by Calculated Risk on 7/05/2023 02:00:00 PM

Wednesday, July 05, 2023

FOMC Minutes: Staff Predicts Mild Recession; Additional Increases in Fed Funds Rate "Appropriate"

From the Fed: Minutes of the Federal Open Market Committee, June 13-14, 2023. Excerpt:

The economic forecast prepared by the staff for the June FOMC meeting continued to assume that the effects of the expected further tightening in bank credit conditions, amid already tight financial conditions, would lead to a mild recession starting later this year, followed by a moderately paced recovery. Real GDP was projected to decelerate in the current quarter and the next one before declining modestly in both the fourth quarter of this year and first quarter of next year. Real GDP growth over 2024 and 2025 was projected to be below the staff's estimate of potential output growth. The unemployment rate was forecast to increase this year, peak next year, and remain near that level through 2025. Current tight resource utilization in both product and labor markets was forecast to ease, with the level of real output moving below the staff's estimate of potential output in 2025 and the unemployment rate rising above the staff's estimate of its natural rate at that time.

The staff's inflation forecast was little revised relative to the previous projection, and supply–demand imbalances in both goods markets and labor markets were still judged to be easing only slowly. On a four-quarter change basis, total PCE price inflation was projected to be 3.0 percent this year, with core inflation at 3.7 percent. Core goods inflation was forecast to move down further this year and then remain subdued. Housing services inflation was considered to have about peaked and was expected to move down over the rest of the year. Core nonhousing services inflation was projected to slow gradually as nominal wage growth eased further. Reflecting the effects of the easing in resource utilization over the projection, core inflation was forecast to slow through next year but remain moderately above 2 percent. With expected declines in consumer energy prices and further moderation in food price inflation, total inflation was projected to run below core inflation this year and the next. In 2025, both total and core PCE price inflation were expected to be close to 2 percent.

The staff continued to judge that uncertainty around the baseline projection was considerable and still viewed the risks as being influenced importantly by the potential macroeconomic implications of banking-sector developments, which could end up being more, or less, negative than assumed in the baseline. Given the continued strength in labor market conditions and the resilience of consumer spending, however, the staff saw the possibility of the economy continuing to grow slowly and avoiding a downturn as almost as likely as the mild‑recession baseline. On balance, the staff saw the risks around the baseline inflation forecast as tilted to the upside, as economic scenarios with higher inflation appeared more likely than scenarios with lower inflation and because inflation could continue to be more persistent than expected and inflation expectations could become unanchored after a long period of elevated inflation.

...

In discussing the policy outlook, all participants continued to anticipate that, with inflation still well above the Committee's 2 percent goal and the labor market remaining very tight, maintaining a restrictive stance for monetary policy would be appropriate to achieve the Committee's objectives. Almost all participants noted that in their economic projections that they judged that additional increases in the target federal funds rate during 2023 would be appropriate. Most participants observed that uncertainty about the outlook for the economy and inflation remained elevated and that additional information would be valuable for considering the appropriate stance of monetary policy. Many also noted that, after rapidly tightening the stance of monetary policy last year, the Committee had slowed the pace of tightening and that a further moderation in the pace of policy firming was appropriate in order to provide additional time to observe the effects of cumulative tightening and assess their implications for policy. Participants agreed that their policy decisions at every meeting would continue to be based on the totality of incoming information and its implications for the economic outlook as well as the balance of risks. They also emphasized the importance of communicating to the public their data-dependent approach. Most participants observed that postmeeting communications, including the SEP, would help clarify their assessment regarding the stance of monetary policy that is likely to be appropriate to bring inflation down to 2 percent over time.

Participants also discussed several risk-management considerations that could bear on future policy decisions. Almost all participants stated that, with inflation still well above the Committee's longer-run goal and the labor market remaining tight, upside risks to the inflation outlook or the possibility that persistently high inflation might cause inflation expectations to become unanchored remained key factors shaping the policy outlook. Even though economic activity had been resilient recently and that the labor market remained strong, some participants commented that there continued to be downside risks to economic growth and upside risks to unemployment. Despite the receding of the stresses in the banking sector, some participants commented that it would be important to monitor whether developments in the banking sector lead to further tightening of credit conditions and weigh on economic activity. Some participants noted concerns about the potential risks stemming from weakness in commercial real estate.

emphasis added

Asking Rent Growth Flat Year-over-year

by Calculated Risk on 7/05/2023 08:34:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Asking Rent Growth Flat Year-over-year

A brief excerpt:

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The surge in household formation has been confirmed (mostly due to work-from-home), and this also led to the supposition that household formation would slow sharply in 2023 (mostly confirmed) and that asking rents might decrease in 2023 on a year-over-year basis (now flat year-over-year).

...

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through May 2023, except CoreLogic is through April and Apartment List is through June 2023.

...

The CoreLogic measure is up 3.7% YoY in April, down from 4.3% in March, and down from a peak of 13.9% in April 2022.

The Zillow measure is up 4.8% YoY in May, down from 5.3% YoY in April, and down from a peak of 17.0% YoY in February 2022.

The ApartmentList measure is flat at 0.0% YoY as of June, down from 1.0% YoY in May, and down from a peak of 18.2% YoY November 2021.

...

With slow household formation, more supply comes on the market and a rising vacancy rate, rents will be under pressure all year. Although asking rents increased in June according to ApartmentList, “rent growth is gradually declining at a time of the year when it’s normally picking up steam”.

Since rents increased sharply last year in July, asking rents will likely be down YoY in the next ApartmentList report.

Tuesday, July 04, 2023

Wednesday: FOMC Minutes

by Calculated Risk on 7/04/2023 09:46:00 PM

NOTE: The MBA Mortgage Applications Index will be released on Thursday this week due to the holiday.

Wednesday:

• At 2:00 PM ET, FOMC Minutes, Meeting of June 13-14, 2023

Monday, July 03, 2023

Housing Inventory and Demographics: The Next Big Shift

by Calculated Risk on 7/03/2023 02:10:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Housing Inventory and Demographics: The Next Big Shift

A brief excerpt:

In 2021 I wrote Housing and Demographics: The Next Big Shift. In that article I reviewed how demographics had helped me call the apartment boom in the early 2010s, and the home buying boom in 2020.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

I also noted:No cohort is monolithic - some people will age-in-place until they pass away, others will move in with family (or family will move in with their parents), and some will move to retirement communities.

There is no magic age that people reach and start to transition, but looking at prior generations, it seems to start when people are around 80 years old.This graph shows the longer term trend for two key age groups: 60 to 79, and 80+.Now the leading edge of the Baby Boom generation is 77. My view is we will see a pickup in downsizing later this decade, but mostly this will be a 2030s story.

This graph is from 2010 to 2060 (all data from Census: current to 2060 is projected).

The leading edge of the Baby Boom generation is currently 75 (born in 1946), and these people will be turning 80 in 2026.

The peak of the boomers will be turning 80 in 2035 or so, and the tail end turning 80 in 2044 (born in 1964).

My sense is there will be a pickup in Boomers selling their homes in the 2nd half of the 2020s and lasting until 2040 or so. These homes will be older - and most will need updating - but many of these homes will be in prime locations.

Construction Spending Increased 0.9% in May

by Calculated Risk on 7/03/2023 10:17:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during May 2023 was estimated at a seasonally adjusted annual rate of $1,925.6 billion, 0.9 percent above the revised April estimate of $1,909.0 billion. The May figure is 2.4 percent above the May 2022 estimate of $1,880.9 billion.Both private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,513.2 billion, 1.1 percent above the revised April estimate of $1,497.2 billion. ...

In May, the estimated seasonally adjusted annual rate of public construction spending was $412.4 billion, 0.1 percent above the revised April estimate of $411.8 billion.

Click on graph for larger image.

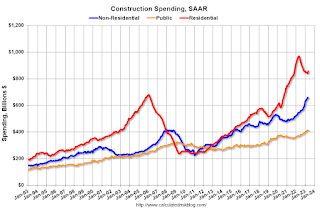

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 11.6% below the recent peak.

Non-residential (blue) spending is close to the peak in April 2023.

Public construction spending is at a new peak.

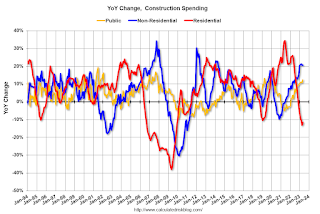

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 11.6%. Non-residential spending is up 20.5% year-over-year. Public spending is up 12.3% year-over-year.

ISM® Manufacturing index Decreased to 46.0% in June

by Calculated Risk on 7/03/2023 10:04:00 AM

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 46.0% in June, down from 46.9% in May. The employment index was at 48.1%, down from 51.4% the previous month, and the new orders index was at 45.6%, up from 42.6%.

From ISM: Manufacturing PMI® at 46%

June 2023 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in June for the eighth consecutive month following a 28-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in June. This was below the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The June Manufacturing PMI® registered 46 percent, 0.9 percentage point lower than the 46.9 percent recorded in May. Regarding the overall economy, this figure indicates a seventh month of contraction after a 30-month period of expansion. The New Orders Index remained in contraction territory at 45.6 percent, 3 percentage points higher than the figure of 42.6 percent recorded in May. The Production Index reading of 46.7 percent is a 4.4-percentage point decrease compared to May’s figure of 51.1 percent. The Prices Index registered 41.8 percent, down 2.4 percentage points compared to the May figure of 44.2 percent. The Backlog of Orders Index registered 38.7 percent, 1.2 percentage points higher than the May reading of 37.5 percent. The Employment Index dropped into contraction, registering 48.1 percent, down 3.3 percentage points from May’s reading of 51.4 percent.”

emphasis added

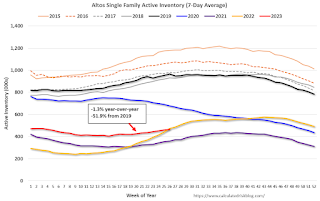

Housing July 3rd Weekly Update: Inventory Increased 1.3% Week-over-week; Down Year-over-year

by Calculated Risk on 7/03/2023 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, July 02, 2023

Sunday Night Futures

by Calculated Risk on 7/02/2023 07:48:00 PM

Weekend:

• Schedule for Week of July 2, 2023

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for June. The consensus is for the ISM to be at 47.2, up from 46.9 in May.

• Also, at 10:00 AM, Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

• Late in the day, Light vehicle sales for June. The consensus is for light vehicle sales to be 15.3 million SAAR in June, up from 15.1 million in May (Seasonally Adjusted Annual Rate). Wards Auto is forecasting sales of 15.9 million SAAR in June.

• US markets will close at 1:00 PM ET prior to the Independence Day Holiday.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are unchanged (fair value).

Oil prices were up over the last week with WTI futures at $70.64 per barrel and Brent at $75.41 per barrel. A year ago, WTI was at $110, and Brent was at $119 - so WTI oil prices are down about 36% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.50 per gallon. A year ago, prices were at $4.81 per gallon, so gasoline prices are down $1.31 per gallon year-over-year.

Update: Lumber Prices Down About 35% YoY

by Calculated Risk on 7/02/2023 08:21:00 AM

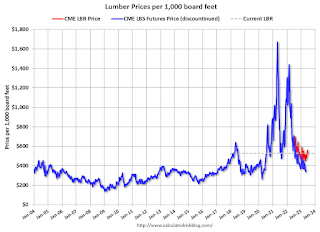

This graph shows CME random length framing futures through May 16th (blue), and the new physically-delivered Lumber Futures (LBR) contract starting in August 2022 (Red).

Click on graph for larger image.

Click on graph for larger image.We didn't see a significant runup in prices this Spring due to the housing slowdown.

Saturday, July 01, 2023

Real Estate Newsletter Articles this Week: New Home Sales Increase in May

by Calculated Risk on 7/01/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales increase to 763,000 Annual Rate in May

• Case-Shiller: National House Price Index Decreased 0.2% year-over-year in April

• Inflation Adjusted House Prices 3.8% Below Peak

• Fannie and Freddie Serious Delinquencies in May: Single Family Declined, Multi-Family Increased

• Freddie Mac House Price Index Increased Slightly in May; Up 0.4% Year-over-year

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!