by Calculated Risk on 8/11/2023 01:58:00 PM

Friday, August 11, 2023

Realtor.com Reports Weekly Active Inventory Down 9% YoY; New Listings Down 14% YoY

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Danielle Hale: Weekly Housing Trends View — Data Week Ending Aug 5, 2023

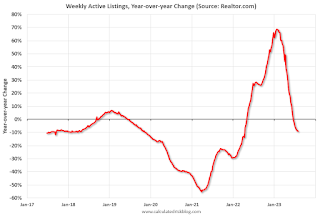

• Active inventory declined, with for-sale homes lagging behind year ago levels by 9%.. This week marks a 7th consecutive decline in the number of homes actively for sale compared to the prior year, and the gap is growing.

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 14% from one year ago. For 57 weeks, there have been fewer newly listed homes compared to the same time one year ago. The gap is starting to shrink as we get into a comparison against low new listings in the second half of 2022. This week’s data shows a 2.5 percentage point improvement over last week as the market slowly trends in a buyer-friendly direction, reflecting a stabilization of the low new listings count.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 9.1% year-over-year - this was the seventh consecutive week with a YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

Early Q3 GDP Tracking: Wide Range

by Calculated Risk on 8/11/2023 12:58:00 PM

As usual, there is a wide range of estimates early in the quarter. GDPNow's estimate is probably way too high.

From BofA:

Next week, we will initiate our 3Q US GDP tracker with the July retail sales data.From Goldman:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +1.5% (qoq ar) [Aug 8th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2023 is 4.1 percent on August 8, up from 3.9 percent on August 1. [Aug 8 estimate]

Part 1: Current State of the Housing Market; Overview for mid-August

by Calculated Risk on 8/11/2023 10:33:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-August

A brief excerpt:

Interestingly, new home inventory is close to a record percentage of total inventory. This graph uses Not Seasonally Adjusted (NSA) existing home inventory from the National Association of Realtors® (NAR) and new home inventory from the Census Bureau (only completed and under construction inventory).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Note: Mark Fleming, Chief Economist at First American pointed this out in March.

It took a number of years following the housing bust for new home inventory to return to the pre-bubble percent of total inventory. Then, with the pandemic, existing home inventory collapsed and now the percent of new homes is close to 24% of total for sale inventory. The lack of existing home inventory, and few distressed sales, has been a positive for homebuilders.

Hotels: Occupancy Rate Down 1.0% Year-over-year

by Calculated Risk on 8/11/2023 08:15:00 AM

U.S. hotel performance declined from the previous week and showed lower comparisons year over year, according to CoStar’s latest data through 5 August. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

30 July – 5 August 2023 (percentage change from comparable week in 2022):

• Occupancy: 68.9% (-1.0%)

• Average daily rate (ADR): US$158.10 (+2.2%)

• Revenue per available room (RevPAR): US$108.97 (+1.2%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Thursday, August 10, 2023

Friday: PPI

by Calculated Risk on 8/10/2023 08:59:00 PM

Friday:

• At 8:30 AM ET, The Producer Price Index for July from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for August)

The Long-Term Housing and Population Shift

by Calculated Risk on 8/10/2023 01:40:00 PM

Today, in the Calculated Risk Real Estate Newsletter: The Long-Term Housing and Population Shift

A brief excerpt:

Something different …There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Here is a look at the last 50 to 60 years, and some predictions about the next 50+ years.

First, here is a graph from the Census Bureau showing the Median Center of Population for the United States: 1880 to 2020

A key driver of the westward movement was the availability of water, and this boosted population growth in California, and in several other states like Arizona, and Nevada. The population California increased 150% from 1960 to 2020, and Arizona’s population increased more than five-fold. Nevada’s population increased more than ten-fold! (For comparison, the US population increased 85% from 1960 to 2020).

The key driver of the southward movement was Air Conditioning! AC has made the Southern States and D.C. more habitable year-round (Arizona and Nevada benefited from both additional water supply and AC).

...

If you were a home builder 50 years ago, you’d start concentrating on building in the West and all across the South to take advantage of this shift.

But what about the next 50 years?

Cleveland Fed: Median CPI increased 0.2% and Trimmed-mean CPI increased 0.2% in July

by Calculated Risk on 8/10/2023 12:58:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI.

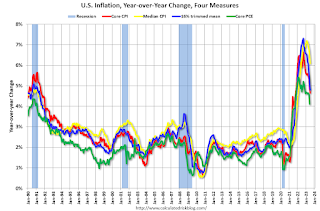

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% in July. The 16% trimmed-mean Consumer Price Index also increased 0.2% in July. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. "Fuel oil and other fuels" increased at a 54% annualized rate in July.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 8/10/2023 11:54:00 AM

Here are a few measures of inflation:

The first graph is the one Fed Chair Powell had mentioned when services less rent of shelter was up 7.6% year-over-year. This has fallen sharply and is now up 3.3% YoY.

This graph shows the YoY price change for Services and Services less rent of shelter through July 2023.

Services less rent of shelter was up 3.3% YoY in July, up from 3.2% YoY in June.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were up 0.9% YoY in July, down from 1.4% YoY in June.

Here is a graph of the year-over-year change in shelter from the CPI report (through July) and housing from the PCE report (through June 2023)

Here is a graph of the year-over-year change in shelter from the CPI report (through July) and housing from the PCE report (through June 2023)Shelter was up 7.7% year-over-year in July, down from 7.8% in June. Housing (PCE) was up 8.0% YoY in June, down from 8.3% in May.

The BLS noted this morning: "The index for shelter was by far the largest contributor to the monthly all items increase, accounting for over 90 percent of the increase, with the index for motor vehicle insurance also contributing."

MBA: "Mortgage Delinquencies Decrease in the Second Quarter of 2023"; Lowest Level on Record

by Calculated Risk on 8/10/2023 10:20:00 AM

From the MBA: Mortgage Delinquencies Decrease in the Second Quarter of 2023

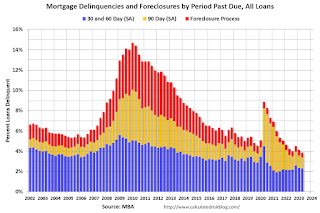

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.37 percent of all loans outstanding at the end of the second quarter of 2023, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was down 19 basis points from the first quarter of 2023 and down 27 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the second quarter fell by 3 basis points to 0.13 percent.

“The seasonally-adjusted mortgage delinquency rate fell to its lowest level since MBA’s survey began in 1979, reaching 3.37 percent in the second quarter of 2023,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Buoyed by a resilient job market, homeowners are continuing to make their mortgage payments.”

Walsh noted that delinquencies fell across all mortgage types – conventional, FHA, and VA. Both foreclosure starts and foreclosure inventory also declined relative to the previous quarter.

Added Walsh, “Despite low delinquency rates, there are early signs of possible consumer credit stress. Delinquencies are rising for other forms of credit such as credit cards and car loans[1]. In addition, FHA delinquencies rose 10 basis points compared to year ago levels. On a non-seasonally adjusted basis, FHA delinquencies rose 13 basis points year-over-year and 71 basis points from the first quarter of 2023. As the economy slows and labor market cools, homeowners with FHA loans are likely to feel the distress first.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q2.

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 2 basis points to 1.75 percent, the 60-day delinquency rate remained unchanged at 0.55 percent, and the 90-day delinquency bucket decreased 17 basis points to 1.07 percent.The sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 0.53 percent, down 4 basis points from the first quarter of 2023 and 6 basis points lower than one year ago.

The percent of loans in the foreclosure process decreased slightly year-over-year in Q2 even with the end of the foreclosure moratoriums and are historically low.

Weekly Initial Unemployment Claims Increase to 248,000

by Calculated Risk on 8/10/2023 08:54:00 AM

The DOL reported:

In the week ending August 5, the advance figure for seasonally adjusted initial claims was 248,000, an increase of 21,000 from the previous week's unrevised level of 227,000. The 4-week moving average was 231,000, an increase of 2,750 from the previous week's unrevised average of 228,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 231,000.

The previous week was unrevised.

Weekly claims were above the consensus forecast.