by Calculated Risk on 8/10/2023 08:30:00 AM

Thursday, August 10, 2023

BLS: CPI increased 0.2% in July; Core CPI increased 0.2%

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in July on a seasonally adjusted basis, the same increase as in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.2 percent before seasonal adjustment.CPI and core CPI were at expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter was by far the largest contributor to the monthly all items increase, accounting for over 90 percent of the increase, with the index for motor vehicle insurance also contributing. The food index increased 0.2 percent in July after increasing 0.1 percent the previous month. The index for food at home increased 0.3 percent over the month while the index for food away from home rose 0.2 percent in July. The energy index rose 0.1 percent in July as the major energy component indexes were mixed.

The index for all items less food and energy rose 0.2 percent in July, as it did in June. Indexes which increased in June include shelter, motor vehicle insurance, education, and recreation. The indexes for airline fares, used cars and trucks, medical care, and communication were among those that decreased over the month.

The all items index increased 3.2 percent for the 12 months ending July, slightly more than the 3.0-percent increase for the 12 months ending in June. The all items less food and energy index rose 4.7 percent over the last 12 months. The energy index decreased 12.5 percent for the 12 months ending July, and the food index increased 4.9 percent over the last year.

emphasis added

Wednesday, August 09, 2023

Thursday: CPI, Unemployment Claims

by Calculated Risk on 8/09/2023 08:49:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 236 thousand initial claims, up from 227 thousand last week.

• Also at 8:30 AM, The Consumer Price Index for July from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI. The consensus is for CPI to be up 3.2% year-over-year and core CPI to be up 4.8% YoY.

• At 12:00 PM,: (expected) MBA Q2 National Delinquency Survey

Oops. Wrong Graph Last Friday for 25- to 54-Years-Old Participation Rate

by Calculated Risk on 8/09/2023 04:06:00 PM

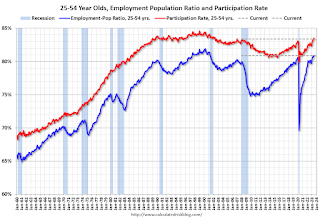

Last Friday I posted the incorrect chart for the 25 to 54 employment-population ratio and participation rate (ht Kevin). Here is the correct graph.

Prime (25 to 54 Years Old) Participation

The 25 to 54 participation rate decreased in July to 83.4% from 83.5% in June, and the 25 to 54 employment population ratio was unchanged at 80.9% from 80.9% the previous month.

Fannie "Real Estate Owned" inventory Decreased in Q2

by Calculated Risk on 8/09/2023 03:47:00 PM

Fannie reported results for Q2 2023. Here is some information on single-family Real Estate Owned (REOs).

Click on graph for larger image.

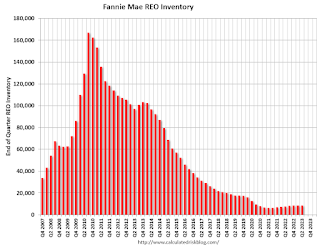

Click on graph for larger image.Here is a graph of Fannie Real Estate Owned (REO).

This is well below a normal level of REOs for Fannie, and REO levels will increase further in 2023, but there will not be a huge wave of foreclosures.

Atlanta Fed: Home Ownership Affordability Monitor

by Calculated Risk on 8/09/2023 11:06:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Atlanta Fed: Home Ownership Affordability Monitor

A brief excerpt:

For house prices, there is an ongoing battle between low inventory and affordability. Here is another measure of affordability that readers might find useful from the Atlanta Fed: Home Ownership Affordability MonitorThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is a graph of affordability (higher is more affordable), and of the year-over-year change in affordability through April 2023. By this measure, houses are close to the least affordable since 2007. (Note that the Atlanta Fed projects income.)

Since April, both house prices and mortgage rates have increased, and affordability is even worse. ...

I’ll have some comments on this tomorrow.

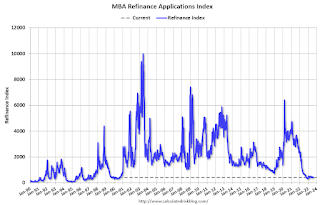

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 8/09/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

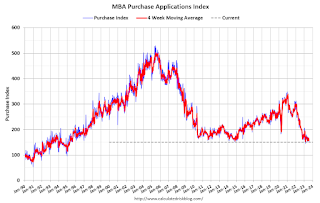

Mortgage applications decreased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 4, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 3.1 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 4 percent compared with the previous week. The Refinance Index decreased 4 percent from the previous week and was 37 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 27 percent lower than the same week one year ago.

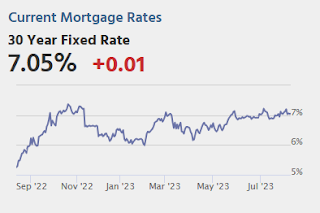

“Treasury yields rates rose last week and mortgage rates followed suit, due to a combination of the Treasury’s funding announcement and the downgrading of the U.S. government debt rating. Rates increased for all loan types in our survey, with the 30-year fixed mortgage rate increasing to 7.09 percent, the highest level since November 2022,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Additionally, the rate for FHA mortgages increased to 7.02 percent, the highest rate since 2002. Not surprisingly, mortgage applications continued to decline given these higher rates, with overall application counts falling for the third consecutive week, as both purchase and refinance activity declined. The purchase index fell for the fourth consecutive week, as homebuyers continue to struggle with low for-sale inventory and elevated mortgage rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.09 percent from 6.93 percent, with points increasing to 0.70 from 0.68 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 27% year-over-year unadjusted.

Tuesday, August 08, 2023

Wednesday: MBA Mortgage Applications

by Calculated Risk on 8/08/2023 09:05:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

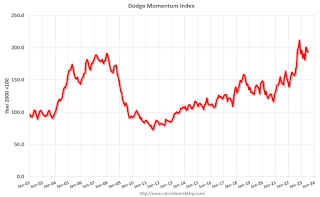

Leading Index for Commercial Real Estate Decreased in July

by Calculated Risk on 8/08/2023 02:42:00 PM

From Dodge Data Analytics: Dodge Momentum Index Recedes 1% in July

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, declined 0.9% in July to 193.4 (2000=100) from the revised June reading of 195.1. Over the month, the commercial component of the DMI remained relatively flat, ticking down 0.2%, while the institutional component fell 1.9%.

“While both segments of the Index fell this month, underlying project data points to divergent trends in the nonresidential sector,” said Sarah Martin, associate director of forecasting for Dodge Construction Network. “In comparison to January 2023, commercial planning activity is down 10% through July, while institutional planning is up 16%. Distinctly large institutional projects entering planning in May temporarily inflated month-to-month trends, but activity has since ticked down. As we progress through the remainder of 2023, weaker commercial activity, resulting from tighter lending standards and higher interest rates, will counter sturdier institutional activity, bolstered by public funding and less sensitivity to interest rates.”

All commercial sectors pulled back, or remained flat, over the month of July. Hotel planning saw the largest month-over-month decay, marking four months of consecutive decline in the sector. July also saw a deceleration in the number of education and healthcare projects entering planning — the two largest institutional segments.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 193.4 in July, down from 195.1 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests some slowdown towards the end of 2023 or in 2024.

1st Look at Local Housing Markets in July

by Calculated Risk on 8/08/2023 11:30:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in July

A brief excerpt:

This is the first look at several early reporting local markets in July. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in July were mostly for contracts signed in May and June. Since 30-year fixed mortgage rates were in the 6.4% range in May, and 6.7% in June, compared to the low-to-mid 5% range the previous year, closed sales were down year-over-year in July.

...

In July, sales in these markets were down 14.5%. In June, these same markets were down 20.5% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in June for these early reporting markets. Note that there were the same number of selling days each year in July 2022 and July 2023.

A key factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates. ...

This was just several early reporting markets. Many more local markets to come!

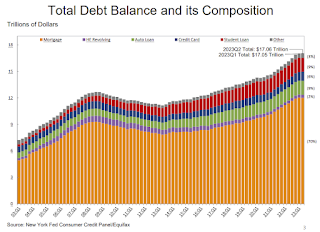

NY Fed Q2 Report: Household Debt Increased Slightly, Mortgage Balances "Unchanged"

by Calculated Risk on 8/08/2023 11:13:00 AM

From the NY Fed: Total Household Debt Reaches $17.06 Trillion in Q2 2023; Credit Card Debt Exceeds $1 Trillion

The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The report shows a slight uptick in total household debt in the second quarter of 2023, increasing by $16 billion (0.1%) to $17.06 trillion. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

Credit card balances increased by $45 billion, from $986 billion in Q1 2023 to a series high of $1.03 trillion in the Q2 2023, marking a 4.6% quarterly increase. Credit card accounts expanded by 5.48 million to 578.35 million. Aggregate limits on credit card accounts increased by $9 billion and now stand at $4.6 trillion.

Mortgage balances were largely unchanged from the previous quarter and stood at $12.01 trillion at the end of June, in large part due to declining mortgage originations and slowing home prices. Mortgage originations, which include refinances, stood at $393 billion in the second quarter, representing a $70 billion increase from the first quarter. Other balances, which include retail cards and other consumer loans, increased by $15 billion.

Auto loan balances rose by $20 billion, consistent with the upward trajectory seen since 2011. The volume of newly originated auto loans, which includes leases, was $179 billion, largely reflecting high dollar values of originated loans even as the number of newly opened loans remains below pre-pandemic levels. Student loan balances fell by $35 billion and stood at $1.57 trillion.

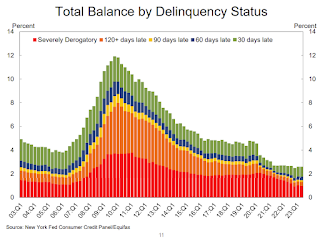

Delinquency rates were roughly flat in the second quarter of 2023 and remained low, after declining sharply since the beginning of the pandemic. The share of debt newly transitioning into delinquency increased for credit cards and auto loans, with increases in transition rates of 0.7 and 0.4 percentage points respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are three graphs from the report:

The first graph shows household debt increased slightly in Q2. Household debt previously peaked in 2008 and bottomed in Q3 2013. Unlike following the great recession, there wasn't a decline in debt during the pandemic.

From the NY Fed:

Aggregate household debt balances increased by $16 billion in the second quarter of 2023, a 0.1% rise from 2023Q1. Balances now stand at $17.06 trillion and have increased by $2.9 trillion since the end of 2019, just before the pandemic recession.

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate "roughly flat" in Q2. From the NY Fed:

Aggregate delinquency rates were roughly flat in the second quarter of 2023 and remained low, after declining sharply through the beginning of the pandemic. As of June, 2.7% of outstanding debt was in some stage of delinquency, 2 percentage points lower than the last quarter of 2019, just before the COVID-19 pandemic hit the United States.

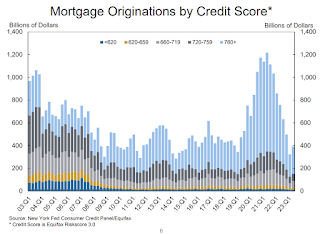

The third graph shows Mortgage Originations by Credit Score.

The third graph shows Mortgage Originations by Credit Score.From the NY Fed:

Mortgage originations, measured as appearances of new mortgages on consumer credit reports and including both refinance and purchase originations, were at $393 billion in 2023Q2, an uptick from the 9-year low observed in the previous quarter. ... The median credit score for newly originated mortgages increased by 4 points, to 769.There is much more in the report.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |