by Calculated Risk on 7/26/2023 07:00:00 AM

Wednesday, July 26, 2023

MBA: Mortgage Applications Decreased in Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 21, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.8 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index 1.5 percent compared with the previous week. The Refinance Index decreased 0.4 percent from the previous week and was 30 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 23 percent lower than the same week one year ago.

“Mortgage rates were essentially flat last week but remained high, with the 30-year fixed staying at 6.87 percent and contributing to a pullback in mortgage applications,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The 2.5 percent decline in purchase activity, partly driven by a 10 percent decrease in FHA applications, pushed the purchase index to its lowest level in over a month. The decrease in FHA purchase applications contributed to an increase in the overall average purchase loan size to $432,700, its highest level since the end of this May. Refinance applications remained lackluster, running 30 percent behind year-ago levels. Many borrowers remain on the sidelines given current rates and persistent affordability challenges.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) remained unchanged at 6.87 percent, with points decreasing to 0.65 from 0.66 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 23% year-over-year unadjusted.

Tuesday, July 25, 2023

Wednesday: New Home Sales, FOMC Statement

by Calculated Risk on 7/25/2023 08:55:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for June from the Census Bureau. The consensus is for 722 thousand SAAR, down from 763 thousand in May.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to raise rates 25 bps, increasing the target range for the federal funds rate to 5‑1/4 to 5-1/2 percent.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

July Vehicle Sales Forecast: 15.8 million SAAR, Up Sharply YoY

by Calculated Risk on 7/25/2023 06:07:00 PM

From WardsAuto: July U.S. Light-Vehicle Sales Tracking to 15.8-Million SAAR; Q3 Volume Forecast for 17% Increase (pay content). Brief excerpt:

The initial outlook for Q3 is a 15.5 million-unit SAAR, a slight decline from Q2’s 15.6 million but above Q3-2022’s 13.3 million. However, as with July due to its atypical fifth weekend, there is upside to Q3, as well as the rest of the year, though that depends on continued steadiness in the economy, no major geopolitical disruptions and the impact from possible labor walkouts.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for July (Red).

The Wards forecast of 15.8 million SAAR, would be up 0.7% from last month, and up 18.7% from a year ago.

Comments on May Case-Shiller and FHFA House Prices

by Calculated Risk on 7/25/2023 09:47:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Decreased 0.5% year-over-year in May

Excerpt:

The recent increase in mortgage rates to near 7% will not impact the Case-Shiller index until reports are released in the Fall.

...

Here is a comparison of year-over-year change in median house prices from the NAR and the year-over-year change in the Case-Shiller index. Median prices are distorted by the mix and repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices. However, in general, the Case-Shiller index follows the median price.

The median price was down 0.9% year-over-year in June, and, as expected, the Case-Shiller National Index was down 0.5% year-over-year in the May report.

Note: I’ll have more on real prices, price-to-rent and affordability later this week.

Seasonally adjusted house prices have increased over the last four months, and the big question is “Will house prices decline further later this year?”

Case-Shiller: National House Price Index Decreased 0.5% year-over-year in May

by Calculated Risk on 7/25/2023 09:11:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3-month average of March, April and May closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Repeats Gains in May

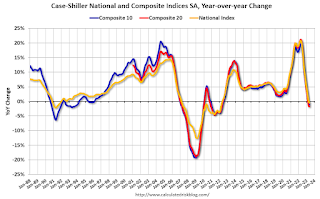

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a -0.5% annual decrease in May, down from a loss of -0.1% in the previous month. The 10-City Composite showed a decrease of -1.0%, which is a tick up from the -1.1% decrease in the previous month. The 20-City Composite posted a -1.7% year-over-year loss, same as in the previous month.

...

Before seasonal adjustment, the U.S. National Index posted a 1.2% month-over-month increase in May, while the 10-City and 20-City Composites both posted increases of 1.5%.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.7%, while the 10-City Composite gained 1.1% and 20-City Composites posted an increase of 1.0%.

“The rally in U.S. home prices continued in May 2023,” says Craig J. Lazzara, Managing Director at S&P DJI. “Our National Composite rose by 1.2% in May, and now stands only 1.0% below its June 2022 peak. The 10- and 20-City Composites also rose in May, in both cases by 1.5%.

“The ongoing recovery in home prices is broadly based. Before seasonal adjustment, prices rose in all 20 cities in May (as they had also done in March and April). Seasonally adjusted data showed rising prices in 19 cities in May, repeating April’s performance. (The outlier is Phoenix, down 0.1% in both months.) On a trailing 12-month basis, the National Composite is 0.5% below its May 2022 level, with the 10- and 20-City Composites also negative on a year-over-year basis.

“Regional differences continue to be striking. This month’s league table shows the Revenge of the Rust Belt, as Chicago (+4.6%), Cleveland (+3.9%), and New York (+3.5%) were the top performers.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.1% in May (SA) and down 1.6% from the recent peak in June 2022.

The Composite 20 index is up 1.0% (SA) in May and down 2.3% from the recent peak in June 2022.

The National index is up 0.7% (SA) in May and is down 1.0% from the peak in June 2022.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is down 1.1% year-over-year. The Composite 20 SA is down 1.8% year-over-year.

The National index SA is down 0.5% year-over-year.

Annual price changes were at expectations. I'll have more later.

Monday, July 24, 2023

Tuesday: Case-Shiller House Prices

by Calculated Risk on 7/24/2023 07:22:00 PM

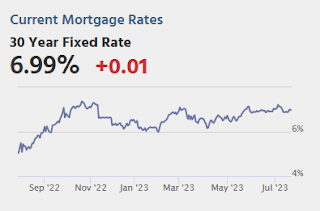

It was a fairly uneventful day for mortgage rates for the average lender--at least until the very end of the business day. Mortgage lenders prefer to set rates once a day, in the morning. Because rates are ultimately determined by bond prices, if bonds move enough during the day, lenders can "reprice" to follow the market.Tuesday:

In today's case, things had deteriorated enough by the last hour that several lenders repriced for the worse. This didn't amount to a big change in rates as far as the average mortgage borrower would be concerned, but it does leave the average lender in line with the highest rates in nearly 2 weeks. [30 year fixed 6.99%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for May. The consensus is for a 1.9% year-over-year decrease in the Comp 20 index for May.

• At 9:00 AM, FHFA House Price Index for May. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for July.

Update on Four High Frequency Indicators

by Calculated Risk on 7/24/2023 10:23:00 AM

I stopped the weekly updates of high frequency indicators at the end of 2022.

The TSA is providing daily travel numbers.

This data is as of July 23rd.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue), 2022 (Orange) and 2023 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is above the level for the same week in 2019 (101.4% of 2019). (Dashed line)

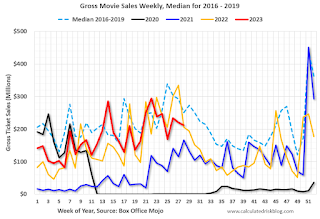

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released. This is prior to Barbie and Oppenheimer.

Movie ticket sales (dollars) have been running below the pre-pandemic levels.

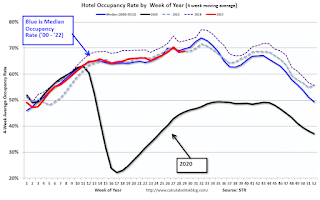

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

This data is through July 15th. The occupancy rate was up 0.1% compared to the same week in 2022.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

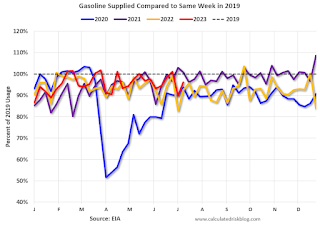

Blue is for 2020. Purple is for 2021, and Orange is for 2022, and Red is for 2023.

Gasoline supplied in 2023 is running about 4% below 2019 levels.

Housing July 24th Weekly Update: Inventory increased 1.9% Week-over-week; Down 8.8% Year-over-year

by Calculated Risk on 7/24/2023 08:15:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, July 23, 2023

Sunday Night Futures

by Calculated Risk on 7/23/2023 06:25:00 PM

Weekend:

• Schedule for Week of July 23, 2023

• FOMC Preview: Likely 25bp Rate Hike

Monday:

• 8:30 AM ET, Chicago Fed National Activity Index for June. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $77.07 per barrel and Brent at $81.07 per barrel. A year ago, WTI was at $98, and Brent was at $107 - so WTI oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.56 per gallon. A year ago, prices were at $4.35 per gallon, so gasoline prices are down $0.78 per gallon year-over-year.

FOMC Preview: Likely 25bp Rate Hike

by Calculated Risk on 7/23/2023 08:14:00 AM

Most analysts expect the FOMC to raise rates 25 bps at this meeting, increasing the target range for the federal funds rate to 5‑1/4 to 5-1/2 percent.

"After remaining on hold in June, we look for the Fed to raise the target range for the Federal funds rate by 25bp in July to 5.25-5.50%. ... The more important question is what the Fed says about the path of policy into September and beyond. ... We think some of the June CPI weakness was statistical and not real, and look for strong activity and labor market data to mean the Fed hikes again – and for the last time – at its September meeting."And from Goldman Sachs economists:

emphasis added

"A 25bp rate hike is fully priced for the July FOMC meeting next week. The key question is how strongly Chair Powell will nod toward the “careful pace” of tightening he advocated in June, which we and others have taken to imply an every-other-meeting approach. We expect Powell to cautiously avoid implying that the FOMC has already reached an agreement but are confident that he does want to slow the pace and that the FOMC will end up skipping in September."

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| June 2023 | 0.7 to 1.2 | 0.9 to 1.5 | 1.6 to 2.0 | |

| March 2023 | 0.0 to 0.8 | 1.0 to 1.5 | 1.7 to 2.1 | |

The unemployment rate was at 3.6% in June. To reach the mid-point of the FOMC projections for Q4 2023, the economy would likely have to lose a significant number of jobs in Q3 and Q4. The FOMC's unemployment rate projection for Q4 appears high.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| June 2023 | 4.0 to 4.3 | 4.3 to 4.6 | 4.3 to 4.6 | |

| March 2023 | 4.0 to 4.7 | 4.3 to 4.9 | 4.3 to 4.8 | |

As of May 2023, PCE inflation increased 3.8 percent year-over-year (YoY), down from 4.4 percent YoY in April, and down from the recent peak of 7.0 percent in June 2022. A year ago, June 2022 PCE inflation was very high, and YoY PCE inflation will likely decrease further in June.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| June 2023 | 3.0 to 3.5 | 2.3 to 2.8 | 2.0 to 2.4 | |

| March 2023 | 3.0 to 3.8 | 2.2 to 2.8 | 2.0 to 2.2 | |

PCE core inflation increased 4.6 percent YoY, down from 4.7 percent in April, and down from the recent peak of 5.4 percent in February 2022.; This remains a concern for the FOMC, however this includes shelter that was up 8.3% YoY in May (even though asking rents are mostly unchanged YoY).

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| June 2023 | 3.7 to 4.2 | 2.5 to 3.1 | 2.0 to 2.4 | |

| March 2023 | 3.5 to 3.9 | 2.3 to 2.8 | 2.0 to 2.2 | |