by Calculated Risk on 8/03/2023 01:01:00 PM

Thursday, August 03, 2023

July Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus is for 184,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

From BofA economists:

"For the July employment report, we expect nonfarm payroll employment increased by 200k, little changed from the 209k gain in June. ... We expect the unemployment rate to hold at 3.6%."From Goldman Sachs following the strong ADP report:

"[The] ADP report was consistent with the strong pace of July hiring suggested by other alternative employment indicators. We left our nonfarm payroll forecast unchanged at an above-consensus +250k ahead of Friday’s release."• ADP Report: The ADP employment report showed 324,000 private sector jobs were added in July. This suggests job gains well above consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in July to 44.4%, down from 48.1% last month. This would suggest about 50,000 jobs lost in manufacturing. The ADP report indicated 36,000 manufacturing jobs lost in July.

The ISM® services employment index decreased in July to 50.7%, up from 53.1% last month. This would suggest about 90,000 jobs added in the service sector. Combined this suggests job gains of 40,000, well below consensus expectations.

• Unemployment Claims: The weekly claims report showed a sharp increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 265,000 in June to 228,000 in July. This suggests more layoffs in July than in June.

ISM® Services Index Decreases to 52.7% in July

by Calculated Risk on 8/03/2023 10:00:00 AM

(Posted with permission). The ISM® Services index was at 52.7%, down from 53.9% last month. The employment index decreased to 50.7%, from 53.1%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 52.7% July 2023 Services ISM® Report On Business®

Economic activity in the services sector expanded in July for the seventh consecutive month as the Services PMI® registered 52.7 percent, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®. The sector has grown in 37 of the last 38 months, with the lone contraction in December of last year.The PMI was below expectations.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In July, the Services PMI® registered 52.7 percent, 1.2 percentage points lower than June’s reading of 53.9 percent. The composite index indicated growth in July for the seventh consecutive month after a reading of 49.2 percent in December, which was the first contraction since June 2020 (45.4 percent). The Business Activity Index registered 57.1 percent, a 2.1-percentage point decrease compared to the reading of 59.2 percent in June. The New Orders Index expanded in July for the seventh consecutive month after contracting in December for the first time since May 2020; the figure of 55 percent is 0.5 percentage point lower than the June reading of 55.5 percent.

“The Supplier Deliveries Index registered 48.1 percent, 0.5 percentage point higher than the 47.6 percent recorded in June. In the last six months, the average reading of 47.6 percent (with a low of 45.8 percent in March) reflects the fastest supplier delivery performance since June 2009, when the index registered 46 percent. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.)

emphasis added

Weekly Initial Unemployment Claims Increase to 227,000

by Calculated Risk on 8/03/2023 08:33:00 AM

The DOL reported:

In the week ending July 29, the advance figure for seasonally adjusted initial claims was 227,000, an increase of 6,000 from the previous week's unrevised level of 221,000. The 4-week moving average was 228,250, a decrease of 5,500 from the previous week's unrevised average of 233,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 228,250.

The previous week was unrevised.

Weekly claims were close to the consensus forecast.

Wednesday, August 02, 2023

Thursday: Unemployment Claims, ISM Services

by Calculated Risk on 8/02/2023 08:23:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, up from 221 thousand last week.

• At 10:00 AM, the ISM Services Index for July. The consensus is for a reading of 53.1, down from 53.9.

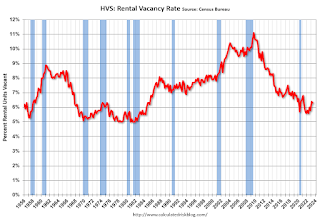

HVS: Q2 2023 Homeownership and Vacancy Rates; Rental Vacancy Rates Increased YoY

by Calculated Risk on 8/02/2023 05:20:00 PM

The Census Bureau released the Residential Vacancies and Homeownership report for Q2 2023 today.

The results of this survey were significantly distorted by the pandemic in 2020.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. Analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

National vacancy rates in the second quarter 2023 were 6.3 percent for rental housing and 0.7 percent for homeowner housing. The rental vacancy rate was higher than the rate in the second quarter 2022 (5.6 percent) and not statistically different than the rate in the first quarter 2023 (6.4 percent).

The homeowner vacancy rate of 0.7 percent was lower than the rate in the second quarter 2022 (0.8 percent) and not statistically different than the rate in the first quarter 2023 (0.8 percent).

The homeownership rate of 65.9 percent was not statistically different from the rate in the second quarter 2022 (65.8 percent) and not statistically different from the rate in the first quarter 2023 (66.0 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The HVS homeownership rate was declined slightly at 65.9% in Q2, from 66.0% in Q1.

The results in Q2 and Q3 2020 were distorted by the pandemic and should be ignored.

The HVS homeowner vacancy was decreased to 0.7% in Q2 from 0.8% in Q1.

The HVS homeowner vacancy was decreased to 0.7% in Q2 from 0.8% in Q1. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

Heavy Truck Sales Hit New Record High; Up 18% Year-over-year in July

by Calculated Risk on 8/02/2023 01:02:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the July 2023 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

How Much will the Fannie & Freddie Conforming Loan Limit Change for 2024?

by Calculated Risk on 8/02/2023 10:19:00 AM

Today, in the Calculated Risk Real Estate Newsletter: How Much will the Fannie & Freddie Conforming Loan Limit Change for 2024?

A brief excerpt:

With house prices mostly unchanged over the last year, an interesting question is: How much will the Fannie & Freddie conforming loan limits (CLL) change for 2024? And how much will the FHA insured loan limits change?There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

First, there are different loan limits for various geographical areas. There are also different loan limits depending on the number of units (from 1 to 4 units). For example, currently the CLL is $726,200 for one-unit properties in low-cost areas. For high-cost areas like Los Angeles County, the CLL is $1,089,300 for one-unit properties (50% higher than the baseline CLL).

...

The CLL for each county is available at 2023 Conforming Loan Limits (excel file).

The limit is updated annually, and is adjusted using the FHFA’s quarterly national, seasonally adjusted, expanded-data index: Expanded-Data Indexes (Estimated using Enterprise, FHA, and Real Property County Recorder Data Licensed from DataQuick for sales below the annual loan limit ceiling). The adjustment is based on the House Price Index value in Q3 divided by Q3 in the prior year. The FHFA index is a repeat sales index, similar to Case-Shiller.

...

Currently we only have data for Q1 2023 for the quarterly index (up 5.9% from Q1 2022), and the monthly House Price Index was up 2.8% YoY through May 2023.

...

We need the house price data through September 2023 to calculate the conforming loan limit for 2024. This quarterly data will be released in late November.

ADP: Private Employment Increased 324,000 in July

by Calculated Risk on 8/02/2023 08:20:00 AM

Private sector employment increased by 324,000 jobs in July and annual pay was up 6.2 percent year-over-year, according to the July ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”).This was above the consensus forecast of 185,000. The BLS report will be released Friday, and the consensus is for 184 thousand non-farm payroll jobs added in July.

...

“The economy is doing better than expected and a healthy labor market continues to support household spending,” said Nela Richardson, chief economist, ADP. “We continue to see a slowdown in pay growth without broad-based job loss.”

emphasis added

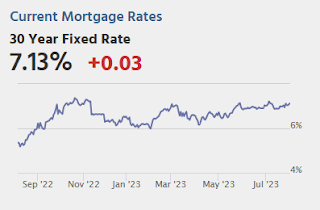

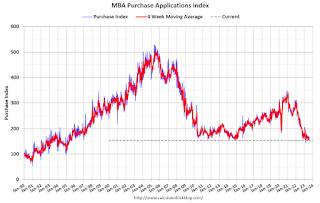

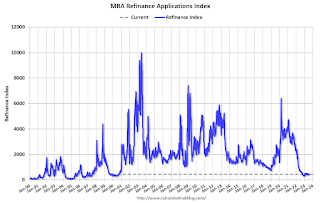

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 8/02/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 28, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 3.0 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 3 percent compared with the previous week. The Refinance Index decreased 3 percent from the previous week and was 32 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 26 percent lower than the same week one year ago.

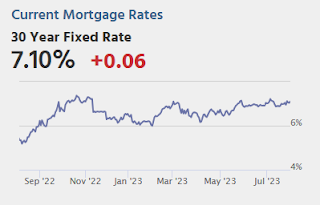

“Mortgage rates edged higher last week, with the 30-year fixed mortgage rate’s increase to 6.93 percent and leading to another decline in overall applications,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The purchase index decreased for the third straight week to its lowest level since the beginning of June and remains 26 percent behind last year’s levels. The decline in purchase activity was driven mainly by weaker conventional purchase application volume, as limited housing inventory and rates still close to 7 percent are crimping affordability for many potential homebuyers. The refinance market continues to feel the impact of these higher rates, and applications trailed last year’s pace by over 30 percent with many homeowners not looking for refinance opportunities.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.93 percent from 6.87 percent, with points increasing to 0.68 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 26% year-over-year unadjusted.

Tuesday, August 01, 2023

Wednesday: ADP Employment, Q2 Housing Vacancies and Homeownership

by Calculated Risk on 8/01/2023 09:02:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 185,000 payroll jobs added in July, down from 497,000 in June.

• At 10:00 AM, the Q2 2023 Housing Vacancies and Homeownership from the Census Bureau.