by Calculated Risk on 7/12/2023 03:47:00 PM

Wednesday, July 12, 2023

Early Look at 2024 Cost-Of-Living Adjustments and Maximum Contribution Base

The BLS reported this morning:

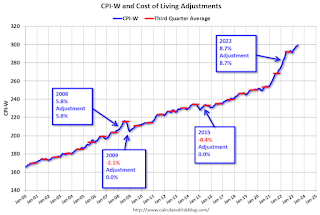

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 2.3 percent over the last 12 months to an index level of 299.394 (1982-84=100). For the month, the index increased 0.3 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U and is not seasonally adjusted (NSA).

• In 2022, the Q3 average of CPI-W was 291.901.

The 2022 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled is for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 2.3% year-over-year in June, and although this is early - we need the data for July, August and September - my very early guess is COLA will probably be close to 3% this year, the smallest increase since 1.3% in 2021.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one-year lag. The National Average Wage Index is not available for 2022 yet, wages increased solidly in 2022. If wages increased 5% in 2022, then the contribution base next year will increase to around $168,200 in 2024, from the current $160,200.

Remember - this is an early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

Cleveland Fed: Median CPI increased 0.1% and Trimmed-mean CPI increased 0.1% in June

by Calculated Risk on 7/12/2023 01:06:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% in June. The 16% trimmed-mean Consumer Price Index also increased 0.1% in June. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. "Motor Vehicle Insurance" increased at a 21% annualized rate in June.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 7/12/2023 08:59:00 AM

Here are a few measures of inflation:

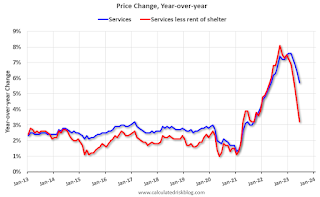

The first graph is the one Fed Chair Powell had been mentioning when services less rent of shelter was up 7.6% year-over-year. This has fallen sharply and is now up 3.2% YoY.

This graph shows the YoY price change for Services and Services less rent of shelter through June 2023.

Services less rent of shelter was up 3.2% YoY in June, down from 4.2% YoY in May.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were up 1.4% YoY in June, down from 2.0% YoY in May.

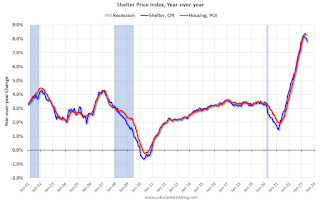

Here is a graph of the year-over-year change in shelter from the CPI report (through June) and housing from the PCE report (through May 2023)

Here is a graph of the year-over-year change in shelter from the CPI report (through June) and housing from the PCE report (through May 2023)Shelter was up 7.8% year-over-year in June, down from 8.0% in May. Housing (PCE) was up 8.3% YoY in May, down from 8.4% in April.

The BLS noted this morning: "The index for shelter was the largest contributor to the monthly all items increase, accounting for over 70 percent of the increase, with the index for motor vehicle insurance also contributing." Asking rent increases have slowed sharply, and these measures of shelter will continue to decline.

BLS: CPI increased 0.2% in June; Core CPI increased 0.2%

by Calculated Risk on 7/12/2023 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in June on a seasonally adjusted basis, after increasing 0.1 percent in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.0 percent before seasonal adjustment.CPI was as expectations and core CPI was lower than expected. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter was the largest contributor to the monthly all items increase, accounting for over 70 percent of the increase, with the index for motor vehicle insurance also contributing. The food index increased 0.1 percent in June after increasing 0.2 percent the previous month. The index for food at home was unchanged over the month while the index for food away from home rose 0.4 percent in June. The energy index rose 0.6 percent in June as the major energy component indexes were mixed.

The index for all items less food and energy rose 0.2 percent in June, the smallest 1-month increase in that index since August 2021. Indexes which increased in June include shelter, motor vehicle insurance, apparel, recreation, and personal care. The indexes for airline fares, communication, used cars and trucks, and household furnishings and operations were among those that decreased over the month.

The all items index increased 3.0 percent for the 12 months ending June; this was the smallest 12-month increase since the period ending March 2021. The all items less food and energy index rose 4.8 percent over the last 12 months. The energy index decreased 16.7 percent for the 12 months ending June, and the food index increased 5.7 percent over the last year.

emphasis added

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 7/12/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 7, 2023. This week’s results include an adjustment for the observance of Independence Day.

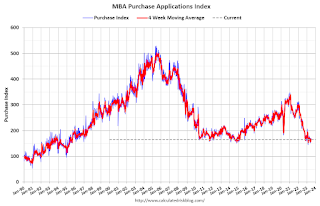

The Market Composite Index, a measure of mortgage loan application volume, increased 0.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 19 percent compared with the previous week. The Refinance Index decreased 1 percent from the previous week and was 39 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index decreased 19 percent compared with the previous week and was 26 percent lower than the same week one year ago.

“Incoming economic data continue to send mixed signals about the economy, with the overall impact leaving Treasury yields higher last week as markets expect that the Federal Reserve will need to hold rates higher for longer to slow inflation. All mortgage rates in our survey followed suit, with the 30-year fixed rate increasing to 7.07 percent, the highest level since November 2022,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The jumbo rate also increased to 7.04 percent, a record high for the jumbo series, which dates back to 2011.”

Added Kan, “Purchase applications increased, but remained at a very low level and are 26 percent lower than the same week last year. The rise in purchase activity was driven by increases in both FHA and VA purchase applications. The refinance index dropped to its lowest level since early June, as demand for rate/term and cash-out refinances remains extremely low with mortgage rates over 7 percent.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.07 percent from 6.85 percent, with points increasing to 0.74 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

emphasis added

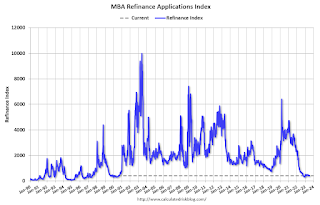

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 26% year-over-year unadjusted.

Tuesday, July 11, 2023

Wednesday: CPI, Beige Book

by Calculated Risk on 7/11/2023 08:41:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for June from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 3.0% year-over-year and core CPI to be up 5.0% YoY.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Leading Index for Commercial Real Estate Decreased in June

by Calculated Risk on 7/11/2023 01:55:00 PM

From Dodge Data Analytics: Decline in Institutional Planning Drops Dodge Momentum Index Down 3% in June

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, declined 2.5% in June to 197.3 (2000=100) from the revised May reading of 202.4. Over the month, the commercial component of the DMI rose 3.1%, while the institutional component sunk 10.5%.

“A deceleration in institutional planning caused the Momentum Index to decrease in June,” said Sarah Martin, associate director of forecasting for Dodge Construction Network. “Project activity in this segment pulled back from the robust highs of the last three months but continued to dwarf year-ago levels. In contrast, growth in the commercial segment may be fleeting, as the continued elevation in interest rates and increasingly tight lending standards weigh down the sector in the latter half of the year.”

Commercial planning in June remained afloat alongside an uptick in data center and hotel planning projects. Institutional planning, on the other hand, was driven lower by a decrease in education and healthcare activity. Year over year, the DMI remains 25% higher than in June 2022. The commercial and institutional components were up 17% and 39% respectively.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 197.3 in June, down from 202.4 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests some slowdown towards the end of 2023 or in 2024.

2nd Look at Local Housing Markets in June

by Calculated Risk on 7/11/2023 09:39:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in June

A brief excerpt:

This is the second look at local markets in June. I’m tracking a sample of about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in June were mostly for contracts signed in April and May. Since 30-year fixed mortgage rates were in the 6.4% range in April and May - compared to the 5% range the previous year - closed sales were down year-over-year in June.

...

In June, sales in these markets were down 17.3%. In May, these same markets were down 19.1% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in May for these markets. Note that there were the same number of selling days each year in June 2022 and June 2023.

A key factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates. ...

This sample data suggests the June existing home sales report will show another significant YoY decline - and probably at or below the May sales rate of 4.3 million (SAAR) - and the 22nd consecutive month with a YoY decline in sales.

...

Many more local markets to come!

CoreLogic: US Annual Home Price Growth Drops to the Lowest Rate in 11 Years in May

by Calculated Risk on 7/11/2023 08:00:00 AM

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic: US Annual Home Price Growth Drops to the Lowest Rate in 11 Years in May

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for May 2023.This index was up 2.0% YoY in April.

Annual U.S. single-family home price growth slowed for the 12th straight month in May, falling to 1.4% increase year over year. The last time CoreLogic’s Home Price index saw annual growth fall to less than 2% was in early 2012, but U.S. appreciation still remained positive for the 136th straight month in May.

Following recent trends, a significant number of Western states saw prices decline in May from the same time in 2022, reflecting out-migration from less-urban locations where people moved during the height of the pandemic and the significant loss of affordability due to those resulting home price surges. Northeastern states and Southeastern metro areas continue to see larger home price gains compared with other areas of the country, due to both workers slowly moving back to job centers in some areas of the country and settling in relatively affordable places in others.

“After peaking in the spring of 2022, annual home price deceleration continued in May,” said Selma Hepp, chief economist at CoreLogic. “Despite slowing year-over-year price growth, the recent momentum in monthly price gains continues in the face of recent mortgage rates increases.”

“Nevertheless, following a cumulative increase of almost 4% in home prices between February and April of 2023, “Hepp continued, “elevated mortgage rates and high home prices are putting pressure on potential buyers. These dynamics are cooling recent month-over-month home price growth, which began to taper and is returning to the pre-pandemic average, with a 0.9% increase from April to May.”

...

U.S. home prices (including distressed sales) increased by 1.4% year over year in May 2023 compared with May 2022. On a month-over-month basis, home prices increased by 0.9% compared with April 2023.

emphasis added

Monday, July 10, 2023

Tuesday: Corelogic House Price index

by Calculated Risk on 7/10/2023 08:51:00 PM

We've been here before--just a few months ago, but not for very long. Also, we haven't been much higher than this in more than 20 years. That said, many experts thought we might not be back here quite so soon--if at all during the same cycle. [30 year fixed 7.12%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for June.

• At 8:00 AM, Corelogic House Price index for May.