by Calculated Risk on 6/08/2023 08:00:00 AM

Thursday, June 08, 2023

CoreLogic: 1.2 million Homeowners with Negative Equity in Q1 2023

From CoreLogic: CoreLogic: US Home Borrowers See First Annual Home Equity Losses Since 2012 in Q1 2023, but Overall Mortgage Performance Remains Strong

CoreLogic® ... today released the Homeowner Equity Report (HER) for the first quarter of 2023. The report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) saw home equity decrease by 0.7% year over year, representing a collective loss of $108.4 billion, and an average loss of $5,400 per borrower since the first quarter of 2022.The above graph is from CoreLogic and compares Q1 2023 to Q4 2022 equity distribution by LTV. There are still a few properties with LTV over 125%. But most homeowners have a significant amount of equity.

In the first quarter of 2023, U.S. homeowners with a mortgage lost a small amount of equity year over year for the first time since early 2012, while national combined equity followed suit. As in the fourth quarter of 2022, Western states posted the largest annual home equity losses: Washington (-$74,300), California (-$59,600) and Utah (-$37,700). The equity losses in those states reflect decelerating home prices, with all three posting annual declines in February and March, according to CoreLogic’s Home Price Index.

Despite these declines, home equity remains solid, with the number of underwater properties unchanged since the fourth quarter of 2022. And although some major metro areas saw equity decline on an annual basis, years of rapid appreciation in places like Los Angeles and San Francisco, which have negative equity shares of 0.9%, is keeping homeowners in these metros in good standing.

“Home equity trends closely follow home price changes,” said CoreLogic Chief Economist Selma Hepp. “As a result, while the average amount of equity declined from a year ago, it increased from the fourth quarter of 2022, as monthly home prices growth accelerated in early 2023.”

“The average U.S. homeowner now has more than $274,000 in equity — up significantly from $182,000 before the pandemic,” Hepp continued. “Also, while homeowners in some areas of the country who bought a property last spring have no equity as a result of price losses, forecasted home price appreciation over the next year should help many borrowers regain some of that lost equity.”

Negative equity, also referred to as underwater or upside-down mortgages, applies to borrowers who owe more on their mortgages than their homes are currently worth. As of the first quarter of 2023, the quarterly and annual changes in negative equity were:

Click on graph for larger image.

• Quarterly change: From the fourth quarter of 2022 to the first quarter of 2023, the total number of mortgaged homes in negative equity was unchanged, remaining at 1.2 million homes or 2.1% of all mortgaged properties.

• Annual change: From the first quarter of 2022 to the first quarter of 2023, the total number of homes in negative equity increased by 4% from 1.1 million homes or 2% of all mortgaged properties.

emphasis added

This is a very different picture than at the start of the housing bust when many homeowners had little equity.

This is a very different picture than at the start of the housing bust when many homeowners had little equity.On a year-over-year basis, the number of homeowners with negative equity has increased from 1.1 million to 1.2 million.

Wednesday, June 07, 2023

Thursday: Unemployment Claims, Flow of Funds

by Calculated Risk on 6/07/2023 09:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 238 thousand initial claims, up from 232 thousand last week.

• At 12:00 PM, Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

Leading Index for Commercial Real Estate Decreased in May

by Calculated Risk on 6/07/2023 03:13:00 PM

From Dodge Data Analytics: Dodge Momentum Index Slides 2% in May Due to Weaker Commercial Planning

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, fell 2.0% in May to 180.5 (2000=100) from the revised April reading of 184.1. Over the month, the commercial component of the DMI fell 6.1%, while the institutional component improved 5.6%.

“The DMI dipped in May amid sustained weakness in commercial planning activity,” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. “Conversely, institutional planning steadily improved over the month as research and development laboratories and hospital projects steadily entered planning. Sustained elevation in the federal funds rate and tighter lending standards will likely constrain growth in the DMI over the second half of 2023; however the index remains above the historical average. This paints an optimistic landscape for non-residential construction in mid-2024, as the economy recovers and the Fed begins to pull back rates.”

Commercial planning in May was negatively impacted by continued weakness in office and hotel planning activity. Institutional planning accelerated alongside steady growth in education, health and amusement projects. Year over year, the DMI remains 11% higher than in May 2022. The commercial and institutional components were up 7% and 18%, respectively.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 180.5 in May, down from 184.1 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a slowdown towards the end of 2023 or in 2024.

Could 6% to 7% 30-Year Mortgage Rates be the "New Normal"?

by Calculated Risk on 6/07/2023 11:52:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Could 6% to 7% 30-Year Mortgage Rates be the "New Normal"?

A brief excerpt:

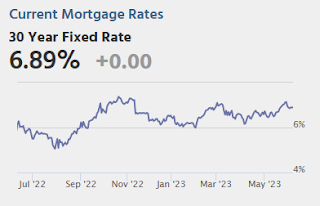

A key pitch, by real estate agents for home buyers right now, is that they will likely be able to refinance at a lower mortgage rate in a few years. The argument is that once the Federal Reserve has inflation back down to the 2% target, 30-mortgage rates will decline, perhaps to around 5% or lower. Of course, no one expects to see 3% mortgage rates without another crisis.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

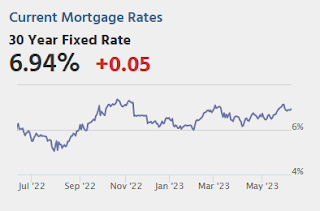

This graph is from Mortgage News Daily and shows the 30-year mortgage rate since 2010. Rates were mostly in the 3.5% to 5% range for over a decade prior to the pandemic, but it is possible - without a recession or a crisis - that 6% to 7% mortgage rates could be the new normal.

Wholesale Used Car Prices Decreased in May; Down 7.6% Year-over-year

by Calculated Risk on 6/07/2023 10:05:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices See Continued Declines in May

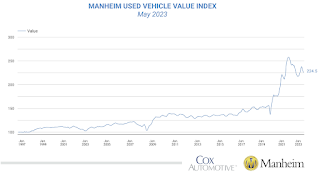

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 2.7% in May from April. The Manheim Used Vehicle Value Index (MUVVI) declined to 224.5, down 7.6% from a year ago.

“Price erosion continued in May, with another month-over-month drop in the index bringing it 0.3 points below our January result,” said Chris Frey, senior manager of Economic and Industry insights for Cox Automotive. “Taking a longer view, May’s year-over-year decline accelerated from April and March; however, the rate of decline might slow over the next several months as we encounter the lower prices seen at auction from May through November last year. Two consecutive reads in either measure do not a trend make, as used retail inventory is still below last year, and that tends to keep buyers at the auction, supporting prices.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Trade Deficit Increased to $74.6 Billion in April

by Calculated Risk on 6/07/2023 08:50:00 AM

The Census Bureau and the Bureau of Economic Analysis reported:

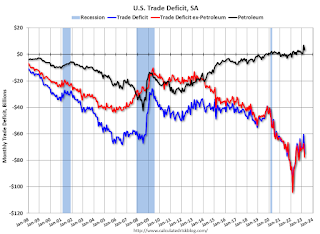

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $74.6 billion in April, up $14.0 billion from $60.6 billion in March, revised.

April exports were $249.0 billion, $9.2 billion less than March exports. April imports were $323.6 billion, $4.8 billion more than March imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports decreased and imports increased in April.

Exports are down 1% year-over-year; imports are down 4% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - and both have been decreasing recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have picked up.

The trade deficit with China decreased to $20.3 billion in March, from $30.4 billion a year ago.

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 6/07/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

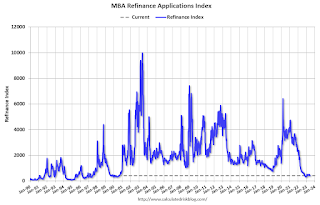

Mortgage applications decreased 1.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 2, 2023. This week’s results include an adjustment for the Memorial Day holiday.

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.4 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 12 percent compared with the previous week. The Refinance Index decreased 1 percent from the previous week and was 42 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 13 percent compared with the previous week and was 27 percent lower than the same week one year ago.

“Mortgage rates declined last week from a recent high, but total application activity slipped for the fourth straight week. The 30-year fixed rate dipped to 6.81 percent, 10 basis points lower than last week but still the second highest rate of 2023 to date,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Overall applications were more than 30 percent lower than a year ago, as borrowers continue to grapple with the higher rate environment. Purchase activity is constrained by reduced purchasing power from higher rates and the ongoing lack of for-sale inventory in the market, while there continues to be very little rate incentive for refinance borrowers. There was less of a decline in government purchase applications last week, which was consistent with a growing share of first-time home buyers in the market.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.81 percent from 6.91 percent, with points decreasing to 0.66 from 0.83 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 27% year-over-year unadjusted.

Tuesday, June 06, 2023

Wednesday: Trade Deficit

by Calculated Risk on 6/06/2023 08:22:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Trade Balance report for April from the Census Bureau. The consensus is the trade deficit to be $75.4 billion. The U.S. trade deficit was at $64.2 Billion in March.

Second Home Market: South Lake Tahoe in May

by Calculated Risk on 6/06/2023 01:12:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

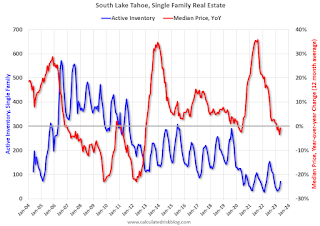

This graph is for South Lake Tahoe since 2004 through May 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently active inventory is still very low and is down 32% year-over-year.

Early Look at Local Housing Markets in May

by Calculated Risk on 6/06/2023 10:15:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Early Look at Local Housing Markets in May

A brief excerpt:

This is a look at a few early reporting local markets in May. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in May were mostly for contracts signed in March and April. Since 30-year fixed mortgage rates were in the 6% to 6.5% range in March and April - compared to the 4% to 5% range the previous year - closed sales were down significantly year-over-year in May.

...

In May, sales in these markets were down 26.6%. In April, these same markets were down 34.4% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in April for these early reporting markets, however seasonally adjusted, it is closer. Note that there was one less selling day in April this year than in April 2022, but the same number of selling days each year in May.

Another factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates. ...

This was a just a few early reporting markets. Many more local markets to come!