by Calculated Risk on 7/10/2023 10:47:00 AM

Monday, July 10, 2023

Black Knight Mortgage Monitor: Home Prices Increased Month-to-month to New Record High in May

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: Home Prices Increased Month-to-month to New Record High in May

A brief excerpt:

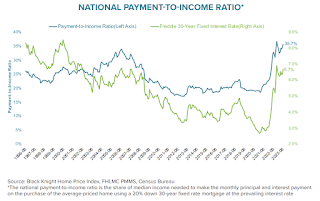

National Payment to Income Ratio Increased to Near RecordThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This was as of June 22nd when mortgage rates (according to the Freddie Mac PMMS), were at 6.67%. Rates have increased since then, and it is likely the payment-to-income ratio is now at a new record high.

Black Knight on the payment to income ratio:

• After a modest improvement in early 2023, home affordability has worsened in recent months fueled by both rising home prices and rising interest rates

• As of June 22, with 30-year rates at 6.67%, it required $2,258 per month in principal and interest to make the monthly payment on a median-priced home with 20% down and a 30-year mortgage, the highest such payment on record, marginally higher than the $2,234 required back in October

• Factoring in current income levels, that means 35.7% of the median household income would need to be allocated to the monthly payment of a median-priced home, making June the second least affordable month in the past 37 years

emphasis added

Wholesale Used Car Prices Decreased 4.2% in June; Down 10.3% Year-over-year

by Calculated Risk on 7/10/2023 09:55:00 AM

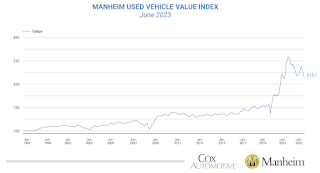

From Manheim Consulting today: Wholesale Used-Vehicle Prices See Large Decline in June

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 4.2% in June from May. The Manheim Used Vehicle Value Index (MUVVI) declined to 215.1, down 10.3% from a year ago.

“The 4.2% drop is among the largest declines in MUVVI history and the largest decline since the start of the pandemic in April 2020 when the index plunged 11.4%,” said Chris Frey, senior manager of Economic and Industry Insights for Cox Automotive. “The year-over-year decline was also large, another 2.7% drop from May’s annualized 7.6% decline, but as mentioned last month, auction prices were lower in the fall last year, and we expect these increasing year-over-year moves to shrink in the months ahead as the market normalizes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Housing July 10th Weekly Update: Inventory Decreased 0.2% Week-over-week; Down 4.6% Year-over-year

by Calculated Risk on 7/10/2023 08:21:00 AM

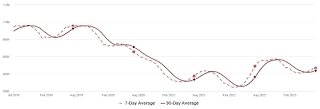

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, July 09, 2023

Sunday Night Futures

by Calculated Risk on 7/09/2023 08:50:00 PM

• Schedule for Week of July 9, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $73.51 per barrel and Brent at $78.13 per barrel. A year ago, WTI was at $107, and Brent was at $114 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.50 per gallon. A year ago, prices were at $4.68 per gallon, so gasoline prices are down $1.18 per gallon year-over-year.

Hotels: Occupancy Rate Up 4.1% Year-over-year

by Calculated Risk on 7/09/2023 02:12:00 PM

U.S. hotel performance fell from the previous week, but year-over-year comparisons improved, according to STR‘s latest data through 1 July.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

25 June through 1 July 2023 (percentage change from comparable week in 2022):

• Occupancy: 69.9% (+4.1%)

• Average daily rate (ADR): US$156.27 (+1.5%)

• Revenue per available room (RevPAR): US$109.18 (+5.7%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Realtor.com Reports Weekly Active Inventory Down 2% YoY; New Listings Down 21% YoY

by Calculated Risk on 7/09/2023 08:12:00 AM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from economist Danielle Hale: Weekly Housing Trends View — Data Week Ending July 1, 2023

• Active inventory declined, with for-sale homes lagging behind year ago levels by 2%. As we lap the surge in inventory that occurred in 2022 as higher mortgage rates priced out many home shoppers, the number of homes for sale is not keeping up. With 1 in 7 homeowners choosing not to sell this year citing high mortgage rates, and even 4 in 5 home shoppers (82%) report feeling locked-in by their existing low-rate mortgage, the housing market is not getting the influx of homes for sale that it typically does, and this is reflected in what’s available for sale. We expect inventory in 2023 to continue to struggle to keep pace and likely decline for the year as a whole.

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 21% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 52 weeks–an entire year. And this week’s data shows a more modest gap than the prior two weeks, but it’s still on par with what has been typical year-to-date. The economy continues to be relatively resilient despite higher interest rates which have dampened homeowner interest in selling. The lack of existing inventory has led to a stronger market for new home sales.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 2.1% year-over-year - this was the second consecutive YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

Saturday, July 08, 2023

Real Estate Newsletter Articles this Week: Asking Rent Growth Flat Year-over-year

by Calculated Risk on 7/08/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Asking Rent Growth Flat Year-over-year

• Early Look at Local Housing Markets in June

• Housing Inventory and Demographics: The Next Big Shift

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of July 9, 2023

by Calculated Risk on 7/08/2023 08:11:00 AM

The key report this week is June CPI.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for June.

8:00 AM: Corelogic House Price index for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for June from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 3.0% year-over-year and core CPI to be up 5.0% YoY.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 245 thousand initial claims, down from 248 thousand last week.

8:30 AM: The Producer Price Index for June from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for July).

Friday, July 07, 2023

July 7th COVID Update: New Pandemic Lows for Deaths and Hospitalizations

by Calculated Risk on 7/07/2023 08:59:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 5,758 | 6,233 | ≤3,0001 | |

| Deaths per Week2 | 515 | 568 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Q2 GDP Tracking: Around 2%

by Calculated Risk on 7/07/2023 05:12:00 PM

From BofA:

Overall, data since our last weekly publication moved down our 2Q GDP tracking estimate from 1.5% q/q saar to 1.4%. [July 7th estimate]From Goldman:

emphasis added

The details of the trade balance report were slightly softer than our previous assumptions, and we lowered our Q2 GDP tracking estimate by one tenth to +2.2% (qoq ar). [July 6th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2023 is 2.1 percent on July 6, up from 1.9 percent on July 3. [July 6th estimate]