by Calculated Risk on 7/16/2023 08:15:00 AM

Sunday, July 16, 2023

LA Port Inbound Traffic Down Sharply YoY in June

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

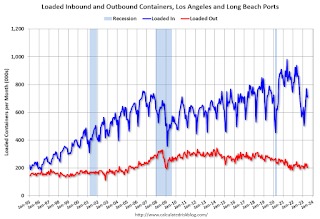

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

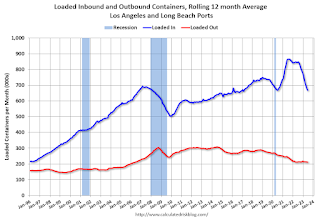

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 1.8% in June compared to the rolling 12 months ending in May. Outbound traffic decreased 0.3% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year. Saturday, July 15, 2023

Real Estate Newsletter Articles this Week: Currently 23.3% of mortgage loans are under 3%, 61.3% are under 4%

by Calculated Risk on 7/15/2023 02:36:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• 3rd Look at Local Housing Markets in June

• Lawler: Update on Demographic Trends, and Population and Household Projections Through 2025

• Part 1: Current State of the Housing Market; Overview for mid-July

• Part 2: Current State of the Housing Market; Overview for mid-July

• 2nd Look at Local Housing Markets in June

• Black Knight Mortgage Monitor: Home Prices Increased Month-to-month to New Record High in May

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of July 16, 2023

by Calculated Risk on 7/15/2023 08:11:00 AM

The key reports this week are June Retail Sales, Housing Starts and Existing Home Sales.

For manufacturing, the June Industrial Production report and the July New York and Philly Fed manufacturing surveys will be released.

8:30 AM: The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of 0.0, down from 6.6.

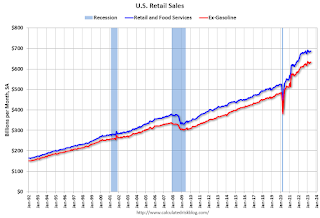

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 0.5% increase in retail sales.

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 0.5% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

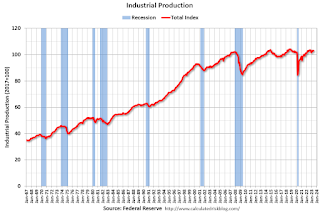

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.This graph shows industrial production since 1967.

The consensus is for a no change in Industrial Production, and for Capacity Utilization to decrease to 79.5%.

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 55, unchanged from 55. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

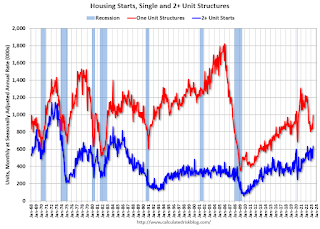

8:30 AM ET: Housing Starts for June.

8:30 AM ET: Housing Starts for June. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.450 million SAAR, down from 1.631 million SAAR in May.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 246 thousand initial claims, up from 237 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of -10.0, up from -13.7.

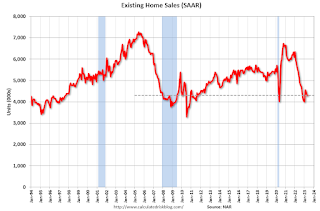

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 4.23million SAAR, down from 4.30 million last month.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 4.23million SAAR, down from 4.30 million last month.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for June 2023

Friday, July 14, 2023

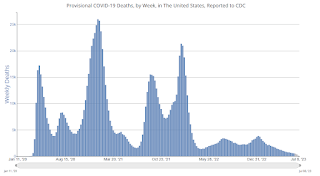

July 14th COVID Update: New Pandemic Lows for Deaths and Hospitalizations

by Calculated Risk on 7/14/2023 08:11:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 5,178 | 5,494 | ≤3,0001 | |

| Deaths per Week2 | 468 | 550 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

3rd Look at Local Housing Markets in June

by Calculated Risk on 7/14/2023 09:54:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in June

A brief excerpt:

This is the third look at local markets in June. I’m tracking a sample of about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

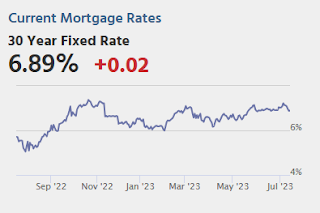

Closed sales in June were mostly for contracts signed in April and May. Since 30-year fixed mortgage rates were in the 6.4% range in April and May - compared to the 5% range the previous year - closed sales were down year-over-year in June.

...

In June, sales in these markets were down 15.3%. In May, these same markets were down 16.1% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in May for these markets. Note that there were the same number of selling days each year in June 2022 and June 2023.

A key factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates. ...

This sample data suggests the June existing home sales report will show another significant YoY decline - and probably below the May sales rate of 4.3 million (SAAR) - and the 22nd consecutive month with a YoY decline in sales.

Note: the NAR is scheduled to release June existing home sales next Thursday, July 20th, and the consensus expectation is for the NAR to report sales of 4.23 million on a Seasonally Adjusted Annual Rate (SAAR) basis, down from 4.30 million in May.

Many more local markets to come!

Q2 GDP Tracking: Around 2%

by Calculated Risk on 7/14/2023 08:25:00 AM

From BofA:

Data since our last weekly publication moved up our 2Q GDP tracking estimate from 1.4% q/q saar to 1.5%. [July 14th estimate]From Goldman:

emphasis added

We boosted our Q2 GDP tracking estimate by one tenth to +2.3% (qoq ar). Our Q2 domestic final sales growth forecast stands at +2.6%. [July 10th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2023 is 2.3 percent on July 10, up from 2.1 percent on July 6. After recent releases from the US Bureau of Economic Analysis, the US Bureau of Labor Statistics, and the US Census Bureau, the nowcast of second-quarter real gross private domestic investment growth increased from 9.6 percent to 10.5 percent. [July 10th estimate]

Thursday, July 13, 2023

Realtor.com Reports Weekly Active Inventory Down 5% YoY; New Listings Down 27% YoY

by Calculated Risk on 7/13/2023 03:50:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from analyst Hannah Jones: Weekly Housing Trends View — Data Week Ending July 8, 2023

• Active inventory declined, with for-sale homes lagging behind year ago levels by 5%. A year into weekly new listing declines, active inventory levels have started to mirror the slow down in listing activity. More than 80% of home-shoppers looking to buy and sell a home feel locked in by their current mortgage rate. As a result, buyers are seeing fewer available homes on the market. We expect to see this trend continue as mortgage rates are expected to remain elevated for the time being.

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 27% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 53 weeks. This week’s data shows a wider gap than last week, and is bigger than what has been typical year-to-date. The job market’s ongoing resilience has enabled buyers to remain active in today’s market, despite the high cost of homeownership. However, high mortgage rates have convinced many would-be sellers to hold off on listing their home for sale. Buyer demand and lack of existing home inventory has resulted in renewed new home sales energy.

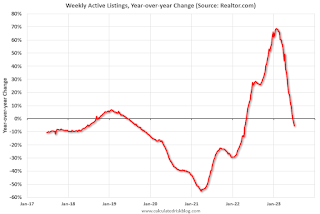

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 5.0% year-over-year - this was the third consecutive YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

Hotels: Occupancy Rate Down 2.3% Year-over-year

by Calculated Risk on 7/13/2023 01:28:00 PM

Due to constricted business travel during the Fourth of July, U.S. hotel performance fell from the previous week and showed weaker year-over-year comparisons, according to STR‘s latest data through 8 July.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

2-8 July 2023 (percentage change from comparable week in 2022):

• Occupancy: 61.8% (-2.3%)

• Average daily rate (ADR): US$155.81 (+1.2%)

• Revenue per available room (RevPAR): US$96.36 (-1.2%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Part 2: Current State of the Housing Market; Overview for mid-July

by Calculated Risk on 7/13/2023 10:32:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-July

A brief excerpt:

Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-July I reviewed home inventory and sales.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is some data from the recently released FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q1 2023.

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 23.3% of loans are under 3%, 61.3% are under 4%, and 81.2% are under 5%.

The percent of outstanding loans under 4% peaked in Q1 2022 at 65.3%, and the percent under 5% peaked at 85.6%.

This is very different from the housing bust, when many homeowners were forced to sell as their teaser rates expired and they could not afford the fully amortized mortgage payment. The current situation is similar to the 1980 period, when rates also increased quickly.

Weekly Initial Unemployment Claims Decrease to 237,000

by Calculated Risk on 7/13/2023 08:34:00 AM

The DOL reported:

In the week ending July 8, the advance figure for seasonally adjusted initial claims was 237,000, a decrease of 12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 248,000 to 249,000. The 4-week moving average was 246,750, a decrease of 6,750 from the previous week's revised average. The previous week's average was revised up by 250 from 253,250 to 253,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 246,750.

The previous week was revised up.

Weekly claims were below the consensus forecast.