by Calculated Risk on 7/19/2023 02:39:00 PM

Wednesday, July 19, 2023

Lawler: Early Read on Existing Home Sales in June & 4th Look at Local Markets

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in June & 4th Look at Local Markets

A brief excerpt:

An early read from housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.26 million in June, down 0.9% from May’s preliminary pace and down 17.0% from last June’s seasonally adjusted pace.Note: the NAR is scheduled to release June existing home sales tomorrow, Thursday, July 20th, and the consensus expectation is for the NAR to report sales of 4.23 million on a Seasonally Adjusted Annual Rate (SAAR) basis, down from 4.30 million in May.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was virtually unchanged from a year earlier.

...

In June, sales in these markets were down 14.9%. In June, these same markets were down 15.9% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in May for these markets. Note that there were the same number of selling days each year in June 2022 and June 2023.

A key factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates.

This sample data suggests that June existing home sales report will show another significant YoY decline - and will probably be below the May sales rate of 4.30 million (SAAR) - and the 22nd consecutive month with a YoY decline in sales.

I’ll have several more local markets after that will be released after the NAR report, including New York, Miami, and Illinois.

AIA: Architecture Billings "Stable" in June; Multi-family Billings Decline for 11th Consecutive Month

by Calculated Risk on 7/19/2023 12:21:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: AIA/Deltek Architecture Billings Index Stable in June

Architecture firms reported flat billings in June, according to the latest Architecture Billings Index (ABI) from the American Institute of Architects (AIA) and Deltek.

The ABI score of 50.1 for the month indicates that billings at architecture firms remained steady as design activity continues to slowly recover from roiled economic conditions. This also marks the first time since last fall that there have been two consecutive months of scores above 50, although growth in June was weaker than May (any score above 50 indicates an increase in firm billings).

“It is encouraging to see two consecutive months of stability in billings after a couple quarters of weakness due to high inflation, rising interest rates, and increased construction costs,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “We are still facing some headwinds in the broader economy, but this respite suggests that market conditions may be finding firmer ground.”

Firms located in the Midwest continue to report the strongest billings for the eighth consecutive month, while firms in nearly all regions of the country also reported improving business conditions in June. Firms also reported that inquiries into new projects fell slightly from 57.2 to 56.7 the previous month. Further, the value of new design contracts edged up to 52.7 in June from 52.3 in May.

Firm backlogs have decreased from their record-high levels in 2022 but remain robust at an average of 6.8 months.

...

• Regional averages: Midwest (52.4); Northeast (50.6); South (50.5); West (48.6)

• Sector index breakdown: institutional (55.4); mixed practice (firms that do not have at least half of their billings in any one other category) (48.8); commercial/industrial (47.8); multi-family residential (47.4)

emphasis added

Click on graph for larger image.

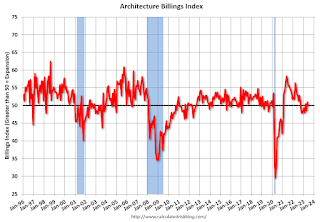

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.1 in June, down from 51.0 in May. Anything above 50 indicates an increase in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has declined in 6 of the last 9 months. This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment later in 2023 and into 2024.

June Housing Starts: Record Number of Multi-Family Housing Units Under Construction

by Calculated Risk on 7/19/2023 09:27:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: June Housing Starts: Record Number of Multi-Family Housing Units Under Construction

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

Red is single family units. Currently there are 688 thousand single family units (red) under construction (SA). This was down in June compared to May, and 143 thousand below the recent peak in May 2022. Single family units under construction peaked over a year ago since single family starts declined sharply.

Blue is for 2+ units. Currently there are 994 thousand multi-family units under construction. This ties the record set in July 1973 of multi-family units being built for the baby-boom generation. For multi-family, construction delays are a significant factor. The completion of these units should help with rent pressure.

Combined, there are 1.682 million units under construction, just 28 thousand below the all-time record of 1.710 million set in October 2022.

Housing Starts Decreased Sharply to 1.434 million Annual Rate in June

by Calculated Risk on 7/19/2023 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in June were at a seasonally adjusted annual rate of 1,434,000. This is 8.0 percent below the revised May estimate of 1,559,000 and is 8.1 percent below the June 2022 rate of 1,561,000. Single‐family housing starts in June were at a rate of 935,000; this is 7.0 percent below the revised May figure of 1,005,000. The June rate for units in buildings with five units or more was 482,000.

Building Permits:

Privately‐owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,440,000. This is 3.7 percent below the revised May rate of 1,496,000 and is 15.3 percent below the June 2022 rate of 1,701,000. Single‐family authorizations in June were at a rate of 922,000; this is 2.2 percent above the revised May figure of 902,000. Authorizations of units in buildings with five units or more were at a rate of 467,000 in June.

emphasis added

Click on graph for larger image.

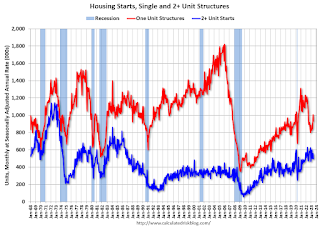

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) decreased in June compared to May. Multi-family starts were down 9.4% year-over-year in June.

Single-family starts (red) decreased in June and were down 7.4% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse in single-family starts.

Total housing starts in June were below expectations, and starts in April and May were revised down, combined.

I'll have more later …

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 7/19/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 14, 2023. Last week’s results included an adjustment for Independence Day.

The Market Composite Index, a measure of mortgage loan application volume, increased 1.1 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 27 percent compared with the previous week. The Refinance Index increased 7 percent from the previous week and was 32 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index increased 24 percent compared with the previous week and was 21 percent lower than the same week one year ago.

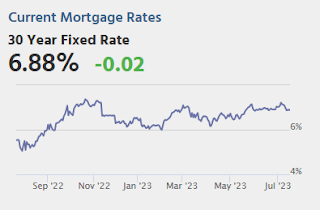

“Mortgage rates declined last week, as markets responded positively to incoming data showing that U.S. inflation continues to cool. Most rates in our survey declined, with the 30-year fixed rate falling to 6.87 percent,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Refinance applications increased more than 7 percent, but that activity accounted for only 28 percent of applications and was more than 30 percent behind last year’s pace. Despite last week’s lower rates, purchase applications decreased, as home purchase activity is still being held back by low housing supply and rates that are still much higher than a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.87 percent from 7.07 percent, with points decreasing to 0.66 from 0.74 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 21% year-over-year unadjusted.

Tuesday, July 18, 2023

Wednesday: Housing Starts

by Calculated Risk on 7/18/2023 08:33:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for June. The consensus is for 1.450 million SAAR, down from 1.631 million SAAR in May.

• During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

NMHC: "Apartment Market Continues to Loosen"

by Calculated Risk on 7/18/2023 02:50:00 PM

Today, in the Calculated Risk Real Estate Newsletter: NMHC: "Apartment Market Continues to Loosen"

A brief excerpt:

Apartment market conditions continued to weaken in the National Multifamily Housing Council’s (NMHC’s) Quarterly Survey of Apartment Market Conditions for July 2023, as the Market Tightness (26), Sales Volume (40), Equity Financing (22) and Debt Financing (18) indexes all came in well below the breakeven level (50).There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

• The Market Tightness Index came in at 26 this quarter – below the breakeven level (50) – indicating looser market conditions for the fourth consecutive quarter. More than half of respondents (57%) reported markets to be looser than three months ago, while only 9% thought markets have become tighter. Meanwhile, around a third of respondents (34%) thought that market conditions were unchanged over the past three months.

NAHB: Builder Confidence Increased in July

by Calculated Risk on 7/18/2023 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 56, up from 55 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Edges Higher Despite Rising Rate Concerns

Low existing inventory that is keeping demand solid for new homes helped to push builder confidence up in July even as the industry continues to grapple with rising mortgage rates, elevated construction costs and limited lot availability.

Builder confidence in the market for newly built single-family homes in July posted a one-point gain to 56, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This is the seventh straight month that builder confidence has increased and marks the highest level since June of last year.

The lack of resale inventory means prospective home buyers who have not been priced out of the market continue to seek out new construction in greater numbers. At the same time, builders are troubled over rising mortgage rates approaching 7% and continue to grapple with supply-side challenges, including ongoing scarcity of electrical transformer equipment and growing concerns about lot availability.

...

The July HMI survey also revealed that despite elevated interest rates, builders’ use of sales incentives has declined, as the market has firmed and resale inventory options remain limited. Only 22% of builders report cutting prices in July. This is down from 25% in June and 27% in May.

...

The HMI index gauging current sales conditions in July rose one point to 62, the component charting sales expectations in the next six months fell two points to 60, and the gauge measuring traffic of prospective buyers increased three points to 40, the highest reading since June of last year. However, the decline for the future sales expectation reading is a reminder that housing affordability continues to be challenged by elevated interest rates.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased five points to 52, the Midwest edged up two points to 45, the South increased three points to 58 and the West posted a five-point gain to 51.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was slightly above the consensus forecast.

Industrial Production Decreased 0.5% in June

by Calculated Risk on 7/18/2023 09:15:00 AM

From the Fed: Industrial Production and Capacity Utilization

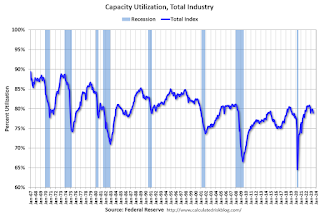

Industrial production declined 0.5 percent in June for a second consecutive month but advanced 0.7 percent at an annual rate for the second quarter as a whole. Manufacturing output moved down 0.3 percent in June but rose 1.5 percent in the second quarter. In June, the indexes for mining and utilities fell 0.2 percent and 2.6 percent, respectively. At 102.2 percent of its 2017 average, total industrial production in June was 0.4 percent below its year-earlier level. Capacity utilization stepped down to 78.9 percent in June, a rate that is 0.8 percentage point below its long-run (1972–2022) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.9% is 0.8 percentage points below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

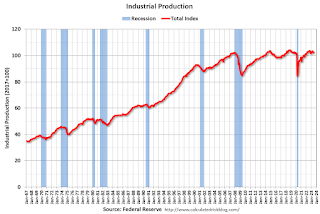

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in June to 102.2. This is above the pre-pandemic level.

Industrial production was below consensus expectations, and the previous months were revised down, combined.

Retail Sales Increased 0.2% in June

by Calculated Risk on 7/18/2023 08:30:00 AM

On a monthly basis, retail sales were up 0.2% from May to June (seasonally adjusted), and sales were up 1.5 percent from June 2022.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for June 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $689.5 billion, up 0.2 percent from the previous month, and up 1.5 percent above June 2022. ... The April 2023 to May 2023 percent change was revised from up 0.3 percent to up 0.5 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.3% in June.

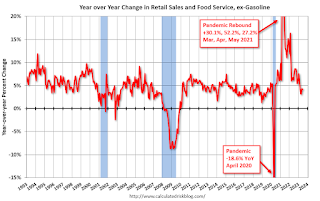

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.1% on a YoY basis.

The increase in sales in June was below expectations, however sales in April and May were revised up.

The increase in sales in June was below expectations, however sales in April and May were revised up.