by Calculated Risk on 7/11/2023 01:55:00 PM

Tuesday, July 11, 2023

Leading Index for Commercial Real Estate Decreased in June

From Dodge Data Analytics: Decline in Institutional Planning Drops Dodge Momentum Index Down 3% in June

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, declined 2.5% in June to 197.3 (2000=100) from the revised May reading of 202.4. Over the month, the commercial component of the DMI rose 3.1%, while the institutional component sunk 10.5%.

“A deceleration in institutional planning caused the Momentum Index to decrease in June,” said Sarah Martin, associate director of forecasting for Dodge Construction Network. “Project activity in this segment pulled back from the robust highs of the last three months but continued to dwarf year-ago levels. In contrast, growth in the commercial segment may be fleeting, as the continued elevation in interest rates and increasingly tight lending standards weigh down the sector in the latter half of the year.”

Commercial planning in June remained afloat alongside an uptick in data center and hotel planning projects. Institutional planning, on the other hand, was driven lower by a decrease in education and healthcare activity. Year over year, the DMI remains 25% higher than in June 2022. The commercial and institutional components were up 17% and 39% respectively.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 197.3 in June, down from 202.4 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests some slowdown towards the end of 2023 or in 2024.

2nd Look at Local Housing Markets in June

by Calculated Risk on 7/11/2023 09:39:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in June

A brief excerpt:

This is the second look at local markets in June. I’m tracking a sample of about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in June were mostly for contracts signed in April and May. Since 30-year fixed mortgage rates were in the 6.4% range in April and May - compared to the 5% range the previous year - closed sales were down year-over-year in June.

...

In June, sales in these markets were down 17.3%. In May, these same markets were down 19.1% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in May for these markets. Note that there were the same number of selling days each year in June 2022 and June 2023.

A key factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates. ...

This sample data suggests the June existing home sales report will show another significant YoY decline - and probably at or below the May sales rate of 4.3 million (SAAR) - and the 22nd consecutive month with a YoY decline in sales.

...

Many more local markets to come!

CoreLogic: US Annual Home Price Growth Drops to the Lowest Rate in 11 Years in May

by Calculated Risk on 7/11/2023 08:00:00 AM

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic: US Annual Home Price Growth Drops to the Lowest Rate in 11 Years in May

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for May 2023.This index was up 2.0% YoY in April.

Annual U.S. single-family home price growth slowed for the 12th straight month in May, falling to 1.4% increase year over year. The last time CoreLogic’s Home Price index saw annual growth fall to less than 2% was in early 2012, but U.S. appreciation still remained positive for the 136th straight month in May.

Following recent trends, a significant number of Western states saw prices decline in May from the same time in 2022, reflecting out-migration from less-urban locations where people moved during the height of the pandemic and the significant loss of affordability due to those resulting home price surges. Northeastern states and Southeastern metro areas continue to see larger home price gains compared with other areas of the country, due to both workers slowly moving back to job centers in some areas of the country and settling in relatively affordable places in others.

“After peaking in the spring of 2022, annual home price deceleration continued in May,” said Selma Hepp, chief economist at CoreLogic. “Despite slowing year-over-year price growth, the recent momentum in monthly price gains continues in the face of recent mortgage rates increases.”

“Nevertheless, following a cumulative increase of almost 4% in home prices between February and April of 2023, “Hepp continued, “elevated mortgage rates and high home prices are putting pressure on potential buyers. These dynamics are cooling recent month-over-month home price growth, which began to taper and is returning to the pre-pandemic average, with a 0.9% increase from April to May.”

...

U.S. home prices (including distressed sales) increased by 1.4% year over year in May 2023 compared with May 2022. On a month-over-month basis, home prices increased by 0.9% compared with April 2023.

emphasis added

Monday, July 10, 2023

Tuesday: Corelogic House Price index

by Calculated Risk on 7/10/2023 08:51:00 PM

We've been here before--just a few months ago, but not for very long. Also, we haven't been much higher than this in more than 20 years. That said, many experts thought we might not be back here quite so soon--if at all during the same cycle. [30 year fixed 7.12%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for June.

• At 8:00 AM, Corelogic House Price index for May.

Second Home Market: South Lake Tahoe in June; Prices Down 6.8% YoY

by Calculated Risk on 7/10/2023 05:42:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

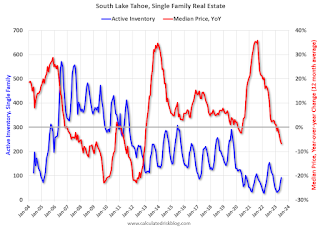

This graph is for South Lake Tahoe since 2004 through June 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently active inventory is still very low and is down 35% year-over-year.

Lawler: Update on Demographic Trends, and Population and Household Projections Through 2025

by Calculated Risk on 7/10/2023 01:35:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Update on Demographic Trends, and Population and Household Projections Through 2025

A brief excerpt:

Executive Summary: Higher Net International Migration (NIM) and lower deaths have improved the US “demographic” outlook, though population growth from 2022 to 2025 will still be historically on the low side – in part because of continued very low birth rates. Household growth, on the other hand, will likely be materially slower than the apparent very rapid growth following the pandemic, and will probably not be that different from the annual average growth experienced last decade.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The Census Bureau’s “Vintage 2022” population estimates suggested that the US resident population increased by 0.38% from July 1, 2021 to July 1, 2022, very low by historical standards but up from the 0.16% from the previous year. The uptick in growth reflected a modest increase in the number of births (from very low level) and a significant increase in estimate net international migration (from very low levels), offset by a slight increase in the number of deaths. (Note that CDC data suggest that the Vintage 2022 estimates for deaths over the 12-month period ending 6/20/2022 is understated by almost 20,000.).

Available data since July 1, 2022 suggest that (1) births over the 12-month period ending July 1, 2023 will probably be down very slightly from the year ago 12-month period; (2) deaths will be significantly lower over the 12-month period ending July 1, 2023 compared to the year ago 12-month period, mainly reflecting substantial declines in Covid related deaths; and (3) net international migration over the 12-month period ending July 1, 2023 should be higher than the year ago 12-month period.

...Translating all of this information into actual and projected household growth, however, is challenging given the lack of actual and timely historical data. Based on the limited data available, below are my “guesstimates” for household growth from 2020 to 2023, as well as my projections through 2025. In terms of headship rates, I assumed that headship rates by age gradually declined from 2022 to 2025, but that over that period the “reversal” in headship gains was only 30%. (Yes, I am aware that is arbitrary.). Also shown are what household growth would have been if headship rates by age had been unchanged from 2020 (I used Decennial Census data to derive 2020 headship rates, though that data may have issues.)

emphasis added

Black Knight Mortgage Monitor: Home Prices Increased Month-to-month to New Record High in May

by Calculated Risk on 7/10/2023 10:47:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: Home Prices Increased Month-to-month to New Record High in May

A brief excerpt:

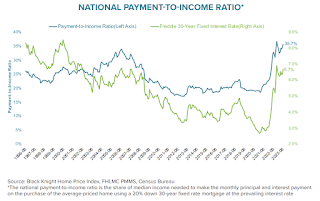

National Payment to Income Ratio Increased to Near RecordThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This was as of June 22nd when mortgage rates (according to the Freddie Mac PMMS), were at 6.67%. Rates have increased since then, and it is likely the payment-to-income ratio is now at a new record high.

Black Knight on the payment to income ratio:

• After a modest improvement in early 2023, home affordability has worsened in recent months fueled by both rising home prices and rising interest rates

• As of June 22, with 30-year rates at 6.67%, it required $2,258 per month in principal and interest to make the monthly payment on a median-priced home with 20% down and a 30-year mortgage, the highest such payment on record, marginally higher than the $2,234 required back in October

• Factoring in current income levels, that means 35.7% of the median household income would need to be allocated to the monthly payment of a median-priced home, making June the second least affordable month in the past 37 years

emphasis added

Wholesale Used Car Prices Decreased 4.2% in June; Down 10.3% Year-over-year

by Calculated Risk on 7/10/2023 09:55:00 AM

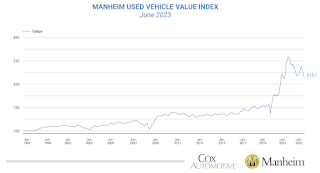

From Manheim Consulting today: Wholesale Used-Vehicle Prices See Large Decline in June

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 4.2% in June from May. The Manheim Used Vehicle Value Index (MUVVI) declined to 215.1, down 10.3% from a year ago.

“The 4.2% drop is among the largest declines in MUVVI history and the largest decline since the start of the pandemic in April 2020 when the index plunged 11.4%,” said Chris Frey, senior manager of Economic and Industry Insights for Cox Automotive. “The year-over-year decline was also large, another 2.7% drop from May’s annualized 7.6% decline, but as mentioned last month, auction prices were lower in the fall last year, and we expect these increasing year-over-year moves to shrink in the months ahead as the market normalizes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Housing July 10th Weekly Update: Inventory Decreased 0.2% Week-over-week; Down 4.6% Year-over-year

by Calculated Risk on 7/10/2023 08:21:00 AM

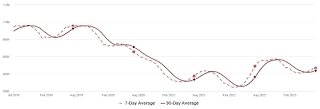

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, July 09, 2023

Sunday Night Futures

by Calculated Risk on 7/09/2023 08:50:00 PM

• Schedule for Week of July 9, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $73.51 per barrel and Brent at $78.13 per barrel. A year ago, WTI was at $107, and Brent was at $114 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.50 per gallon. A year ago, prices were at $4.68 per gallon, so gasoline prices are down $1.18 per gallon year-over-year.