by Calculated Risk on 5/25/2023 10:51:00 AM

Thursday, May 25, 2023

Total Housing Completions will Likely Decrease Slightly in 2023; The Mix will Change

Today, in the Calculated Risk Real Estate Newsletter: Total Housing Completions will Likely Decrease Slightly in 2023; The Mix will Change

Brief excerpt:

Although housing starts have slowed, completions will likely only decrease slightly in 2023.You can subscribe at https://calculatedrisk.substack.com/.

This graph shows total housing completions and placements since 1968 with an estimate for 2023. Note that the net additional to the housing stock is less because of demolitions and destruction of older housing units.

My current estimate is total completions (single-family, multi-family, manufactured homes) will decrease in 2023 to around 1.45 million, down from 1.505 million in 2022. However, the mix will change significantly from 2022 with fewer single family completions, and more multi-family completions.

NAR: Pending Home Sales Unchanged in April; Down 20.3% Year-over-year

by Calculated Risk on 5/25/2023 10:03:00 AM

From the NAR: Pending Home Sales Recorded No Change in April

Pending home sales recorded no change in April, according to the National Association of REALTORS®. Three U.S. regions posted monthly gains, while the Northeast decreased. All four regions saw year-over-year declines in transactions.This is way below expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – remained at 78.9 in April, posting no change from the previous month. Year over year, pending transactions dropped by 20.3%. An index of 100 is equal to the level of contract activity in 2001.

"Not all buying interests are being completed due to limited inventory," said NAR Chief Economist Lawrence Yun. "Affordability challenges certainly remain and continue to hold back contract signings, but a sizeable increase in housing inventory will be critical to get more Americans moving."

...

The Northeast PHSI dropped 11.3% from last month to 59.1, a decrease of 21.8% from April 2022. The Midwest index improved 3.6% to 78.4 in April, down 21.4% from one year ago.

The South PHSI increased 0.1% to 99.6 in April, sinking 16.7% from the prior year. The West index augmented 4.7% in April to 62.2, sliding 26.0% from April 2022.

emphasis added

Q1 GDP Growth Revised up to 1.3% Annual Rate

by Calculated Risk on 5/25/2023 08:40:00 AM

From the BEA: Gross Domestic Product (Second Estimate), Corporate Profits (Preliminary Estimate), First Quarter 2023

Real gross domestic product (GDP) increased at an annual rate of 1.3 percent in the first quarter of 2023, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.6 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 3.7% to 3.8%. Residential investment was revised down from -4.2% to -5.4%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 1.1 percent (refer to "Updates to GDP"). The updated estimates primarily reflected an upward revision to private inventory investment.

The increase in real GDP reflected increases in consumer spending, exports, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by decreases in private inventory investment and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

emphasis added

Weekly Initial Unemployment Claims at 229,000

by Calculated Risk on 5/25/2023 08:35:00 AM

The DOL reported:

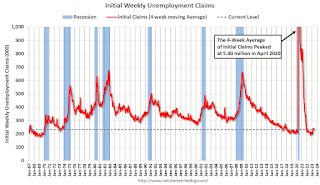

In the week ending May 20, the advance figure for seasonally adjusted initial claims was 229,000, an increase of 4,000 from the previous week's revised level. The previous week's level was revised down by 17,000 from 242,000 to 225,000. The 4-week moving average was 231,750, unchanged from the previous week's revised average. The previous week's average was revised down by 12,500 from 244,250 to 231,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged at 231,750.

The previous week was revised down.

Weekly claims were below the consensus forecast.

Wednesday, May 24, 2023

Thursday: 2nd Estimate Q1 GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 5/24/2023 09:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 242 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 1st quarter 2023 (Second estimate). The consensus is that real GDP increased 1.1% annualized in Q1, unchanged from the advance estimate of 1.1%.

• Also at 8:30 AM, Chicago Fed National Activity Index for April. This is a composite index of other data.

• At 10:00 AM, Pending Home Sales Index for April. The consensus is for a 0.5% increase in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.

Black Knight: "Mortgage Delinquencies Rise on Calendar Effect" in April

by Calculated Risk on 5/24/2023 04:05:00 PM

From Black Knight: Black Knight’s First Look: Early-Stage Mortgage Delinquencies Rise on Calendar Effect; Prepayments Slow as Spring Homebuying Season Falters on High Rates, Low Inventory

• The national delinquency rate spiked 13% higher in April from March’s record low, with the month ending on a Sunday impacting the processing of payments made on the last calendar day of the monthAccording to Black Knight's First Look report, the percent of loans delinquent increased 13% in April compared to March and increased 2% year-over-year.

• Early-stage delinquencies (borrowers 30 days late) bore the brunt of the rise, increasing by 200K (+25%) which matches the impact of previous similar calendar-related events

• Serious delinquencies (90+ days past due) continued to improve nationally, with the number of such loans shrinking in 45 states (90%) plus the District of Columbia in April

• Foreclosure starts fell 23% to 25K for the month – the lowest since September 2022 –and 45% below April 2019’s pre-pandemic level

• Foreclosure actions were started on 4.9% of serious delinquencies in April, down slightly from March and still more than four percentage points below the monthly average prior to the pandemic

• Active foreclosure inventory declined by 6K in the month, and is down 60K or 21% from March 2020

• March saw 6,400 foreclosure sales (completions) nationally, down 14% from the month prior

• Prepayment activity (SMM) fell to 0.44% – giving back some of the previous month’s gain and suggesting the spring homebuying season is faltering on high rates and low inventory – remaining 59% off last April’s levels

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.31% in April, up from 2.92% the previous month.

The percent of loans in the foreclosure process decrease in April to 0.44%, from 0.46% the previous month.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Apr 2023 | Mar 2023 | |||

| Delinquent | 3.31% | 2.92% | ||

| In Foreclosure | 0.44% | 0.46% | ||

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,746,000 | 1,539,000 | ||

| Number of properties in foreclosure pre-sale inventory: | 234,000 | 240,000 | ||

| Total Properties | 1,980,000 | 1,779,000 | ||

FOMC Minutes: Staff Predicts Recession Starting in Q4; Future Monetary Policy "less certain"

by Calculated Risk on 5/24/2023 02:13:00 PM

From the Fed: Minutes of the Federal Open Market Committee, May 2-3, 2023. Excerpt:

The economic forecast prepared by the staff for the May FOMC meeting continued to assume that the effects of the expected further tightening in bank credit conditions, amid already tight financial conditions, would lead to a mild recession starting later this year, followed by a moderately paced recovery. Real GDP was projected to decelerate over the next two quarters before declining modestly in both the fourth quarter of this year and the first quarter of next year. Real GDP growth over 2024 and 2025 was projected to be below the staff's estimate of potential output growth. The unemployment rate was forecast to increase this year, to peak next year, and then to start declining gradually in 2025.

...

In discussing the policy outlook, participants generally agreed that in light of the lagged effects of cumulative tightening in monetary policy and the potential effects on the economy of a further tightening in credit conditions, the extent to which additional increases in the target range may be appropriate after this meeting had become less certain. Participants agreed that it would be important to closely monitor incoming information and assess the implications for monetary policy. In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, various participants noted specific factors that should bear on future decisions on policy actions. One such factor was the degree and timing with which cumulative policy tightening restrained economic activity and reduced inflation, with some participants commenting that they saw evidence that the past years' tightening was beginning to have its intended effect. Another factor was the degree to which tighter credit conditions for households and businesses resulting from events in the banking sector would weigh on activity and reduce inflation, which participants agreed was very uncertain. Additional factors included the progress toward returning inflation to the Committee's longer-run goal of 2 percent, and the pace at which labor market conditions softened and economic growth slowed.

emphasis added

AIA: Architecture Billings Decreased in April

by Calculated Risk on 5/24/2023 12:38:00 PM

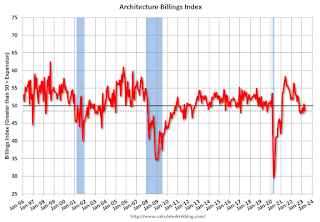

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: AIA/Deltek Architecture Billings Index Reflects Continued Weakness in Business Conditions in April

Architecture firms reported a modest decrease in April billings. However, there was a slight increase in inquiries into future project activity according to a report released today from The American Institute of Architects (AIA).

The billings score for March decreased from 50.4 in March to 48.5 in April (any score below 50 indicates a decrease in firm billings). However, firms reported that inquiries into new projects accelerated slightly to 53.9, while most firms continued to report a decline in the value of new design contracts, with a score of 49.8.

“The ongoing weakness in design activity at architecture firms reflects clients’ concerns regarding the economic outlook,” said AIA Chief Economist Kermit Baker Hon. AIA, Ph.D. “High construction costs, extended project schedules, elevated interest rates, and growing difficulty in obtaining financing are all weighing on the construction market.”

...

• Regional averages: Midwest (51.2); West (49.3); South (48.7); Northeast (47.2)

• Sector index breakdown: mixed practice (firms that do not have at least half of their billings in any one other category) (52.1); commercial/industrial (51.8); institutional (50.6); multi-family residential (41.5)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 48.5 in April, down from 50.4 in March. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has declined in 6 of the last 7 months. This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment later in 2023 and into 2024.

Two Key Housing Themes: Low Inventory and Few Distressed Sales

by Calculated Risk on 5/24/2023 09:43:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Two Key Housing Themes: Low Inventory and Few Distressed Sales

Brief excerpt:

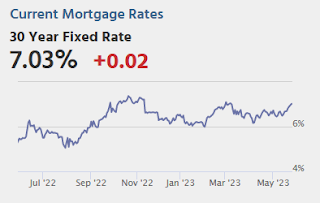

Every housing cycle is different. One of the key themes in this cycle is that existing home inventory is historically extremely low as many homeowners are “locked in” to their current home with low mortgage rates.You can subscribe at https://calculatedrisk.substack.com/.

Another key theme is that there will be few distressed sales as most homeowners have substantial equity.

Here is some data on outstanding mortgage rates and current loan-to-values.

Here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q4 2022.

This shows the recent surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. The percent of outstanding loans under 4% peaked in Q1 2022 at 65.4%, and the percent under 5% peaked at 85.8%. These low existing mortgage rates makes it difficult for homeowners to sell their homes and buy a new home since their monthly payments would increase sharply. This is a key reason existing home inventory levels are very low.

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 5/24/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 19, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 4.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 5 percent compared with the previous week. The Refinance Index decreased 5 percent from the previous week and was 44 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 30 percent lower than the same week one year ago.

“Mortgage applications declined almost five percent last week as borrowers remained sensitive to higher rates. The 30-year fixed rate increased to 6.69 percent, the highest level since March,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. Since rates have been so volatile and for-sale inventory still scarce, we have yet to see sustained growth in purchase applications. Refinance activity remains limited, with the refinance index falling to its lowest level in two months and more than 40 percent below last year’s pace.”

Added Kan, “Investors remained attuned to the uncertainty around the U.S. debt ceiling and communication from several Federal Reserve officials last week, which sent Treasury yields higher, along with mortgage rates. Economic data released over the past week have also pointed to a still-resilient economy. The housing market received positive data on new residential construction – which is seen as a key solution to the lack of housing inventory.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.69 percent from 6.57 percent, with points increasing to 0.66 from 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 30% year-over-year unadjusted.