by Calculated Risk on 6/16/2023 09:17:00 PM

Friday, June 16, 2023

June 16th COVID Update: New Pandemic Lows for Deaths and Hospitalizations

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 6,133 | 6,642 | ≤3,0001 | |

| Deaths per Week2 | 588 | 682 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Lawler: Early Read on Existing Home Sales in May

by Calculated Risk on 6/16/2023 05:35:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, comprising over 225,000 transactions, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.25 million in May, down 0.7% from April’s preliminary pace and down 21.3% from last May’s seasonally adjusted pace. Unadjusted sales should show a smaller YOY % decline, reflecting this May’s higher business day count relative to last May’s.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was down by about 0.5% from last May.

3rd Look at Local Housing Markets in May

by Calculated Risk on 6/16/2023 03:27:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in May

A brief excerpt:

This is the third look at local markets in May. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in May were mostly for contracts signed in March and April. Since 30-year fixed mortgage rates were in the 6% to 6.5% range in March and April - compared to the 4% to 5% range the previous year - closed sales were down significantly year-over-year in May.

...

In May, sales in these markets were down 16.3%. In April, these same markets were down 24.9% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in April for these markets, however seasonally adjusted, it is closer. Another factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates.

This data suggests the May existing home sales report will show another significant YoY decline and the 21st consecutive month with a YoY decline in sales.

More local markets to come!

Update: Lumber Prices Down About 25% YoY

by Calculated Risk on 6/16/2023 09:52:00 AM

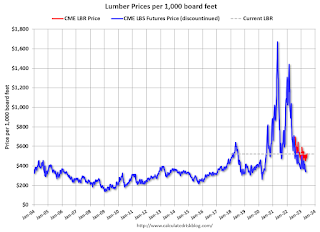

SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16th. I've now switched to a new physically-delivered Lumber Futures contract that was started in August 2022. Unfortunately, this impacts long term price comparisons.

This graph shows CME random length framing futures through May 16th (blue), and the new physically-delivered Lumber Futures (LBR) contract starting in August 2022 (Red).

Click on graph for larger image.

Click on graph for larger image.We didn't see a significant runup in prices this Spring due to the housing slowdown.

Q2 GDP Tracking: Around 1.5%

by Calculated Risk on 6/16/2023 08:29:00 AM

From BofA:

Today's data left our 2Q US GDP tracking unchanged at 1.3% q/q saar and decreased our 1Q tracker from 2.0% to 1.8%. [June 15th estimate]From Goldman:

emphasis added

[W]e lowered our Q2 GDP tracking estimate by 0.1pp to +1.7% (qoq ar) on the back of softer consumption growth. [June 15th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2023 is 1.8 percent on June 15, down from 2.2 percent on June 8. [June 15th estimate]

Thursday, June 15, 2023

Hotels: Occupancy Rate Down 1.6% Year-over-year

by Calculated Risk on 6/15/2023 05:47:00 PM

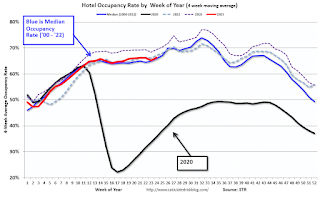

U.S. hotel performance jumped from the previous week, while year-over-year comparisons were mixed, according to STR‘s latest data through 10 June.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

4-10 June 2023 (percentage change from comparable week in 2022):

• Occupancy: 69.4% (-1.6%)

• Average daily rate (ADR): US$157.69 (+0.5%)

• Revenue per available room (RevPAR): US$109.38 (-1.2%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Realtor.com Reports Weekly Active Inventory Up 10% YoY; New Listings Down 22% YoY

by Calculated Risk on 6/15/2023 02:16:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from economist Jiayi Xu: Weekly Housing Trends View — Data Week Ending June 10th, 2023

• Active inventory growth slowed again, with for-sale homes up just 10% above one year ago. The number of homes for sale continues to grow, but compared to one year ago, the pace is slowing. While today’s shoppers still have many more homes to consider than last year’s shoppers did, worries about high inflation, rising interest rates, and escalating home prices have caused many prospective buyers, especially more first-time buyers, to postpone their plans to purchase a home. This, in turn, has contributed to an increase in the number of homes listed for sale. However, the ongoing decrease in new listings has restrained the growth of active inventory, and there is a possibility of further deceleration in the upcoming weeks.

...

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 22% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 49 weeks. As the year-over-year declines fluctuated in the -20% to -26% range, there are no clear signs of sellers re-entering the market at a steady pace. The large decline in new listings is primarily driven by the mortgage “locked-in” as many existing homeowners benefit from mortgage rates that are significantly lower than the current level.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up year-over-year - from record lows - however, the YoY increase has slowed sharply recently.

Lawler: Update on Mortgage/Treasury Spreads

by Calculated Risk on 6/15/2023 10:55:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Update on Mortgage/Treasury Spreads

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Last May I wrote a two-part piece on why the spread between the 30-year fixed-rate mortgage rate and the 10-year Treasury rate had widened significantly from the end of 2021 to early May of last year, and explained why changes in the yield curve, changes in market-implied interest rate volatility, and the end of the Federal Reserve’s misplaced MBS purchase program all logically and rationally resulted in a widening of the mortgage/10-year Treasury spread. I also said that it was unlikely that mortgage/10-year Treasury spreads were unlikely to revert to what some argue is the “normal” level (there is no such thing) any time soon. Since then, mortgage/10-year Treasury spreads have on average been wider than there were last May, for the most part for logical and rational reasons based on what has happened to the yield curve and implied interest rate volatility. ...

Since mortgage cash flows are very much interest-rate path dependent, the “expected” value of mortgage cash flows across all possible interest-rate paths is heavily dependent on the probability distribution of future interest rates. If market expectations of future interest rate volatility were low, one would expect relatively low mortgage/Treasury spreads, while if market expectation of future interest rate volatility were high, one would expect relatively wide mortgage/Treasury spreads.

The shape of the yield curve also impacts that probability distribution of future interest rates. A very steep yield curve implies a market expectation of increasing future interest rates, and future rate simulations are typically “centered” around this rising “base case” scenario (with possible adjustments for estimated term premia). An inverted yield curve, in contrast, implies a market expectation of declining future interest rates, with future rate simulations centered around this falling “base case” rate scenario. As such, a simulation of future rates with an inverted curve “produces” more rate scenarios where borrowers exercise their prepayment option, implying that mortgage/10-year spreads will be narrower with a steep curve and wider with an inverted curve.

To sum up, one would expect mortgage/10-year spreads to be (1) wider when interest rate volatility is high; and (2) wider when the Treasury yield curve is inverted. And when interest rate volatility is high AND the yield curve is very inverted, one would expect the mortgage/10-year spread to be VERY wide.

Industrial Production Decreased 0.2% in May

by Calculated Risk on 6/15/2023 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

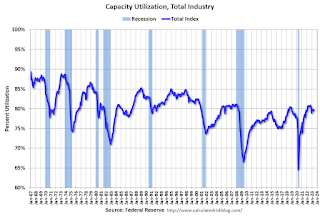

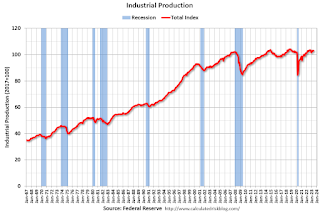

Industrial production edged down 0.2 percent in May following two consecutive months of increases. In May, the index for manufacturing ticked up 0.1 percent, while the indexes for mining and utilities fell 0.4 and 1.8 percent, respectively. At 103.0 percent of its 2017 average, total industrial production in May was 0.2 percent above its year-earlier level. Capacity utilization moved down to 79.6 percent in May, a rate that is 0.1 percentage point below its long-run (1972–2022) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 79.6% is close to the average from 1972 to 2022. This was slightly below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in May to 103.0. This is above the pre-pandemic level.

Industrial production was below consensus expectations, however previous months were revised up.

Retail Sales Increased 0.3% in May

by Calculated Risk on 6/15/2023 08:44:00 AM

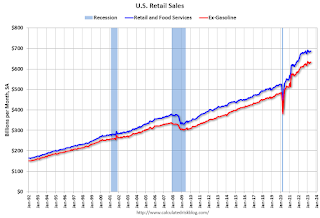

On a monthly basis, retail sales were up 0.3% from April to May (seasonally adjusted), and sales were up 1.6 percent from May 2022.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for May 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $686.6 billion, up 0.3 percent from the previous month, and up 1.6 percent above May 2022. ... The March 2023 to April 2023 percent change was unrevised at 0.4 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in May.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.1% on a YoY basis.

The increase in sales in May was close to expectations, however sales in March and April were revised down.

The increase in sales in May was close to expectations, however sales in March and April were revised down.