by Calculated Risk on 8/07/2023 10:07:00 AM

Monday, August 07, 2023

Wholesale Used Car Prices Decreased 1.6% in July; Down 11.6% Year-over-year

From Manheim Consulting today: Wholesale Used-Vehicle Prices See Large Decline in June

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 1.6% in July from June. The Manheim Used Vehicle Value Index (MUVVI) declined to 211.7, down 11.6% from a year ago.

“The July drop of 1.6% is an indicator of slowing wholesale price declines, at least when compared to the month-over-month losses we’ve seen since April,” said Chris Frey, senior manager of Economic and Industry Insights for Cox Automotive. “While the year-over-year price drop was again double-digit, let’s put some perspective on that. From July 2020, there were 22 straight monthly double-digit increases through April 2022; we’ve had just six double-digit declines since October last year, with only four of them consecutive. Keeping to the April theme, we’re now back to the same index value last seen in April 2021: 211.7. Used retail inventory continues to rebuild; but with used retail sales also showing some summer strength, we do not foresee wholesale price declines of serious import through December.”

July’s decrease was softened by the seasonal adjustment. The non-adjusted price change in July decreased by 3.8% compared to June, moving the unadjusted average price down 10.7% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Housing August 7th Weekly Update: Inventory increased 0.7% Week-over-week; Down 10.3% Year-over-year

by Calculated Risk on 8/07/2023 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, August 06, 2023

Sunday Night Futures

by Calculated Risk on 8/06/2023 06:15:00 PM

Weekend:

• Schedule for Week of August 6, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 7 and DOW futures are up 45 (fair value).

Oil prices were up over the last week with WTI futures at $82.82 per barrel and Brent at $86.24 per barrel. A year ago, WTI was at $92, and Brent was at $100 - so WTI oil prices are down about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.81 per gallon. A year ago, prices were at $4.05 per gallon, so gasoline prices are down $0.24 per gallon year-over-year.

Summer Teen Employment

by Calculated Risk on 8/06/2023 09:07:00 AM

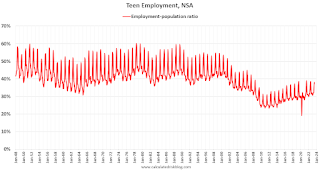

Here is a look at the percentage of teens employed over time.

The graph below shows the employment-population ratio for teens (16 to 19 years old) since 1948.

The graph is Not Seasonally Adjusted (NSA), to show the seasonal hiring of teenagers during the summer.

A few observations:

1) Although teen employment has recovered some since the great recession, overall teen employment had been trending down. This is probably because more people are staying in school (a long term positive for the economy).

2) Teen employment was significantly impacted in 2020 by the pandemic.

3) A smaller percentage of teenagers are obtaining summer employment. The seasonal spikes are smaller than in previous decades.

4) The decline in teenager participation is one of the reasons the overall participation rate has declined (of course, the retiring baby boomers is the main reason the overall participation rate has declined over the last 20+ years).

Saturday, August 05, 2023

Real Estate Newsletter Articles this Week: Asking Rents Negative Year-over-year

by Calculated Risk on 8/05/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Asking Rents Negative Year-over-year

• Freddie Mac House Price Index Increased in June to New High; Up 1.7% Year-over-year

• How Much will the Fannie & Freddie Conforming Loan Limit Change for 2024?

• The impact of 7% Mortgage Rates

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of August 6, 2023

by Calculated Risk on 8/05/2023 08:11:00 AM

The key reports this week are July CPI and the June Trade Deficit.

No major economic releases scheduled.

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $65.7 billion. The U.S. trade deficit was at $69.0 Billion the previous month.

11:00 AM: NY Fed: Q2 Quarterly Report on Household Debt and Credit

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 236 thousand initial claims, up from 227 thousand last week.

8:30 AM: The Consumer Price Index for July from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI. The consensus is for CPI to be up 3.2% year-over-year and core CPI to be up 4.8% YoY.

12:00 PM: (expected) MBA Q2 National Delinquency Survey

8:30 AM: The Producer Price Index for July from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for August)

Friday, August 04, 2023

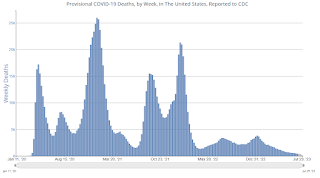

Aug 4th COVID Update: New Pandemic Low for Deaths

by Calculated Risk on 8/04/2023 08:16:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 6,121 | 5,686 | ≤3,0001 | |

| Deaths per Week2 | 426 | 437 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

The impact of 7% Mortgage Rates

by Calculated Risk on 8/04/2023 01:48:00 PM

Today, in the Calculated Risk Real Estate Newsletter: The impact of 7% Mortgage Rates

A brief excerpt:

The following table is from the Freddie Mac’s primary mortgage market survey (PMMS)..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Existing home sales bottomed in December 2022 and January 2023 on a seasonally adjusted annual rate (SAAR) basis. Those closed sales were for contracts signed mostly in the October through December timeframe when rates were the highest.

The recent surge in rates started in June, and if there is an impact on sales from higher mortgage rates, it will likely impact closed sales in the August through October timeframe. We will know about July sales very soon as local market data is released.

There will likely be less of an impact on new home sales since homebuilders will offer various incentives and mortgage rate buydowns (3-2-1 is fairly common - with the homebuilder buying the rate down by 3 percentage points in year 1, 2 percentage points in year 2, and 1 percentage point in year 3).

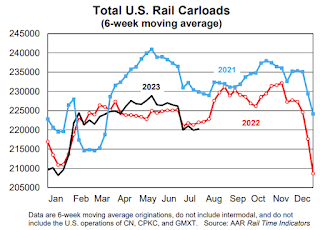

AAR: July Rail Carloads and Intermodal Decreased Year-over-year

by Calculated Risk on 8/04/2023 01:05:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

The July 4th holiday complicates an analysis of U.S. rail volumes in July, but there were some encouraging signs.

For example, the three non-July 4 weeks in July were the three highest-volume intermodal weeks of the year for U.S. railroads. Intermodal in July 2023 was still down 5.5% from July 2022, but that’s the smallest percentage decline for any month so far this year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2021, 2022 and 2022:

U.S. railroads originated 875,660 total carloads in July 2023, down 0.6% from July 2022 and their second straight small decline. Carloads averaged 218,915 per week in July 2023, the fewest for any month so far in 2023. July 4th is a big reason for that — the week of July 4th is always one of the lowest-volume weeks of the year. .

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):U.S. intermodal volume averaged 241,888 containers and trailers per week in July 2023, down 5.5% from July 2022 and the 23rd decline in the past 24 months. July’s percentage decline was the smallest so far this year. The three non-July 4 weeks in July were the three highest-volume intermodal weeks of the year, which could be a hopeful sign for the future.

Comments on July Employment Report

by Calculated Risk on 8/04/2023 09:20:00 AM

The headline jobs number in the July employment report was slightly below expectations, however, employment for the previous two months was revised down by 49,000, combined. The participation rate was unchanged, and the employment population ratio increased slightly, and the unemployment rate decreased to 3.5%.

In July, the year-over-year employment change was 3.36 million jobs.

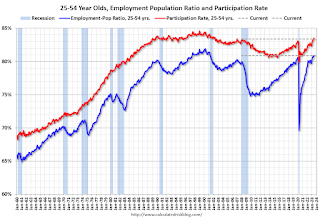

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate decreased in July to 83.4% from 83.5% in June, and the 25 to 54 employment population ratio was unchanged at 80.9% from 80.9% the previous month.

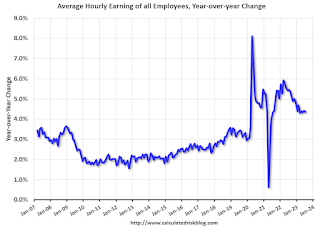

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.4% YoY in July.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 4.0 million, changed little in July. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in July to 4.00 million from 4.19 million in June. This is below pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 6.7% from 6.9% in the previous month. This is down from the record high in April 22.9% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is below the 7.0% level in February 2020 (pre-pandemic).

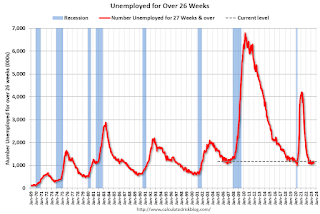

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.164 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.105 million the previous month.

This is at pre-pandemic levels.

Summary:

The headline monthly jobs number was slightly below consensus expectations; however, May and June payrolls were revised down by 49,000 combined.