by Calculated Risk on 8/01/2023 05:25:00 PM

Tuesday, August 01, 2023

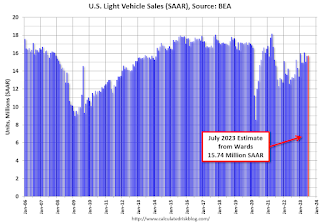

Vehicles Sales at 15.74 million SAAR in July; Up 18% YoY

Wards Auto released their estimate of light vehicle sales for July: U.S. Light-Vehicle Sales Post 11th Straight Increase in July (pay site).

Assuming no shocks to the economy, sales appear easily on their way to reaching the 15.4 million units forecast for the year. Battery-electric-vehicle deliveries increased 51% year-over-year, accounting for a record-high 7.5% of the market.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for July (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic). However, sales decreased in 2021 due to supply issues. The "supply chain bottom" was in September 2021.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Sales in July were above the consensus forecast.

Asking Rents Negative Year-over-year

by Calculated Risk on 8/01/2023 11:15:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Asking Rents Negative Year-over-year

A brief excerpt:

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The surge in household formation has been confirmed (mostly due to work-from-home), and this also led to the supposition that household formation would slow sharply in 2023 (mostly confirmed) and that asking rents might decrease in 2023 on a year-over-year basis (now flat year-over-year).

...

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through June 2023, except CoreLogic is through June and Apartment List is through July 2023.

...

The CoreLogic measure is up 3.4% YoY in May, down from 3.7% in April, and down from a peak of 13.9% in April 2022.

The Zillow measure is up 4.1% YoY in June, down from 4.9% YoY in May, and down from a peak of 16.5% YoY in March 2022.

The ApartmentList measure is down at 0.7% YoY as of July, down from unchanged in June, and down from a peak of 18.1% YoY November 2021.

...

With slow household formation, more supply coming on the market and a rising vacancy rate, rents will be under pressure all year.

Construction Spending Increased 0.5% in June

by Calculated Risk on 8/01/2023 10:22:00 AM

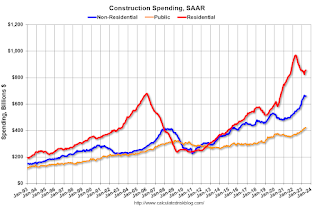

From the Census Bureau reported that overall construction spending increased:

Construction spending during June 2023 was estimated at a seasonally adjusted annual rate of $1,938.4 billion, 0.5 percent above the revised May estimate of $1,929.6 billion. The June figure is 3.5 percent above the June 2022 estimate of $1,873.2 billion.Both private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,516.9 billion, 0.5 percent above the revised May estimate of $1,509.4 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $421.4 billion, 0.3 percent above the revised May estimate of $420.2 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 11.7% below the recent peak.

Non-residential (blue) spending is close to the peak in April 2023.

Public construction spending is at a new peak.

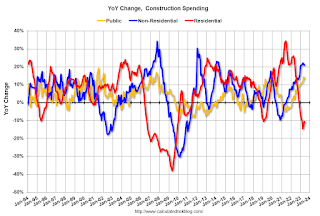

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 10.4%. Non-residential spending is up 20.9% year-over-year. Public spending is up 13.6% year-over-year.

BLS: Job Openings Decreased Slightly to 9.6 million in June

by Calculated Risk on 8/01/2023 10:09:00 AM

From the BLS: Job Openings and Labor Turnover Summary

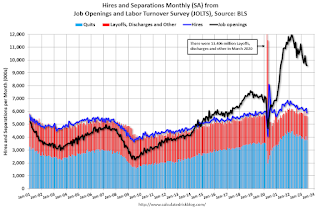

The number of job openings was little changed at 9.6 million on the last business day of June, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations decreased to 5.9 million and 5.6 million, respectively. Within separations, quits (3.8 million) decreased, while layoffs and discharges (1.5 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June; the employment report this Friday will be for July.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in June to 9.58 million from 9.62 million in May.

The number of job openings (black) were down 13% year-over-year.

Quits were down 9% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

ISM® Manufacturing index Increased to 46.4% in July

by Calculated Risk on 8/01/2023 10:00:00 AM

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 46.4% in July, up from 46.0% in June. The employment index was at 44.4%, down from 48.1% the previous month, and the new orders index was at 47.3%, up from 45.6%.

From ISM: Manufacturing PMI® at 46.4%

July 2023 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in July for the ninth consecutive month following a 28-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in July. This was close to the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The July Manufacturing PMI® registered 46.4 percent, 0.4 percentage point higher than the 46 percent recorded in June. Regarding the overall economy, this figure indicates an eighth month of contraction after a 30-month period of expansion. The New Orders Index remained in contraction territory at 47.3 percent, 1.7 percentage points higher than the figure of 45.6 percent recorded in June. The Production Index reading of 48.3 percent is a 1.6-percentage point increase compared to June’s figure of 46.7 percent. The Prices Index registered 42.6 percent, up 0.8 percentage point compared to the June figure of 41.8 percent. The Backlog of Orders Index registered 42.8 percent, 4.1 percentage points higher than the June reading of 38.7 percent. The Employment Index dropped further into contraction, registering 44.4 percent, down 3.7 percentage points from June’s reading of 48.1 percent.

emphasis added

CoreLogic: US Annual Home Price Growth Inches Up in June

by Calculated Risk on 8/01/2023 08:00:00 AM

Notes: This CoreLogic House Price Index report is for June. The recent Case-Shiller index release was for May. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: US Annual Home Price Growth Inches Up in June

• U.S. home prices continued to reach new highs in June and are 41% above pre-pandemic levels.This index was up 1.5% YoY in May.

• Annual U.S. single-family home price growth was up by 1.6% in June after increasing by 1.5% in May, marking the 137th straight month of year-over-year gains and a pivot after 13 months of slowing.

• National home prices increased by 4.8% since the beginning of the year in June, marking the sixth consecutive month of gains.

• Ten states and one district posted year-over-year home price declines in June, with most of the losses again concentrated in the West. While the annual losses reflect last year’s declines, many West Coast markets are expected to see a strong rebound in prices over the next year.

• The strongest home price gains since the beginning of the year have been in the Northeast (New Hampshire, Connecticut, Rhode Island and New Jersey) and the Midwest (Missouri, Wisconsin and Ohio).

emphasis added

Monday, July 31, 2023

Tuesday: CoreLogic House Prices, Job Openings, ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 7/31/2023 08:27:00 PM

As the new week begins, mortgage rates are almost perfectly in line with those seen on Friday afternoon. Putting that in context, last Thursday and Friday marked the highest rates in weeks although Friday was quite a bit better. In both cases and again today, the average lender is just over 7% for a top tier conventional 30yr fixed scenario. [30 year fixed 7.04%]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for June

• At 10:00 AM, Job Openings and Labor Turnover Survey for June from the BLS.

• Also at 10:00 AM, ISM Manufacturing Index for July. The consensus is for the ISM to be at 46.5, up from 46.0 in June.

• Also at 10:00 AM, Construction Spending for June. The consensus is for no change in construction spending.

• All Day, Light vehicle sales for July from the BEA. The consensus is for light vehicle sales to be 15.5 million SAAR in July, down from 15.7 million in June (Seasonally Adjusted Annual Rate).

Freddie Mac House Price Index Increased in June to New High; Up 1.7% Year-over-year

by Calculated Risk on 7/31/2023 02:21:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in June to New High; Up 1.7% Year-over-year

A brief excerpt:

On a year-over-year basis, the National FMHPI was up 1.7% in June, from up 0.8% YoY in May. The YoY increase peaked at 19.2% in July 2021. ...There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

In June, 15 states and D.C. were below their previous peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Idaho (-7.7%), Nevada (-5.2%), D.C. (-4.9%), Arizona (-4.9%), Hawaii (-4.6%), Utah (-3.8%), Washington (-33%), and Oregon (-2.5%).

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted.

...

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. The Case-Shiller index was down 0.5% YoY in May. The FMHPI is suggesting the YoY change in the Case-Shiller index will likely by up soon.

The big question is “Will house prices decline further later this year?”

Fed SLOOS Survey: Banks reported Tighter Standards, Weaker Demand for All Loan Types

by Calculated Risk on 7/31/2023 02:13:00 PM

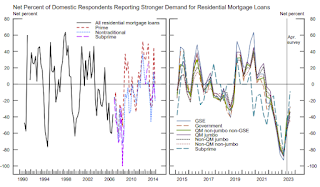

From the Federal Reserve: The July 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices

The July 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the second quarter of 2023.

Regarding loans to businesses, survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the second quarter. Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans, especially for RRE loans other than government-sponsored enterprise (GSE)-eligible and government loans. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Furthermore, standards tightened for all consumer loan categories; demand weakened for auto and other consumer loans, while it remained basically unchanged for credit card loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate demand is from the Senior Loan Officer Survey Charts.

This shows that demand has declined.

Housing July 31st Weekly Update: Inventory increased 1.1% Week-over-week; Down 10.1% Year-over-year

by Calculated Risk on 7/31/2023 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.