by Calculated Risk on 5/27/2023 02:11:00 PM

Saturday, May 27, 2023

Real Estate Newsletter Articles this Week: "Multi-Family Delinquencies Increased"

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales at 683,000 Annual Rate in April

• Two Key Housing Themes: Low Inventory and Few Distressed Sales

• Total Housing Completions will Likely Decrease Slightly in 2023; The Mix will Change

• Fannie and Freddie Serious Delinquencies in April: Single Family Declined, Multi-Family Increased

• Final Look at Local Housing Markets in April

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of May 28, 2023

by Calculated Risk on 5/27/2023 08:11:00 AM

The key report scheduled for this week is the May employment report.

Other key reports include the March Case-Shiller house prices, May ISM Manufacturing and May Vehicle Sales.

All US markets will be closed in observance of Memorial Day.

9:00 AM: S&P/Case-Shiller House Price Index for March.

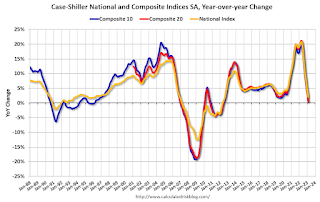

9:00 AM: S&P/Case-Shiller House Price Index for March.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for March 2022. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Dallas Fed Survey of Manufacturing Activity for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:45 AM: Chicago Purchasing Managers Index for May.

10:00 AM ET: Job Openings and Labor Turnover Survey for April from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in March to 9.6 million from 10.0 million in February. The number of job openings (black) were down 20% year-over-year.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 160,000 payroll jobs added in May, down from 296,000 in April.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 234 thousand initial claims, up from 229 thousand last week.

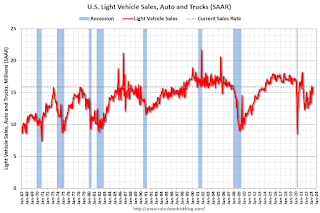

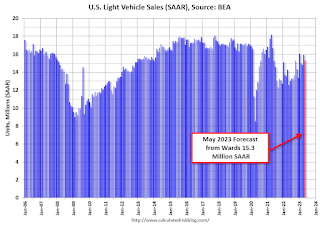

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 14.5 million SAAR in May, up from 14.3 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 14.5 million SAAR in May, up from 14.3 million in April (Seasonally Adjusted Annual Rate).10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 47.0, down from 47.1 in April.

10:00 AM: Construction Spending for April. The consensus is for a 0.2% increase in construction spending.

8:30 AM: Employment Report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to increase to 3.5%.

8:30 AM: Employment Report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to increase to 3.5%.There were 253,000 jobs added in April, and the unemployment rate was at 3.4%.

This graph shows the jobs added per month since January 2021.

Friday, May 26, 2023

May 26th COVID Update: New Pandemic Lows for Deaths and Hospitalizations

by Calculated Risk on 5/26/2023 09:01:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

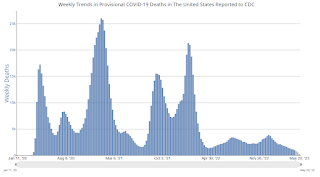

| Hospitalized2 | 7,465 | 8,249 | ≤3,0001 | |

| Deaths per Week2 | 778 | 949 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Fannie and Freddie Serious Delinquencies in April: Single Family Declined, Multi-Family Increased

by Calculated Risk on 5/26/2023 01:08:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie Serious Delinquencies in April: Single Family Declined, Multi-Family Increased

Brief excerpt:

Single-family serious delinquencies continued to decline in April, however, multi-family serious delinquencies are now increasing.You can subscribe at https://calculatedrisk.substack.com/.

...

Freddie Mac reports that multi-family delinquencies increased to 0.19% in April, up from 0.08% in April 2022..

This graph shows the Freddie multi-family serious delinquency rate since 2012. Rates were still high in 2012 following the housing bust and financial crisis.

The multi-family rate increased following the pandemic and has increased recently as rent growth has slowed, vacancy rates have increased, and interest rates have increased sharply. This will be something to watch as rents soften.

Q2 GDP Tracking: Around 1% to 2%

by Calculated Risk on 5/26/2023 11:58:00 AM

From BofA:

Overall, today's higher than expected personal income and outlays and durable goods print along with the wider than expected advance goods trade deficit decreased our 2Q US GDP tracking from 1.1% q/q saar to 0.9% q/q saar. [May 26th estimate]From Goldman:

emphasis added

Personal income increased as expected and personal spending increased by more than expected in April. ... Both headline and core durable goods orders increased against consensus expectations for declines. The goods trade deficit widened significantly more than expected in April, driven by a large decline in exports and a more modest rise in imports. We boosted our Q2 GDP tracking estimate by one tenth to +2.1% (qoq ar). [May 26th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2023 is 1.9 percent on May 26, down from 2.9 percent on May 17. After recent releases from the US Census Bureau, the US Bureau of Economic Analysis, and the National Association of Realtors, decreases in the nowcasts of second-quarter real net exports and second-quarter real gross private domestic investment growth were partially offset by increases in the nowcasts of second-quarter real personal consumption expenditures growth and second-quarter real government spending growth. [May 26th estimate]

PCE Measure of Shelter Still Accelerating YoY

by Calculated Risk on 5/26/2023 08:58:00 AM

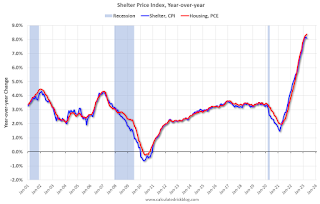

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through April 2023.

Since asking rents are soft and Year-over-year Rent Growth Continues to Decelerate this means both CPI and PCE measures are currently overstating actual inflation.

Personal Income increased 0.4% in April; Spending increased 0.8%

by Calculated Risk on 5/26/2023 08:40:00 AM

The BEA released the Personal Income and Outlays report for April:

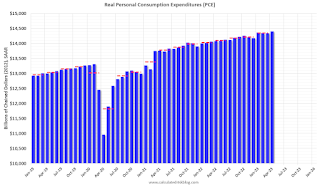

Personal income increased $80.1 billion (0.4 percent at a monthly rate) in April, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $79.4 billion (0.4 percent) and personal consumption expenditures (PCE) increased $151.7 billion (0.8 percent).The April PCE price index increased 4.4 percent year-over-year (YoY), up from 4.2 percent YoY in March, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index increased 0.4 percent. Excluding food and energy, the PCE price index increased 0.4 percent. Real DPI increased less than 0.1 percent in April and Real PCE increased 0.5 percent; goods increased 0.8 percent and services increased 0.3 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through April 2023 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was at expectations, and PCE was above expectations.

Thursday, May 25, 2023

Friday: Personal Income and Outlays, Durable Goods

by Calculated Risk on 5/25/2023 08:39:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, April 2023. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 4.3% YoY, and core PCE prices up 4.6% YoY.

• Also at 8:30 AM, Durable Goods Orders for April from the Census Bureau. The consensus is for a 1.1% decrease in durable goods orders.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 57.7.

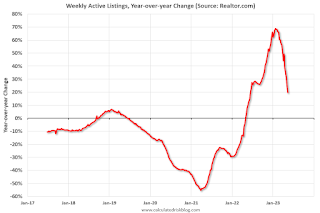

Realtor.com Reports Weekly Active Inventory Up 20% YoY; New Listings Down 26% YoY

by Calculated Risk on 5/25/2023 04:05:00 PM

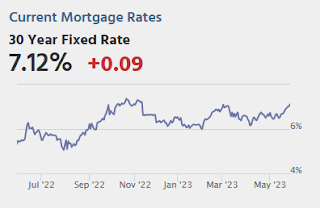

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending May 20, 2023

• Active inventory growth slowed again, with for-sale homes up just 20% above one year ago. The number of homes for sale was higher than this time last year, but not by as much as we’ve seen in recent weeks. As we have discussed, further slowing is likely ahead. One key way that this has played out is by pushing some home shoppers to consider buying a newly built home.

...

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 26% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 46 weeks. This week tied last week’s drop. With roughly two thirds of existing homeowners holding onto a mortgage more than 2 percentage points below current mortgage rates, it’s easy to see why new listings lag behind.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up year-over-year - from record lows - however, the YoY increase has slowed sharply recently.

May Vehicle Sales Forecast: 15.3 million SAAR, Up Sharply YoY

by Calculated Risk on 5/25/2023 02:02:00 PM

From WardsAuto: May U.S. Light-Vehicle Sales Set for Biggest Volume Gain in 2023 (pay content). Brief excerpt:

Rising inventory, combined with pent-up demand, is keeping growth going mostly by holding the long list of economic- and price-related headwinds at bay, but there is potential for demand to sharply drop at the end of the month – and in June - if an agreement on the U.S. debt ceiling remains elusive and further spooks consumers.Note: When writing "biggest volume gain", Wards is referring to the year-over-year gain since sales were especially weak in May 2022.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for May (Red).

The Wards forecast of 15.3 million SAAR, would be down 3.9% from last month, and up 21.6% from a year ago.