by Calculated Risk on 6/27/2023 09:10:00 AM

Tuesday, June 27, 2023

Case-Shiller: National House Price Index Decreased 0.2% year-over-year in April

S&P/Case-Shiller released the monthly Home Price Indices for April ("April" is a 3-month average of February, March and April closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Continued Gains in April

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a -0.2% annual decrease in April, down from a gain of 0.7% in the previous month. The 10-City Composite showed a decrease of -1.2%, down from the -0.7% decrease in the previous month. The 20-City Composite posted a -1.7% year-over-year loss, down from -1.1% in the previous month.

...

Before seasonal adjustment, the U.S. National Index posted a 1.3% month-over-month increase in April, while the 10-City and 20-City Composites both posted increases of 1.7%.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.5%, while the 10-City Composite gained 1.0% and 20-City Composites posted an increase of 0.9%.

“The U.S. housing market continued to strengthen in April 2023, says Craig J. Lazzara, Managing Director at S&P DJI. “Home prices peaked in June 2022, declined until January 2023, and then began to recover. The National Composite rose by 1.3% in April (repeating March’s performance), and now stands only 2.4% below its June 2022 peak. Our 10- and 20-City Composites both gained 1.7% in April.

“The ongoing recovery in home prices is broadly based. Before seasonal adjustments, prices rose in all 20 cities in April (as they had also done in March). Seasonally adjusted data showed rising prices in 19 cities in April (versus 14 in March).

emphasis added

Click on graph for larger image.

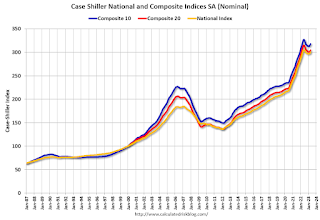

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.5% in April (SA) and down 2.7% from the recent peak in June 2022.

The Composite 20 index is up 1.0% (SA) in April and down 3.3% from the recent peak in June 2022.

The National index is up 0.9% (SA) in April and is down 1.8% from the peak in June 2022.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is down 1.2% year-over-year. The Composite 20 SA is down 1.7% year-over-year.

The National index SA is down 0.2% year-over-year.

Annual price changes were below expectations. I'll have more later.

Monday, June 26, 2023

Tuesday: Case-Shiller House Prices, New Home Sales, Durable Goods

by Calculated Risk on 6/26/2023 09:02:00 PM

The average 30yr fixed mortgage rate has been holding just under 7% for the entire month, making June the least volatile month in well over a year. [30 year fixed 6.91%]Tuesday:

emphasis added

• At 8:30 AM ET, Durable Goods Orders for May from the Census Bureau. The consensus is for a 1.3% decrease in durable goods orders.

• At 9:00 AM, S&P/Case-Shiller House Price Index for April. The consensus is for a 1.1% year-over-year decrease in the Comp 20 index for April.

• Also at 9:00 AM, FHFA House Price Index for April. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for May from the Census Bureau. The consensus is for 657 thousand SAAR, down from 683 thousand in April.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for June.

Fannie and Freddie Serious Delinquencies in May: Single Family Declined, Multi-Family Increased

by Calculated Risk on 6/26/2023 04:57:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie Serious Delinquencies in May: Single Family Declined, Multi-Family Increased

Brief excerpt:

Single-family serious delinquencies continued to decline in May, however, multi-family serious delinquencies are now increasing.You can subscribe at https://calculatedrisk.substack.com/.

...

Freddie Mac reports that multi-family delinquencies increased to 0.20% in May, up from 0.07% in May 2022.

This graph shows the Freddie multi-family serious delinquency rate since 2012. Rates were still high in 2012 following the housing bust and financial crisis.

The multi-family rate increased following the pandemic and has increased recently as rent growth has slowed, vacancy rates have increased, and interest rates have increased sharply. This will be something to watch as rents soften.

Update on Four High Frequency Indicators

by Calculated Risk on 6/26/2023 10:01:00 AM

I stopped the weekly updates of high frequency indicators at the end of 2022.

The TSA is providing daily travel numbers.

This data is as of June 25th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue), 2022 (Orange) and 2023 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is at the same level as the same week in 2019 (100.5% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales (dollars) are running close to the pre-pandemic levels.

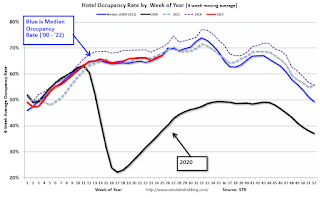

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

This data is through June 17th. The occupancy rate was down 1,1% compared to the same week in 2022.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

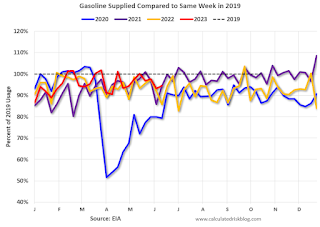

Blue is for 2020. Purple is for 2021, and Orange is for 2022, and Red is for 2023.

Gasoline supplied in 2023 is running about 5% below 2019 levels.

Housing June 26th Weekly Update: Inventory Increased 2.0% Week-over-week

by Calculated Risk on 6/26/2023 08:21:00 AM

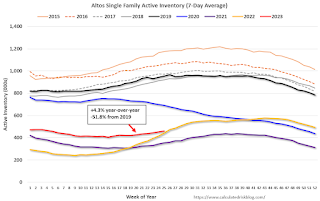

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, June 25, 2023

Sunday Night Futures

by Calculated Risk on 6/25/2023 07:05:00 PM

Weekend:

• Schedule for Week of June 25, 2023

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for June.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 6 and DOW futures are up 40 (fair value).

Oil prices were down over the last week with WTI futures at $69.16 per barrel and Brent at $73.85 per barrel. A year ago, WTI was at $109, and Brent was at $117 - so WTI oil prices are down about 37% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.56 per gallon. A year ago, prices were at $4.90 per gallon, so gasoline prices are down $1.34 per gallon year-over-year.

A Very Early Look at 2024 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 6/25/2023 08:12:00 AM

The BLS reported on June 13th:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 3.6 percent over the last 12 months to an index level of 298.382 (1982-84=100). For the month, the index increased 0.2 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U and is not seasonally adjusted (NSA).

• In 2022, the Q3 average of CPI-W was 291.901.

The 2022 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled is for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 3.6% year-over-year in May, and although this is very early - we need the data for July, August and September - my very early guess is COLA will probably be close to 3% this year, the smallest increase since 1.3% in 2021.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one-year lag. The National Average Wage Index is not available for 2022 yet, wages increased solidly in 2022. If wages increased 5% in 2022, then the contribution base next year will increase to around $168,200 in 2024, from the current $160,200.

Remember - this is a very early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

Saturday, June 24, 2023

Real Estate Newsletter Articles this Week: Record Number of Multi-Family Housing Units Under Construction

by Calculated Risk on 6/24/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Increased to 4.30 million SAAR in May; Median Prices Declined 3.1% YoY in May

• May Housing Starts: Record Number of Multi-Family Housing Units Under Construction

• Some More Good News for Homebuilders

• Final Look at Local Housing Markets in May

• California Home Sales Down 23.6% YoY in May, Median Prices Decline 6.4% YoY

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of June 25, 2023

by Calculated Risk on 6/24/2023 08:11:00 AM

The key reports this week are May New Home sales, the third estimate of Q1 GDP, Personal Income and Outlays for May and April Case-Shiller house prices.

For manufacturing, the June Richmond and Dallas Fed manufacturing surveys will be released.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for June.

8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 1.3% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for April.

9:00 AM: S&P/Case-Shiller House Price Index for April.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 1.1% year-over-year decrease in the Comp 20 index for April.

9:00 AM: FHFA House Price Index for April. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for May from the Census Bureau.

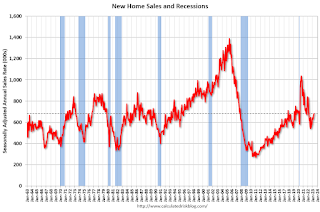

10:00 AM: New Home Sales for May from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 657 thousand SAAR, down from 683 thousand in April.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:30 AM: Discussion, Fed Chair Jerome Powell, Policy Panel Discussion, At the European Central Bank (ECB) Forum on Central Banking 2023, Sintra, Portugal

4:30 PM: Fed Bank Stress Test Results

2:30 AM: Discussion, Fed Chair Jerome Powell, Dialogue with Bank of Spain Governor Pablo Hernández de Cos, At the Banco de España Fourth Conference on Financial Stability, Madrid, Spain

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 266 thousand initial claims, up from 264 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2023 (Third estimate). The consensus is that real GDP increased 1.4% annualized in Q1, up from the second estimate of a 1.3% increase.

10:00 AM: Pending Home Sales Index for May. The consensus is for a 0.3% decrease in the index.

8:30 AM ET: Personal Income and Outlays, May 2023. The consensus is for a 0.4% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.4%. PCE prices are expected to be up 3.8% YoY, and core PCE prices up 4.7% YoY.

9:45 AM: Chicago Purchasing Managers Index for June.

10:00 AM: University of Michigan's Consumer sentiment index (Final for June). The consensus is for a reading of 63.9.

Friday, June 23, 2023

June 23rd COVID Update: New Pandemic Lows for Deaths and Hospitalizations

by Calculated Risk on 6/23/2023 08:01:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 6,133 | 6,642 | ≤3,0001 | |

| Deaths per Week2 | 653 | 709 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

On Hospitalizations (table data above is from last week):

"COVID-19 hospitalization data will not be updated during the week of June 19, 2023, due to a change in required reporting cadence from daily to weekly, following the expiration of the federal Public Health Emergency (PHE) declaration. COVID-19 hospitalization data will be updated each Monday beginning June 26, 2023."