Read on Existing Home Sales in April

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of May 21, 2023

by Calculated Risk on 5/20/2023 08:11:00 AM

The key reports this week are the second estimate of Q1 GDP, April New Home Sales, and Personal Income and Outlays for April.

For manufacturing, the May Richmond and Kansas City Fed manufacturing surveys will be released.

No major economic releases scheduled.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 660 thousand SAAR, down from 683 thousand SAAR in March.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

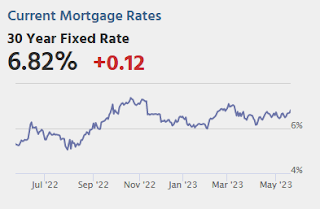

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Minutes Meeting of May 2-3, 2023

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 242 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2023 (Second estimate). The consensus is that real GDP increased 1.1% annualized in Q1, unchanged from the advance estimate of 1.1%.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.5% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for May.

8:30 AM ET: Personal Income and Outlays, April 2023. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 4.3% YoY, and core PCE prices up 4.6% YoY.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 1.1% decrease in durable goods orders.

10:00 AM: University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 57.7.

Friday, May 19, 2023

May 19th COVID Update: New Pandemic Lows for Deaths and Hospitalizations

by Calculated Risk on 5/19/2023 09:01:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 8,159 | 8,859 | ≤3,0001 | |

| Deaths per Week2 | 865 | 1,079 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

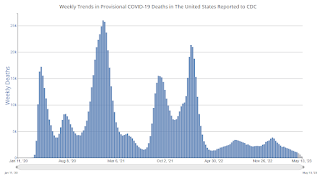

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

LA Port Inbound Traffic Down Sharply YoY in April

by Calculated Risk on 5/19/2023 03:03:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

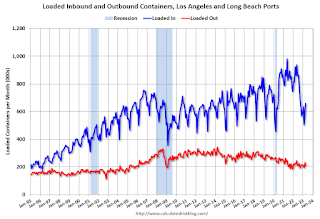

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

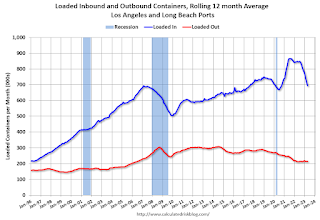

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 2.4% in April compared to the rolling 12 months ending in March. Outbound traffic decreased 0.4% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.Similar Number of Housing Units started in Q1 as 'Built-for-Rent' as 'Built-for-Sale'

by Calculated Risk on 5/19/2023 12:03:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Similar Number of Housing Units started in Q1 as 'Built-for-Rent' as 'Built-for-Sale'

A brief excerpt:

Along with the monthly housing starts report for January last week, the Census Bureau released Housing Units Started by Purpose and Design through Q1 2023.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and multi-family built for sale.Single family starts ‘built for sale (red) were down 33% in Q1 2023 compared to Q1 2022. And owner built starts (orange) were down 22% year-over-year. Multi-family ‘built for sale’ decreased and are still low.

The 'units built for rent' (blue) and were up 8% in Q1 2023 compared to Q1 2022. The number of ‘built-for-rent’ units in Q1 was almost the same number as ‘built-for-sale’. Last quarter, Q4 2022, was the first time since this series started in 1974, that there were more units built-for-rent started than single family units built-for-sale started.

Q2 GDP Tracking: Around 2%

by Calculated Risk on 5/19/2023 08:41:00 AM

From BofA:

Overall, this week’s data pushed up our 1Q US GDP tracking estimate up from 0.9% q/q saar to 1.1% q/q saar and kicked off our 2Q GDP tracking estimate at 1.2% q/q saar [May 19th estimate]From Goldman:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +2.0% (qoq ar) and our past-quarter GDP tracking estimate for Q1 unchanged at +1.4%. Our Q2 domestic final sales growth forecast stands at +1.9%. [May 17th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2023 is 2.9 percent on May 17, up from 2.6 percent on May 16. After this morning's housing starts report from the US Census Bureau, the nowcast of second-quarter real residential investment growth increased from -6.3 percent to 0.6 percent. [May 17th estimate]

Thursday, May 18, 2023

Friday: Discussion, Fed Chair Jerome Powell and Ben Bernanke

by Calculated Risk on 5/18/2023 08:35:00 PM

Friday:

• At 10:00 AM ET, State Employment and Unemployment (Monthly) for April 2023

• At 11:00 AM, Discussion, Conversation with Chair Jerome Powell and Ben Bernanke, former Chair of the Board of Governors of the Federal Reserve System

At the Thomas Laubach Research Conference, Washington, D.C.

Hotels: Occupancy Rate Down 2.0% Year-over-year

by Calculated Risk on 5/18/2023 04:01:00 PM

U.S. weekly hotel performance produced mixed year-over-year comparisons, according to STR‘s latest data through 13 May.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

U.S. weekly hotel performance produced mixed year-over-year comparisons, according to STR‘s latest data through 13 May.

• Occupancy: 65.1% (-2.0%)

• Average daily rate (ADR): US$154.90 (+3.4%)

• Revenue per available room (RevPAR): US$100.81 (+1.3%)

Worsened comparisons than the week prior were expected and normal given seasonal slowing and the negative side of the Mother’s Day calendar shift.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Realtor.com Reports Weekly Active Inventory Up 23% YoY; New Listings Down 25% YoY

by Calculated Risk on 5/18/2023 02:09:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending May 13, 2023

• Active inventory was up at a slower pace, with for-sale homes up just 23% above one year ago. The number of homes for sale continues to grow, but at a slower pace compared to one year ago.

...

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 25% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 45 weeks.

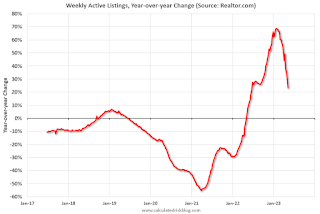

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up year-over-year - from record lows - however, the YoY increase has slowed sharply recently.

NAR: Existing-Home Sales Decreased to 4.28 million SAAR in April; Median Prices Declined 1.7% YoY

by Calculated Risk on 5/18/2023 10:47:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.28 million SAAR in April; Median Prices Declined 1.7% YoY

Excerpt:

The second graph shows existing home sales by month for 2022 and 2023.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!

Sales declined 23.2% year-over-year compared to April 2022. This was the twentieth consecutive month with sales down year-over-year.