by Calculated Risk on 6/05/2023 11:00:00 AM

Monday, June 05, 2023

Black Knight Mortgage Monitor: Home Prices Increased Month-to-month in April; Prices Unchanged YoY

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: Home Prices Increased Month-to-month in April; Prices Unchanged YoY

A brief excerpt:

Note: The Black Knight House Price Index (HPI) is a repeat sales index. Black Knight reports the median price change of the repeat sales.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

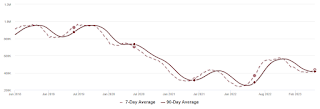

Here is a graph of the Black Knight HPI. The index is still up 1.0% year-over-year and will likely turn negative YoY soon.

• April’s 0.46% seasonally adjusted rise was down from March’s revised +0.62% and roughly on par with the 0.49% rise in February

• April’s seasonally adjusted increase was near the 30-year average of 0.48% for the month – 5.5% annualized

• Despite prices firming up this spring, the annual home price growth rate slipped to 0% in April, the first-time prices have been flat year over year since the rebound from the Great Financial Crisis began in 2012

• At its current trajectory, the annual home price growth rate would only fall modestly below 0% for a very short time before pulling back above water by late Q2/early Q3

emphasis added

Housing June 5th Weekly Update: Inventory Increased 0.7% Week-over-week

by Calculated Risk on 6/05/2023 08:21:00 AM

Click on graph for larger image.

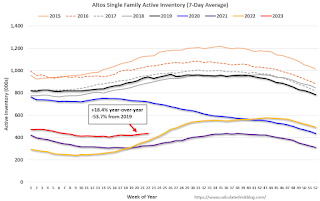

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, June 04, 2023

Sunday Night Futures

by Calculated Risk on 6/04/2023 07:15:00 PM

Weekend:

• Schedule for Week of June 4, 2023

Monday:

• At 10:00 AM ET, the ISM Services Index for May. The consensus is for a reading of 52.5, up from 51.9.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 3 and DOW futures are up 70 (fair value).

Oil prices were down over the last week with WTI futures at $71.74 per barrel and Brent at $76.13 per barrel. A year ago, WTI was at $119, and Brent was at $126 - so WTI oil prices are down about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.52 per gallon. A year ago, prices were at $4.82 per gallon, so gasoline prices are down $1.30 per gallon year-over-year.

Hotels: Occupancy Rate Up 0.6% Year-over-year

by Calculated Risk on 6/04/2023 03:01:00 PM

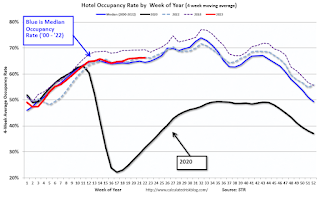

As expected ahead of Memorial Day, U.S. hotel performance decreased from the previous week, according to STR‘s latest data through 27 May. Year-over-year comparisons were improved.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

21-27 May 2023 (percentage change from comparable week in 2022):

• Occupancy: 66.8% (+0.6%)

• Average daily rate (ADR): US$156.63 (+2.2%)

• Revenue per available room (RevPAR): US$104.62 (+2.9%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Realtor.com Reports Weekly Active Inventory Up 18% YoY; New Listings Down 20% YoY

by Calculated Risk on 6/04/2023 08:11:00 AM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from economist Jiayi Xu: Weekly Housing Trends View — Data Week Ending May 27, 2023

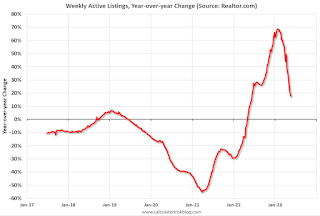

• Active inventory growth slowed again, with for-sale homes up just 18% above one year ago. The number of homes for sale continues to grow, but compared to one year ago, the pace is slowing. As we have discussed previously, further slowing is likely ahead. Due to the limited housing inventory, many buyers have turned their attention towards newly constructed homes.

...

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 20% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 47 weeks. This week’s gap was smaller than last two weeks’, but the lack of new sellers is still a drag on home sales. In fact, this trend holds for all four regions in May, and the West saw the most significant decline in listing activities. Existing homeowners, benefiting from mortgage rates considerably lower than current rates, are reluctant to list their properties, leading to a lag in new listings.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up year-over-year - from record lows - however, the YoY increase has slowed sharply recently.

Saturday, June 03, 2023

Real Estate Newsletter Articles this Week: Case-Shiller National House Price Index Increased 0.7% year-over-year in March

by Calculated Risk on 6/03/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index Increased 0.7% year-over-year in March

• Inflation Adjusted House Prices 4.2% Below Peak

• Freddie Mac House Price Index Increased Slightly in April; Up 0.3% Year-over-year

• Lawler: Census Finally Releases 2020 Census Demographic Profile and Demographic and Housing Characteristics File

• Year-over-year Rent Growth Continues to Decelerate

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of June 4, 2023

by Calculated Risk on 6/03/2023 08:11:00 AM

The key report scheduled for this week is the April trade balance.

10:00 AM: the ISM Services Index for May. The consensus is for a reading of 52.5, up from 51.9.

8:00 AM ET: CoreLogic House Price index for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

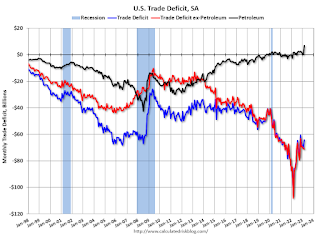

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum.

The consensus is the trade deficit to be $75.4 billion. The U.S. trade deficit was at $64.2 Billion in March.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 238 thousand initial claims, up from 232 thousand last week.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

No major economic releases scheduled.

Friday, June 02, 2023

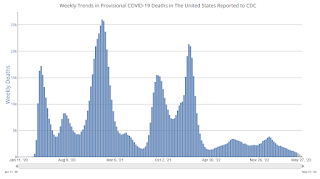

June 2nd COVID Update: New Pandemic Lows for Deaths and Hospitalizations

by Calculated Risk on 6/02/2023 09:10:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 6,942 | 7,544 | ≤3,0001 | |

| Deaths per Week2 | 684 | 849 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Heavy Truck Sales Up Sharply Year-over-year in May

by Calculated Risk on 6/02/2023 03:08:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the May 2023 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

Year-over-year Rent Growth Continues to Decelerate; Asking Rents Likely to be Down year-over-year in June or July

by Calculated Risk on 6/02/2023 11:59:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Year-over-year Rent Growth Continues to Decelerate

A brief excerpt:

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand). This has been confirmed (mostly due to work-from-home), and also led to the supposition that household formation would slow sharply now (mostly confirmed) and that asking rents might decrease in 2023 on a year-over-year basis.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through April 2023, except CoreLogic is through May and Apartment List is through May 2023.

...

The CoreLogic measure is up 4.3% YoY in March, down from 5.0% in February, and down from a peak of 13.9% in April 2022.

The Zillow measure is up 5.3% YoY in April, down from 6.0% YoY in March, and down from a peak of 16.9% YoY in February 2022.

The ApartmentList measure is up 0.9% YoY as of May, down from 1.8% in April, and down from a peak of 18.3% YoY November 2021.

...

My view is it is likely that we will see a year-over-year decline in asking rents sometime in the next couple of months.