by Calculated Risk on 6/02/2023 11:01:00 AM

Friday, June 02, 2023

Vehicles Sales at 15.05 million SAAR in May; Up 19.6% YoY

The BEA estimates sales of 15.05 million SAAR in May 2023 (Seasonally Adjusted Annual Rate), down 6.5% from the April sales rate, and up 19.6% from May 2022.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and BEA's estimate for May (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Sales in May were above the consensus forecast and sales in April were revised up.

Comments on May Employment Report

by Calculated Risk on 6/02/2023 09:15:00 AM

The headline jobs number in the May employment report was above expectations, and employment for the previous two months was revised up by 93,000, combined. The participation rate was unchanged, the employment population ratio declined slightly, and the unemployment rate increased to 3.7%.

In May, the year-over-year employment change was 4.06 million jobs.

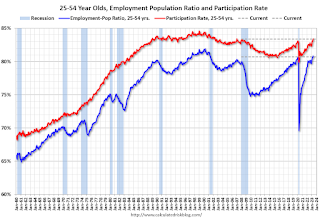

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate was increased in May to 83.4% from 83.3% in April, and the 25 to 54 employment population ratio decreased to 80.7% from 80.8% the previous month.

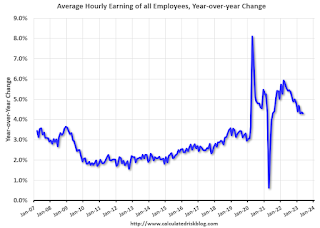

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in May.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 3.7 million, changed little in May. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in April to 3.739 million from 3.903 million in April. This is below pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 6.7% from 6.6% in the previous month. This is down from the record high in April 22.9% and up slightly from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is below the level in February 2020 (pre-pandemic).

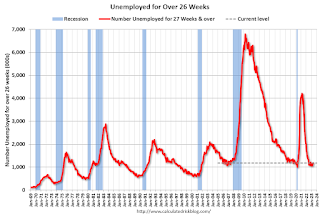

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.188 million workers who have been unemployed for more than 26 weeks and still want a job, up from 1.156 million the previous month.

This is at pre-pandemic levels.

Summary:

The headline monthly jobs number was well above expectations, and employment for the previous two months was revised up by 93,000, combined.

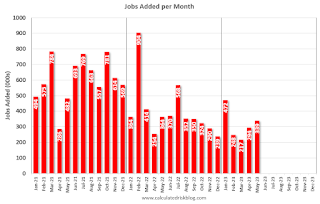

May Employment Report: 339 thousand Jobs, 3.7% Unemployment Rate

by Calculated Risk on 6/02/2023 08:41:00 AM

From the BLS:

Total nonfarm payroll employment increased by 339,000 in May, and the unemployment rate rose by 0.3 percentage point to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in professional and business services, government, health care, construction, transportation and warehousing, and social assistance.

...

The change in total nonfarm payroll employment for March was revised up by 52,000, from +165,000 to +217,000, and the change for April was revised up by 41,000, from +253,000 to +294,000. With these revisions, employment in March and April combined is 93,000 higher than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the jobs added per month since January 2021.

Payrolls for March and April were revised up 93 thousand, combined.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In May, the year-over-year change was 4.06 million jobs. Employment was up significantly year-over-year.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 62.6% in May, from 62.6% in April. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was unchanged at 62.6% in May, from 62.6% in April. This is the percentage of the working age population in the labor force. The Employment-Population ratio declined to 60.3% from 60.4% (blue line).I'll have more later ...

Thursday, June 01, 2023

Friday: Employment Report

by Calculated Risk on 6/01/2023 09:01:00 PM

Friday:

• At 8:30 AM ET, Employment Report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to increase to 3.5%.

U.S. Births decreased Slightly in 2022

by Calculated Risk on 6/01/2023 03:00:00 PM

From the National Center for Health Statistics: Births: Provisional Data for 2022. The NCHS reports:

The provisional number of births for the United States in 2022 was 3,661,220, a nonsignificant decline from 2021. The general fertility rate was 56.1 births per 1,000 women aged 15–44, down less than 1% from 2021. The total fertility rate was 1,665.0 births per 1,000 women in 2022, essentially unchanged from 2021. Birth rates declined for women in age groups 15–24 and 30–34, rose for women in age groups 25–29 and 35–49, and were unchanged for females aged 10–14 years in 2022. The birth rate for teenagers aged 15–19 declined by 3% in 2022 to 13.5 births per 1,000 females; rates declined for both younger (aged 15–17) and older (aged 18–19) teenagers.Here is a long-term graph of annual U.S. births through 2022.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Births had declined for six consecutive years, before increasing in 2021. The decline in 2022 was not significant.

Note the amazing decline in teenage births.

There is much more in the report.

May Employment Preview

by Calculated Risk on 6/01/2023 02:34:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to increase to 3.5%.

From BofA economists:

"For the May employment report, we forecast a 200k increase in nonfarm payrolls (NFP), which would be a downshift from the addition of 253k jobs in April. Still it would leave payroll growth well above levels needed to offset the pace of natural growth in the labor force, thereby putting downward pressure on the unemployment rate in an already tight labor market ... we expect the unemployment rate to remain at 3.4%"From Goldman Sachs following the strong ADP report:

According to the ADP report, private sector employment rose by 278k in May, 108k above consensus expectations and one of the stronger Big Data employment indicators in May. We left our nonfarm payroll forecast unchanged at +175k ahead of tomorrow’s release."• ADP Report: The ADP employment report showed 278,000 private sector jobs were added in May. This suggests job gains well above consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in May to 51.4%, up from 50.2% last month. This would suggest about 10,000 jobs lost in manufacturing. The ADP report indicated 48,000 manufacturing jobs lost in May.

The ISM® services employment index for May has not been released yet.

• Unemployment Claims: The weekly claims report showed a decline in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 246,000 in April to 225,000 in May. This suggests fewer layoffs in May than in April.

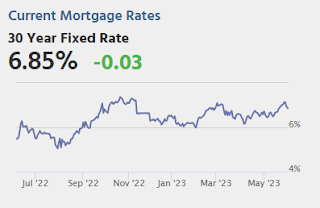

Construction Spending Increased 1.2% in April

by Calculated Risk on 6/01/2023 10:16:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during April 2023 was estimated at a seasonally adjusted annual rate of $1,908.4 billion, 1.2 percent above the revised March estimate of $1,885.0 billion. The April figure is 7.2 percent above the April 2022 estimate of $1,780.9 billion.Both private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,500.7 billion, 1.3 percent above the revised March estimate of $1,481.6 billion. ...

In April, the estimated seasonally adjusted annual rate of public construction spending was $407.7 billion, 1.1 percent above the revised March estimate of $403.4 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 10.5% below the recent peak.

Non-residential (blue) spending is at a new peak.

Public construction spending is at a new peak.

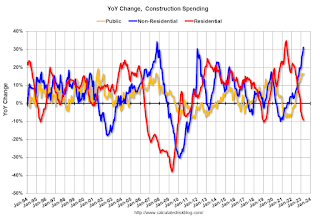

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 9.2%. Non-residential spending is up 31.1% year-over-year. Public spending is up 16.5% year-over-year.

ISM® Manufacturing index Decreased to 46.9% in May

by Calculated Risk on 6/01/2023 10:03:00 AM

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 46.9% in May, down from 47.1% in April. The employment index was at 51.4%, up from 50.2% last month, and the new orders index was at 42.6%, down from 45.7%.

From ISM: Manufacturing PMI® at 47.1%

May 2023 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in May for the seventh consecutive month following a 28-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in May. This was slightly above the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The May Manufacturing PMI® registered 46.9 percent, 0.2 percentage point lower than the 47.1 percent recorded in April. Regarding the overall economy, this figure indicates a sixth month of contraction after a 30-month period of expansion. The New Orders Index remained in contraction territory at 42.6 percent, 3.1 percentage points lower than the figure of 45.7 percent recorded in April. The Production Index reading of 51.1 percent is a 2.2-percentage point increase compared to April’s figure of 48.9 percent. The Prices Index registered 44.2 percent, down 9 percentage points compared to the April figure of 53.2 percent. The Backlog of Orders Index registered 37.5 percent, 5.6 percentage points lower than the April reading of 43.1 percent. The Employment Index indicated another month of expansion, registering 51.4 percent, up 1.2 percentage points from April’s reading of 50.2 percent. The Supplier Deliveries Index figure of 43.5 percent is 1.1 percentage points lower than the 44.6 percent recorded in April; this is the index’s lowest reading since March 2009 (43.2 percent). The Inventories Index dropped 0.5 percentage point to 45.8 percent; the April reading was 46.3 percent. The New Export Orders Index reading of 50 percent is 0.2 percentage point higher than April’s figure of 49.8 percent. The Imports Index remained in contraction territory, registering 47.3 percent, 2.6 percentage points lower the 49.9 percent reported in April.”

emphasis added

Inflation Adjusted House Prices 4.2% Below Peak; Price-to-rent index is 8.3% below recent peak

by Calculated Risk on 6/01/2023 09:00:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 4.2% Below Peak; Price-to-rent index is 8.3% below recent peak

Excerpt:

It has been 17 years since the bubble peak. In the February Case-Shiller house price index released Tuesday, the seasonally adjusted National Index (SA), was reported as being 62% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 11% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is at the bubble peak.

The inflation adjusted indexes increased in real terms in March using CPI ex-shelter. CPI less shelter has only increased at a 1.1% annual rate over the last six months, and that has kept real prices from falling even faster.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $200,000 in January 2000, the price would be $340,000 today adjusted for inflation (70% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index.

Weekly Initial Unemployment Claims increased to 232,000

by Calculated Risk on 6/01/2023 08:33:00 AM

The DOL reported:

In the week ending May 27, the advance figure for seasonally adjusted initial claims was 232,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 229,000 to 230,000. The 4-week moving average was 229,500, a decrease of 2,500 from the previous week's revised average. The previous week's average was revised up by 250 from 231,750 to 232,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was decreased to 229,500.

The previous week was revised up.

Weekly claims were below the consensus forecast.