by Calculated Risk on 6/07/2023 07:00:00 AM

Wednesday, June 07, 2023

MBA: Mortgage Applications Decreased in Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 2, 2023. This week’s results include an adjustment for the Memorial Day holiday.

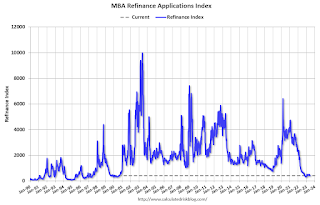

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.4 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 12 percent compared with the previous week. The Refinance Index decreased 1 percent from the previous week and was 42 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 13 percent compared with the previous week and was 27 percent lower than the same week one year ago.

“Mortgage rates declined last week from a recent high, but total application activity slipped for the fourth straight week. The 30-year fixed rate dipped to 6.81 percent, 10 basis points lower than last week but still the second highest rate of 2023 to date,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Overall applications were more than 30 percent lower than a year ago, as borrowers continue to grapple with the higher rate environment. Purchase activity is constrained by reduced purchasing power from higher rates and the ongoing lack of for-sale inventory in the market, while there continues to be very little rate incentive for refinance borrowers. There was less of a decline in government purchase applications last week, which was consistent with a growing share of first-time home buyers in the market.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.81 percent from 6.91 percent, with points decreasing to 0.66 from 0.83 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans

emphasis added

Click on graph for larger image.

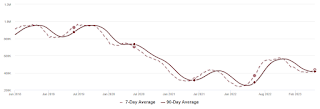

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 27% year-over-year unadjusted.

Tuesday, June 06, 2023

Wednesday: Trade Deficit

by Calculated Risk on 6/06/2023 08:22:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Trade Balance report for April from the Census Bureau. The consensus is the trade deficit to be $75.4 billion. The U.S. trade deficit was at $64.2 Billion in March.

Second Home Market: South Lake Tahoe in May

by Calculated Risk on 6/06/2023 01:12:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

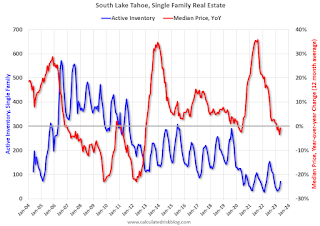

This graph is for South Lake Tahoe since 2004 through May 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently active inventory is still very low and is down 32% year-over-year.

Early Look at Local Housing Markets in May

by Calculated Risk on 6/06/2023 10:15:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Early Look at Local Housing Markets in May

A brief excerpt:

This is a look at a few early reporting local markets in May. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in May were mostly for contracts signed in March and April. Since 30-year fixed mortgage rates were in the 6% to 6.5% range in March and April - compared to the 4% to 5% range the previous year - closed sales were down significantly year-over-year in May.

...

In May, sales in these markets were down 26.6%. In April, these same markets were down 34.4% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in April for these early reporting markets, however seasonally adjusted, it is closer. Note that there was one less selling day in April this year than in April 2022, but the same number of selling days each year in May.

Another factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates. ...

This was a just a few early reporting markets. Many more local markets to come!

CoreLogic: House Prices up 2.0% YoY in April

by Calculated Risk on 6/06/2023 08:11:00 AM

Notes: This CoreLogic House Price Index report is for April. The recent Case-Shiller index release was for March. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic: Home Price Growth Continues Annual Single-Digit Slowdown in April

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for April 2023.This index was up 3.1% YoY in March.

Nationwide, single-family home price growth rose by 2% year over year in April. This marked the 135th consecutive month of annual growth but the sixth straight month of single-digit gains, which have slowed from an all-time high of nearly 20% annual appreciation in the spring of 2022.

Numerous economic concerns are contributing to buyer reluctance, including mortgage rate volatility and the related uncertainty surrounding the recent debt-ceiling debate. That said, a continued shortage of homes for sale could keep pressure on housing prices over the next 12 months. CoreLogic projects that home price growth will slow a bit more in 2023 before regaining steam to about 5% annual appreciation by April 2024.

“While mortgage rate volatility continues to cause buyer hesitation, the lack of for-sale homes is putting firm pressure on prices this spring, leading to above-average seasonal monthly gains and a rebound in home prices in most markets,” said CoreLogic Chief Economist Selma Hepp. ”Nevertheless, the recent surge in mortgage rates and continued inflation issues suggest that rates may remain elevated, leading home price appreciation to possibly relax this summer and return to average seasonal gains later in 2023.”

“Still, while slim inventory is pushing prices up once again and constraining affordability,” Hepp continued, “recent trends suggest that home price growth in 2023 will fall in line with the historical 4% annual average.“

...

U.S. home prices (including distressed sales) increased by 2% year over year in April 2023 compared with April 2022. On a month-over-month basis, home prices increased by 1.2% compared with March 2023.

emphasis added

Monday, June 05, 2023

Tuesday: CoreLogic House Prices

by Calculated Risk on 6/05/2023 08:11:00 PM

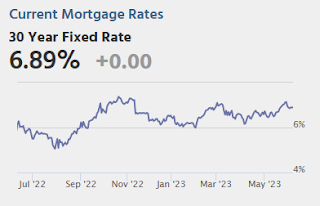

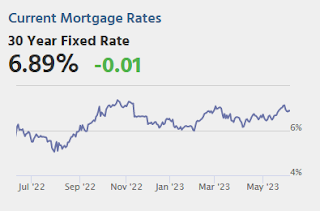

Mortgage rates held fairly steady over the weekend. That wasn't necessarily destined to be the case as the underlying bond market suggested another mover higher earlier this morning. But bonds rallied after an important economic report on the services sector suggested slower growth (bonds tend to improve in response to weaker cues on the economy and inflation). ... With the next major inflation report (CPI) and the next Fed rate announcement on Tuesday and Wednesday next week, rates might not be inclined to make a big run in either direction between now and then. [30 year fixed 6.89%]Tuesday:

emphasis added

• At 8:00 AM ET, CoreLogic House Price index for April.

ISM® Services Index Decreases to 50.3% in May

by Calculated Risk on 6/05/2023 12:52:00 PM

(Posted with permission). The ISM® Services index was at 50.3%, down from 51.9% last month. The employment index decreased to 49.2%, from 50.8%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 50.3% May 2023 Services ISM® Report On Business®

Economic activity in the services sector expanded in May for the fifth consecutive month as the Services PMI® registered 50.3 percent, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®. The sector has grown in 35 of the last 36 months, with the lone contraction in December of last year.The PMI was below expectations.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In May, the Services PMI® registered 50.3 percent, 1.6 percentage points lower than April’s reading of 51.9 percent. The composite index indicated growth in May for the fifth consecutive month after a reading of 49.2 percent in December, which was the first contraction since May 2020 (45.4 percent). The Business Activity Index registered 51.5 percent, a 0.5-percentage point decrease compared to the reading of 52 percent in April. The New Orders Index expanded in May for the fifth consecutive month after contracting in December for the first time since May 2020; the figure of 52.9 percent is 3.2 percentage points lower than the April reading of 56.1 percent.

“The Supplier Deliveries registered 47.7 percent, 0.9 percentage point lower than the 48.6 percent recorded in April. In the last six months, the average reading of 48.0 percent (with a low of 45.8 percent in March) reflects the fastest supplier delivery performance since June 2009, when the index registered 46 percent. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.)

“The Prices Index was down 3.4 percentage points in May, to 56.2 percent. The Inventories Index expanded in May after a month of contraction and two previous months of growth, preceded by eight straight months of contraction; the reading of 58.3 percent is up 11.1 percentage points from April’s figure of 47.2 percent. The Inventory Sentiment Index (61 percent, up 12.1 percentage points from April’s reading of 48.9 percent) expanded after a month of contraction preceded by four months of growth, with a four-month period of contraction before that. The Backlog of Orders Index registered 40.9 percent, an 8.8-percentage point decrease compared to the April figure of 49.7 percent and the index’s lowest reading since May 2009 (40 percent).

emphasis added

Black Knight Mortgage Monitor: Home Prices Increased Month-to-month in April; Prices Unchanged YoY

by Calculated Risk on 6/05/2023 11:00:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: Home Prices Increased Month-to-month in April; Prices Unchanged YoY

A brief excerpt:

Note: The Black Knight House Price Index (HPI) is a repeat sales index. Black Knight reports the median price change of the repeat sales.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Here is a graph of the Black Knight HPI. The index is still up 1.0% year-over-year and will likely turn negative YoY soon.

• April’s 0.46% seasonally adjusted rise was down from March’s revised +0.62% and roughly on par with the 0.49% rise in February

• April’s seasonally adjusted increase was near the 30-year average of 0.48% for the month – 5.5% annualized

• Despite prices firming up this spring, the annual home price growth rate slipped to 0% in April, the first-time prices have been flat year over year since the rebound from the Great Financial Crisis began in 2012

• At its current trajectory, the annual home price growth rate would only fall modestly below 0% for a very short time before pulling back above water by late Q2/early Q3

emphasis added

Housing June 5th Weekly Update: Inventory Increased 0.7% Week-over-week

by Calculated Risk on 6/05/2023 08:21:00 AM

Click on graph for larger image.

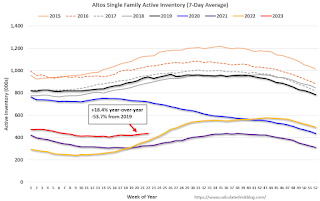

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, June 04, 2023

Sunday Night Futures

by Calculated Risk on 6/04/2023 07:15:00 PM

Weekend:

• Schedule for Week of June 4, 2023

Monday:

• At 10:00 AM ET, the ISM Services Index for May. The consensus is for a reading of 52.5, up from 51.9.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 3 and DOW futures are up 70 (fair value).

Oil prices were down over the last week with WTI futures at $71.74 per barrel and Brent at $76.13 per barrel. A year ago, WTI was at $119, and Brent was at $126 - so WTI oil prices are down about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.52 per gallon. A year ago, prices were at $4.82 per gallon, so gasoline prices are down $1.30 per gallon year-over-year.