by Calculated Risk on 7/31/2023 02:13:00 PM

Monday, July 31, 2023

Fed SLOOS Survey: Banks reported Tighter Standards, Weaker Demand for All Loan Types

From the Federal Reserve: The July 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices

The July 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the second quarter of 2023.

Regarding loans to businesses, survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the second quarter. Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

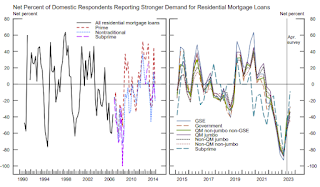

For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans, especially for RRE loans other than government-sponsored enterprise (GSE)-eligible and government loans. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Furthermore, standards tightened for all consumer loan categories; demand weakened for auto and other consumer loans, while it remained basically unchanged for credit card loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate demand is from the Senior Loan Officer Survey Charts.

This shows that demand has declined.

Housing July 31st Weekly Update: Inventory increased 1.1% Week-over-week; Down 10.1% Year-over-year

by Calculated Risk on 7/31/2023 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, July 30, 2023

Sunday Night Futures

by Calculated Risk on 7/30/2023 06:30:00 PM

Weekend:

• Schedule for Week of July 30, 2023

Monday:

• 9:45 AM ET, Chicago Purchasing Managers Index for July.

• 10:30 AM, Dallas Fed Survey of Manufacturing Activity for July.

• 2:00 PM, Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) for July.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 6 and DOW futures are up 29 (fair value).

Oil prices were up over the last week with WTI futures at $80.58 per barrel and Brent at $84.99 per barrel. A year ago, WTI was at $101, and Brent was at $112 - so WTI oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.71 per gallon. A year ago, prices were at $4.19 per gallon, so gasoline prices are down $0.48 per gallon year-over-year.

Q2 2023 Update: Unofficial Problem Bank list Increased to 47 Institutions

by Calculated Risk on 7/30/2023 08:21:00 AM

The Heartland Tri-State Bank was closed on Friday, but wasn't on the unofficial list.

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources only, and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here are the quarterly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List through June 30, 2023. Since the last update at the end of March 2023, the list increased by one to 47 institutions after three additions and two removals. Assets increased by $5.7 billion to $55 billion, overcoming a $3.1 billion decrease from updated asset figures through March 31, 2023. A year ago, the list held 54 institutions with assets of $54.4 billion. Additions include Cross River Bank, Teaneck, NJ ($8.5 billion); The Idabel National Bank, Idabel, OK ($292 million); and Du Quoin State Bank, Du Quoin, IL ($137 million). Removals were United Trust Bank, Palos Heights, IL ($143 million) and Wabash Savings Bank, Mount Carmel, IL ($9.6 million).

With the conclusion of the second quarter, we bring an updated transition matrix to detail how banks are transitioning off the Unofficial Problem Bank List. Since we first published the Unofficial Problem Bank List on August 7, 2009 with 389 institutions, 1,784 institutions have appeared on a weekly or monthly list since then. Only 2.6 percent of the banks that have appeared on a list remain today as 1,745 institutions have transitioned through the list. Departure methods include 1,032 action terminations, 411 failures, 283 mergers, and 19 voluntary liquidations. Of the 389 institutions on the first published list, only 3 or less than 1.0 percent, still have a troubled designation more than ten years later. The 411 failures represent nearly 23 percent of the 1,792 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

On May 31, 2023, the FDIC released first quarter results and provided an update on the Official Problem Bank List. While FDIC did not make a comment within its press release on the Official Problem Bank List, they provided aggregate totals of 43 institutions with assets of $58 billion.

Saturday, July 29, 2023

Real Estate Newsletter Articles this Week: Case-Shiller House Prices Decreased 0.5% year-over-year

by Calculated Risk on 7/29/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index Decreased 0.5% year-over-year in May

• New Home Sales decrease to 697,000 Annual Rate in June

• Fannie and Freddie: Single-Family Mortgage Delinquency Rate Declined, Multi-Family Increased in June

• Inflation Adjusted House Prices 4.4% Below Peak

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of July 30, 2023

by Calculated Risk on 7/29/2023 08:11:00 AM

The key report this week is the July employment report.

Other key reports include ISM manufacturing and services indexes and July vehicle sales.

9:45 AM ET: Chicago Purchasing Managers Index for July.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for July.

2:00 PM: Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) for July.

8:00 AM ET: Corelogic House Price index for June

10:00 AM ET: Job Openings and Labor Turnover Survey for June from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for June from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in May to 9.8 million from 10.3 million in April.

The number of job openings (black) were down 14% year-over-year and Quits were down 5% year-over-year.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 46.5, up from 46.0 in June.

10:00 AM: Construction Spending for June. The consensus is for no change in construction spending.

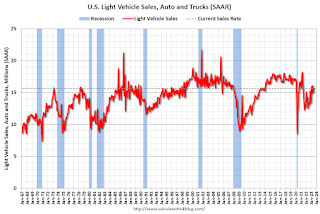

All Day: Light vehicle sales for July from the BEA. The consensus is for light vehicle sales to be 15.5 million SAAR in July, down from 15.7 million in June (Seasonally Adjusted Annual Rate).

All Day: Light vehicle sales for July from the BEA. The consensus is for light vehicle sales to be 15.5 million SAAR in July, down from 15.7 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 185,000 payroll jobs added in July, down from 497,000 in June.

10:00 AM: the Q2 2023 Housing Vacancies and Homeownership from the Census Bureau.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, up from 221 thousand last week.

10:00 AM: the ISM Services Index for July. The consensus is for a reading of 53.1, down from 53.9.

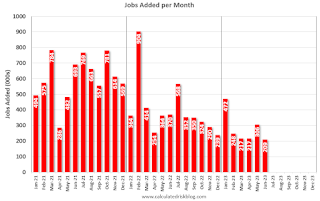

8:30 AM: Employment Report for July. The consensus is for 184,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

8:30 AM: Employment Report for July. The consensus is for 184,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.There were 209,000 jobs added in June, and the unemployment rate was at 3.6%.

This graph shows the jobs added per month since January 2021.

Friday, July 28, 2023

July 28th COVID Update: New Pandemic Lows for Deaths

by Calculated Risk on 7/28/2023 08:40:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 5,648 | 5,406 | ≤3,0001 | |

| Deaths per Week2 | 405 | 494 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

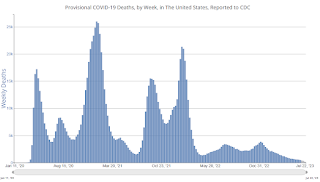

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Las Vegas June 2023: Visitor Traffic Up 1.5% YoY; Convention Traffic Down 2.9% YoY

by Calculated Risk on 7/28/2023 03:01:00 PM

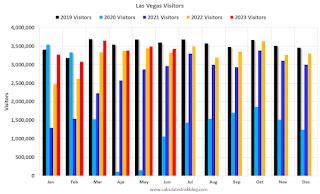

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

From the Las Vegas Visitor Authority: June 2023 Las Vegas Visitor Statistics

Punctuated by the Vegas Golden Knights' victorious quest for the Stanley Cup, Las Vegas visitation in June surpassed last year as the destination hosted more than 3.4M visitors, +3.1% YoY.

Overall hotel occupancy reached 85.5% for the month (+2.8 pts YoY). Weekend occupancy matched last June, reaching 90.2% (+0.2 pts YoY), and Midweek occupancy reached 83.5%, surpassing last June by 3.5 pts.

Overall ADR exceeded $165, +5.3% from June 2022 while RevPAR reached $141, +8.8% YoY

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (light blue), 2021 (purple), 2022 (orange), and 2023 (red).

Visitor traffic was up 3.1% compared to last June.

Note: There was almost no convention traffic from April 2020 through May 2021.

Hotels: Occupancy Rate Up 0.5% Year-over-year

by Calculated Risk on 7/28/2023 02:43:00 PM

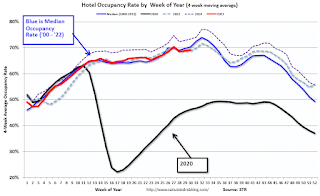

U.S. hotel performance increased from the previous week and showed improved comparisons year over year, according to CoStar’s latest data through 22 July. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

16-22 July 2023 (percentage change from comparable week in 2022):

• Occupancy: 72.9% (+0.5%)

• Average daily rate (ADR): US$161.65 (+1.5%)

• Revenue per available room (RevPAR): US$117.91 (+2.0%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Inflation Adjusted House Prices 4.4% Below Peak; Price-to-rent index is 7.9% below recent peak

by Calculated Risk on 7/28/2023 10:46:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 4.4% Below Peak; Price-to-rent index is 7.9% below recent peak

Excerpt:

It has been over 17 years since the bubble peak. In the May Case-Shiller house price index released Tuesday, the seasonally adjusted National Index (SA), was reported as being 64% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 8% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 2% below the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $200,000 in January 2000, the price would be $358,000 today adjusted for inflation (79% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.