by Calculated Risk on 7/28/2023 03:01:00 PM

Friday, July 28, 2023

Las Vegas June 2023: Visitor Traffic Up 1.5% YoY; Convention Traffic Down 2.9% YoY

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

From the Las Vegas Visitor Authority: June 2023 Las Vegas Visitor Statistics

Punctuated by the Vegas Golden Knights' victorious quest for the Stanley Cup, Las Vegas visitation in June surpassed last year as the destination hosted more than 3.4M visitors, +3.1% YoY.

Overall hotel occupancy reached 85.5% for the month (+2.8 pts YoY). Weekend occupancy matched last June, reaching 90.2% (+0.2 pts YoY), and Midweek occupancy reached 83.5%, surpassing last June by 3.5 pts.

Overall ADR exceeded $165, +5.3% from June 2022 while RevPAR reached $141, +8.8% YoY

Click on graph for larger image.

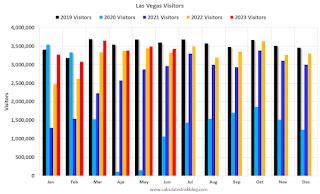

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (light blue), 2021 (purple), 2022 (orange), and 2023 (red).

Visitor traffic was up 3.1% compared to last June.

Note: There was almost no convention traffic from April 2020 through May 2021.

Hotels: Occupancy Rate Up 0.5% Year-over-year

by Calculated Risk on 7/28/2023 02:43:00 PM

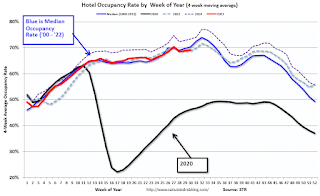

U.S. hotel performance increased from the previous week and showed improved comparisons year over year, according to CoStar’s latest data through 22 July. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

16-22 July 2023 (percentage change from comparable week in 2022):

• Occupancy: 72.9% (+0.5%)

• Average daily rate (ADR): US$161.65 (+1.5%)

• Revenue per available room (RevPAR): US$117.91 (+2.0%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Inflation Adjusted House Prices 4.4% Below Peak; Price-to-rent index is 7.9% below recent peak

by Calculated Risk on 7/28/2023 10:46:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 4.4% Below Peak; Price-to-rent index is 7.9% below recent peak

Excerpt:

It has been over 17 years since the bubble peak. In the May Case-Shiller house price index released Tuesday, the seasonally adjusted National Index (SA), was reported as being 64% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 8% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 2% below the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $200,000 in January 2000, the price would be $358,000 today adjusted for inflation (79% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

PCE Measure of Shelter Slows to 8.0% YoY in June

by Calculated Risk on 7/28/2023 09:17:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through June 2023.

Since asking rents are mostly unchanged year-over-year, these measures will slow sharply in coming months.

Personal Income increased 0.3% in June; Spending increased 0.5%

by Calculated Risk on 7/28/2023 08:36:00 AM

The BEA released the Personal Income and Outlays report for June:

Personal income increased $69.5 billion (0.3 percent at a monthly rate) in June, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $67.5 billion (0.3 percent) and personal consumption expenditures (PCE) increased $100.4 billion (0.5 percent).The June PCE price index increased 3.0 percent year-over-year (YoY), down from 3.8 percent YoY in May, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index also increased 0.2 percent. Real DPI increased 0.2 percent in June and real PCE increased 0.4 percent; goods increased 0.9 percent and services increased 0.1 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through June 2023 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was slightly below expectations, and PCE was slightly above expectations.

Thursday, July 27, 2023

Friday: Personal Income and Outlays

by Calculated Risk on 7/27/2023 08:47:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, June 2022. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 3.1% YoY, and core PCE prices up 4.2% YoY.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for July). The consensus is for a reading of 72.6.

Realtor.com Reports Weekly Active Inventory Down 8% YoY; New Listings Down 18% YoY

by Calculated Risk on 7/27/2023 03:46:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Danielle Hale: Weekly Housing Trends View — Data Week Ending July 22, 2023

• Active inventory declined, with for-sale homes lagging behind year ago levels by 8%. This week marks a 5th consecutive annual decline in the number of homes actively available for sale.

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 18% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 55 weeks. The size of the gap has been large and fairly consistent over the past year, but as we pass the period in 2022 when new listings slowed sharply, we may see declines wane.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 8.1% year-over-year - this was the fifth consecutive week with a YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

Fannie and Freddie: Single-Family Mortgage Delinquency Rate Declined, Multi-Family Increased in June

by Calculated Risk on 7/27/2023 11:56:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single-Family Mortgage Delinquency Rate Declined, Multi-Family Increased in June

Brief excerpt:

I’ve argued that there would not be a huge wave of single-family foreclosures this cycle since lending standards have been solid and most homeowners have substantial equity. That means we will not see cascading price declines like following the housing bubble. This is a high confidence prediction and is supported by the following data.You can subscribe at https://calculatedrisk.substack.com/.

However, there is some concern about some multi-family properties.

...

Freddie Mac reports that multi-family delinquencies increased to 0.21% in June, up from 0.07% in June 2022.

This graph shows the Freddie multi-family serious delinquency rate since 2012. Rates were still high in 2012 following the housing bust and financial crisis.

The multi-family rate increased following the pandemic and has increased recently as rent growth has slowed, vacancy rates have increased, lending has tightened, and interest rates have increased sharply. This will be something to watch as rents soften.

NAR: Pending Home Sales Up 0.3% in June; Down 15.6% Year-over-year

by Calculated Risk on 7/27/2023 10:03:00 AM

From the NAR: Pending Home Sales Rose 0.3% in June, First Increase in Three Months

Pending home sales registered a modest increase of 0.3% in June from the previous month – the first increase since February – according to the National Association of REALTORS®. The South and West posted monthly losses, while sales in the Northeast and Midwest grew. All four U.S. regions saw year-over-year declines in transactions.This is close to expectations of a 0.1% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

"The recovery has not taken place, but the housing recession is over," said NAR Chief Economist Lawrence Yun, "The presence of multiple offers implies that housing demand is not being satisfied due to lack of supply. Homebuilders are ramping up production and hiring workers."

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – rose 0.3% to 76.8 in May. Year over year, pending transactions fell by 15.6%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI ascended 0.6% from last month to 67.1, a decrease of 16.7% from June 2022. The Midwest index jumped 4.3% to 77.6 in June, down 17.1% from one year ago.

The South PHSI receded 1.4% to 93.3 in June, lessening 14.3% from the prior year. The West index fell 1.0% in June to 57.7, dipping 15.5% from May 2022.

emphasis added

Weekly Initial Unemployment Claims Decrease to 221,000

by Calculated Risk on 7/27/2023 08:37:00 AM

The DOL reported:

In the week ending July 22, the advance figure for seasonally adjusted initial claims was 221,000, a decrease of 7,000 from the previous week's unrevised level of 228,000. The 4-week moving average was 233,750, a decrease of 3,750 from the previous week's unrevised average of 237,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 233,750.

The previous week was unrevised.

Weekly claims were below the consensus forecast.