by Calculated Risk on 7/06/2023 08:38:00 PM

Thursday, July 06, 2023

Friday: Employment Report

Friday:

• At 8:30 AM ET, Employment Report for June. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

June Employment Preview

by Calculated Risk on 7/06/2023 05:45:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for June. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

From BofA economists:

"Nonfarm payrolls likely rose by 250k in June after adding 339k jobs in May. ... Given our forecasts of the participation rate and nonfarm payroll growth, we expect the unemployment rate will fall from 3.7% to 3.6%."From Goldman Sachs following the strong ADP report:

We estimate nonfarm payrolls rose by 250k in June (mom sa). Job growth tends to pick up in June when the labor market is tight—reflecting strong hiring of youth summer workers ... We estimate the unemployment rate pulled back by one tenth to 3.6% (consensus also 3.6%) reflecting a rise in household employment and unchanged labor force participation at 62.6%.• ADP Report: The ADP employment report showed 497,000 private sector jobs were added in June. This suggests job gains well above consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in June to 48.1%, down from 51.4% last month. This would suggest about 30,000 jobs lost in manufacturing. The ADP report indicated 42,000 manufacturing jobs lost in May.

The ISM® services employment index increased in June to 53.1%, up from 49.2% last month. This would suggest about 160,000 jobs added in the service sector. Combined this suggests job gains of 120,000, well below consensus expectations.

• Unemployment Claims: The weekly claims report showed a sharp increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 246,000 in May to 265,000 in June. This suggests more layoffs in June than in May.

Early Look at Local Housing Markets in June

by Calculated Risk on 7/06/2023 02:56:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Early Look at Local Housing Markets in June

A brief excerpt:

This is a look at a few early reporting local markets in May. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

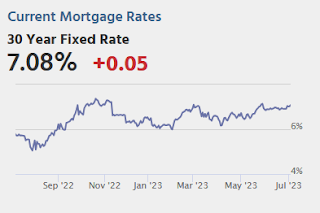

Closed sales in June were mostly for contracts signed in April and May. Since 30-year fixed mortgage rates were in the 6.4% range in April and May - compared to the 5% range the previous year - closed sales were down year-over-year in June.

...

In June, sales in these markets were down 20.4%. In May, these same markets were down 24.7% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in May for these early reporting markets. Note that there were the same number of selling days each year in June 2022 and June 2023.

A key factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates. ...

This was a just a few early reporting markets. Many more local markets to come!

BLS: Job Openings Decreased to 9.8 million in May

by Calculated Risk on 7/06/2023 10:05:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings decreased to 9.8 million on the last business day of May, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations were little changed at 6.2 million and 5.9 million, respectively. Within separations, quits (4.0 million) increased, while layoffs and discharges (1.6 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May the employment report this Friday will be for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in May to 9.8 million from 10.3 million in April.

The number of job openings (black) were down 14% year-over-year.

Quits were down 5% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Trade Deficit Decreased to $69.0 Billion in May

by Calculated Risk on 7/06/2023 08:47:00 AM

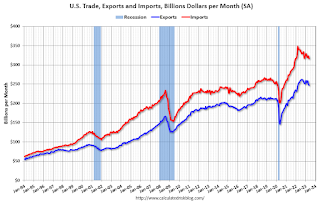

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $69.0 billion in May, down $5.5 billion from $74.4 billion in April, revised.

May exports were $247.1 billion, $2.1 billion less than April exports. May imports were $316.1 billion, $7.5 billion less than April imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports and imports decreased in May.

Exports are down 3% year-over-year; imports are down 7% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - and both have been decreasing recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have picked up.

The trade deficit with China decreased to $25.2 billion in March, from $31.5 billion a year ago.

Weekly Initial Unemployment Claims Increase to 248,000

by Calculated Risk on 7/06/2023 08:34:00 AM

The DOL reported:

In the week ending July 1, the advance figure for seasonally adjusted initial claims was 248,000, an increase of 12,000 from the previous week's revised level. The previous week's level was revised down by 3,000 from 239,000 to 236,000. The 4-week moving average was 253,250, a decrease of 3,500 from the previous week's revised average. The previous week's average was revised down by 750 from 257,500 to 256,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 253,250.

The previous week was revised down.

Weekly claims were above the consensus forecast.

ADP: Private Employment Increased 497,000 in June

by Calculated Risk on 7/06/2023 08:25:00 AM

Private sector employment increased by 497,000 jobs in June and annual pay was up 6.4 percent year-over-year, according to the June ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”).This was way above the consensus forecast of 236,000. The BLS report will be released Friday, and the consensus is for 200 thousand non-farm payroll jobs added in June.

...

“Consumer-facing service industries had a strong June, aligning to push job creation higher than expected,” said Nela Richardson, chief economist, ADP. “But wage growth continues to ebb in these same industries, and hiring likely is cresting after a late-cycle surge.”

emphasis added

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 7/06/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 30, 2023. Last week’s results included an adjustment for the Juneteenth holiday.

The Market Composite Index, a measure of mortgage loan application volume, decreased 4.4 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 6 percent compared with the previous week. The Refinance Index decreased 4 percent from the previous week and was 30 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index increased 6 percent compared with the previous week and was 22 percent lower than the same week one year ago.

“Mortgage applications fell to their lowest level in a month last week as rates for most loan types increased. As mortgage-Treasury spreads remained wide, the 30-year fixed rate increased to 6.85 percent, the highest rate since the end of May,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications decreased for the first time in a month, as homebuyers remained sensitive to rate changes. Rates are still over a percentage point higher than a year ago, and housing affordability is still a challenge in many parts of the country. However, the average loan size for a purchase application declined to $423,500 – its lowest level since January 2023. This was likely driven by reduced purchase activity in some high-price markets and more activity in some of the lower price tiers as buyers searched for more affordable options.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.85 percent from 6.75 percent, with points increasing to 0.65 from 0.64 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 22% year-over-year unadjusted.

Wednesday, July 05, 2023

Thursday: Unemployment Claims, ADP Employment, Trade Deficit, Job Openings and More

by Calculated Risk on 7/05/2023 08:58:00 PM

Thursday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 236,000 payroll jobs added in June, down from 278,000 in May.

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 245 thousand initial claims, up from 239 thousand last week.

• Also, at 8:30 AM: Trade Balance report for May from the Census Bureau. The consensus is the trade deficit will be $69.8 billion.

• At 10:00 AM ET: Job Openings and Labor Turnover Survey for May from the BLS.

• Also, at 10:00 AM: the ISM Services Index for June. The consensus is for a reading of 50.5, up from 50.3.

Vehicles Sales at 15.68 million SAAR in June; Up 20% YoY

by Calculated Risk on 7/05/2023 05:01:00 PM

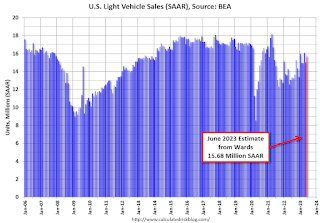

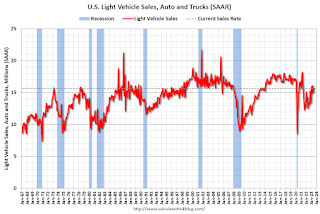

Wards Auto released their estimate of light vehicle sales for June: U.S. Light-Vehicle Sales End First-Half 2023 on Solid Note as June, Q2 Record Double-Digit Growth (pay site).

With second-quarter results finishing 18% above the same period last year, first-half 2023 volume totaled 7.66 million units, a 13% increase on January-June 2022. Sales are forecast to rise 11% year-over-year to 7.72 million units in the second half, and Wards Intelligence partner GlobalData is pegging entire-2023 at 15.4 million units.Wards Auto estimates sales of 15.68 million SAAR in June 2023 (Seasonally Adjusted Annual Rate), up 4.2% from the May sales rate, and up 20.2% from May 2022.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for June (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic). However, sales decreased in 2021 due to supply issues. The "supply chain bottom" was in September 2021.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Sales in June were above the consensus forecast.