by Calculated Risk on 8/14/2023 10:10:00 AM

Monday, August 14, 2023

2nd Look at Local Housing Markets in July

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in July

A brief excerpt:

This is the second look at local markets in July. I’m tracking a sample of about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

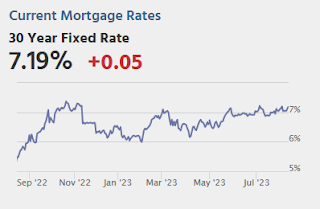

Closed sales in July were mostly for contracts signed in May and June. Since 30-year fixed mortgage rates were in the 6.4% range in May, and 6.7% in June, compared to the low-to-mid 5% range the previous year, closed sales were down year-over-year in July.

...

In July, sales in these markets were down 13.9%. In June, these same markets were down 15.9% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in June for these markets. Note that there were the same number of selling days each year in July 2022 and July 2023.

A key factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates. ...

This data suggests the July existing home sales report will show another significant YoY decline - and probably close to the June sales rate of 4.16 million (SAAR) - and the 23rd consecutive month with a YoY decline in sales.

Many more local markets to come!

Housing August 14th Weekly Update: Inventory increased 0.9% Week-over-week; Down 10.5% Year-over-year

by Calculated Risk on 8/14/2023 08:11:00 AM

Click on graph for larger image.

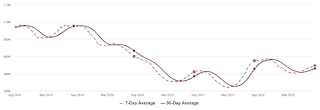

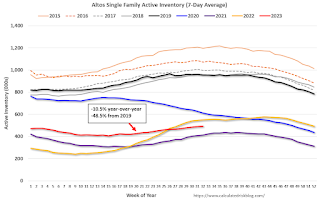

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, August 13, 2023

Sunday Night Futures

by Calculated Risk on 8/13/2023 06:12:00 PM

Weekend:

• Schedule for Week of August 13, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 10 and DOW futures are up 52 (fair value).

Oil prices were up over the last week with WTI futures at $83.19 per barrel and Brent at $86.81 per barrel. A year ago, WTI was at $95, and Brent was at $104 - so WTI oil prices are down about 12% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.82 per gallon. A year ago, prices were at $3.93 per gallon, so gasoline prices are down $0.11 per gallon year-over-year.

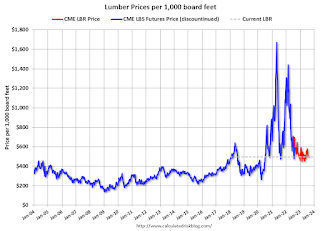

Update: Lumber Prices Down 29% YoY

by Calculated Risk on 8/13/2023 09:25:00 AM

This graph shows CME random length framing futures through last August (blue), and the new physically-delivered Lumber Futures (LBR) contract starting in August 2022 (Red).

Saturday, August 12, 2023

Real Estate Newsletter Articles this Week: The Long-Term Housing and Population Shift

by Calculated Risk on 8/12/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• The Long-Term Housing and Population Shift

• Part 1: Current State of the Housing Market; Overview for mid-August

• 1st Look at Local Housing Markets in July

• Black Knight Mortgage Monitor: Home Prices Increased Month-to-month to New Record High in June

• Atlanta Fed: Home Ownership Affordability Monitor

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of August 13, 2023

by Calculated Risk on 8/12/2023 08:11:00 AM

The key reports this week are July Retail Sales and Housing Starts.

For manufacturing, the Industrial Production report will be released.

No major economic releases scheduled.

8:30 AM: Retail sales for July is scheduled to be released. The consensus is for 0.4% increase in retail sales.

8:30 AM: Retail sales for July is scheduled to be released. The consensus is for 0.4% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline)

8:30 AM: The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of -0.7, down from 1.1.

10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 56, unchanged from 56. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

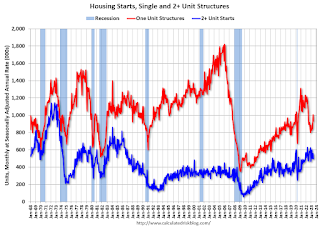

8:30 AM ET: Housing Starts for July.

8:30 AM ET: Housing Starts for July. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.440 million SAAR, up from 1.434 million SAAR in June.

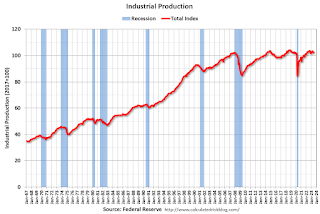

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

2:00 PM: FOMC Minutes, Meeting of July 25-26, 2023

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 256 thousand initial claims, up from 248 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of -10.0, up from -13.5.

10:00 AM: State Employment and Unemployment (Monthly) for July 2023

Friday, August 11, 2023

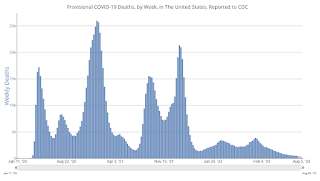

Aug 11th COVID Update: New Pandemic Low for Deaths

by Calculated Risk on 8/11/2023 08:02:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 6,829 | 6,151 | ≤3,0001 | |

| Deaths per Week2 | 437 | 473 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Realtor.com Reports Weekly Active Inventory Down 9% YoY; New Listings Down 14% YoY

by Calculated Risk on 8/11/2023 01:58:00 PM

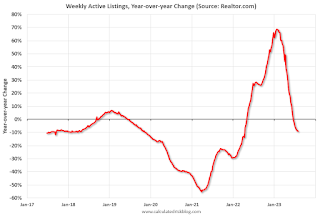

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Danielle Hale: Weekly Housing Trends View — Data Week Ending Aug 5, 2023

• Active inventory declined, with for-sale homes lagging behind year ago levels by 9%.. This week marks a 7th consecutive decline in the number of homes actively for sale compared to the prior year, and the gap is growing.

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 14% from one year ago. For 57 weeks, there have been fewer newly listed homes compared to the same time one year ago. The gap is starting to shrink as we get into a comparison against low new listings in the second half of 2022. This week’s data shows a 2.5 percentage point improvement over last week as the market slowly trends in a buyer-friendly direction, reflecting a stabilization of the low new listings count.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 9.1% year-over-year - this was the seventh consecutive week with a YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

Early Q3 GDP Tracking: Wide Range

by Calculated Risk on 8/11/2023 12:58:00 PM

As usual, there is a wide range of estimates early in the quarter. GDPNow's estimate is probably way too high.

From BofA:

Next week, we will initiate our 3Q US GDP tracker with the July retail sales data.From Goldman:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +1.5% (qoq ar) [Aug 8th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2023 is 4.1 percent on August 8, up from 3.9 percent on August 1. [Aug 8 estimate]

Part 1: Current State of the Housing Market; Overview for mid-August

by Calculated Risk on 8/11/2023 10:33:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-August

A brief excerpt:

Interestingly, new home inventory is close to a record percentage of total inventory. This graph uses Not Seasonally Adjusted (NSA) existing home inventory from the National Association of Realtors® (NAR) and new home inventory from the Census Bureau (only completed and under construction inventory).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Note: Mark Fleming, Chief Economist at First American pointed this out in March.

It took a number of years following the housing bust for new home inventory to return to the pre-bubble percent of total inventory. Then, with the pandemic, existing home inventory collapsed and now the percent of new homes is close to 24% of total for sale inventory. The lack of existing home inventory, and few distressed sales, has been a positive for homebuilders.