by Calculated Risk on 6/21/2023 12:13:00 PM

Wednesday, June 21, 2023

AIA: Architecture Billings "Rebound" in May; Multi-family Billings Decline for 11th Consecutive Month

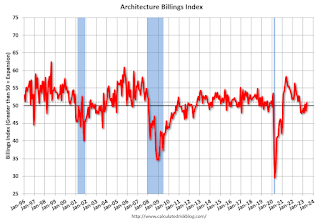

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: AAIA/Deltek Architecture Billings Index Indicates Rebound in May Business Conditions

Architecture firms experienced a rebound in billings in May after a downturn in April, according to the latest Architecture Billings Index (ABI) from the American Institute of Architects (AIA) and Deltek. The index score for May was the highest it has been since September 2022. Inquiries into new projects and design contracts also increased this month, reaching their highest levels since February.

The billings score for April increased from 48.5 in April to 51.0 in May (any score above 50 indicates an increase in firm billings). Firms also reported that inquiries into new projects accelerated to 57.2 from 53.9 the previous month. Further, the value of new design contracts also moved up to 52.3 in May from 49.8 in April.

“The modest improvement in overall demand for architectural services that we saw last month is encouraging news", said AIA Chief Economist Kermit Baker Hon. AIA, Ph.D., “However, there continues to be variation in the performance of firms by regional location and building specialization. This suggests that overall business conditions for the profession likely will continue to be variable."

Despite growth in the overall ABI this month, business conditions remain variable in different regions of the country. Billings improved at firms located in the South for the second consecutive month in May, while they were essentially flat at firms located in the Midwest, following six months of growth. However, billings continued to decline at firms located in both the West and Northeast, where scores have been below 50 since last fall.

By firm specialization, business conditions softened further at firms with a multifamily residential specialization in May, falling to the lowest level in two years. Billings also declined for the ninth consecutive month at firms with a commercial/industrial specialization. On the other hand, business conditions improved for the second month in a row at firms with an institutional specialization, as they reported their strongest growth since last year.

...

• Regional averages: South (52.3); Midwest (49.6); Northeast (48.7); West (47.7)

• Sector index breakdown: institutional (53.4); mixed practice (firms that do not have at least half of their billings in any one other category) (52.7); commercial/industrial (47.5); multi-family residential (43.0)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.0 in May, up from 48.5 in April. Anything above 50 indicates an increase in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has declined in 6 of the last 8 months. This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment later in 2023 and into 2024.

California Home Sales Down 23.6% YoY in May, Median Prices Decline 6.4% YoY

by Calculated Risk on 6/21/2023 10:31:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: California Home Sales Down 23.6% YoY in May, Median Prices Decline 6.4% YoY

Excerpt:

California doesn’t report monthly inventory numbers, but they do report sales and the change in months of inventory.There is more in the post. You can subscribe at https://calculatedrisk.substack.com/

Note: The National Association of Realtors (NAR) is scheduled to release May existing home sales tomorrow, Thursday, June 22, 2023, at 10:00 AM ET. The consensus is for 4.24 million SAAR.

Last Friday, housing economist Tom Lawler noted:Based on publicly-available local realtor/MLS reports released across the country through today, comprising over 225,000 transactions, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.25 million in May, down 0.7% from April’s preliminary pace and down 21.3% from last May’s seasonally adjusted pace.Here is the press release from the California Association of Realtors® (C.A.R.): Interest rate reprieve boosts California home sales to highest level in eight months, C.A.R. reports• Existing, single-family home sales totaled 289,460 in May on a seasonally adjusted annualized rate, up 9.8 percent from April and down 23.6 percent from May 2022.

• May’s statewide median home price was $836,110, up 3.0 percent from April and down 6.4 percent from May 2022.

Fed Chair Powell: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 6/21/2023 08:42:00 AM

This testimony will be live here at 10:00 AM ET.

Report here.

From Fed Chair Powell: Semiannual Monetary Policy Report to the Congress. An excerpt on inflation:

We at the Fed remain squarely focused on our dual mandate to promote maximum employment and stable prices for the American people. My colleagues and I understand the hardship that high inflation is causing, and we remain strongly committed to bringing inflation back down to our 2 percent goal. Price stability is the responsibility of the Federal Reserve, and without it, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all.

...

In light of how far we have come in tightening policy, the uncertain lags with which monetary policy affects the economy, and potential headwinds from credit tightening, the FOMC decided last week to maintain the target range for the federal funds rate at 5 to 5-1/4 percent and to continue the process of significantly reducing our securities holdings. Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year. But at last week's meeting, considering how far and how fast we have moved, we judged it prudent to hold the target range steady to allow the Committee to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, we will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. We will continue to make our decisions meeting by meeting, based on the totality of incoming data and their implications for the outlook for economic activity and inflation, as well as the balance of risks.

We remain committed to bringing inflation back down to our 2 percent goal and to keeping longer-term inflation expectations well anchored. Reducing inflation is likely to require a period of below-trend growth and some softening of labor market conditions. Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the longer run.

emphasis added

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 6/21/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

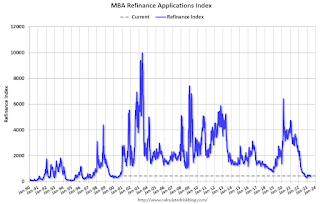

Mortgage applications increased 0.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 16, 2023.

The Market Composite Index, a measure of mortgage loan application volume, increased 0.5 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 1 percent compared with the previous week. The Refinance Index decreased 2 percent from the previous week and was 40 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index decreased 0.1 percent compared with the previous week and was 32 percent lower than the same week one year ago.

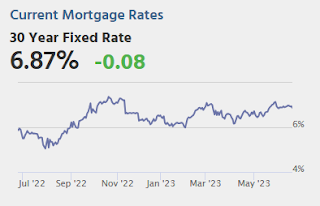

“The 30-year fixed mortgage rate declined for the third consecutive week to 6.73 percent, while other mortgage rates saw mixed results. Purchase applications increased, driven by a 2 percent gain in conventional purchase applications and a 3 percent increase in FHA purchase activity,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “First-time homebuyers account for a large share of FHA purchase loans, and this increase is a sign that while buyer interest is there, activity continues to be constrained by low levels of affordable inventory. Refinance applications continued their decline after the previous week’s increase, with the refinance share of applications just below 27 percent.”

Added Kan, “The rate for jumbo loans exceeded the conforming rate for the second straight week – the last time jumbo rates were higher was in December 2021.Tighter liquidity conditions have prompted jumbo lenders to pull back, increasing rates in the process.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.73 percent from 6.77 percent, with points decreasing to 0.64 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 32% year-over-year unadjusted.

Tuesday, June 20, 2023

Wednesday: Fed Chair Powell Semiannual Monetary Policy Report to Congress

by Calculated Risk on 6/20/2023 07:54:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to Congress, Before the U.S. House Financial Services Committee

• During the day, The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.49% in May"

by Calculated Risk on 6/20/2023 04:00:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.49% in May

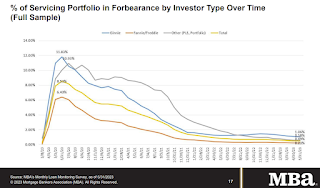

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.51% of servicers’ portfolio volume in the prior month to 0.49% as of May 31, 2023. According to MBA’s estimate, 245,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 7.9 million borrowers since March 2020.

In May 2023, the share of Fannie Mae and Freddie Mac loans in forbearance decreased 1 basis point to 0.23%. Ginnie Mae loans in forbearance decreased 5 basis points to 1.06%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 3 basis points to 0.58%.

“The number of loans in forbearance is reaching levels not seen since the beginning of March 2020, prior to the passage of the CARES Act,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Today, more than 96 percent of homeowners are current on their mortgages, thanks to the favorable jobs market and the success of loss mitigation options over the past three years.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans has been decreasing, declined to 0.49% in May from 0.51% in April.

At the end of May, there were about 245,000 homeowners in forbearance plans.

The second graph shows the percent of mortgages current by state.

The second graph shows the percent of mortgages current by state.From the MBA:

Total loans serviced that were current (not delinquent or in foreclosure) as a percent of servicing portfolio volume (#) increased to 96.12% in May 2023 from 95.89% in April 2023 (on a non-seasonally adjusted basis).

o The five states with the highest share of loans that were current as a percent of servicing portfolio: Washington, Idaho, Colorado, California, and Oregon.

o The five states with the lowest share of loans that were current as a percent of servicing portfolio: Louisiana, Mississippi, West Virginia, New York, and Indiana.

May Housing Starts: Record Number of Multi-Family Housing Units Under Construction

by Calculated Risk on 6/20/2023 09:32:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: May Housing Starts: Record Number of Multi-Family Housing Units Under Construction

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

Red is single family units. Currently there are 695 thousand single family units (red) under construction (SA). This was down in May compared to April, and 136 thousand below the recent peak in May 2022. Single family units under construction peaked a year ago since single family starts declined sharply.

Blue is for 2+ units. Currently there are 994 thousand multi-family units under construction. This ties the record set in July 1973 of multi-family units being built for the baby-boom generation. For multi-family, construction delays are a significant factor. The completion of these units should help with rent pressure.

Combined, there are 1.689 million units under construction, just 21 thousand below the all-time record of 1.710 million set in October 2022.

Housing Starts Increased Sharply to 1.631 million Annual Rate in May

by Calculated Risk on 6/20/2023 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in May were at a seasonally adjusted annual rate of 1,631,000. This is 21.7 percent above the revised April estimate of 1,340,000 and is 5.7 percent above the May 2022 rate of 1,543,000. Single‐family housing starts in May were at a rate of 997,000; this is 18.5 percent above the revised April figure of 841,000. The May rate for units in buildings with five units or more was 624,000.

Building Permits:

Privately‐owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,491,000. This is 5.2 percent above the revised April rate of 1,417,000, but is 12.7 percent below the May 2022 rate of 1,708,000. Single‐family authorizations in May were at a rate of 897,000; this is 4.8 percent above the revised April figure of 856,000. Authorizations of units in buildings with five units or more were at a rate of 542,000 in May.

emphasis added

Click on graph for larger image.

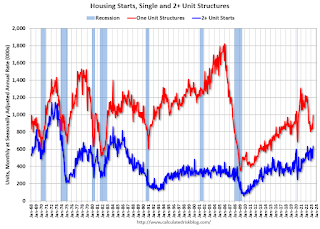

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) increased in May compared to April. Multi-family starts were up 33.2% year-over-year in May.

Single-family starts (red) increased sharply in May and were down 6.6% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse in single-family starts.

Total housing starts in May were well above expectations, however, starts in March and April were revised down, combined.

I'll have more later …

Monday, June 19, 2023

Tuesday: Housing Starts

by Calculated Risk on 6/19/2023 07:06:00 PM

Weekend:

• Schedule for Week of June 18, 2023

Monday:

• At 8:30 AM ET, Housing Starts for May. The consensus is for 1.405 million SAAR, up from 1.401 million SAAR in April.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 20 and DOW futures are down 165 (fair value).

Oil prices were up over the last week with WTI futures at $71.29 per barrel and Brent at $76.09 per barrel. A year ago, WTI was at $110, and Brent was at $118 - so WTI oil prices are down about 35% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.55 per gallon. A year ago, prices were at $4.97 per gallon, so gasoline prices are down $1.42 per gallon year-over-year.

Some More Good News for Homebuilders

by Calculated Risk on 6/19/2023 01:48:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Some More Good News for Homebuilders

A brief excerpt:

Every housing cycle is different; however, I’ve been arguing that this cycle wouldn’t be anything like the new home market that followed the housing bust, and that this recovery would be more similar to other previous cycles.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is an updated graph from the previous posts showing new home sales from the Census Bureau for four periods: 1978-1982, 1989 -1993, 2005-2020, and current (red). The prior peak in sales is set to 100 (updated through the April New Home sales release).

Also, it is likely that the Census Bureau is underestimating sales now since cancellation rates are falling! See: New Home Sales and Cancellations for a discussion on how cancellations impact the Census’ sales numbers.