by Calculated Risk on 7/07/2023 08:59:00 PM

Friday, July 07, 2023

July 7th COVID Update: New Pandemic Lows for Deaths and Hospitalizations

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 5,758 | 6,233 | ≤3,0001 | |

| Deaths per Week2 | 515 | 568 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Q2 GDP Tracking: Around 2%

by Calculated Risk on 7/07/2023 05:12:00 PM

From BofA:

Overall, data since our last weekly publication moved down our 2Q GDP tracking estimate from 1.5% q/q saar to 1.4%. [July 7th estimate]From Goldman:

emphasis added

The details of the trade balance report were slightly softer than our previous assumptions, and we lowered our Q2 GDP tracking estimate by one tenth to +2.2% (qoq ar). [July 6th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2023 is 2.1 percent on July 6, up from 1.9 percent on July 3. [July 6th estimate]

AAR: June Rail Carloads and Intermodal Decreased Year-over-year

by Calculated Risk on 7/07/2023 03:47:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Total originated carloads on U.S. railroads were down 0.2% in June 2023 from June 2022, their first decline in three months. Total carloads in 2023 through June (5.84 million) were up 0.6% (32,547( carloads) over the same period in 2022 and were the highest since 2019.

U.S. intermodal volumes fell again in June — their 7.0% decline from June 2022 was their 16th straight. That said, U.S. railroads originated an average of 247,192 containers and trailers per week in June 2023, the most since October 2022.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2021, 2022 and 2022:

Total originated carloads (which don’t include intermodal) on U.S. railroads in June 2023 were down 0.2% from June 2022, their first decline in three months. In June, 11 of the 20 carload categories we track had carload gains ... Total carloads averaged 225,849 per week in June 2023. Except for December 2022, weekly average total carloads have fluctuated within a relatively narrow band for the past year.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):U.S. intermodal was down 10.3% in Q2 2023 from Q2 2022 (their eighth straight quarterly decline) and also down 10.3% (698,375 units) for the year to date. Volume was 6.11 million units in the first six months of 2023, the fewest for the first six months of a year since 2013.

Intermodal’s decline is a function of a number of factors, including reduced consumer spending on goods, sharply lower port activity, a lack of inventory growth at retailers, and lower truck rates that are making all-truck movements more price competitive vis-à-vis rail intermodal movements.

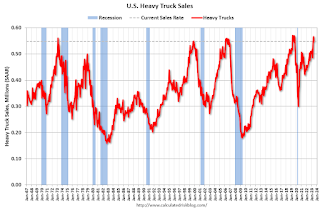

Heavy Truck Sales Up 15% Year-over-year in June

by Calculated Risk on 7/07/2023 01:31:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the June 2023 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

Comments on June Employment Report

by Calculated Risk on 7/07/2023 10:23:00 AM

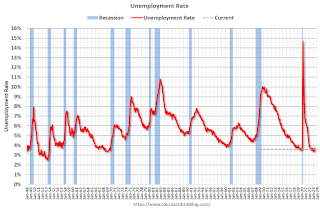

The headline jobs number in the June employment report was at expectations, however, employment for the previous two months was revised down by 110,000, combined. The participation rate and the employment population ratio were unchanged, and the unemployment rate decreased to 3.6%.

In June, the year-over-year employment change was 3.79 million jobs.

Prime (25 to 54 Years Old) Participation

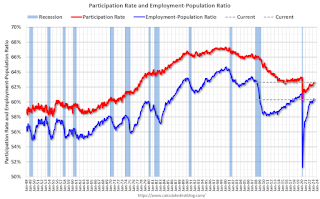

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate increased in June to 83.5% from 83.4% in May, and the 25 to 54 employment population ratio increased to 80.9% from 80.7% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.4% YoY in June.

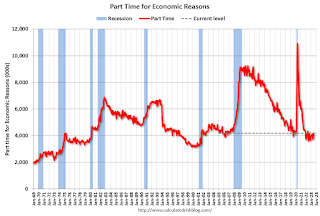

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons increased by 452,000 to 4.2 million in June, partially reflecting an increase in the number of persons whose hours were cut due to slack work or business conditions. Persons employed part time for economic reasons are individuals who would have preferred full-time employment but were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in June to 4.191 million from 3.739 million in May. This is below pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 6.9% from 6.7% in the previous month. This is down from the record high in April 22.9% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is below the 7.0% level in February 2020 (pre-pandemic).

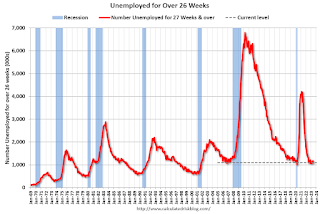

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.105 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.188 million the previous month.

This is at pre-pandemic levels.

Summary:

The headline monthly jobs number was at expectations; however, employment for the previous two months was revised down by 110,000, combined.

June Employment Report: 209 thousand Jobs, 3.6% Unemployment Rate

by Calculated Risk on 7/07/2023 08:40:00 AM

From the BLS:

Total nonfarm payroll employment increased by 209,000 in June, and the unemployment rate changed little at 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in government, health care, social assistance, and construction.

...

The change in total nonfarm payroll employment for April was revised down by 77,000, from +294,000 to +217,000, and the change for May was revised down by 33,000, from +339,000 to +306,000. With these revisions, employment in April and May combined is 110,000 lower than previously reported.

emphasis added

Click on graph for larger image.

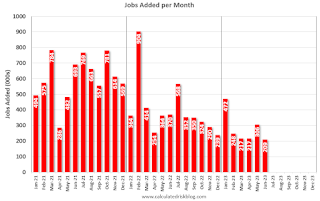

Click on graph for larger image.The first graph shows the jobs added per month since January 2021.

Payrolls for April and May were revised down 110 thousand, combined.

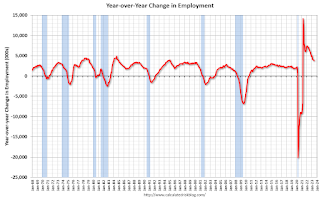

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In June, the year-over-year change was 3.79 million jobs. Employment was up significantly year-over-year.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 62.6% in June, from 62.6% in May. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was unchanged at 62.6% in June, from 62.6% in May. This is the percentage of the working age population in the labor force. The Employment-Population ratio was unchanged at 60.3% from 60.3% (blue line).I'll have more later ...

Thursday, July 06, 2023

Friday: Employment Report

by Calculated Risk on 7/06/2023 08:38:00 PM

Friday:

• At 8:30 AM ET, Employment Report for June. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

June Employment Preview

by Calculated Risk on 7/06/2023 05:45:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for June. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

From BofA economists:

"Nonfarm payrolls likely rose by 250k in June after adding 339k jobs in May. ... Given our forecasts of the participation rate and nonfarm payroll growth, we expect the unemployment rate will fall from 3.7% to 3.6%."From Goldman Sachs following the strong ADP report:

We estimate nonfarm payrolls rose by 250k in June (mom sa). Job growth tends to pick up in June when the labor market is tight—reflecting strong hiring of youth summer workers ... We estimate the unemployment rate pulled back by one tenth to 3.6% (consensus also 3.6%) reflecting a rise in household employment and unchanged labor force participation at 62.6%.• ADP Report: The ADP employment report showed 497,000 private sector jobs were added in June. This suggests job gains well above consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in June to 48.1%, down from 51.4% last month. This would suggest about 30,000 jobs lost in manufacturing. The ADP report indicated 42,000 manufacturing jobs lost in May.

The ISM® services employment index increased in June to 53.1%, up from 49.2% last month. This would suggest about 160,000 jobs added in the service sector. Combined this suggests job gains of 120,000, well below consensus expectations.

• Unemployment Claims: The weekly claims report showed a sharp increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 246,000 in May to 265,000 in June. This suggests more layoffs in June than in May.

Early Look at Local Housing Markets in June

by Calculated Risk on 7/06/2023 02:56:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Early Look at Local Housing Markets in June

A brief excerpt:

This is a look at a few early reporting local markets in May. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in June were mostly for contracts signed in April and May. Since 30-year fixed mortgage rates were in the 6.4% range in April and May - compared to the 5% range the previous year - closed sales were down year-over-year in June.

...

In June, sales in these markets were down 20.4%. In May, these same markets were down 24.7% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in May for these early reporting markets. Note that there were the same number of selling days each year in June 2022 and June 2023.

A key factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates. ...

This was a just a few early reporting markets. Many more local markets to come!

BLS: Job Openings Decreased to 9.8 million in May

by Calculated Risk on 7/06/2023 10:05:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings decreased to 9.8 million on the last business day of May, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations were little changed at 6.2 million and 5.9 million, respectively. Within separations, quits (4.0 million) increased, while layoffs and discharges (1.6 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May the employment report this Friday will be for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in May to 9.8 million from 10.3 million in April.

The number of job openings (black) were down 14% year-over-year.

Quits were down 5% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").