by Calculated Risk on 6/29/2023 08:45:00 PM

Thursday, June 29, 2023

Friday: Personal Income & Outlays

Friday:

• At 8:30 AM ET, Personal Income and Outlays, May 2023. The consensus is for a 0.4% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.4%. PCE prices are expected to be up 3.8% YoY, and core PCE prices up 4.7% YoY.

• At 9:45 AM, Chicago Purchasing Managers Index for June.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for June). The consensus is for a reading of 63.9.

Hotels: Occupancy Rate Down 1.0% Year-over-year

by Calculated Risk on 6/29/2023 03:45:00 PM

U.S. hotel performance remained mostly flat from the previous week, and year-over-year comparisons remained mixed, according to STR‘s latest data through 24 June.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

18-24 June 2023 (percentage change from comparable week in 2022):

• Occupancy: 71.4% (-1.0%)

• Average daily rate (ADR): US$159.00 (+0.9%)

• Revenue per available room (RevPAR): US$113.58 (-0.1%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

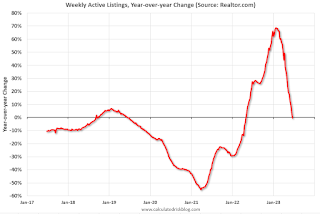

Realtor.com Reports Weekly Active Inventory Down Slightly YoY; New Listings Down 29% YoY

by Calculated Risk on 6/29/2023 12:43:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from economist Danielle Hale: Weekly Housing Trends View — Data Week Ending June 24, 2023

• Active inventory growth stalled completely, with for-sale homes lagging behind year ago levels for the first time in 59 weeks. As mortgage rates surged in 2022, buyers saw costs soar, and a large number of shoppers reoriented their housing plans. The time it took to sell a home lengthened and the number of homes for sale piled up. Flash forward a little more than a year, and this week, the number of homes actively for sale slipped compared to a year ago. The decline was slight–it actually rounds to zero–but it is notable in that it highlights a key reason why despite high costs home prices have not budged much.

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 29% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 51 weeks–nearly a whole year. And this week’s data shows an even larger gap.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is down 0.3% year-over-year - this was the first YoY decrease in 59 weeks (since May 2022).

NAR: Pending Home Sales Down 2.7% in May; Down 22.2% Year-over-year

by Calculated Risk on 6/29/2023 10:04:00 AM

From the NAR: Pending Home Sales Shrunk 2.7% in May

Pending home sales shrunk 2.7% in May from the previous month, according to the National Association of REALTORS®. Three U.S. regions posted monthly losses, while sales in the Northeast surged. All four regions saw year-over-year declines in transactions.This is way below expectations of a 0.3% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

“Despite sluggish pending contract signings, the housing market is resilient with approximately three offers for each listing,” said NAR Chief Economist Lawrence Yun, “The lack of housing inventory continues to prevent housing demand from being fully realized.”

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – dropped 2.7% to 76.5 in May. Year over year, pending transactions fell by 22.2%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI climbed 12.9% from last month to 66.7, a decrease of 21.9% from May 2022. The Midwest index dropped 5.3% to 74.4 in May, down 23.5% from one year ago.

The South PHSI decreased 4.4% to 94.4 in May, reducing 19.6% from the prior year. The West index lessened 6.1% in May to 58.4, falling 26.6% from May 2022.

emphasis added

Weekly Initial Unemployment Claims Decrease to 239,000

by Calculated Risk on 6/29/2023 08:38:00 AM

The DOL reported:

In the week ending June 24, the advance figure for seasonally adjusted initial claims was 239,000, a decrease of 26,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 264,000 to 265,000. The 4-week moving average was 257,500, an increase of 1,500 from the previous week's revised average. This is the highest level for this average since November 13, 2021 when it was 260,000. The previous week's average was revised up by 250 from 255,750 to 256,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 257,500.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

Q1 GDP Growth Revised Up to 2.0% Annual Rate

by Calculated Risk on 6/29/2023 08:34:00 AM

From the BEA: Gross Domestic Product (Third Estimate), Corporate Profits (Revised Estimate), and GDP by Industry, First Quarter 2023

Real gross domestic product (GDP) increased at an annual rate of 2.0 percent in the first quarter of 2023, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.6 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised up from 3.8% to 4.2%. Residential investment was revised up from -5.4% to -4.0%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 1.3 percent. The updated estimates primarily reflected upward revisions to exports and consumer spending that were partly offset by downward revisions to nonresidential fixed investment and federal government spending. Imports, which are a subtraction in the calculation of GDP, were revised down (refer to "Updates to GDP").

The increase in real GDP in the first quarter reflected increases in consumer spending, exports, state and local government spending, federal government spending, and nonresidential fixed investment that were partly offset by decreases in private inventory investment and residential fixed investment. Imports increased .

emphasis added

Wednesday, June 28, 2023

Thursday: Fed Chair Powell, Unemployment Claims, GDP, Pending Home Sales

by Calculated Risk on 6/28/2023 08:15:00 PM

Thursday:

• At 2:30 AM ET, Discussion, Fed Chair Jerome Powell, Dialogue with Bank of Spain Governor Pablo Hernández de Cos, At the Banco de España Fourth Conference on Financial Stability, Madrid, Spain

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 266 thousand initial claims, up from 264 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 1st quarter 2023 (Third estimate). The consensus is that real GDP increased 1.4% annualized in Q1, up from the second estimate of a 1.3% increase.

• At 10:00 AM, Pending Home Sales Index for May. The consensus is for a 0.3% decrease in the index.

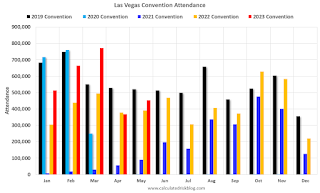

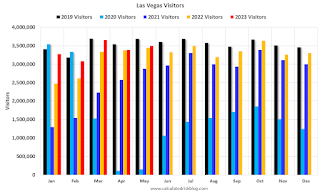

Las Vegas May 2023: Visitor Traffic Up 1.5% YoY; Convention Traffic up 16% YoY

by Calculated Risk on 6/28/2023 02:55:00 PM

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

From the Las Vegas Visitor Authority: May 2023 Las Vegas Visitor Statistics

Supported by strong demand along with multiple weekend music festivals including the Lovers & Friends festival, Sick New World festival and the recurring Electric Daisy Carnival (EDC) event, Las Vegas hosted approx. 3.5M visitors, 1.5% ahead of last May.

Overall hotel occupancy reached 84.4% for the month (+1.8 pts YoY). Weekend occupancy was healthy at 93.2%, +1.3 pts YoY, and Midweek occupancy approached 81%, surpassing last May by 2.0 pts.

Overall ADR exceeded $183, +4.3% from May 2022 while RevPAR neared $155, +6.6% YoY

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (light blue), 2021 (purple), 2022 (orange), and 2023 (red).

Visitor traffic was down 5.2% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.

Inflation Adjusted House Prices 3.8% Below Peak; Price-to-rent index is 8.4% below recent peak

by Calculated Risk on 6/28/2023 11:11:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 3.8% Below Peak; Price-to-rent index is 8.4% below recent peak

Excerpt:

It has been over 17 years since the bubble peak. In the April Case-Shiller house price index released yesterday, the seasonally adjusted National Index (SA), was reported as being 62% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 11% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 1% above the bubble peak.

The inflation adjusted indexes increased in real terms in April using CPI ex-shelter.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $200,000 in January 2000, the price would be $341,000 today adjusted for inflation (70.5% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

CNBC: Fed Chair "Powell says more ‘restriction’ is coming"

by Calculated Risk on 6/28/2023 09:59:00 AM

Fed Chair Jerome Powell is participating in a panel discussion today at the European Central Bank (ECB) Forum on Central Banking 2023 in Sintra, Portugal.

From Jeff Cox at CNBC: Powell says more ‘restriction’ is coming, including possibility of hikes at consecutive meetings. Excerpt:

“We believe there’s more restriction coming,” Powell said during a monetary policy session in Sintra, Portugal. “What’s really driving it ... is a very strong labor market.”

...

“I wouldn’t take, you know, moving at consecutive meetings off the table,” he said during an exchange moderated by CNBC’s Sara Eisen