by Calculated Risk on 8/10/2023 10:20:00 AM

Thursday, August 10, 2023

MBA: "Mortgage Delinquencies Decrease in the Second Quarter of 2023"; Lowest Level on Record

From the MBA: Mortgage Delinquencies Decrease in the Second Quarter of 2023

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.37 percent of all loans outstanding at the end of the second quarter of 2023, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was down 19 basis points from the first quarter of 2023 and down 27 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the second quarter fell by 3 basis points to 0.13 percent.

“The seasonally-adjusted mortgage delinquency rate fell to its lowest level since MBA’s survey began in 1979, reaching 3.37 percent in the second quarter of 2023,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Buoyed by a resilient job market, homeowners are continuing to make their mortgage payments.”

Walsh noted that delinquencies fell across all mortgage types – conventional, FHA, and VA. Both foreclosure starts and foreclosure inventory also declined relative to the previous quarter.

Added Walsh, “Despite low delinquency rates, there are early signs of possible consumer credit stress. Delinquencies are rising for other forms of credit such as credit cards and car loans[1]. In addition, FHA delinquencies rose 10 basis points compared to year ago levels. On a non-seasonally adjusted basis, FHA delinquencies rose 13 basis points year-over-year and 71 basis points from the first quarter of 2023. As the economy slows and labor market cools, homeowners with FHA loans are likely to feel the distress first.”

emphasis added

Click on graph for larger image.

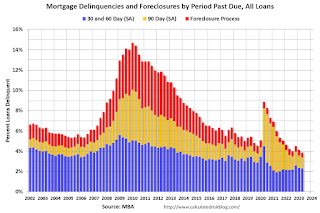

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q2.

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 2 basis points to 1.75 percent, the 60-day delinquency rate remained unchanged at 0.55 percent, and the 90-day delinquency bucket decreased 17 basis points to 1.07 percent.The sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 0.53 percent, down 4 basis points from the first quarter of 2023 and 6 basis points lower than one year ago.

The percent of loans in the foreclosure process decreased slightly year-over-year in Q2 even with the end of the foreclosure moratoriums and are historically low.

Weekly Initial Unemployment Claims Increase to 248,000

by Calculated Risk on 8/10/2023 08:54:00 AM

The DOL reported:

In the week ending August 5, the advance figure for seasonally adjusted initial claims was 248,000, an increase of 21,000 from the previous week's unrevised level of 227,000. The 4-week moving average was 231,000, an increase of 2,750 from the previous week's unrevised average of 228,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 231,000.

The previous week was unrevised.

Weekly claims were above the consensus forecast.

BLS: CPI increased 0.2% in July; Core CPI increased 0.2%

by Calculated Risk on 8/10/2023 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in July on a seasonally adjusted basis, the same increase as in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.2 percent before seasonal adjustment.CPI and core CPI were at expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter was by far the largest contributor to the monthly all items increase, accounting for over 90 percent of the increase, with the index for motor vehicle insurance also contributing. The food index increased 0.2 percent in July after increasing 0.1 percent the previous month. The index for food at home increased 0.3 percent over the month while the index for food away from home rose 0.2 percent in July. The energy index rose 0.1 percent in July as the major energy component indexes were mixed.

The index for all items less food and energy rose 0.2 percent in July, as it did in June. Indexes which increased in June include shelter, motor vehicle insurance, education, and recreation. The indexes for airline fares, used cars and trucks, medical care, and communication were among those that decreased over the month.

The all items index increased 3.2 percent for the 12 months ending July, slightly more than the 3.0-percent increase for the 12 months ending in June. The all items less food and energy index rose 4.7 percent over the last 12 months. The energy index decreased 12.5 percent for the 12 months ending July, and the food index increased 4.9 percent over the last year.

emphasis added

Wednesday, August 09, 2023

Thursday: CPI, Unemployment Claims

by Calculated Risk on 8/09/2023 08:49:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 236 thousand initial claims, up from 227 thousand last week.

• Also at 8:30 AM, The Consumer Price Index for July from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI. The consensus is for CPI to be up 3.2% year-over-year and core CPI to be up 4.8% YoY.

• At 12:00 PM,: (expected) MBA Q2 National Delinquency Survey

Oops. Wrong Graph Last Friday for 25- to 54-Years-Old Participation Rate

by Calculated Risk on 8/09/2023 04:06:00 PM

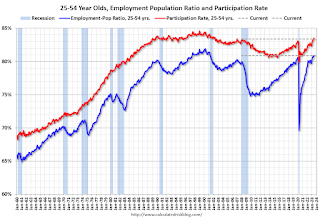

Last Friday I posted the incorrect chart for the 25 to 54 employment-population ratio and participation rate (ht Kevin). Here is the correct graph.

Prime (25 to 54 Years Old) Participation

The 25 to 54 participation rate decreased in July to 83.4% from 83.5% in June, and the 25 to 54 employment population ratio was unchanged at 80.9% from 80.9% the previous month.

Fannie "Real Estate Owned" inventory Decreased in Q2

by Calculated Risk on 8/09/2023 03:47:00 PM

Fannie reported results for Q2 2023. Here is some information on single-family Real Estate Owned (REOs).

Click on graph for larger image.

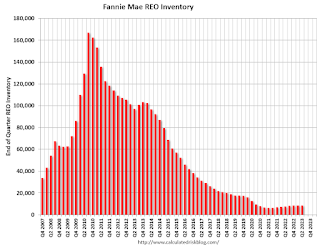

Click on graph for larger image.Here is a graph of Fannie Real Estate Owned (REO).

This is well below a normal level of REOs for Fannie, and REO levels will increase further in 2023, but there will not be a huge wave of foreclosures.

Atlanta Fed: Home Ownership Affordability Monitor

by Calculated Risk on 8/09/2023 11:06:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Atlanta Fed: Home Ownership Affordability Monitor

A brief excerpt:

For house prices, there is an ongoing battle between low inventory and affordability. Here is another measure of affordability that readers might find useful from the Atlanta Fed: Home Ownership Affordability MonitorThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is a graph of affordability (higher is more affordable), and of the year-over-year change in affordability through April 2023. By this measure, houses are close to the least affordable since 2007. (Note that the Atlanta Fed projects income.)

Since April, both house prices and mortgage rates have increased, and affordability is even worse. ...

I’ll have some comments on this tomorrow.

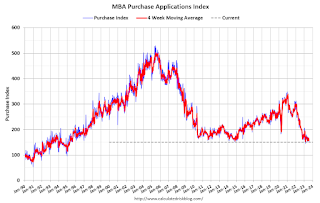

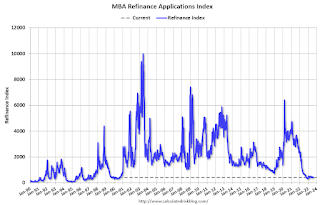

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 8/09/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 4, 2023.

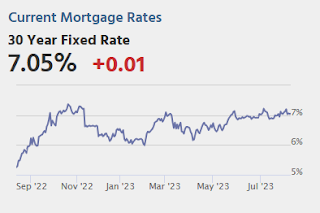

The Market Composite Index, a measure of mortgage loan application volume, decreased 3.1 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 4 percent compared with the previous week. The Refinance Index decreased 4 percent from the previous week and was 37 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 27 percent lower than the same week one year ago.

“Treasury yields rates rose last week and mortgage rates followed suit, due to a combination of the Treasury’s funding announcement and the downgrading of the U.S. government debt rating. Rates increased for all loan types in our survey, with the 30-year fixed mortgage rate increasing to 7.09 percent, the highest level since November 2022,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Additionally, the rate for FHA mortgages increased to 7.02 percent, the highest rate since 2002. Not surprisingly, mortgage applications continued to decline given these higher rates, with overall application counts falling for the third consecutive week, as both purchase and refinance activity declined. The purchase index fell for the fourth consecutive week, as homebuyers continue to struggle with low for-sale inventory and elevated mortgage rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.09 percent from 6.93 percent, with points increasing to 0.70 from 0.68 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 27% year-over-year unadjusted.

Tuesday, August 08, 2023

Wednesday: MBA Mortgage Applications

by Calculated Risk on 8/08/2023 09:05:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

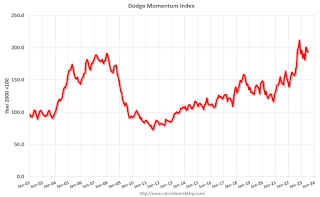

Leading Index for Commercial Real Estate Decreased in July

by Calculated Risk on 8/08/2023 02:42:00 PM

From Dodge Data Analytics: Dodge Momentum Index Recedes 1% in July

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, declined 0.9% in July to 193.4 (2000=100) from the revised June reading of 195.1. Over the month, the commercial component of the DMI remained relatively flat, ticking down 0.2%, while the institutional component fell 1.9%.

“While both segments of the Index fell this month, underlying project data points to divergent trends in the nonresidential sector,” said Sarah Martin, associate director of forecasting for Dodge Construction Network. “In comparison to January 2023, commercial planning activity is down 10% through July, while institutional planning is up 16%. Distinctly large institutional projects entering planning in May temporarily inflated month-to-month trends, but activity has since ticked down. As we progress through the remainder of 2023, weaker commercial activity, resulting from tighter lending standards and higher interest rates, will counter sturdier institutional activity, bolstered by public funding and less sensitivity to interest rates.”

All commercial sectors pulled back, or remained flat, over the month of July. Hotel planning saw the largest month-over-month decay, marking four months of consecutive decline in the sector. July also saw a deceleration in the number of education and healthcare projects entering planning — the two largest institutional segments.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 193.4 in July, down from 195.1 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests some slowdown towards the end of 2023 or in 2024.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |